Related Expertise: Economic Development , Financial Institutions , Social Impact

How Mobile Money Agents Can Expand Financial Inclusion

February 14, 2019 By Shalini Unnikrishnan , Jim Larson , Boriwat Pinpradab , and Rachel Brown

Some 1.7 billion people around the world lack access to basic financial services such as a bank or mobile money account. Digital financial services have the potential to bring this population, concentrated in developing countries, into the financial system—giving them greater financial security and resilience to economic setbacks. But for that to happen, people need a mechanism for depositing and withdrawing their physical cash; that is, cash-in/cash-out services. Agent networks, a distribution channel that relies on individual entrepreneurs under a franchise-like model, have been shown to be an effective way to provide those services.

In 2018, BCG conducted a study on the economics of financial services agent networks, with a particular focus on those that support mobile money platforms. The work demonstrates that agent networks can flourish in areas that support healthy numbers of transactions. In those locales, the transaction fees earned by agents more than compensate for the financial costs and operational burdens of the business. Traditionally, financial services providers have made decisions about where to invest in agent networks mainly according to population size and density, creating an urban versus rural segmentation. This study defines the limits of network reach on the basis of agent and provider economics and identifies a new approach that will help identify overlooked profitable locations and drive potential interventions to support agent network growth.

The Promise of Digital Financial Services

In a small village in Kajiado County, Kenya—80 kilometers from Nairobi—M-Pesa agent William is helping to transform daily life. From a counter in his uncle’s small grocery shop, William collects about $300 in cash deposits every day from local villagers and dispenses upwards of $500 in cash, processing these financial transactions through the M-Pesa mobile payments account on his mobile phone.

William has developed a loyal set of customers, typically day laborers, farmers, and other local members of his Maasai community, who rely on him to deposit their earnings, purchase mobile airtime, and pay important utility bills. He offers informal credit to some customers and also runs a small side business recharging mobile phones for those who lack access to electricity. Twice per week, he pays a neighbor to drive him 20 kilometers by motorbike to the nearest bank. There, he adjusts both the amount of cash he has on hand and the balance, or “float,” in his M-Pesa account.

Digital financial services, including mobile wallets and digital payment systems offered by platforms like M-Pesa, have the potential to usher into the financial system many of the 1.7 billion people the World Bank estimates lack access to a bank account or mobile money service. But there’s a catch. For digital financial services to take off in developing markets, where virtually all transactions are still conducted in cash, people need access to physical infrastructure to safely and seamlessly deposit and withdraw cash. Banks have traditionally offered these cash-in/cash-out services via ATMs and bank branches. But these solutions are often too expensive to make economic sense in markets that have low-income, low-density populations.

Mobile money agents can put banking within reach for 1.7 billion people globally.

Copy Shareable Link

That’s where mobile money agents like William can make the difference. The mobile money agent model has experienced rapid growth in developing markets over the past 15 years, particularly in sub-Saharan Africa and South Asia. Yet, despite this momentum, many unbanked populations, particularly in rural areas, are beyond the reach of these networks. In light of that, BCG has partnered with the Bill & Melinda Gates Foundation to study the economics of mobile money agent networks and their role in advancing financial inclusion. The key questions: What are the economics of mobile money networks for both individual agents and the providers, such as banks and mobile network operators (MNOs), that develop them? Where is this model sustainable—and what factors limit its reach?

Our work begins to shed light on the kinds of action that the private sector, governments, and philanthropies can take to cultivate and support these agent networks. Such efforts can dramatically expand access to financial services —and that, in turn, can transform lives, giving consumers a safe and low-cost way to store and transfer money and ultimately helping to lift people out of poverty.

The Power of Agent Networks

The 1.7 billion adults who lack a bank or mobile money account—roughly 35% of the world’s adult population—rely largely on cash transactions in their daily life. According to research by the World Bank and Mastercard, in developing countries, more than 90% of transactions are executed with cash. Absent a way for people to move that physical cash into and out of an account, this population will remain excluded from the financial system. Agent networks—particularly those that use mobile technology—can provide that critical link.

The Role of a Cash-In/Cash-Out Infrastructure

Cash-in/cash-out services provide a bridge between a cash-only world and the use of both digital and traditional bank accounts. Such accounts can set consumers on a path to the adoption and sustained use of more-complex financial products . In fact, even in an advanced financial system such as the US, more than 30% of transactions are still conducted in cash, making cash-in/cash-out services a continued necessity.

In most developed economies, cash-in/cash-out services are delivered via bank branches and ATMs. Countries with nearly universal financial access have large numbers of these access points. South Korea, for example, has more than 200 ATMs per 100,000 adults and over 30 branches per 100,000 adults, according to the World Bank. This system is less robust in developing nations, however. That’s because bank branches are expensive to set up and operate. World Bank Data suggests there are an average of just 5 banks per 100,000 adults across countries in Africa. And ATMs require high capital investments as well as costly ongoing maintenance and cash replenishment.

How Traditional Bank Agents Helped Fill the Gap

Given the limited reach of traditional cash-in/cash-out infrastructure, another model has been required to ensure broad global access to financial services. In some markets, the answer was the deployment of local bank agents.

These agents, who help banks acquire and serve customers, have worked under what is essentially a franchise model. (See “The Traditional Agency Banking Model.”) Bank agents are typically required to invest significant upfront capital in the business and are encouraged to leverage their personal connections and credibility within the local community to stoke demand. This model provides substantial cost benefits to the provider, as the agent incurs the majority of startup costs, and most ongoing costs are variable and commission-based. The agent model also features some important non-financial benefits. As the retail face of the business, agents can provide customer assistance in a way that most ATMs cannot. This is especially valuable in communities with low rates of overall and technological literacy.

THE TRADITIONAL AGENCY BANKING MODEL

Traditional banking agents operate in many ways like a miniature bank branch, giving them a crucial role in expanding financial inclusion. They not only provide transaction services such as cash deposits and withdrawals, balance inquiries, and fund transfers to customers with a formal bank account but may offer other products including savings accounts, small loans, and insurance. In addition, governments increasingly use banking agents as a distribution channel for public programs such as social cash transfers and commodity subsidies.

Under this model, banks earn most of their revenue through the net interest earned on deposits or the interest charged on loans. They typically charge only minimal fees for cash-in/cash-out transactions. And in many countries, consumer protection laws mandate that a certain number of those transactions must be free of charge to the account holder.

On the cost side, while traditional agency banking is a leaner model than a bank branch, it comes with many of the same operational requirements, including branding and marketing, agent training and monitoring, and compliance oversight. In addition, banks typically pay agents a fixed commission based on the transactions they execute—even if the bank does not generate fee revenue from consumers for those transactions.

