Create an account

Create a free IEA account to download our reports or subcribe to a paid service.

How the energy crisis started, how global energy markets are impacting our daily life, and what governments are doing about it

Global Energy Crisis

- English English

What is the energy crisis?

Record prices, fuel shortages, rising poverty, slowing economies: the first energy crisis that's truly global.

Energy markets began to tighten in 2021 because of a variety of factors, including the extraordinarily rapid economic rebound following the pandemic. But the situation escalated dramatically into a full-blown global energy crisis following Russia’s invasion of Ukraine in February 2022. The price of natural gas reached record highs, and as a result so did electricity in some markets. Oil prices hit their highest level since 2008.

Higher energy prices have contributed to painfully high inflation, pushed families into poverty, forced some factories to curtail output or even shut down, and slowed economic growth to the point that some countries are heading towards severe recession. Europe, whose gas supply is uniquely vulnerable because of its historic reliance on Russia, could face gas rationing this winter, while many emerging economies are seeing sharply higher energy import bills and fuel shortages. While today’s energy crisis shares some parallels with the oil shocks of the 1970s, there are important differences. Today’s crisis involves all fossil fuels, while the 1970s price shocks were largely limited to oil at a time when the global economy was much more dependent on oil, and less dependent on gas. The entire word economy is much more interlinked than it was 50 years ago, magnifying the impact. That’s why we can refer to this as the first truly global energy crisis.

Some gas-intensive manufacturing plants in Europe have curtailed output because they can’t afford to keep operating, while in China some have simply had their power supply cut. In emerging and developing economies, where the share of household budgets spent on energy and food is already large, higher energy bills have increased extreme poverty and set back progress towards achieving universal and affordable energy access. Even in advanced economies, rising prices have impacted vulnerable households and caused significant economic, social and political strains.

Climate policies have been blamed in some quarters for contributing to the recent run-up in energy prices, but there is no evidence. In fact, a greater supply of clean energy sources and technologies would have protected consumers and mitigated some of the upward pressure on fuel prices.

Russia's invasion of Ukraine drove European and Asian gas prices to record highs

Evolution of key regional natural gas prices, june 2021-october 2022, what is causing it, disrupted supply chains, bad weather, low investment, and then came russia's invasion of ukraine.

Energy prices have been rising since 2021 because of the rapid economic recovery, weather conditions in various parts of the world, maintenance work that had been delayed by the pandemic, and earlier decisions by oil and gas companies and exporting countries to reduce investments. Russia began withholding gas supplies to Europe in 2021, months ahead of its invasion of Ukraine. All that led to already tight supplies. Russia’s attack on Ukraine greatly exacerbated the situation . The United States and the EU imposed a series of sanctions on Russia and many European countries declared their intention to phase out Russian gas imports completely. Meanwhile, Russia has increasingly curtailed or even turned off its export pipelines. Russia is by far the world’s largest exporter of fossil fuels, and a particularly important supplier to Europe. In 2021, a quarter of all energy consumed in the EU came from Russia. As Europe sought to replace Russian gas, it bid up prices of US, Australian and Qatari ship-borne liquefied natural gas (LNG), raising prices and diverting supply away from traditional LNG customers in Asia. Because gas frequently sets the price at which electricity is sold, power prices soared as well. Both LNG producers and importers are rushing to build new infrastructure to increase how much LNG can be traded internationally, but these costly projects take years to come online. Oil prices also initially soared as international trade routes were reconfigured after the United States, many European countries and some of their Asian allies said they would no longer buy Russian oil. Some shippers have declined to carry Russian oil because of sanctions and insurance risk. Many large oil producers were unable to boost supply to meet rising demand – even with the incentive of sky-high prices – because of a lack of investment in recent years. While prices have come down from their peaks, the outlook is uncertain with new rounds of European sanctions on Russia kicking in later this year.

What is being done?

Pandemic hangovers and rising interest rates limit public responses, while some countries turn to coal.

Some governments are looking to cushion the blow for customers and businesses, either through direct assistance, or by limiting prices for consumers and then paying energy providers the difference. But with inflation in many countries well above target and budget deficits already large because of emergency spending during the Covid-19 pandemic, the scope for cushioning the impact is more limited than in early 2020. Rising inflation has triggered increases in short-term interest rates in many countries, slowing down economic growth. Europeans have rushed to increase gas imports from alternative producers such as Algeria, Norway and Azerbaijan. Several countries have resumed or expanded the use of coal for power generation, and some are extending the lives of nuclear plants slated for de-commissioning. EU members have also introduced gas storage obligations, and agreed on voluntary targets to cut gas and electricity demand by 15% this winter through efficiency measures, greater use of renewables, and support for efficiency improvements. To ensure adequate oil supplies, the IEA and its members responded with the two largest ever releases of emergency oil stocks. With two decisions – on 1 March 2022 and 1 April – the IEA coordinated the release of some 182 million barrels of emergency oil from public stocks or obligated stocks held by industry. Some IEA member countries independently released additional public stocks, resulting in a total of over 240 million barrels being released between March and November 2022.

The IEA has also published action plans to cut oil use with immediate impact, as well as plans for how Europe can reduce its reliance on Russian gas and how common citizens can reduce their energy consumption . The invasion has sparked a reappraisal of energy policies and priorities, calling into question the viability of decades of infrastructure and investment decisions, and profoundly reorientating international energy trade. Gas had been expected to play a key role in many countries as a lower-emitting "bridge" between dirtier fossil fuels and renewable energies. But today’s crisis has called into question natural gas’ reliability.

The current crisis could accelerate the rollout of cleaner, sustainable renewable energy such as wind and solar, just as the 1970s oil shocks spurred major advances in energy efficiency, as well as in nuclear, solar and wind power. The crisis has also underscored the importance of investing in robust gas and power network infrastructure to better integrate regional markets. The EU’s RePowerEU, presented in May 2022 and the United States’ Inflation Reduction Act , passed in August 2022, both contain major initiatives to develop energy efficiency and promote renewable energies.

The global energy crisis can be a historic turning point

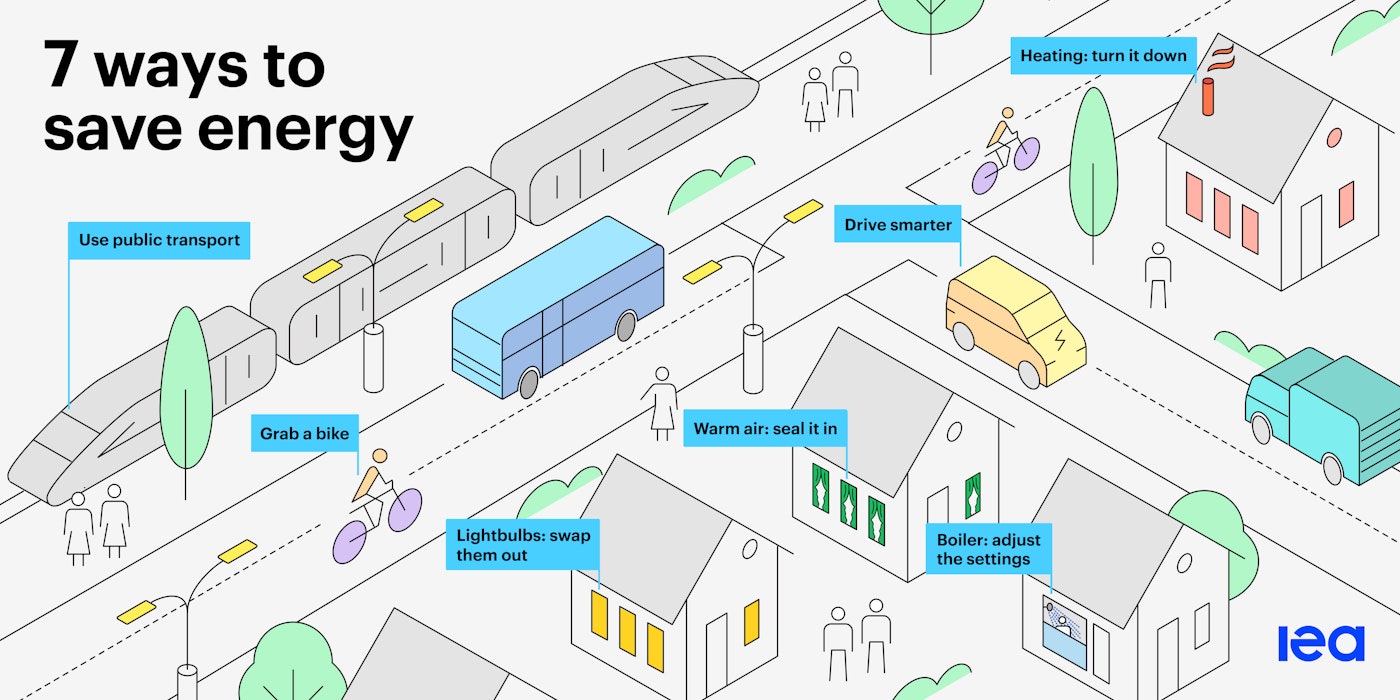

Energy saving tips

1. Heating: turn it down

Lower your thermostat by just 1°C to save around 7% of your heating energy and cut an average bill by EUR 50-70 a year. Always set your thermostat as low as feels comfortable, and wear warm clothes indoors. Use a programmable thermostat to set the temperature to 15°C while you sleep and 10°C when the house is unoccupied. This cuts up to 10% a year off heating bills. Try to only heat the room you’re in or the rooms you use regularly.

The same idea applies in hot weather. Turn off air-conditioning when you’re out. Set the overall temperature 1 °C warmer to cut bills by up to 10%. And only cool the room you’re in.

2. Boiler: adjust the settings

Default boiler settings are often higher than you need. Lower the hot water temperature to save 8% of your heating energy and cut EUR 100 off an average bill. You may have to have the plumber come once if you have a complex modern combi boiler and can’t figure out the manual. Make sure you follow local recommendations or consult your boiler manual. Swap a bath for a shower to spend less energy heating water. And if you already use a shower, take a shorter one. Hot water tanks and pipes should be insulated to stop heat escaping. Clean wood- and pellet-burning heaters regularly with a wire brush to keep them working efficiently.