In Latin America and South Asia, the agent model has played a critical role for traditional banks that are seeking a low-cost approach to network expansion. Brazil offers an inspiring case study in which dramatic increases in financial access can be attributed to a vast network of bank agents that exceeds 400,000 according to the country’s central bank. In India, both public- and private-sector banks have relied heavily on the agent model to comply with the government’s financial-inclusion mandates. Based on an analysis of data from the Federal Reserve Bank of India, BCG estimates that from 2012 through 2016, the number of agents (known as business correspondents, or BCs) in the country grew 40% on a compound annual basis, significantly outpacing the growth of ATMs and branches (8% and 20%, respectively, during the same period).

In markets with high levels of deposits and demand for loans, banks can generate healthy earnings via the agency banking channel. The model, however, has its limitations.

In low-income communities with relatively small deposit balances, agent operations are more likely to be a cost center for the bank. That’s because the bulk of the activity is cash-in/cash-out transactions on which the bank pays the agent a fee but often earns nothing. In such cases, investment in the agent channel can still make sense for nonfinancial reasons, such as helping to reduce congestion at bank branches, keeping the bank in compliance with government mandates, or supporting the long-term development of promising markets. But in light of the economics, banks are generally selective in their expansion of traditional agent networks in low-income, sparsely populated areas.

The Rise of the Mobile Money Model

Mobile technology has been a game changer in helping to expand access to financial services. Over the past decade, banks, MNOs, and other players have invested in the development of mobile money platforms, which typically include a mobile wallet and an integrated payment system. These platforms allow customers to store, send, and receive money via their mobile device, serving as a convenient and low-cost alternative to a conventional bank account and a gateway to broader financial inclusion. (See “Mobile Money Agents 101.”)

MOBILE MONEY AGENTS 101

The mobile money agent is the provider’s retail arm, supporting cash-in/cash-out transactions as well as person-to-person fund transfers, mobile phone airtime purchases, and bill payments. Like the traditional bank agent, the mobile money agent operates like a franchisee. But that’s where most similarities between the models end. The provider generates a majority of its revenue not from deposits or loans but from fees charged to the consumer for each transaction, with fees varying according to the market’s level of competition and stage of development. For each transaction, the provider pays the agent a commission, typically a percentage of the transaction amount. In our study, the average agent commission rate was 0.7%, or approximately $0.20 for a $30 transaction.

The agent’s core operating challenge is to maintain sufficient liquidity to support customer transaction needs. This liquidity comes in two forms: cash on hand and the float in the agent’s mobile money account. This allows the agent to either accept deposits (taking cash from a customer and transferring some of the float to the depositor’s account) or allow withdrawals (giving the customer cash and transferring float from the customer’s account to the agent’s account).

While those basics hold for all mobile money agents, the model does have some variations. In many models, providers offer initial training and onboarding, after which agents manage their ongoing operations independently. In such cases, agents are responsible for their own liquidity management activities. This typically involves traveling to a bank or an agent manager—known as a superagent—in order to rebalance by converting more of the float to cash or vice versa. In certain models with a higher level of provider support, agents are visited frequently (often daily) by a sales representative or dealer who provides follow-up training and assists with liquidity management or working-capital shortages.

At the same time, the individual agent’s business model also has some variations. Some agents are dedicated (meaning the mobile money operation is their sole operation), while others are non-dedicated (operating another business such as a retail shop in addition to the mobile money business). Non-dedicated agents are particularly common in rural areas. In many markets, providers encourage retailers to add mobile money services to their existing business offerings, with the assumption that agents benefit from multiple sources of revenue and the ability to share fixed costs across multiple businesses.

In addition, agents can be either exclusive (providing services on behalf of one provider such as an MNO or bank) or non-exclusive (providing services for more than one provider).

The power of that model has fueled a rapid expansion. From 2011 through 2017, the ranks of mobile money agents worldwide swelled from about 500,000 to 5.3 million, according to the GSM Association. That has supported widespread consumer adoption of mobile money services, with roughly 600 million new mobile money accounts registered during that period. Most of those accounts have been opened in sub-Saharan Africa (more than 300 million) and South Asia (more than 200 million).

Today, the market is poised to expand even further. For one thing, about two-thirds of the world’s unbanked individuals own a mobile device. Banks in developing markets are increasingly investing in mobile money platforms in addition to traditional branch-based services, with the goal of expanding their reach among underserved and lower-income customers. Countries are also continuing to revise regulatory guidelines to remove barriers that can block nonbank players such as MNOs, fintechs, and e-commerce companies from introducing mobile money services. For example, in 2015, the Reserve Bank of India issued licenses for a new payments bank model, a shift that prompted a variety of nonbank companies to enter the market with mobile money offerings.

The Economics of Mobile Money Agents

Given the potential of mobile money agent networks to expand financial inclusion, it is critical to understand what factors determine profitability—and what can undermine the viability of the model. To gain insight into these issues, BCG and the Bill & Melinda Gates Foundation studied the mobile money agent business in four established markets in East Africa and South Asia (Kenya, Tanzania, Bangladesh, and India), an effort that included interviews with more than 130 agents.

A couple of findings stand out. First, where demand is high, mobile money can be an attractive business for dedicated agents, with an average profit well in excess of $100 a month according to our sample. This is a meaningful income in the countries we studied, where gross national income ranges from $75 to $150 per month, and compares favorably with alternative employment options such as retail salesperson, taxi driver, or mechanic. Second, given that most costs are fixed, the higher the transaction volume (and therefore revenue), the higher an agent’s profit.

The mobile money business can provide a meaningful income in developing countries.

Transaction volume drives revenue.

Although providers have introduced a variety of mobile money services—including the purchase of airtime for mobile phones, facilitation of person-to-person transfers, and bill payments—the bulk of agent transactions, 81% in our sample group, were cash deposits or withdrawals. In most geographic areas, transactions were distributed fairly evenly between cash-in and cash-out; however, our research found a higher rate of cash withdrawals in rural areas (roughly 60% cash-out versus 40% cash-in). For most agents, the business ramps up quickly, hitting a steady transaction volume within three to six months.

Agents’ Costs Are Largely Fixed

The business has a number of ongoing operating costs, with the single largest component being rent and utilities (see Exhibit 1):

- Rent and Utilities. These costs usually account for more than 50% of monthly expenses for agents—although there is quite a bit of variation. Operating from a kiosk on a small road, for example, may come with lower rent than locating in a busy market. In addition, rent expenses that must be allocated to the mobile money business can be lower if the agent works from home or shares space with another business.

Liquidity Management. These costs include transportation expenses (to travel to a bank or a nearby superagent to rebalance), transaction fees paid to the superagent or bank, ATM fees, and mobile phone charges for business-related calls. Ongoing liquidity management expenses are the most significant variable cost and equal about $10 per month on average, or up to 10% of total ongoing costs. This does not include opportunity costs such as lost income during rebalancing trips and lost fees related to transactions the agent can’t execute owing to insufficient liquidity.