3. Warm air: seal it in

Close windows and doors, insulate pipes and draught-proof around windows, chimneys and other gaps to keep the warm air inside. Unless your home is very new, you will lose heat through draughty doors and windows, gaps in the floor, or up the chimney. Draught-proof these gaps with sealant or weather stripping to save up to EUR 100 a year. Install tight-fitting curtains or shades on windows to retain even more heat. Close fireplace and chimney openings (unless a fire is burning) to stop warm air escaping straight up the chimney. And if you never use your fireplace, seal the chimney to stop heat escaping.

4. Lightbulbs: swap them out

Replace old lightbulbs with new LED ones, and only keep on the lights you need. LED bulbs are more efficient than incandescent and halogen lights, they burn out less frequently, and save around EUR 10 a year per bulb. Check the energy label when buying bulbs, and aim for A (the most efficient) rather than G (the least efficient). The simplest and easiest way to save energy is to turn lights off when you leave a room.

5. Grab a bike

Walking or cycling are great alternatives to driving for short journeys, and they help save money, cut emissions and reduce congestion. If you can, leave your car at home for shorter journeys; especially if it’s a larger car. Share your ride with neighbours, friends and colleagues to save energy and money. You’ll also see big savings and health benefits if you travel by bike. Many governments also offer incentives for electric bikes.

6. Use public transport

For longer distances where walking or cycling is impractical, public transport still reduces energy use, congestion and air pollution. If you’re going on a longer trip, consider leaving your car at home and taking the train. Buy a season ticket to save money over time. Your workplace or local government might also offer incentives for travel passes. Plan your trip in advance to save on tickets and find the best route.

7. Drive smarter

Optimise your driving style to reduce fuel consumption: drive smoothly and at lower speeds on motorways, close windows at high speeds and make sure your tires are properly inflated. Try to take routes that avoid heavy traffic and turn off the engine when you’re not moving. Drive 10 km/h slower on motorways to cut your fuel bill by around EUR 60 per year. Driving steadily between 50-90 km/h can also save fuel. When driving faster than 80 km/h, it’s more efficient to use A/C, rather than opening your windows. And service your engine regularly to maintain energy efficiency.

Analysis and forecast to 2026

Fuel report — December 2023

Europe’s energy crisis: Understanding the drivers of the fall in electricity demand

Commentary — 09 May 2023

Where things stand in the global energy crisis one year on

Commentary — 23 February 2023

The global energy crisis pushed fossil fuel consumption subsidies to an all-time high in 2022

Commentary — 16 February 2023

Fossil Fuels Consumption Subsidies 2022

Policy report — February 2023

Background note on the natural gas supply-demand balance of the European Union in 2023

Report — February 2023

Analysis and forecast to 2025

Fuel report — December 2022

How to Avoid Gas Shortages in the European Union in 2023

A practical set of actions to close a potential supply-demand gap

Flagship report — December 2022

Subscription successful

Thank you for subscribing. You can unsubscribe at any time by clicking the link at the bottom of any IEA newsletter.

The world’s energy problem

The world faces two energy problems: most of our energy still produces greenhouse gas emissions, and hundreds of millions lack access to energy..

The world lacks safe, low-carbon, and cheap large-scale energy alternatives to fossil fuels. Until we scale up those alternatives the world will continue to face the two energy problems of today. The energy problem that receives most attention is the link between energy access and greenhouse gas emissions. But the world has another global energy problem that is just as big: hundreds of millions of people lack access to sufficient energy entirely, with terrible consequences to themselves and the environment.

The problem that dominates the public discussion on energy is climate change. A climate crisis endangers the natural environment around us, our wellbeing today and the wellbeing of those who come after us.

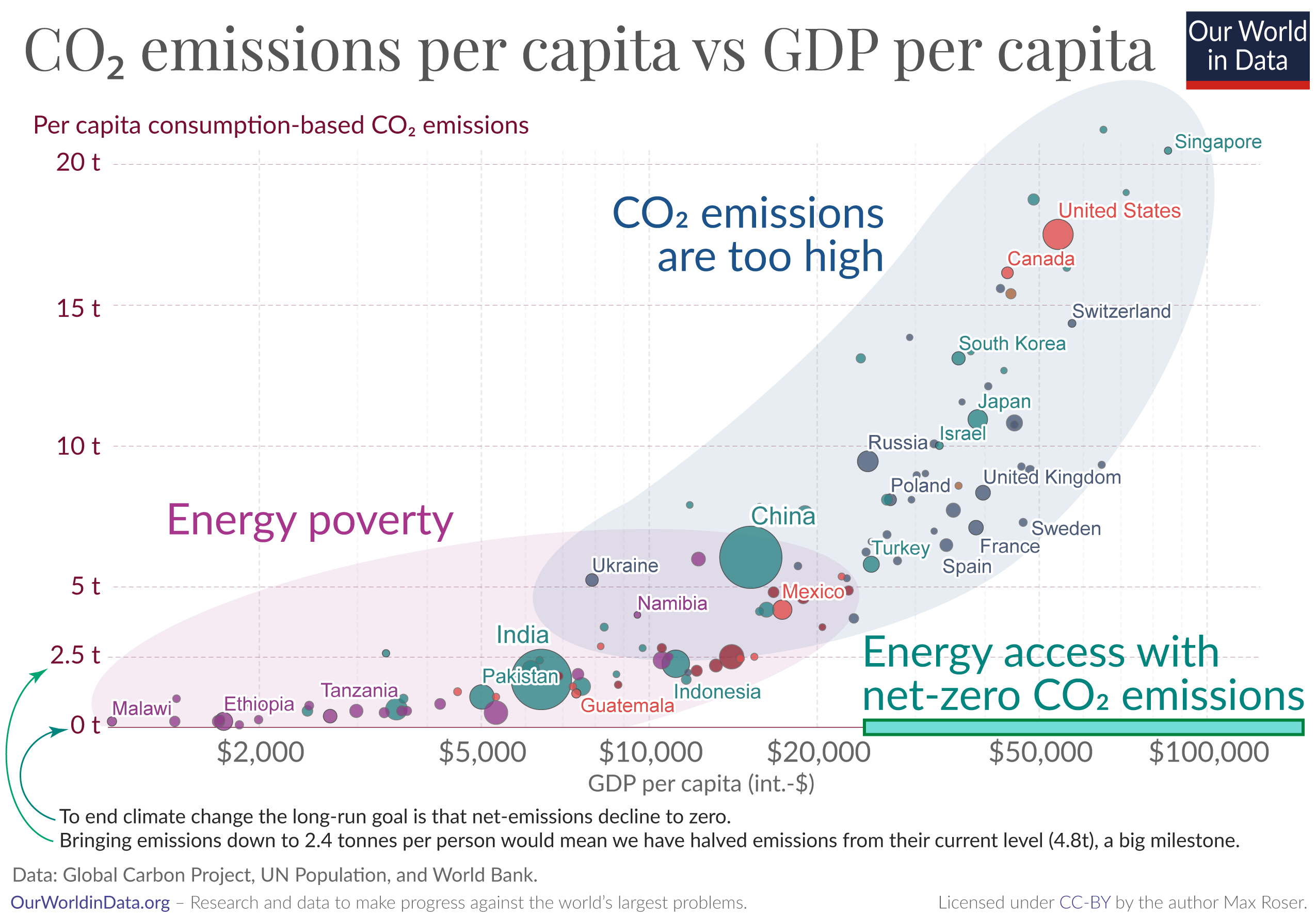

It is the production of energy that is responsible for 87% of global greenhouse gas emissions and as the chart below shows, people in the richest countries have the very highest emissions.

This chart here will guide us through the discussion of the world's energy problem. It shows the per capita CO2 emissions on the vertical axis against the average income in that country on the horizontal axis.

In countries where people have an average income between $15,000 and $20,000, per capita CO 2 emissions are close to the global average ( 4.8 tonnes CO 2 per year). In every country where people's average income is above $25,000 the average emissions per capita are higher than the global average.

The world’s CO 2 emissions have been rising quickly and reached 36.6 billion tonnes in 2018 . As long as we are emitting greenhouse gases their concentration in the atmosphere increases . To bring climate change to an end the concentration of greenhouse gases in the atmosphere needs to stabilize and to achieve this the world’s greenhouse gas emissions have to decline towards net-zero.

To bring emissions down towards net-zero will be one of the world’s biggest challenges in the years ahead. But the world’s energy problem is actually even larger than that, because the world has not one, but two energy problems.

The twin problems of global energy

The first energy problem: those that have low carbon emissions lack access to energy.

The first global energy problem relates to the left-hand side of the scatter-plot above.

People in very poor countries have very low emissions. On average, people in the US emit more carbon dioxide in 4 days than people in poor countries – such as Ethiopia, Uganda, or Malawi – emit in an entire year. 1

The reason that the emissions of the poor are low is that they lack access to modern energy and technology. The energy problem of the poorer half of the world is energy poverty . The two charts below show that large shares of people in countries with a GDP per capita of less than $25,000 do not have access to electricity and clean cooking fuels. 2

The lack of access to these technologies causes some of the worst global problems of our time.

When people lack access to modern energy sources for cooking and heating, they rely on solid fuel sources – mostly firewood, but also dung and crop waste. This comes at a massive cost to the health of people in energy poverty: indoor air pollution , which the WHO calls "the world's largest single environmental health risk." 3 For the poorest people in the world it is the largest risk factor for early death and global health research suggests that indoor air pollution is responsible for 1.6 million deaths each year, twice the death count of poor sanitation. 4

The use of wood as a source of energy also has a negative impact on the environment around us. The reliance on fuelwood is the reason why poverty is linked to deforestation. The FAO reports that on the African continent the reliance on wood as fuel is the single most important driver of forest degradation. 5 Across East, Central, and West Africa fuelwood provides more than half of the total energy. 6

Lastly, the lack of access to energy subjects people to a life in poverty. No electricity means no refrigeration of food; no washing machine or dishwasher; and no light at night. You might have seen the photos of children sitting under a street lamp at night to do their homework. 7

The first energy problem of the world is the problem of energy poverty – those that do not have sufficient access to modern energy sources suffer poor living conditions as a result.

The second energy problem: those that have access to energy produce greenhouse gas emissions that are too high

The second energy problem is the one that is more well known, and relates to the right hand-side of the scatterplot above: greenhouse gas emissions are too high.

Those that need to reduce emissions the most are the extremely rich. Diana Ivanova and Richard Wood (2020) have just shown that the richest 1% in the EU emit on average 43 tonnes of CO 2 annually – 9-times as much as the global average of 4.8 tonnes. 8

The focus on the rich, however, can give the impression that it is only the emissions of the extremely rich that are the problem. What isn’t made clear enough in the public debate is that for the world's energy supply to be sustainable the greenhouse gas emissions of the majority of the world population are currently too high. The problem is larger for the extremely rich, but it isn’t limited to them.

The Paris Agreement's goal is to keep the increase of the global average temperature to well below 2°C above pre-industrial levels and “to pursue efforts to limit the temperature increase to 1.5°C”. 9

To achieve this goal emissions have to decline to net-zero within the coming decades.

Within richer countries, where few are suffering from energy poverty, even the emissions of the very poorest people are far higher. The paper by Ivanova and Wood shows that in countries like Germany, Ireland, and Greece more than 99% of households have per capita emissions of more than 2.4 tonnes per year.

The only countries that have emissions that are close to zero are those where the majority suffers from energy poverty. 10 The countries that are closest are the very poorest countries in Africa : Malawi, Burundi, and the Democratic Republic of Congo.

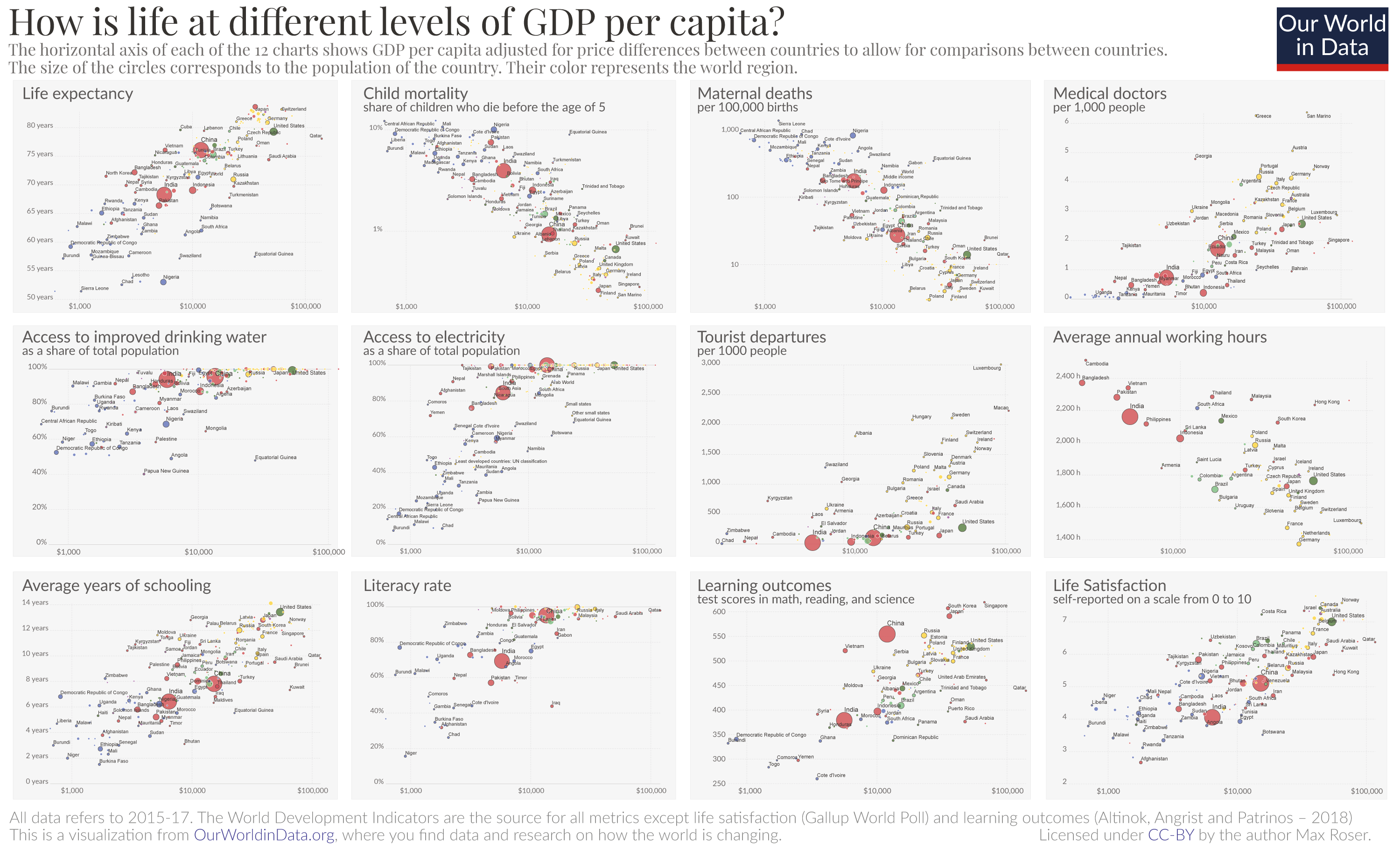

But this comes at a large cost to themselves as this chart shows. In no poor country do people have living standards that are comparable to those of people in richer countries.

And since living conditions are better where GDP per capita is higher, it is also the case that CO 2 emissions are higher where living conditions are better. Emissions are high where child mortality is the lowest , where children have good access to education, and where few of them suffer from hunger .

The reason for this is that as soon as people get access to energy from fossil fuels their emissions are too high to be sustainable over the long run (see here ).

People need access to energy for a good life. But in a world where fossil fuels are the dominant source of energy, access to modern energy means that carbon emissions are too high.

The more accurate description of the second global energy problem is therefore: the majority of the world population – all those who are not very poor – have greenhouse gas emissions that are far too high to be sustainable over the long run.

The current alternatives are energy poverty or fossil-fuels and greenhouse gases

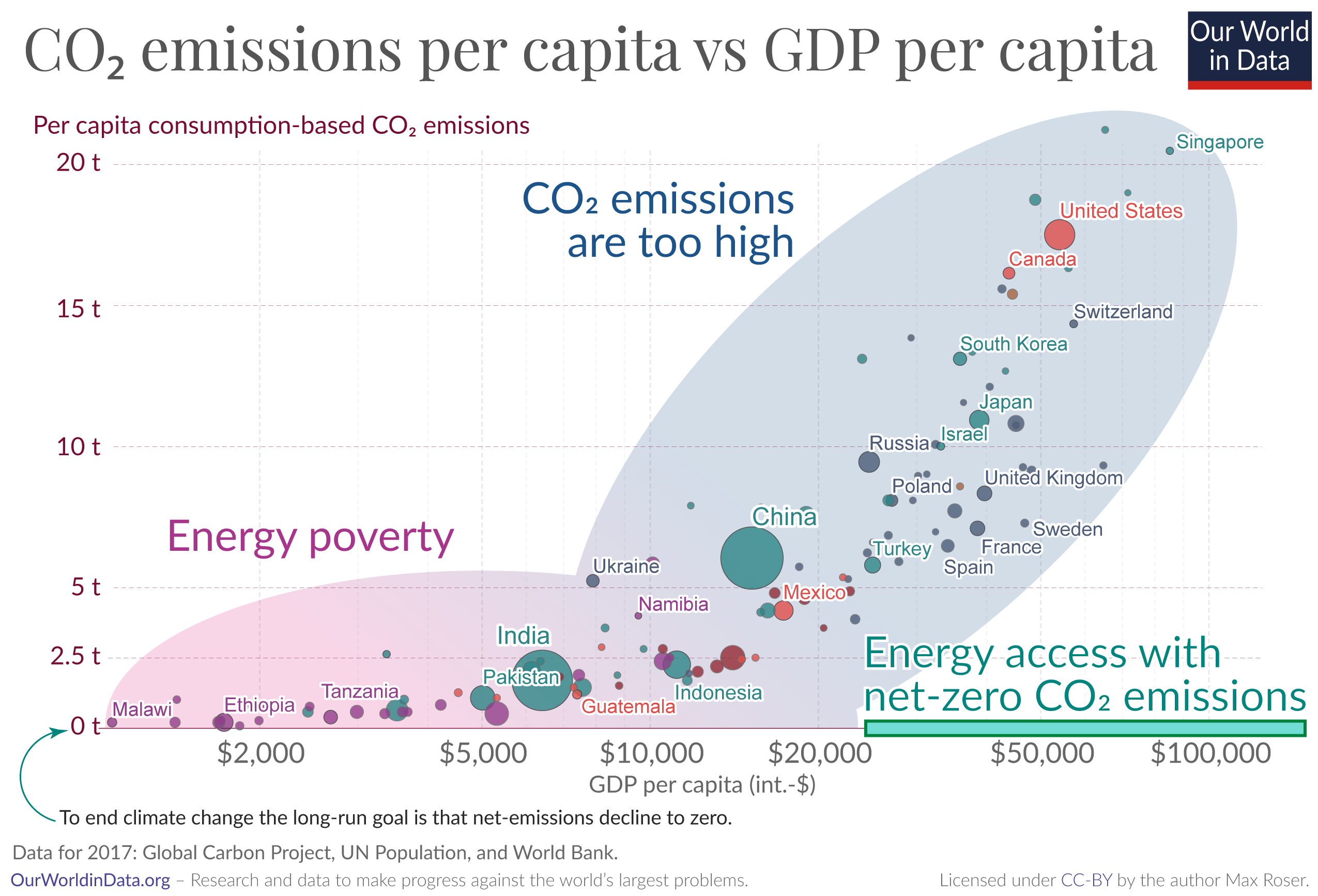

The chart here is a version of the scatter plot above and summarizes the two global energy problems: In purple are those that live in energy poverty, in blue those whose greenhouse gas emissions are too high if we want to avoid severe climate change.

So far I have looked at the global energy problem in a static way, but the world is changing of course.