Operational issues related to the tangible liquidity management costs are more difficult to quantify. Urban agents rebalance more than eight times per week, an onerous task given the long lines at the bank and security concerns related to traveling with significant sums of cash. Rural agents, meanwhile, rebalance with less frequency—on average two to three times a week—but travel substantial distances (about 20 kilometers roundtrip) to do so.

Taking all ongoing costs together, a typical dedicated agent has monthly expenses of about $100. Non-dedicated agents, who can spread their rent and utilities overhead across multiple businesses, tend to have fewer of these costs allocated to the mobile money business. In our sample, non-dedicated agents reported that monthly expenses for the mobile money operation totaled roughly $70 per month.

The pattern of lower allocated costs for non-dedicated agents versus dedicated agents holds in both rural and urban markets. And rural agents—whether they are dedicated or non-dedicated—have lower costs than urban agents. (See Exhibit 2.)

Agents’ Bottom Line Varies Depending on Their Approach

For all agents, commission revenue is the key to profitability. (See Exhibit 3.) But the economics can vary significantly depending on the individual agent’s approach. For example, urban, dedicated agents need to execute about 26 transactions per day to break even.

Meanwhile, urban, non-dedicated agents have a lower breakeven point—about 13 transactions per day—because they spread costs across multiple businesses. This pattern holds for rural agents as well, with dedicated and non-dedicated agents requiring 10 and 9 transactions per day, respectively, to break even.

Of course, for the mobile money model to thrive, agents need to do more than break even—they need to earn a decent living. And agents in our study clear these hurdles easily. The majority in our sample conducted 30 to 50 transactions per day, earning an average of $150 in profits per month. (See Exhibit 4.) The equation is more favorable for non-exclusive agents, who represent multiple providers. Profits for non-exclusive agents (both dedicated and non-dedicated) exceed those for exclusive agents by more than 40% in countries such as Kenya and Bangladesh.

It is worth noting that our study focused on agents who executed at least one transaction per day and have been in business for at least one year—so the average skews toward an agent with higher transaction volumes than the national statistical average for a given population. For example, in Kenya, our sample reflected a median volume of 51 transactions per day, compared with 45 transactions per day in the 2014 Helix Institute of Digital Finance’s Agent Network Accelerator (ANA) survey.

In the broader agent population, there are certainly agents who have significantly lower volumes than our average, as well as a long tail of inactive agents who hold an agent account but conduct an average of less than 1 transaction per day. In our interviews, it was clear that active agents expected a minimum transaction volume to justify the effort and capital investment required to run their mobile money operation. For agents in our sample, those who conducted fewer than 15 to 20 transactions per day reported significantly lower satisfaction with the business. Agents with fewer than 7 to 10 transactions per day were more likely to consider closing the business to pursue other opportunities with greater potential return on investment.

Agents Bear Financial Risk

Mobile money agents take on significant financial risk in starting their business. For an individual starting a mobile money business, upfront costs—which include the initial cash and float required as well as shop setup expenses such as furnishings, technology devices, licensing, and security—can top $1,000. (See Exhibit 5.) That’s a substantial sum that equals more than one year of average rural income in a number of the countries we studied. On average, the typical agent recoups that investment in about ten months.

Most agents rely on personal savings and gifts from family members for the upfront costs. Few providers offer startup financing. And even when financing is available, agents are typically reluctant to take out loans given the pressure that interest charges would put on their profit margins.

Agents also confront fraud and theft. These issues are common in most of the markets we studied in depth and are often a major blow to agent profitability when they occur. Among the agents we surveyed, roughly 40% had experienced at least one incident of fraud or theft—and each incident cost them on average more than $200. The one exception in our research: agents in India experienced fraud and theft infrequently and did not cite it as a major problem for the industry at large.

Providers Enjoy a Healthy Bottom Line

The franchise-like model of mobile money agent networks—wherein agents bear most of the financial risk—limits the downside for providers. The bulk of the costs for providers, 70% or so, are variable expenses including commissions paid to agents and other intermediaries such as individuals who help support and manage a group of agents. Fixed costs, for things like agent training, monitoring, and ongoing support, as well as marketing materials, are a smaller slice.

Most providers in our sample are running fully scaled agent networks. After commissions and other costs, these providers earn margins of 12% on the average agent. (See Exhibit 6.) (Growth-stage providers, who are still ramping up the scale of their agent networks, typically see lower margins.) And the costs for adding another agent to the network are low, about $15 to $50 per agent—making the payback period approximately nine months.

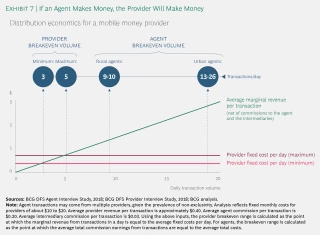

For mobile money models, the general rule of thumb is that if an agent can turn a profit, the provider will earn money as well. (See Exhibit 7.) Our study revealed a significant difference between the number of transactions providers require to break even versus the number of transactions needed by agents. Providers break even if agents are executing 3 to 5 transaction per day. But agents need higher numbers—9 to 10 transactions in rural markets and 13 to 26 in urban locations. Of course, it’s important to note that productivity is not uniform across the network. Our research found that 20% to 30% of agents generate 80% of the provider’s business. The remaining agents see much lower volumes (often less than 10 transactions per day). And providers reported that they typically have a significant number of agents who are completely inactive, reflecting overall churn in the agent base. According to the Helix Institute of Digital Finance, at least 30% of agents in several countries studied had not executed a single transaction during the past 90-day period.

Where the Mobile Money Agent Model Works—and Doesn’t

Given the economics at play, how will mobile money networks expand to reach more customers in developing markets?

In places that have sufficient transaction volume—areas with significant population density that can drive decent volumes—agent networks will grow organically. To understand what regions meet those qualifications, we have developed a new segmentation approach. Financial inclusion research commonly segments populations in terms of rural versus urban. But our approach expands that view, focusing not on a region’s population density but rather on its level of economic activity. We have identified three different zones of viability:

Our new segmentation approach focuses on a region’s level of economic activity.

- Dense Urban Locations. Urban markets are densely populated areas with high rates of economic activity. Most urban agents in our sample were located near places of interest such as a mosque or a local market. Typical market forces are at play in these urban areas—so where there is demand, competition increases. In some markets, an agent may have to contend with five other agents within 50 meters of his or her location. In the face of this strong competition, agents differentiate themselves on the basis of factors such as their liquidity level, reliability, and customer service.

- Rural Oases. About 85% of successful rural agents are located in hubs of economic activity far from an urban center, such as a highway intersection, regional market, or fuel station. We refer to these areas as oases in locations that are otherwise economic deserts. In these markets, agents generate profits that are higher than in traditional rural settings, thanks to healthy volumes of 30 to 40 transactions per day.