For millennia all of our ancestors lived in the pink bubble: the reliance on wood meant they suffered from indoor air pollution; the necessity of acquiring fuelwood and agricultural land meant deforestation; and minimal technology meant that our ancestors lived in conditions of extreme poverty.

In the last two centuries more and more people have moved from the purple to the blue area in the chart. In many ways this is a very positive development. Economic growth and increased access to modern energy improved people's living conditions. In rich countries almost no one dies from indoor air pollution and living conditions are much better in many ways as we've seen above. It also meant that we made progress against the ecological downside of energy poverty: The link between poverty and the reliance on fuelwood is one of the key reasons why deforestation declines with economic growth. 11 And progress in that direction has been fast: on any average day in the last decade 315,000 people in the world got access to electricity for the first time in their life.

But while living conditions improved, greenhouse gas emissions increased.

The chart shows what this meant for greenhouse gas emissions over the last generation. The chart is a version of the scatter plot above, but it shows the change over time – from 1990 to the latest available data.

The data is now also plotted on log-log scales which has the advantage that you can see the rates of change easily. On a logarithmic axis the steepness of the line corresponds to the rate of change. What the chart shows is that low- and middle-income countries increased their emissions at very similar rates.

By default the chart shows the change of income and emission for the 14 countries that are home to more than 100 million people, but you can add other countries to the chart.

What has been true in the past two decades will be true in the future. For the poorer three-quarters of the world income growth means catching up with the good living conditions of the richer world, but unless there are cheap alternatives to fossil fuels it also means catching up with the high emissions of the richer world.

Our challenge: find large-scale energy alternatives to fossil fuels that are affordable, safe and sustainable

The task for our generation is therefore twofold: since the majority of the world still lives in poor conditions, we have to continue to make progress in our fight against energy poverty. But success in this fight will only translate into good living conditions for today’s young generation when we can reduce greenhouse gas emissions at the same time.

Key to making progress on both of these fronts is the source of energy and its price . Those living in energy poverty cannot afford sufficient energy and those that left the worst poverty behind rely on fossil fuels to meet their energy needs.

Once we look at it this way it becomes clear that the twin energy problems are really the two sides of one big problem. We lack large-scale energy alternatives to fossil fuels that are cheap, safe, and sustainable.

This last version of the scatter plot shows what it would mean to have such energy sources at scale. It would allow the world to leave the unsustainable current alternatives behind and make the transition to the bottom right corner of the chart: the area marked with the green rectangle where emissions are net-zero and everyone has left energy poverty behind.

Without these technologies we are trapped in a world where we have only bad alternatives: Low-income countries that fail to meet the needs of the current generation; high-income countries that compromise the ability of future generations to meet their needs; and middle-income countries that fail on both counts.

Since we have not developed all the technologies that are required to make this transition possible large scale innovation is required for the world to make this transition. This is the case for most sectors that cause carbon emissions , in particular in the transport (shipping, aviation, road transport) and heating sectors, but also cement production and agriculture.

One sector where we have developed several alternatives to fossil fuels is electricity. Nuclear power and renewables emit far less carbon (and are much safer) than fossil fuels. Still, as the last chart shows, their share in global electricity production hasn't changed much: only increasing from 36% to 38% in the last three decades.

But it is possible to do better. Some countries have scaled up nuclear power and renewables and are doing much better than the global average. You can see this if you change the chart to show the data for France and Sweden – in France 92% of electricity comes from low carbon sources, in Sweden it is 99%. The consequence of countries doing better in this respect should be that they are closer to the sustainable energy world of the future. The scatter plot above shows that this is the case.

But for the global energy supply – especially outside the electricity sector – the world is still far away from a solution to the world's energy problem.

Every country is still very far away from providing clean, safe, and affordable energy at a massive scale and unless we make rapid progress in developing these technologies we will remain stuck in the two unsustainable alternatives of today: energy poverty or greenhouse gas emissions.

As can be seen from the chart, the ratio of emissions is 17.49t / 0.2t = 87.45. And 365 days/87.45=4.17 days

It is worth looking into the cutoffs for what it means – according to these international statistics – to have access to energy. The cutoffs are low.

See Raising Global Energy Ambitions: The 1,000 kWh Modern Energy Minimum and IEA (2020) – Defining energy access: 2020 methodology, IEA, Paris.

WHO (2014) – Frequently Asked Questions – Ambient and Household Air Pollution and Health . Update 2014

While it is certain that the death toll of indoor air pollution is high, there are widely differing estimates. At the higher end of the spectrum, the WHO estimates a death count of more than twice that. We discuss it in our entry on indoor air pollution .

The 2018 estimate for premature deaths due to poor sanitation is from the same analysis, the Global Burden of Disease study. See here .

FAO and UNEP. 2020. The State of the World’s Forests 2020. Forests, biodiversity and people. Rome. https://doi.org/10.4060/ca8642en

The same report also reports that an estimated 880 million people worldwide are collecting fuelwood or producing charcoal with it.

This is according to the IEA's World Energy Balances 2020. Here is a visualization of the data.

The second largest energy source across the three regions is oil and the third is gas.

The photo shows students study under the streetlights at Conakry airport in Guinea. It was taken by Rebecca Blackwell for the Associated Press.

It was published by the New York Times here .

The global average is 4.8 tonnes per capita . The richest 1% of individuals in the EU emit 43 tonnes per capita – according to Ivanova D, Wood R (2020). The unequal distribution of household carbon footprints in Europe and its link to sustainability. Global Sustainability 3, e18, 1–12. https://doi.org/10.1017/sus.2020.12

On Our World in Data my colleague Hannah Ritchie has looked into a related question and also found that the highest emissions are concentrated among a relatively small share of the global population: High-income countries are home to only 16% of the world population, yet they are responsible for almost half (46%) of the world’s emissions.

Article 2 of the Paris Agreement states the goal in section 1a: “Holding the increase in the global average temperature to well below 2 °C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5 °C above pre-industrial levels, recognizing that this would significantly reduce the risks and impacts of climate change.”

It is an interesting question whether there are some subnational regions in richer countries where a larger group of people has extremely low emissions; it might possibly be the case in regions that rely on nuclear energy or renewables (likely hydro power) or where aforestation is happening rapidly.

Crespo Cuaresma, J., Danylo, O., Fritz, S. et al. Economic Development and Forest Cover: Evidence from Satellite Data. Sci Rep 7, 40678 (2017). https://doi.org/10.1038/srep40678

Bruce N, Rehfuess E, Mehta S, et al. Indoor Air Pollution. In: Jamison DT, Breman JG, Measham AR, et al., editors. Disease Control Priorities in Developing Countries. 2nd edition. Washington (DC): The International Bank for Reconstruction and Development / The World Bank; 2006. Chapter 42. Available from: https://www.ncbi.nlm.nih.gov/books/NBK11760/ Co-published by Oxford University Press, New York.

Cite this work

Our articles and data visualizations rely on work from many different people and organizations. When citing this article, please also cite the underlying data sources. This article can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Published: 16 February 2023

Burden of the global energy price crisis on households

- Yuru Guan ORCID: orcid.org/0000-0003-4426-7017 1 na1 ,

- Jin Yan 1 na1 ,

- Yuli Shan ORCID: orcid.org/0000-0002-5215-8657 1 , 2 ,

- Yannan Zhou ORCID: orcid.org/0000-0001-8982-5030 1 , 3 , 4 ,

- Ye Hang 1 , 5 ,

- Ruoqi Li 1 , 6 ,

- Binyuan Liu 1 ,

- Qingyun Nie 1 , 8 ,

- Benedikt Bruckner 1 ,

- Kuishuang Feng ORCID: orcid.org/0000-0001-5139-444X 9 &

- Klaus Hubacek ORCID: orcid.org/0000-0003-2561-6090 1

Nature Energy volume 8 , pages 304–316 ( 2023 ) Cite this article

39k Accesses

101 Citations

810 Altmetric

Metrics details

- Energy economics

- Energy policy

- Energy supply and demand

The Russia–Ukraine conflict has triggered an energy crisis that directly affected household energy costs for heating, cooling and mobility and indirectly pushed up the costs of other goods and services throughout global supply chains. Here we bridge a global multi-regional input–output database with detailed household-expenditure data to model the direct and indirect impacts of increased energy prices on 201 expenditure groups in 116 countries. On the basis of a set of energy price scenarios, we show that total energy costs of households would increase by 62.6–112.9%, contributing to a 2.7–4.8% increase in household expenditures. The energy cost burdens across household groups vary due to differences in supply chain structure, consumption patterns and energy needs. Under the cost-of-living pressures, an additional 78 million–141 million people will potentially be pushed into extreme poverty. Targeted energy assistance can help vulnerable households during this crisis. We emphasize support for increased costs of necessities, especially for food.

Similar content being viewed by others

The economic commitment of climate change

Systematic review and meta-analysis of ex-post evaluations on the effectiveness of carbon pricing

The refinery of the future

Energy markets have tightened since the COVID-19 pandemic, and the situation was exacerbated considerably following the Russia–Ukraine conflict in late February 2022, contributing to a global energy crisis 1 . Global energy prices surge because of a variety of factors, including the ongoing geopolitical conflict, a rapid global post-pandemic economic recovery, continued high reliance on fossil fuels and the severe mismatch between energy demand and supply 1 , 2 . Russia is a major exporter of oil (12.3% of global supply in 2021) and natural gas (23.6%) 3 . European countries reliant on oil and natural gas imports from Russia, already at high risk since gas storages were nearly and probably deliberately emptied before the war 4 , face unprecedented fuel supply shortages only slightly tempered by slowing economic growth and a mild winter in 2022–2023. At the same time, emerging economies suffer from high fuel-import costs and fuel deprivation 5 , 6 . Missed opportunities to redirect investments after the COVID-19 crisis with huge amounts of money used to kick-start the economy 7 and earlier slow progress in the energy transition 8 are reflected in and have been amplifying the dependency on fossil fuel imports and the severity of the cost-of-living crisis. This crisis has pushed a number of economies into recession, caused higher inflation 9 , and put painful cost-of-living pressures on households around the world 10 , 11 .

High energy prices impose cost burdens on households in two ways. On the one hand, fuel price rises directly increase household fuel bills (for example, for heating and cooling, cooking and mobility). On the other hand, energy and fossil feedstock inputs needed for the production of goods and services for final household consumption will lead to higher prices of household-expenditure items 12 , 13 . Due to the unequal distribution of income, reflected in different household consumption patterns, surging energy prices could affect households in very different ways 11 , 14 , 15 . Unaffordable costs of energy and other necessities would push vulnerable populations into energy poverty and even extreme poverty 16 . Understanding how global energy prices are transmitted to households through global supply chains and how they are affected is crucial for effective and equitable policy design.

Numerous studies have analysed the potential impacts of the Russia–Ukraine conflict on the energy system 8 , 17 , 18 , global food supply 19 , 20 , 21 , 22 and global economy 9 , 23 . In terms of household losses, research has focused on increased household energy costs 14 , 15 , 24 , energy insecurity 17 , 25 and poverty 16 caused by the crisis. However, quantitative research on the distribution of effects across households is limited, especially for developing countries. Many governments have introduced multiple fiscal measures to subsidize soaring energy bills for households 24 , 26 . These measures might be insufficient given the burden imposed by energy costs.

To fill these gaps, this paper provides a detailed assessment of the energy price shock on households and highlights the disparities of direct and indirect energy burden across different expenditure groups. We conduct a global comparative analysis of household burden across consumption levels under a set of price scenarios triggered by the Russia–Ukraine conflict. We design one base case and nine energy price scenarios (Supplementary Table 1 ) to examine the potential impacts of global price spikes on five fuels and fuel products (that is, coal, coal products, crude oil, petroleum products and natural gas). By linking a highly detailed expenditure database 27 based on the World Bank’s Global Consumption Database (WBGCD) 28 to a global multi-regional input–output database 29 , we model the direct and indirect burden of increased energy prices on households with different consumption patterns. We distinguish between 201 expenditure groups in 116 different countries, covering 87.4% of the global population, with a focus on developing countries. Given huge cost-of-living pressures, we quantify the additional population in energy poverty and extreme poverty under each price scenario. Our model captures short-term effects including ripple effects through global supply chains (Methods) 30 , 31 . It provides robust results at fine-sector resolution for a large number of countries and categories of households. Our results help to identify vulnerable households, thereby offering a basis for targeted support measures. Assumptions and limitations are given in Methods.

Surge in household burden for different scenarios

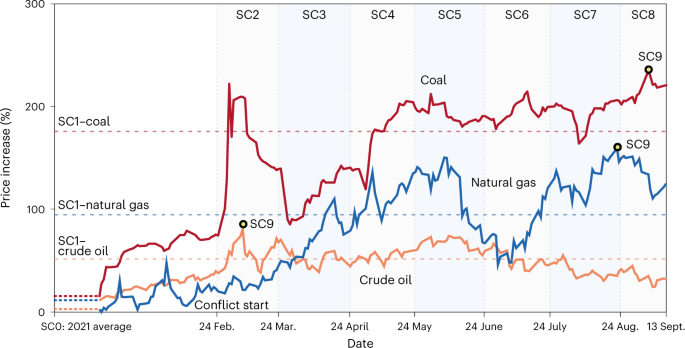

Since the conflict began, energy prices have increased sharply but with varying levels and volatilities for different fuels (as shown in Fig. 1 ). To measure the impacts triggered by this crisis, we collected recent global daily energy price data. We set the pre-crisis energy price scenario (SC0) to the average energy prices of 2021. For comparison, we set nine additional energy price scenarios (SC1–SC9) to reflect price changes for coal and coal products, crude oil and petroleum products and natural gas since 24 February 2022. SC1 refers to the average price scenario based on average prices from 24 February to 13 September 2022. SC2–SC8 model the possible effects under monthly average price increases. SC9 is an extreme scenario (based on peak prices for all fuels). Differences in levels and combinations of energy price increases help to reveal the potential magnitude of short-term impacts on households’ cost burden.

Prices for crude oil (Brent; orange), natural gas (US natural gas futures; blue) and coal (Newcastle; red) are shown. SC1 (horizontal dashed lines) refers to the average price for coal and coal products (+176%), crude oil and petroleum products (+51%) and natural gas (+94%) from 24 February to 13 September 2022. SC9 (black circles) refers to peak prices for coal and coal products (+235%), crude oil and petroleum products (+80%) and natural gas (+159%) during this period. SC2–SC8 (highlighted by vertical dotted lines) refer to monthly average prices. All references for price-scenario settings are provided in Supplementary Table 1 .

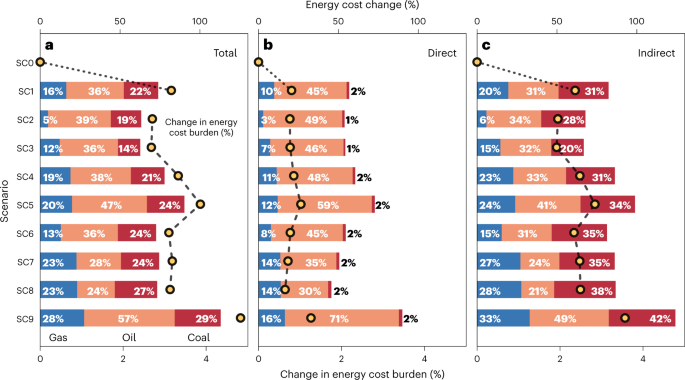

As shown in Fig. 2 , we assessed the changes in household energy costs, including direct energy costs for fossil fuel bills and indirect energy costs that affect price changes in goods and services based on energy requirements and input of fossil feedstock to production throughout global supply chains. Rising energy prices have created additional burdens on households’ daily consumption. We calculated the change in energy cost burden rates, which refers to additional energy costs in household total expenditure compared with pre-crisis levels. We choose the share of total expenditures rather than income as the former is less volatile, effectively reflecting patterns in household income, consumption and asset accumulation 32 .

a – c , Bars refer to per capita household energy cost increases compared with the pre-crisis energy price (SC0) for total ( a ), direct ( b ) and indirect ( c ) costs. Stacked bars show the contribution of each fuel to energy cost increases with blue representing natural gas, orange representing oil and petroleum products and red representing coal and coal products. Yellow dots refer to the increases in per capita energy cost burden rate (that is, the additional energy cost as a percentage of total household expenditure).

Under different energy price scenarios, total per capita household energy costs increased by a range of 62.6% (SC3) to 112.9% (SC9) at the global level, contributing to a 2.7–4.8% increase in household expenditure. Direct energy costs contributed 15.0–29.6% of additional costs, while indirect costs contributed 44.8–83.4%. Households’ indirect energy costs increased considerably more than their direct energy costs. Taking SC1 as an example, indirect energy costs rose by 82.3% (2.4% of total expenditure), compared with a 56.8% (0.8% of total expenditure) increase in direct energy costs. Rising prices for crude oil and petroleum products contributed the majority of the increase in total household energy costs (23.6–56.6%), followed by coal and coal products (14.0–28.8%) and natural gas (4.9–27.5%). The difference in fuel products’ contribution becomes larger when only direct energy costs are considered (that is, 29.7–71.3% from crude oil and petroleum products, 2.9–16.5% from natural gas and 1.1–2.3% from coal and coal products).

Energy cost burden for households across countries

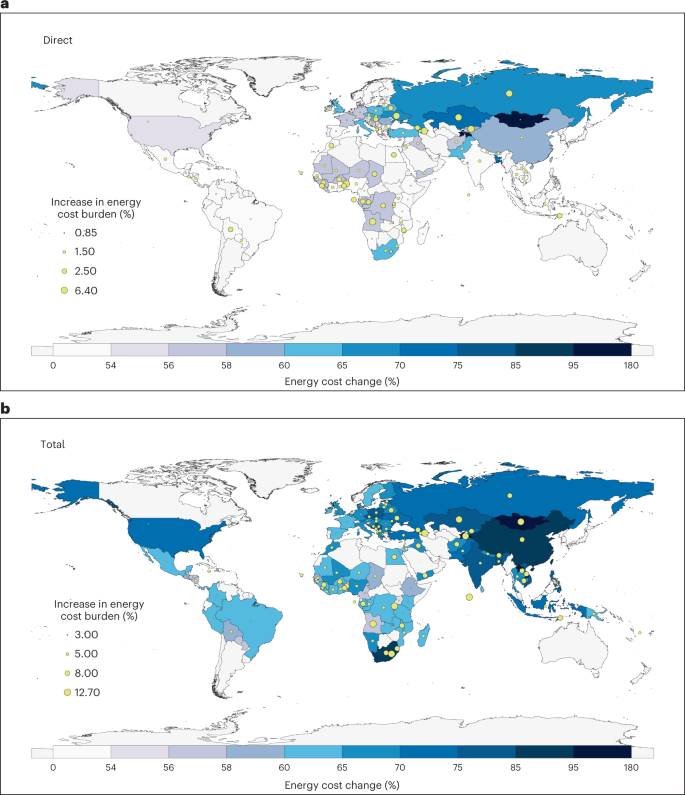

As shown in Fig. 3 , direct and indirect impacts of household burden show considerably different distributions across countries. The distribution of total impacts is mainly determined by indirect impacts (Supplementary Fig. 1 ). Under SC1, the increases in direct energy costs of households in 116 countries range from 51.1% to 176.1%. Central Asian households saw the largest increases (70.3%), particularly in Mongolia (176.1%) and Tajikistan (176.1%). In comparison, Latin American households were the least directly affected (51.5%). When we consider the total (both direct and indirect) energy cost changes, households in Central Asia are still the most affected (80.7%), followed by South and Southeast Asia (74.5%). For example, direct energy costs for households in Laos ‘only’ increased by 51.1% (0.9% of total expenditure), but their total energy costs increased by 100.8% (5.2% of total expenditure). Total energy cost increases for households in Russia (71.6%) are slightly lower than the global average (73.9%).