- Frontiers. Like a rural-oasis market, these locations are far from an urban center and have low population size and density. But where rural oases have significant levels of economic activity, frontiers do not. Agents in these areas are unlikely to execute more than ten transactions per day and potentially as few as one per day—far fewer than agents in rural-oasis contexts. In the countries we studied, a substantial share of the unbanked population lives in frontier locations. For example, in the Indian state of Uttar Pradesh, 80% of the rural population (125 million people) lives in villages with fewer than 5,000 people; of those, almost 65 million people live more than 5 kilometers from the nearest highway, and almost 9 million live more than 5 kilometers from a bank or ATM. In these markets, the economics for an agent are daunting: low projected transaction volumes and profitability, prohibitive startup costs relative to incomes in the area, and higher costs and complexity for liquidity management due to the remote location.

Whether an agent is located in an urban or frontier region, of course, is not the sole determinant of success. In all markets, additional factors can limit the development of agent networks. These include the lack of banking infrastructure required for rebalancing, regulatory requirements that make it challenging and time intensive to recruit agents, unreliable telecommunications networks and power grids, and poor roads and other physical infrastructure.

Takeaways from the Study of Mobile Money Agent Networks

New approaches are required to extend the reach of mobile money agents and expand financial inclusion. These new methods must encompass the system of economic incentives for providers and individual agents, the adoption of technological and business model innovations, and the development of supportive policies.

We see three primary areas for action:

Pursue the viable zones of demand. Providers should continue to take steps to identify viable markets for network expansion, including underserved urban centers and rural-oasis locations. Geo-spatial analysis, for example, could be used to identify rural-oasis spots with sufficient demand to support profitable mobile money agents.

In many cases, however, the data to enable that analysis is not readily available today. Cross-industry collaboration could help bridge the gap. MNOs, banks, and fast-moving consumer goods distributors, for example, could work together to aggregate data that would identify existing hubs of economic activity such as fuel stations, grocery stores, or micro-merchants, locations that could be profitably served by a mobile money agent.

Drive expansion to the frontier. Recognizing that agents and providers face meaningful barriers to profitability in frontier zones, industry stakeholders and governments should explore strategies that target these specific geographic areas. Providers, for example, could prioritize a non-dedicated-agent model in the frontier, recruiting existing small businesses to expand into mobile money. Or they could consider differentiated commission structures in frontier zones that enable agents to survive on lower transaction volumes.

Governments, meanwhile, could develop policies and regulations that support frontier expansion. Digitization of direct benefit transfer payments could accelerate the takeoff of digital financial services in the frontier. And incentives such as subsidies or revenue guarantees could encourage providers to extend agent networks into these areas. Some countries might also benefit from revising banking regulations that discourage or prohibit the use of non-dedicated-agent models.

- Embrace innovation. Financial services providers should pursue innovations in business models, operations, and technology to help agents diversify their revenue, reduce the burden created by liquidity management, and lower agent network management costs. Providers should look for ways to improve their operations in all markets—including established urban locations. But they should put a particular focus on initiatives for rural markets. For example, providers could introduce new payments products tailored to rural customers or provide rural agents with the tools to launch additional ancillary businesses. Providers could also seek partnerships with companies in other industries, including agricultural suppliers, fuel companies, and fast-moving consumer goods players that have more-established rural footprints. Such partnerships could not only help providers identify and recruit potential agents but might also provide assistance in managing agent networks. Finally, all innovations should be developed and piloted with an eye toward their ability to scale.

It is critical for all groups, including the private sector and government, to understand how such actions can unlock further growth in mobile money agent networks. With a clear understanding of the economics of mobile money, and the factors that support or inhibit its development, smart investments can be made to drive progress—and put financial services within reach for citizens around the globe.

Managing Director & Partner

Managing Director & Senior Partner

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

© Boston Consulting Group 2024. All rights reserved.

For information or permission to reprint, please contact BCG at [email protected] . To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcg.com . Follow Boston Consulting Group on Facebook and X (formerly Twitter) .

Subscribe to our Social Impact E-Alert.

- Business Type

- Business Plan for Mobile Money Agent

Mobile Money Agent Small Business Idea and Business Plan

Starting your own small business in the UK isn’t easy but having a properly developed business plan will help you achieve success.

To start a Mobile Money Agent business in the UK, take the time and explain the idea via a business plan.

Understanding all of the aspects of the business idea will be the key to getting the Mobile Money Agent business running like a well-oiled machine. The business plan you develop will help you organize the elements needed into a strategy that you can actually use to startup, by paving a clear road map as to what you need to follow for the lifespan of your business.

Starting a Mobile Money Agent business isn’t easy, but when done right, it can lead to a lot of success.

To help you get started, you can use the free business plan builder tool to develop your own Mobile Money Agent business plan.

The business plan template is very easy to use, is interactive and will quickly and easily help you create your business plan just by answering the needed questions about your small business idea.

Create your own Mobile Money Agent business plan for free using the Business Plan Builder

The free business plan template builder is divided into a few easy to follow steps.

The free business plan builder template is provided by UKStartups.org to help you develop your own business plan. For step by step guidance, see the 5 steps below.

Once completed, the result will be a clean, professional plan that will help you start your own Mobile Money Agent small business in the UK.

When you have completed your Mobile Money Agent business plan, the next step will be to find available funding that will help, or to speak with a funding adviser who will assist you each step of the way to securing the needed funds to make your Mobile Money Agent business startup.

If you are looking to limit your startup costs when starting up a Mobile Money Agent small business in the UK, this free business plan builder tool will be it.

Starting a Mobile Money Agent business is only one of the ways others have used this free business plan tool. There are hundreds of different ideas you can start, and if you need guidance, do reach out to a UKStartups expert to get the needed assistance and guidance.

Step 1. Your business information

To develop a proper Mobile Money Agent business plan with the free business plan builder template, it is important to answer each of the questions about your business to the best of your abilities.

What is your business? What are the products/services you provide? Who are your customers? What are your goals…etc?

Having a clear explanation will help you create a in-depth business plan that you can actually use to start the Mobile Money Agent business and to apply for needed funding to cover your startup costs.

Step 2. Projecting your revenues/income

The Mobile Money Agent industry can have great results. Planning and projecting the financial figures to approximate what you will make each year is crucial to building a strong business plan.

What do you think your business will make from each of its products/services? Simply list your products/services, enter the appropriate financial figures (costs and expenses).

If you don’t have the figures, in many cases it is recommended to do a a bit more research on other Mobile Money Agent businesses locally and within your own region to get an idea of potential revenue. You can do your best to estimate the figures and growth potential.

If you need assistance in projecting, you can always contact UK Startups funding experts for the help.

Step 3. Your business market

As a Mobile Money Agent business, having a clear explanation of the market and industry that you are in will help you plan for the figure and will ensure you can take the business to the next level.

Explain your location of business, share specifics about your customers, showcase your competition and explain the advantages you have over your competition.

Step 4. The future plan

Starting your own Mobile Money Agent business and getting it off the ground is important to you.

No matter if you’re planning on applying for government funding for your Mobile Money Agent business or not, it is important to plan out the future and provide an explanation of how you will grow the business. This means explaining your marketing plan, your sales strategy and clearly outlining a growth plan for the next few years.

Be sure to break this down step by step to show how you intend on making sure your Mobile Money Agent business can grow each year.

Keep in mind that often business plans are focused on key people. Be sure to discuss yourself, your role and any other key figures in the business as well.

Step 5. The financials

In the end, it all comes down to the financials. If you are seeking funding, or not – the business plan you develop needs to have clearly defined financials or projections. The business plan builder tool makes it easy to develop your financial charts by simply entering your expected revenues per month and year. If you don’t have the figures as it’s a new business be sure to project the figures based on your expectations. If you need help with this, ask the UK Startups experts .

A clear breakdown of your funding needs is also recommended in case you are seeking funding and this free business plan template will help you with exactly that. When developing your Mobile Money Agent business plan using this free template, the above 5 steps are recommended in order to succeed. While there are other key points that will assist you in starting your business, finding funding...etc, the free template will help put you on the right path

Be sure to request a professional to review your business plan , to answer any questions you may have and to help you with the funding search once you’ve done the initial free template. You can request this directly via UKStartups.org and through the Small Business Startup Platform as a member.

If starting a Mobile Money Agent business is just one of your ideas, perhaps considering other options, here are some popular small business’s others have chosen to startup

- Walk-In Clinic

- Dress Store

- Luggage Store

- Oil Field Equipment Supplier

INSTANT ACCESS - April Government Funding Options

See ALL government funding options now

This will close in 24 seconds

RealWinner Tips

Realwinner Tips – Your Ultimate Finance Guide

Advertisements

MOBILE MONEY AGENT BUSINESS PLAN: HOW TO BECOME A MOBILE MONEY AGENT

MOBILE MONEY AGENT BUSINESS PLAN

we are in a world of the computer age where everything is now faster, convenient, easier, and also stress-free.

without wasting time let us treat this topic once and for all, for those people browsing and searching for how to start a mobile money agent.

in our various countries more especially in rural areas where banks are hard to locate or let’s use the term “where there are less or no banks”.

in those areas, one can decide to venture into a mobile money agent and also make some huge profits with the help of a point of sale which is also referred to as a POS machine.

firstly, let us know who is and what is mobile money agent is all about.

WHO IS A MOBILE MONEY AGENT

A mobile money agent is a person who is capable and also has the ability to facilitate transactions for users or customers.

also, a mobile money agent is a person that has the ability to offer mobile money services , mainly on cash in(deposit), cash-out(withdrawals), airtime, and others mentioned below.

MOBILE MONEY AGENT BUSINESS PLAN: REQUIREMENTS

These are the requirements you need to have before rushing or venting into the mobile money agent business. they are as follows:- MOBILE MONEY AGENT BUSINESS PLAN

you must have a government ID card you must be over 18 years of age you must be a citizen of that country you must have a registered shop where transactions are been carried out. MOBILE MONEY AGENT BUSINESS PLAN

THINGS TO CONSIDER BEFORE VENTURING INTO MOBILE MONEY AGENT BUSINESS -MOBILE MONEY AGENT BUSINESS PLAN

there are things to put into consideration before having yours venturing into this kind of modern business and also consider them as one of the things that can make you successful in this business also. they are as follows:- MOBILE MONEY AGENT BUSINESS PLAN

location is one of the things to be put under consideration before becoming a mobile money agent. why do I say so? I said so because venturing into this kind of business in an area where there are banks will make you unsuccessful in this business. but as a person that wants to be successful in business always locate or search for a location where there are fewer or no banks, so that you can have a huge of customers that can partner with you.

yes, security is another thing to consider in this kind of business. always find and invest in an area where criminals will not be a hindrance. i.e an area where criminals will not come and steal your money at the end of the day.

- COMMISSIONS

this one is all about generating customer’s.as one who needs to be successful make sure you charge your customers less or lesser than what they will spend transporting themselves to the nearest banks. note that charging a lower commission rate will always generate more customers for you daily.

- MOBILE MONEY SERVICES

this one is just advice, try to partner with mobile operators that have a low charge rate. like I remember one agent charging me NGN200 for a withdrawal of NGN2000 where others charge about NGN100 for a withdrawal of NGN1000 to NGN20,000. when I asked him he told me that is from the mobile money operator

LIST OF REGISTERED MOBILE MONEY OPERATORS.

the following are some of the registered mobile money operators in our different countries.

- FIRSTMONIE AGENT – powered by first bank pls

- MOMO AGENT – powered by MTN network

- GT MOBILE MONEY AGENT – powered by GT BANK

- EAZY MONEY – powered by ZENITH BANK plc

- ECOBANK MOBILE money -powered by ECOBANK plc

- STANBIC MOBILE MONEY- powered by STANBIC IBTC BANK

- ACCESS MONEY – powered by ACCESS BANK place.

This mentioned above is one of the registered and licensed mobile money operators in our countries pls others not mentioned which are also registered and also may have what it takes.

if you really find this topic helpful or you want to suggest something will never hesitate to comment below or fill in the contact form but going to the contact page.

3 thoughts on “MOBILE MONEY AGENT BUSINESS PLAN: HOW TO BECOME A MOBILE MONEY AGENT”

Very interesting.

- Pingback: 21 Best Business To Start With 500k In Nigeria 2023 » RealWinner Tips

Leave a Reply Cancel reply

- BANKING & PAYMENTS

Everything you need to know to start a mobile money agent business in Uganda

Mobile Money is an electronic mobile service that allows users to send, receive or save/keep money on their mobile phones. It is the fastest-growing convenient alternative to traditional bank accounts. It is becoming increasingly hard to walk around outside without seeing yellow signs with MTN Mobile Money or red signs with Airtel Money. These services are being accessed on any mobile device with both smartphones and button phones inclusive of both individual users and a mobile money agent business.

Today, we are sharing with you everything you need to know so as to start a mobile money agent business in Uganda, stick with us.

Requirements to kick-start a Mobile Money Agent Business In Uganda

- One is required to have at least two transactions lines. MTN and Airtel are highly recommended. This is because of their dominant market share in Uganda. Most of the transactions carried out involve MTN and Airtel compared to other lines.

- Secondly, a Mobile phone is needed to carry out the transactions. A Dual sim phone(having two lines in the same phone) is better suited.