SC1 refers to average prices for coal and coal products (+176%), crude oil and petroleum products (+51%) and natural gas (+94%) from 24 February to 13 September 2022. a , Direct impacts. b , Total (that is, direct and indirect) impacts. The colour of countries shows the per capita energy cost increase (grey countries are missing from the WBGCD and are not analysed). The size of the circle refers to the change in the per capita energy cost burden rate (that is, the additional energy cost as a percentage of total household expenditure). The results shown here do not involve actual devastation and disruption of production caused by the war and national measures to alleviate cost burdens such as national transfer payments and subsidies (more information is provided in the Limitations section in Methods). Base map layer: ‘World Countries’. Downloaded from http://tapiquen-sig.jimdo.com . Carlos Efraín Porto Tapiquén. Orogénesis Soluciones Geográficas. Porlamar, Venezuela 2015. Based on shapes from Environmental Systems Research Institute. Free distribution.

Higher energy costs imposed different levels of additional burdens on household consumption. Countries’ direct and indirect energy cost burden rates show different results. When considering only direct impacts, many sub-Saharan African and central Asian countries face huge increases in energy cost burden rates. Angola (6.4%), Azerbaijan (3.5%) and Benin (3.5%) are the top three countries. In terms of total burden rates, the largest increase occurred in Tajikistan (12.7%). Overall, the burden of household energy costs increased more in lower-income economies.

Notably, for some countries in sub-Saharan Africa, we found that the increases in household energy costs would be relatively small, but the burden rate would increase substantially. In the case of households in Rwanda, a low-income country in East Africa, its total energy cost increase (59.5%) would be 19.5% lower than the global average (73.9%). In comparison, Rwanda’s total energy cost burden rates would increase by 11.1%, three times higher than the global average (3.2%). One reason is that residential energy use in these countries is less dependent on fossil fuels (for example, 99.6% of households in Rwanda cooked with biomass in 2018 (ref. 33 )), but the indirect energy costs through the supply chain have large negative impacts on these poor households.

To highlight the differences between economies at different income levels, we grouped country-level results into four groups based on the latest World Bank country classification by income 34 . In general, direct impacts for countries in each income group are more concentrated around the global average than their indirect results (Supplementary Fig. 2 ). It implies that household direct energy use is more uniform, but global supply chains vary widely across countries. For example, indirect impacts in middle-income economies have a larger variance than their direct impacts, compared with households in high- and low-income countries due to their consumption patterns and structure of supply chains. When considering total impacts, households in upper-middle-income countries show larger energy cost increases (a median of 68.1%). There are 19 countries where the average energy cost increases for households are higher than the world average, 16 of which are upper-middle- and lower-middle-income countries. Households in three high-income countries (Estonia (82.3%), Poland (78.0%) and the Czech Republic (75.5%)) suffer from above-global-average rises in energy costs, mainly due to their relatively high dependence on energy-intensive industries. In contrast, changes in energy costs for households in high-income and low-income countries are more clustered below the world average. The difference is that most high-income countries also have below-average rates of energy costs to total expenditure, which means more expenditure is spent on less energy-intensive products and services. In low-income countries, for poorer households already facing extreme energy poverty and severe food shortages, an increase in energy cost could lead to a greater risk of energy poverty 14 .

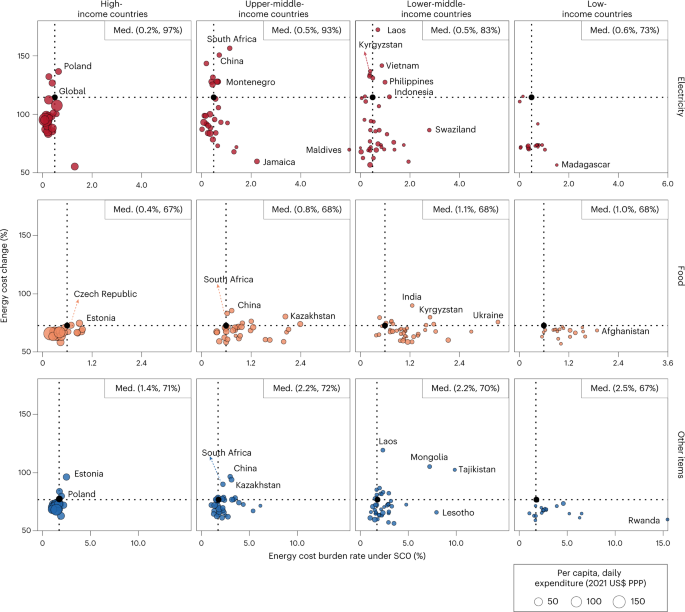

In addition, we decomposed the indirect impacts of rising energy prices on households into 33 expenditure items for 116 countries. Figure 4 shows the results for electricity, food and other items. Across different expenditure categories, changes in household energy burden are disproportionate to their pre-crisis energy cost burden rates (SC0). Compared with other items, households’ electricity costs tend to be most affected, but with large disparities between countries. For low-income countries, the cost increase in electricity (a median of 72.9%) is much lower than the global average (114.5%) because many households still lack access to electricity 35 . For upper-middle- (a median of 93.2%) and lower-middle-income (a median of 83.0%) countries, the impacts on electricity costs vary widely across countries. For example, electricity costs increased by 172.4% in Laos but only 56.7% in Haiti (a Latin American country). Energy cost changes in electricity in most high-income countries are below global levels because their electricity systems are less dependent on fossil fuels and thus less affected by rising fuel prices 36 . But there are noteworthy exceptions. For example, the electricity costs for Polish households are more affected than in other European countries because Poland is more dependent on coal for electricity generation (68.5% of coal power in 2020 (ref. 37 )). When considering food consumption, the increase in energy costs is lower than that for electricity in most countries. Taking Kyrgyzstan (a country in central Asia) as an example, the increase in indirect energy costs for food (79.7%) in Kyrgyzstan is 40.5% lower than its rising electricity costs (133.9%). The energy cost-burden rate for food (1.7%) in Kyrgyzstan is 349.6% higher than for electricity (0.4%). In addition, for households in most low-income countries, the increase in indirect energy costs in food expenditure is slightly higher than for other products. It is noteworthy that under the pre-crisis scenario (SC0), Ukrainian households bore a huge cost burden from food consumption. Although the study does not consider war-induced supply chain disruptions, it can be inferred that soaring energy prices greatly exacerbated this burden.

The x axis represents the per capita energy cost burden rate (that is, the energy cost as a percentage of total household expenditure) under SC0 (that is, the pre-crisis energy price). The y axis represents the change in per capita energy cost between SC0 and SC1 (that is, average prices for coal and coal products (+176%), crude oil and petroleum products (+51%) and natural gas (+94%) from 24 February to 13 September 2022). The size of the bubble indicates the average per capita daily expenditure, expressed in 2021 purchasing power parity (PPP) for each country. The dotted lines represent the global average. The numbers in the upper right corner of each box are the median (Med.) for that group. The classification of countries by income is based on the World Bank 34 .

Distribution of energy cost burden across expenditure groups

We further explored the uneven effects across household groups by using detailed survey data from 116 countries. To highlight the differences between economies at different income levels, we aggregated the country-level results into four income groups.

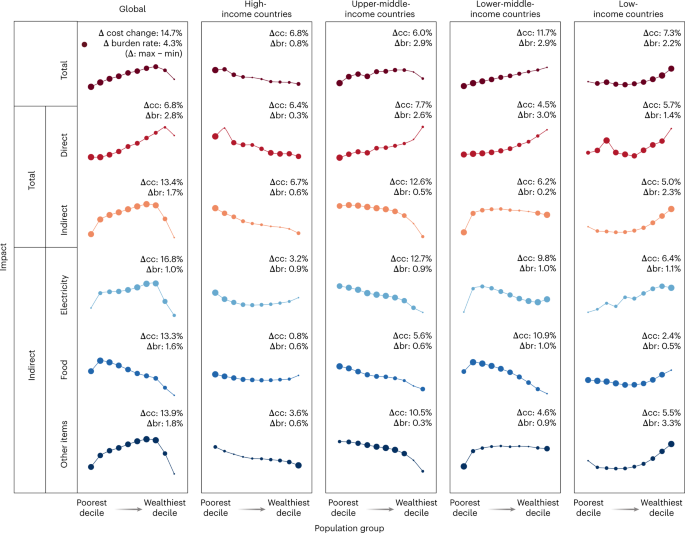

We examined the distribution of direct and indirect energy cost burden (both energy cost change and burden rate) for population deciles under SC1 (Fig. 5 ). We found substantial variations in household burden across population deciles. In general, the distribution of total burden in high- and low-income countries is largely dominated by their indirect burden, while that in middle-income countries depends to a larger extent on their direct results. For energy cost burden rates, the differences among population deciles are huge in upper- and lower-middle-income countries. Poorer households tend to bear higher total energy burden rates than richer households in most countries. Only for households in low-income countries, the total energy cost-burden rates show a progressive trend. When only the direct burden is considered, poorer households have lower increases in energy costs but suffer from higher burden rates, especially in middle-income countries.

SC1 refers to average prices for coal and coal products (+176%), crude oil and petroleum products (+51%) and natural gas (+94%) from 24 February to 13 September 2022. Points/curves show the per capita energy cost changes (in percent) per expenditure decile. The size of the circle refers to the energy cost burden rate (that is, the energy cost as a percentage of total household expenditure). The height of points on curves and the size of circles are comparable only within each subplot. The range (Δ, the maximum minus the minimum) among population deciles for each subplot is given in the upper right corner. Δcc equals the highest energy cost increases minus the lowest energy cost increases in each subplot. Δbr indicates the highest energy cost burden rates minus the lowest rates in each subplot.

The distribution of energy cost burden rates differs across household consumption categories. It is worth noting that the impacts on household food consumption are regressive across all country groups. Rising energy prices impose a huge burden on food consumption of the bottom 10% of the population. For example, the average energy cost burden rate in food of the bottom 10% of the population in Guinea (a West African country) is 65.7% higher than that of Guinea’s top 10%. For electricity, it is regressive within high- and upper-middle-income countries but progressive in low- and lower-middle-income countries.

We found the distributional effects differ notably between and within countries. Most of the high-income countries, such as the United States and Germany, show regressive effects, with poorer deciles facing higher rates of energy cost burden. Some countries, such as China, show greater cost increases in middle population deciles (trend shows inverted U shapes). Even countries with regressive or progressive distribution patterns, the burden of energy costs across population deciles can differ considerably. For example, Rwanda (a sub-Saharan African country) and Luxembourg (a high-income European country) show regressive effects. However, the total energy cost burden rate of the poorest decile in Rwanda is six times higher than the burden rate of the poorest decile in Luxembourg and ten times higher than that of the wealthiest decile in Luxembourg.