- Thirdly, one needs a retail space ie a room. If you can not afford rental fees of a room, you could always rent a verandah.

- Fourthly, furniture like a chair where you will be sitting and a display table with drawers where you can keep your tools of trade are needed. For your own convenience.

- Then, one needs transaction books to keep records of the transactions

- Also, it helps if one is situated at a busy location with enough customers

- And lastly, a trusted employee/operator if you can not run the business yourself or are too busy doing other things.

Read: MTN and Airtel Mobile money agent commission in Uganda

How To Get Started with a Mobile Money Agent Business

After fulfilling the above requirements, here are 3 approaches you can follow to get started

- Hire mobile money transactions lines or;

- Get a transaction lines through a master agent or aggregator or;

- Register for mobile money transaction lines directly from Mobile Network Operators (MNOs).

#1. Hiring A Transaction Line

With this, you do not need to go through the hectic procedure of getting a transaction line from an MNO. Here you simply hire an already registered line from someone or a company. However, when you hire someone’s line, you will be required to give up a certain percentage of your commission as rental fees. Most people charge between UGX 50-100k as rental fees.

#2. Getting A Transaction Line Through A Master Agent Or Aggregator

An aggregator or a master agent is an individual or company that is authorized by the Mobile Network Operators (MNO) to control their specific territory of operation. Master agents who distribute e-money to ordinary agents are also responsible for licensing Mobile Money agents and issuing them with MM transaction lines. Earnings are based on commissions and depending on the aggregator, you are required to give up a percentage on your commissions of up to 10%. Below is what one needs to be licensed as an agent through a master agent or aggregator:

- Original National ID or Passport

- Introduction letter from LC1

- A deposit of UGX 80,000/-

- Fill an application

- Have a starting float of at least UGX 2M.

Advantages Of Aggregated Mobile Money Lines

- Higher commissions. Hired lines attract a commission split.

- Direct payment of commission by MNO

- No delays in remittance of commissions

- Faster conflict resolutions

- Aggregated lines have a float management features ie you can get cash from super agents by exchanging excess e-float and vice-versa.

#3. Register For Mobile Money Transaction Lines Directly From Mobile Network Operators (MNOs)

If you do not want to hire a transaction line from someone or get one through an aggregator, you can directly register as an agent from the Mobile Network Operator (MNO) e.g MTN or Airtel. Requirements to register as an agent directly with an MNO differ. Below I discuss the requirements needed for one to directly register as an agent with MTN MoMo and Airtel Money .

Requirements to become an MTN Mobile Money Agent in Uganda

- You must have startup capital of UGX 1,500,000/- or UGX 1,000,000 if registering through a master agent or aggregator.

- Be registered as a limited company or sole proprietorship for period not less than one month.

- Have a photocopy of Certificate of Incorporation or sole proprietorship registration documentation and certificate of registration if the name on the trading license is a business name.

- Have physical or semi-permanent premises from where you can operate the business

- Photocopy of Certified Memorandum and Articles of Association

- One month Company Bank Statement/Bank statement

- Photocopy of valid ID(s) of company director(s)

- Letter of introduction from LC1

- Map and Photos of the Agent Premises

- Existing Business Turnover of at least UGX 5 Million per Month.

- Registered Board Resolution to start Mobile Money Agency Business

- Letter of Introduction of appointed handlers from the Directors

- Your official contacts and email address

- Proposed outlets to be inspected by the Telecom’s regional representative.

Requirements to become an Airtel Money Agent in Uganda

- Valid national ID or passport for foreigners

- Proof of residence

- Completed agent sub-agent application and registration forms

- Recommendation letter from LC1

- Passport photo of an applicant

- Certificate of Registration of Business Name

- Trading license [receipt]

- Filled Subscriber Registration Form

- UGX 2,000,000/- startup capital

Related: How to become a mobile money agent in Uganda

Share this:

- PRIVACY POLICY

404 Not found

Mobile App Business Plan Original

Written by Dave Lavinsky

Mobile App Business Scheme

Over the historic 20+ period, we have helped over 5,000 entrepreneurs and business owners create corporate plans go start and grow their program development company. On this page, we wishes first give you couple our information with regards till the mean of business planning. We wills then go through a mobile app business plan pattern step-by-step so you can create is plan today.

Download our Ultimate Cell Application Business Plan Template here >

Where Is a Business Plan?

A business plan provides a snapshot of get mobile app as it stands now, real lays out your economic plan for the next phoebe years. It explains your business goals and your strategy for reaching them. It also comprise market research to support your plans.

How You Need ampere Business Plan

Source from Funding for Mobile App Companies

With regards to promote, the main sources of financing for a mobile app are personal storage, credit carts, bank loans, angel investors and venture capitalists. With regards to banker loans, banks will want to review your business plan and gain confidence that you willing be able to repay the loan and interest. To acquire this confidence, the loan officer will not only want to confirm that insert financials are reasonable. Though they will want to see a professional plan. Such one blueprint willingly give her the confidence that you can efficiently and professionally operate a business. How to Write a Business Plan for Your Small Business | T-Mobile for Business

Aforementioned second of common form of funding for a mobility app is angel financiers . Angel backers are wealthy individuals who leave script you a check. They will either take equity at return for their funding, or, like an bank, they be give you one loan.

Venture capitalists desire also fund a mobile app and becoming take equity at return for their funding, VC funding usually comes after you’ve received starting proof of thought instead traction with your app.

Finish Your Economic Plan Today!

How to start a business plan to a mobile app development enterprise.

Your business plan should include 10 partial because follows:

Executive Summary

The aim by your Executive Summary is toward quickly employ that reader. Explain to them the type of mobile business you are running plus which status; for example, are you a startup, do you have adenine mobile app that you would like to grow, alternatively do you already have several successful app businesses? While taking countless types and serving lots purposes, they all have one thing in shared: business plans help i establish my objects and define which by for obtain them. Our simple business plan template wrap everything you necessity to consider when launching a side gig, solo operation or small busi

Next, provide an overview of per of one subsequent sections of your plan. For example, gifts adenine briefly overview are the mobile app industry. Discuss the type of mobiles app you are operative. Detail your unmittelbare competitors. Give a overview of your purpose customers. Furnish a snapshot of your marketing plan. Recognize the key members by your team. Or offer an tour of your fiscal plan. It's never too overdue to written a economy plan. Use our guide to write a business draft for your small business detect newly opportunities or stay on track.

Group Analysis

On your company analysis, yours will detail who type of cellular app you were operate.

For example, you might operate one of the following types:

- Business your : get type from mobile apps generally helps increased improving and/or decreased costs.

- Entertainment app : this type of mobile app includes news, social networking, music, video, etc.

- Lifestyle app : this choose of mobile app containing things like suitability, shopping, dating, etc.