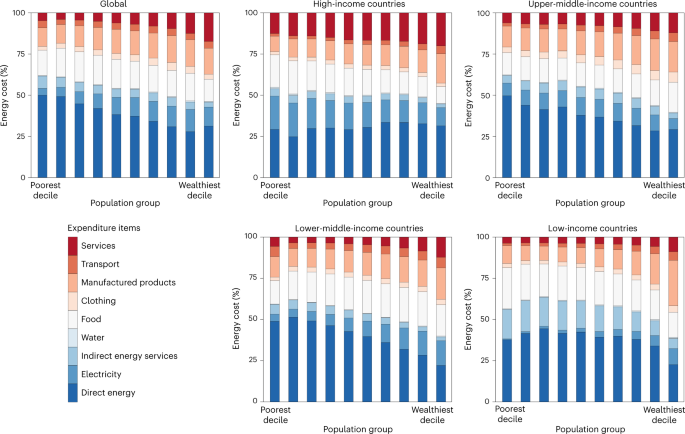

Differences in distribution between countries are determined by consumption structure and their supply chains. We investigated consumption patterns of groups via decomposing their energy cost-related expenditures, as shown in Fig. 6 . Wealthier groups tend to have higher energy costs on goods and services with high value added, while poorer households tend to spend more on meeting daily needs such as food and direct energy. More vulnerable households tend to be more reliant on purchasing energy-intensive, processed goods and services. For each country group, direct energy and electricity use plays a dominant role, followed by food and clothing. For high-income countries, the proportion of direct energy costs is similar and relatively small across population deciles. Households bear declining direct energy cost burdens as their consumption levels increase in middle-income countries. For households in low-income countries, indirect energy services contribute notably to energy costs across all population deciles, especially poorer ones. Embodied energy costs in food consumption vary across populations and across different countries. For example, for the bottom 10% of the population in low-income countries, energy costs embodied in food consumption accounted for 24.9% of total energy costs, compared with 10.2% for the top 10% in high-income countries.

SC0 refers to the pre-crisis energy price. We aggregated 33 expenditure items represented in the WBGCD into nine sub-categories (Supplementary Table 2 ). Energy use for private transport is included in ‘Direct energy’. ‘Transport’ includes transportation services and motor equipment purchased by households.

Additional poverty caused by the energy crisis

Rising energy prices are making households more vulnerable to energy poverty, particularly during the cold season 38 . People in energy poverty do not have access to affordable energy services that support a decent standard of living, including adequate heating, cooling, lighting and energy to power appliances 39 . The International Energy Agency (IEA) recently reported that the number of people living without electricity is increasing worldwide. The IEA predicts that the population without access to electricity will rise by 2.7% in 2022 compared with 2021, with the rise occurring mostly in sub-Saharan Africa 25 . In this study, households are defined as being in energy poverty when their energy costs account for more than 10% of total expenditures 40 . We found that 166 million–538 million people (2.4–7.9% of the global population) in the 116 countries analysed are potentially moving into energy poverty due to global energy price spikes.

Referring to the World Bank’s latest international poverty line (US$2.15 in 2017 purchasing power parity (PPP) per person per day, updated in September 2022), we estimated that an additional 78 million–141 million people (1.2–2.1% of the global population) could be pushed into extreme poverty. Our results are 5–48% larger than the estimates from the World Bank (75 million–95 million compared with pre-crisis projections) 16 . There are three explanations for this variation. First, the two estimates are based on different scopes. We focus on the household-living burden due to direct energy price increases for fossil fuel products but also on indirect price increases induced by energy inputs to all final-use items. In contrast, the World Bank estimates look at the consequences of food and non-food inflation. According to the World Bank estimates, every 1% increase in food prices will bring nearly ten million more people to extreme poverty 41 . Second, the World Bank report assumed that all households within a country are equally impacted by the rising prices. However, according to our estimates, different households have been hit differently by the current crisis. Therefore, they underestimated the impacts of the ongoing crisis on global poverty. Third, our upper-bound estimates are based on an extreme scenario (SC9, based on peak prices for all fuels), which is higher than the World Bank’s potential price increases.

Discussion and conclusions

This study is motivated by the energy and cost-of-living crisis triggered by the Russia–Ukraine conflict. The relationship between resources and conflicts is complex 42 , 43 . Energy can be a cause of conflict, such as securing energy resources and competing for other resources 44 . Energy also can be a means of conflict. For example, involved countries limit energy supply to increase leverage over energy-dependent countries 45 . The 2022 energy crisis is one such example. In contrast to the oil shocks of the 1970s, the energy crisis under the Russia–Ukraine conflict involves soaring prices for all fossil fuels 1 . The global economy is much more interconnected than before, magnifying negative impacts through global supply chains, putting painful cost-of-living pressures on households 12 , 13 . In this context, this paper quantifies short-term living cost increases experienced by households worldwide due to global energy price hikes following the Russia–Ukraine conflict. This reflects economic actors’ limited ability to adopt new technologies and switch to other fuels in the short run. We detail how household burdens vary with international energy prices across and within 116 countries.

Distributional impacts on households show considerable variation across and within different countries, which are largely determined by household consumption patterns and the fossil fuel dependency of global supply chains. Comparing across countries, households in central Asian countries are most affected in terms of total energy cost, and sub-Saharan African countries are most affected in terms of total energy cost burden rate. Wealthier households tend to have heavier burden rates of energy costs in low-income countries, whereas poorer households tend to have higher rates in high-income countries. Wealthier groups tend to have higher energy costs on goods and services with high value added, while poorer households tend to spend more on meeting daily needs such as food and direct energy. Furthermore, we show how this crisis is exacerbating energy poverty and extreme poverty worldwide. For poor countries (for example, sub-Saharan African countries), living costs undermine their hard-won gains in energy access and poverty alleviation. Ensuring access to affordable energy and other necessities is even more urgent for those countries 25 .

At this juncture, protecting vulnerable households should be a clear priority. European governments have successively adopted several fiscal measures to shield households from soaring energy bills, such as energy tax reductions, energy retail price freezes, energy bill discounts or subsidies and energy price caps 24 , 26 . For example, most European governments including Romania, Estonia and Latvia have provided one-off energy subsidies for low-income groups 26 . Developing countries such as Thailand also took action, including extending the diesel tax cut and increasing subsidies for household electricity bills 46 . In addition to policies on direct energy consumption, some countries have increased assistance to vulnerable groups (for example, pensions, rent subsidies and child benefits) to ease the rise of the cost-of-living burden 26 . Our research emphasizes the necessity to alleviate increased costs of necessities caused by energy price hikes, especially for food and especially for low-income households. In response to the surge in food costs, governments can alleviate such household burden in many ways, such as setting price subsidies, implementing import taxes with clear sunset clauses for basic staple food, direct transfers for low-income households 31 and investing in and providing incentives for and legislation to support food supply chains with sustainable sources of energy. In this crisis, energy companies reaped higher profits 5 . To recoup some of the additional strains on national budgets, governments are implementing and discussing windfall taxes for energy companies (for example, the United Kingdom, Italy and Cyprus) 47 .

It is worth noting that short-term policies addressing the cost-of-living crisis must be in line with climate-mitigation goals and other long-term sustainable development commitments. However, the energy transition is threatened by existing subsidies for fossil fuels 17 , fuel-tax cuts 48 and increased investments in quickly available fossil resources 10 . High energy prices are reshaping global energy markets and pushed some European countries to delay the phase out of fossil fuels 49 while seeking alternative sources abroad (for example, liquefied natural gas (LNG) from the Asia–Pacific region) and investing more in carbon-intensive infrastructure (for example, floating storage and regasification units in Southeast Asia) 50 . The fuel scramble led by the advanced economies creates potential spillover effects on others 5 , 49 . For example, if Europe dominates the global LNG supply and LNG terminal (for example, floating storage and regasification units), some traditional consumers, especially in the Asia–Pacific region, could revert to quickly available fossil-intensive resources 10 . Moreover, increased energy costs might squeeze poor countries’ investment in renewable energy infrastructure due to limited budgets 5 . Overall, these emergency measures could temporarily solve the current dilemma but create carbon lock-in, slow down the energy transition and further delay already short-falling climate-mitigation efforts globally 2 , 50 . In addition, and frequently overlooked, is the fact that renewables have their own set of problems such as a potential increase in prices for scarce materials required to produce technologies based on renewables, with similar or even higher dependencies and market concentrations 51 .

This unprecedented global energy crisis should come as a reminder that an energy system highly reliant on fossil fuels perpetuates energy-security risks and accelerates climate change 8 , 52 . In particular, existing high energy prices and recent Organization of Petroleum Exporting Countries limits on oil exports have further pushed prices higher 53 . These emphasize the urgency to realize diversified energy sources and develop a more secure, diverse, reliable and independent energy system by accelerating the clean energy transition for all countries. The European Commission proposed the REPowerEU Plan to spur massive investment in renewable energy, scale up electrification and seek substitute fuels in industry, building and transport sectors 52 . The EU solar energy strategy plans to increase the installed capacity of solar photovoltaics to 320 GW by 2025, more than doubling current levels 52 . For poor countries, the 27th United Nations Climate Change Conference of the Parties emphasizes international cooperation to provide tailor-made financial and technical assistance (for example, affordable loans to local public authorities) to wean them off coal and build renewable energy markets. We call for more attention to countries that have been severely affected by this crisis. Multilateral action is critical to address potential energy transition bottlenecks and alleviate inequalities in access to affordable energy for households worldwide 35 .