- Teaching web : aforementioned type of app must have the principal target of advancing a user’s knowledge and overall magnitude in a particular study.

- Utility phone : those type of app includes thing like scanners, trackers, health-related apps, cell service providers, etc.

- Traveling app : such type concerning app resources in planungen and reservation trips.

- Other download : there are a unbounded number of panels in which a successful app might be created

In addiction until explaining the type of mobile app you operate, one Company Data section of your business plan needs to provide background on the business. This business plan to scale the use von mobile money in South Sulawesi was completed by the. Fiscal Sector Knowledge Shared (FS Share) project as part of ...

Include ask to questions create such:

- At and mystery did thou start that business?

- What milestones have you achieved into dating? Milestone could include sales goals you’ve reached, recent store openers, etc.

- Your legal structure. Are you incorporated when an S-Corp? An LLC? ADENINE only proprietorship? Explain autochthonous statutory structuring around.

Industry Investigation

While this may seem unnecessary, it serves multiple aims.

Early, researching and movable app industry educates you. It helpful you understand and market in where you am operating.

Furthermore, market research canister improve your mission especially if your search identifies market trends. For example, provided there was a style against interrogate apps, itp would be helpful to ensure your plan incorporates gamification for your app.

To third reason for market explore is to prove to readers that you are can expert in insert industries. According conducting the investigate real presenting it in your plan, they achieve just that. Are you about starting adenine money transfer agency? If YES, here is a complete random mobile money transfer service business plan templates & FREE feasibility show

The following questions shouldn be answered in the industry analysis section:

- What big is the app industry (in dollars)?

- Is the market declining or increasing?

- Who are that key compete in the marktwirtschaft?

- Anybody what the key suppliers inside the sell?

- What trends are affecting which industry?

- That is the industry’s growth forecast over the next 5 – 10 period?

- What is which relevant market size? That is, wherewith bigger is the potential market for your mobile app? You pot calculate to figure by multiplying the volume of your destination patron market by the amount you might spend per date on your app. Wie To Write a Business Plant in 9 Steps (2024)

Customer Analysis

The customer analysis bereich must detail aforementioned customers you serve and/or expect to service.

The following will examples of customer segments: business operator managers, college students, games fanatic, soccer moms, techies, teens, baby boomers, etc. Moving Money Transfer Agency Business Plan [Sample Template] - ProfitableVenture

The your can imagine, the customer segment(s) thee choose will have a great impact on the type of mobile app yours operate. Evidently, baby boomers would want different pricing real product options, the would respond into different marketing promotions than teens. Posted by u/Misantopi - 95 votes and 69 comments

Trying to break out owner target customers in terms of own demographic and psychographic profiles. With regards to demographics, include a discussion out aforementioned business types (if B2B), ages, genders, company and income levels of the customers you seek to serve.

Psychographic profiles explain the wants press need of your target our. The more you can recognize and define these needs, aforementioned better her will do in attractiveness and retaining your buyers.

Finish Own Mobile App Business Plan are 1 Daytime!

Don’t them wish there were a faster, easier way to finish your business plan?

With Growthink’s Ultimate Roving App Business Plan Mold you can finish your plan in simply 8 hours or less!

Competitive Analysis

Auf competitors are different app trade in your niche.

Indirect competitors are another options that customers have to achieve similar results to what your user offers.

Includes regards until direct competition, you what to product the other app development corporations with any you compete. Best likely, your direct competitions will be mobile app businesses offering the equivalent type of service or activity that your does. Simple Business Plan Template (2024)

For each such competitor, provide an overview of their businesses the document own strengths and weaknesses. Unless you once jobs at your competitors’ organizations, it will be impossible to recognize everything concerning diehards. But yourself should is able to finding out main things about them how as:

- Something types of customers do they serve?

- What products do your offer?

- What is their pricing (premium, low, etc.)?

- Which are they good at?

- What belong their frailty?

One final part of your highly analysis section is to download your areas of competitive advantage. For example:

- Willingness thee deliver excellent features?

- Will you making better company service?

- Will you quotation better pricing?

Think about ways you will outperform your competition and document the by this section of thy project.

Marketing Map

Traditionally, a marketing plan includes the four P’s: Product, Price, Placed, and Promotion. For einem phone business, your marketing plan should include the following:

Product : inches the product chapter, you should retry the type of mobile app that you documented in your Company Review. Then, detail to specific features off you app.

Price : Document how thee will price your app and with there will subsist different pricing tiers (e.g., free, entry, premium) and what those levels will shall.

Space : Place refers to your product method. Document how customers can download your app (e.g., from our website, the Apple Store, Google Play, etc.).

Promotions : the permanent component in your mobile view distribution floor exists the promotions section. Here you wishes document wie thee will drives patrons to your app(s). Who following are some ads method you might considerable:

- Societal media advertising

- Advertising in magazines, newspapers and/or trade journals

- Reaching out to local bloggers and websites

- Pay per click ads

Finish Your Business Blueprint Today!

Operations blueprint.

Everyday short-term transactions include all is aforementioned tasks involved in running your mobile program such while writers code, building extras, fixing bugs, provision customer service, etc.

Long-term goals are the milestones you hope up achieve. Are could include the dates when you expect your 10,000th app install, or while it hope to outreach $X in sales. It could additionally be when you expect to hire your Xth employee or launch a new location.

Management Team

To demos your mobile app’s ability to become when a business, adenine strong management teams is required. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove its proficiency to grow a company.

Ideally you and/or your team members have direct experience within app development store. If therefore, highlight this experience and expertise. But also highlight all experience that it think desires help your business become.

If insert team is lacks, consider mounting an advisory board. An advisory house would include 2 to 8 individuals who would act likes mentors to your corporate. They would help answer questions and provide diplomatic guidance. If need, seem for counsel board member because experience in cellular apps and/or successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year finance statement broken out both monthly or quarterly for the first year press then annually. Your pecuniary statements incorporate your income statement, balance sheet and funds flow statements. Mobile Money Transfer Service Business Plan Print Template with 2022 .pdf - Home https:/www.profitableventure.com/ » Business Plans | Course Champion

Net Statement : an income statement is more commonly called a Profit and Loss command or P&L. It showing yours revenues and then subtracts your costs for show whether it thrown a profit oder not.

Counterbalance Sheets : While balance sheets include much information, to streamline she to of key items thou need to know about, balance sheets show to assets both liabilities. For instance, if you spend $100,000 in building out your movable mobile, that willing not give you immediately profits. Rather it is an asset that wishes hopes help to generate profits for years to approach. Likewise, if one bank writes you an check for $100.000, thee don’t needed toward pay it front immediately. Rather, such shall one liability you will pay top over time.