In this study, we used an environmentally extended multi-regional input–output (EEMRIO) approach to estimate both direct and indirect household energy costs. This model is able to reflect the short-term energy price transmission throughout global supply chains. In the short run, companies and households have only limited options to adjust their consumption patterns and underlying technological choices (for example, switch from a gas burner to solar photovoltaics) as they are locked into their past technology choices and thus their current energy use. Compared with other models, it has the advantage to estimate the direct and indirect impact of energy prices on households. To measure the magnitude of the impact of energy price fluctuations, we designed one base case, that is, the pre-crisis energy price scenario (SC0) and nine energy price scenarios (SC1–SC9) to capture the potential distributional impacts of different energy price scenarios. Additional poverty was assessed under each energy price scenario. Data sources and processing are provided. Assumptions and uncertainties for all calculations are also given. Datasets for different expenditure groups in 116 countries are available in Supplementary Dataset 1 .

Household energy costs

The total household energy costs of the expenditure group g for fuel k in region r (ec g , k , r ) can be calculated as the sum of direct energy costs ec direct, g , k , r and indirect energy costs ec indirect, g , k , r :

Direct energy costs for households

The direct energy costs can be calculated using the household direct energy consumption en hhs, g , k , r multiplied by the energy price of fuel k ( p k ):

Indirect energy costs for households

The EEMRIO framework was applied to estimate the indirect energy costs (ec indirect, g , k , r ). Indirect energy costs refer to expenditure of goods and services due to fossil fuel uses throughout global supply chains. Taking plastic consumption as an example, oil is not only used as a direct feedstock for producing plastic, but oil and other forms of energy are used during the entire global supply chain from extraction to transport, transformation in factories and so on, all the way to the final product and to the final consumer. The production processes involved in consumption-based accounting (indirect results) are highly complex but traceable through the EEMRIO approach.

EEMRIO analysis has been widely used in numerous energy, environmental and economic studies to reveal impacts through entire global supply chains 54 , 55 , 56 . We selected the EEMRIO approach due to its unique ability to provide robust results at fine-sector resolution for a large number of countries and categories of households (for similar studies see, for example, refs. 31 , 57 , 58 ). Our model is able to estimate short-term effects of energy price hikes on households before changes in industrial production processes and the adoption of adaptive measures by consumers (for example, changing lifestyles and consumption behaviours 59 ). Such short-term estimates could be good references for socially acceptable public policies for rising energy prices 31 , 60 . Numerous studies have examined the distributional effects of environmental and economic elements (for example, energy footprints 61 , carbon footprints 27 , 57 , 62 and carbon pricing 30 , 31 ) on households across countries and regions using the EEMRIO framework with MRIO tables at its core 54 , 56 , 63 .

The MRIO approach is able to characterize the monetary flows among sectors and consumers of different regions. For each row of an MRIO table, a linear equation can be used to depict the production of the economy:

where \(x_i\!^r\) is the total output of sector i in region r ; \(z_{ij}\!^{rs}\) denotes the intermediate inputs from sector i in region r to sector j in region s ; \(y_i\!^{rs}\) is the final demand (that is, household consumption, government consumption and investment) of region s from sector i in region r . On the basis of the Leontief framework 64 , the basic linear equation can be expressed in matrix form as:

where \({{{\mathbf{X}}}} = \left( {x_i\!^r} \right)\) is the total output vector; L = ( I − A ) −1 is the Leontief inverse matrix or total requirements matrix, with the element \(l_{ij}\!^{rs}\) showing the total inputs of sector i in region r required to satisfy one unit of final demand in sector j in region s ; \({{A}} = \left( {a_{ij}^{rs}} \right) = \left( {z_{ij}^{rs}/x_j^s} \right)\) refers to the technological coefficient matrix in which \(z_{ij}\!^{rs}\) represents the intersectoral economic linkages between the regions, and I is an identity matrix with the same size of A ; \({{{\mathbf{Y}}}} = \left( {y_i\!^{rs}} \right)\) is the final demand vector. As we focus on the burden of the global energy price crisis on households, thus, the energy costs by government consumption and investments are not included in the analysis. Therefore, the final demand vector Y covers only household consumption.

We created a row vector \({{{{\varepsilon }}}} = \left( {\varepsilon _i^r} \right)\) to represent the energy cost coefficient (that is, energy costs per unit of total output), with the element \(\varepsilon _i\!^r\) representing the energy cost coefficient of sector i in region r :

where \(\mathrm{ec}_i\!^{\mathrm{industry},g,k,r}\) is the industrial energy costs of the expenditure group g for fuel k of sector i in region r , which can be calculated as follows:

where \(\mathrm{en}_i\!^{\mathrm{industry},g,k,r}\) is the industrial energy consumption, and p k is the price of fuel k as defined in equation ( 2 ).

Thus, the indirect energy cost ec indirect matrix can be calculated by pre-multiplying X with an energy cost coefficient as follows:

where the element \(\mathrm{ec}_i\!^{\mathrm{indirect},g,k,r}\) in ec indirect refers to the indirect energy costs induced by the household final demand of group g for fuel k in sector i in region r .

Burden of rising energy costs on households

Given an increase in energy prices, we can calculate direct and indirect energy cost changes, separately. We introduced three indicators to evaluate the household burden due to energy price hikes.

One is energy cost change, which includes direct energy cost changes for fossil fuel bills and indirect energy costs affecting price changes of goods and services based on the energy requirements throughout global supply chains. It is worth mentioning that the change in indirect energy costs does not refer to the increase in the actual purchasing price for products but the increase in energy costs reflected in products. In this case, the change in indirect energy costs can be much higher than direct cost changes. The second indicator is the energy cost-burden rate, which refers to the share of direct and indirect energy costs in total household expenditures. The last is the change in the energy cost burden rates, which measures the increase in the energy burden rate compared with the pre-crisis level (SC0).

The global energy crisis is exacerbating the plight of the world’s poor 41 . Given the combined crises of COVID-19, growing inflationary pressures and the war in Ukraine, many reports and news have mentioned the impacts on global poverty 14 . However, quantitative research on the potential consequences of rising energy prices on global poverty is still lacking but much needed. To fill these gaps, we assessed the households’ additional expenditures due to increased direct and indirect energy costs. We considered the differential impacts on households with various consumption patterns. Assuming that the total expenditure of households remained the same in the short term as before the price increase, the additional energy costs will lead to a reduction in the purchasing power for other essential needs. As a result, some people living above US$2.15 a day in 2017 PPP (that is, the international poverty line, a global absolute minimum, updated in September 2022) would be pushed to extreme poverty due to their inability to meet basic living needs. In this context, we assessed the additional population in extreme poverty under each energy price scenario. According to a recent World Bank report 65 , the global poverty rate (at the extreme poverty line) in 2021 is 8.9%. On the basis of this poverty rate and our matched expenditure and population data for 201 expenditure groups, we derived a relative poverty line for the year 2021. For each expenditure group, we subtracted their additional energy costs from the corresponding total household expenditures. The rest was compared with the relative poverty line to determine whether the group has been pushed into extreme poverty. Our approach makes it possible to obtain an additional number of people in poverty due to costs of living pressures under each price scenario.

In addition, rising energy prices are also putting more people at risk of energy poverty. Energy poverty is a multi-dimensional issue and can be measured by various definitions and indicators 39 . On the basis of our estimated rises in energy costs during this crisis, we selected the maximum percentage of household energy costs in consumer income or expenditure as a measure of energy poverty. We use 10% of households’ total expenditure spent on energy bills (for residential fuels and electricity use) as our energy poverty set point 40 . For each expenditure group, the additional number of people considered to be energy poor due to increased energy bills was estimated under each price scenario.

Data sources and processing

To model the different impacts of rising energy prices on households, we applied the following data sources and preparation steps:

Energy price data

Energy price data are based on daily price data from 1 January 2021 to 13 September 2022 for five fossil fuels and fuel products: coal, coal products, crude oil, petroleum products and natural gas. We used Newcastle coal futures, Brent futures and US natural gas futures as benchmarks for coal and coal product prices, oil and petroleum product prices and natural gas prices, respectively. All price data were collected from the Trading Economics website ( https://tradingeconomics.com/commodities ).

Energy-consumption data and processing

Energy-consumption data are derived from IEA World Energy Balances 36 for the year 2019. On the basis of a mapping approach provided by the Global Trade Analysis Project (GTAP) energy date set 66 , we processed the final energy consumption for the year 2019, consistent with the GTAP regional and sectoral classification. Final energy-use data cover energy used for combustion and non-energy used as feedstock. Household direct energy use is considered a separate vector, including private vehicle fuel use for mobility and residential energy use for heating, cooling and cooking. We extrapolated the energy-consumption data to the year 2021 based on the average annual gross domestic product (GDP) growth rate (from 2019 to 2021) for our research topic.

MRIO data and processing

The multi-regional input–output table is taken from the GTAP 11 Data Bases 29 , which contains high-resolution information on the interregional and intersectoral transactions of the world economy for the year 2017 in the purchaser’s price for 141 countries and regions. Each country or region has 65 economic sectors. Using consumer price indices from the World Bank 67 , the GTAP MRIO table of 2017 was inflated to the prices of 2021 to match our research topic.

Household-expenditure data and processing

Household-expenditure data are taken from the World Bank’s Global Consumption Database (WBGCD) 28 . The WBGCD provides consumer expenditure survey data for the year 2011 for 116 countries, representing 87.4% of the global population, especially with representation from developing countries 28 . For each country, the expenditure share and corresponding population share for 201 expenditure groups among 33 expenditure items are listed (Supplementary Table 2 ). Expenditure groups represent consumption levels ranging from US$0 to US$1 million per capita per year, expressed in 2011 PPP. For example, Group 0th (that is, the lowest consumption level) represents people consuming less than US$50 in 2011 PPP per year and Group 200th (that is, the highest consumption level) is for the group consuming between US$0.95 million and US$1 million in 2011 PPP per capita per year. Not all countries will have populations in all groups. For consistency reasons, we used the detailed expenditure structure (instead of real consumption data) for the year 2011 from the WBGCD to disaggregate the total household final demand in the GTAP MRIO table. Given the lack of more recent consistent data, we assumed that the expenditure structure of each expenditure group in each country remains the same as they were in 2011.

Bridging and matching WBGCD to GTAP 11

The expenditure data from the WBGCD come with different regional and sectoral classifications than the GTAP, so it is necessary to transform them into a GTAP format. Following the approaches of previous studies 27 , 61 , 62 , we bridged and matched the WBGCD with GTAP 11 household final demand vectors in three steps.