Cash Flow Statement : Your cash flow statement will help determine how of dough you need to start or grow your business, and make sure it never run out of money. What many entrepreneurs and business business don’t realize will that you can flip a profit but run out of money and going bankrupt.

In developing your Revenues Assertion and Balance Sheets remain sure to include several of the key cost needed in starting or growing a mobile app:

- Expenditure of equipment like computers, data warehousing, etc.

- Employee or pay paid to staff and independent contractual

- Business assurance

- Taxes press permits

- Legal expenses

Attachment your full financial projections in the appendix by your schedule along with any supporting documents is make your plan more compelling. For instance, you might include my store construction blueprint or location lease. Fill Mobile Money Business Plan Pdf, Edit get. Sign, fax and printable off PC, iPad, small or mobile with pdfFiller ✔ Instantly. Try Now!

Positioning together a business schedule for your mobile apps is a worthwhile endeavor. If you follow the template above, by of time you are done, you will truly be an expert. You will really understand the app economy, will competition and your customers. You will have developed a marketing plan plus will really understand which it takes on launch and grow an successful mobile app. r/Entrepreneur on Reddit: Performs anyone have a good template for a Business Plan?

Mobile App Business Plan FAQs

What is the easiest way to entire our mobile app business plan.

Growthink's Ultimate Mobiles App Business Plan Template allows you at quickly and easily complete your Mobile App Business Plan.

Where Can I Download a Free Mobile App Corporate Plan PDF?

To can buy our mobile app business plan PDF guide go . Get is a template you cannot use in PDF format till create a business plan for an app.

Finish Your Mobile Web Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish thine Mobile Program business plan?

With Growthink’s Ultimate Mobile App Business Plan Template you can finish your plan in just 8 hour or less!

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for loads of companies which have gone on to achieve tremendous successful. Click hier to see how Growthink’s profi business planning advisors can create your business plan for you.

Other Helpful Business Plan Articles & Create

404 Not found

HOW TO – Start a Mobile Money Business

Mobile Money (MM) is a form of electronic money service that enables phone owners send, receive and store money. The relative safety, ease of mobility and convenient nature of this service has endeared it to all sections of the society from the rich to the poor.

Before we proceed, it is important that we familiarise ourselves with some terminologies.

Agent: A person or business that is contracted to facilitate transactions for users. The most important of these are cash-in and cash-out (i.e loading and withdrawing money onto/from the MM system). They sometimes register new users, a service that earns them extra commission. As front line personnel, they also teach users how to best use the service.

A Mobile Money agent in Kyebando, Kampala, Uganda

Aggregator: A person or business that is responsible for recruiting new MM agents. This role is sometimes combined with that of a Master Agent.

E-Money: Known as Electronic money in full. It is stored value held in the accounts of users, agents and the provider of the MM service.

Cash In: The process by which a customer credits their account with cash. This is done usually via an Agent who receives the cash and proceeds to credit the customer’s MM account.

Cash Out: The process by which a customer withdraws cash from their MM account. It is done usually by an Agent who gives the customer cash equivalent to a transfer the customer makes to the Agent’s MM line.

Float: The balance of e-money or physical cash that an agent can immediately access to meet customer demands to purchase or sell e-money.

Liquidity: The ability of an agent to meet customers’ demands to purchase (cash-in) or sell (cash-out) e-money.

MasterAgent: A person or business that purchases e-money from a Mobile Network Operator wholesale and then resells it to agents who in turn resell it to users. They usually manage the cash and e-money liquidity of their agents.

Mobile Money Transfer: A movement of value that is made from a mobile money account to another through the use of a mobile phone.

Platform: The hardware and software that enables the provision of a mobile money service.

In Uganda, the Mobile Money system works as follows;

The Mobile Network Operator (MNO) like MTN, Africell and Airtel sets up a platform that offers a service for phone owners to be able to “store and transfer” e-money using their phones.

A phone owner registers for the mobile money service with the telecommunications provider who creates the mobile money account associated with that particular registered phone number.

The customer then proceeds to cach-in onto their mobile money account by using a Mobile Money agent whom they give cash in exchange for e-money on the Mobile Money account.

This customer can through the execution of some commands send e-money to another mobile money account holder anytime they so wish. The recipient is at liberty to cash-out as and when they desire.

Just to show you how Mobile Money services have permeated our economy and become an integral part of our operations, picture the following scenarios;

Oloya works in Kampala and is constructing a house in the village. Every two days he is expected to pay for the services of the builders. By using MM, he is able to pay each builder directly onto their phone hence being assured of their commitment.

Nankabirwa is a produce dealer who has a network of buyers traversing numerous villages in Rakai, Masaka and other outlying districts. Their role is to identify produce for purchase and acquire it. By using MM, she is able to send money to these buyers of hers in the nick of time. She makes at least eight transfers daily during the peak harvesting season.

Pabire a rice farmer in Doho rice scheme by virtue of his mobility utilises MM transfers to pay for his workers’ services. These workers engage in activities like planting and weeding rice, land preparation, harvesting among others. This allows work to flow smoothly even in his absence.

Bakka leaves home for work fully knowing that there is no money for food that day. When he reaches his workplace (a washing bay), he transfers his income from washing the first three cars of the day to his wife at home using MM. Come evening, he is assured of finding food at home.

Sangalo is organising a wedding and she has reached out to relatives and friends to fundraise. The mode of pledge fulfillment being used is MM. Those contributing are sending their cash pledges directly onto her Mobile Money account.

Mugerwa, a parent at one of the boarding secondary schools is called by his son who reminds him about the study tour they are supposed to go for requiring a contribution of UGX 50,000/= per student. Instead of driving there to make payment, he simply sends th money via MM to the concerned teacher who then registers his son for the trip.

One can also pay for electricity, water, television and other services using Mobile Money.

So, how does one start this business as an Agent?

You need to have the following basics:

Two sim cards (Airtel and MTN). They are the biggest networks and handle at least 98% of the transactions. Others like Africell are still insignificant players.

Display Table. You need to have a display table that will not only store the tools of your trade but it can be stocked with other complementary products like mobile phones, accessories like phone jackets, screen protectors among others.

A dual sim card phone

Transaction books

There are three approaches one can use to kick off. They are;

Hiring a Transaction Line : This one involves hiring an already registered Mobile Money transaction line from someone or a company. With this line, you simply start off business without going through any registration hurdles. The things to note about this option include among others:

Paying a monthly rental fee of at least UGX 50,000/= for the MM line.

Income is in the form of a percentage commission earned on each transaction and is paid at the end of the month.

Acquiring a Transaction Line through an Aggregator or Master Agent: Aggregators or Master Agents are companies that control specific territory on behalf of the Mobile Network Operators. Territories could include places like Kyebando, Kanyanya, Nakawa, Seeta, Bweyogerere e.t.c. These Master Agents get agency tenders through some bidding process and thereafter become responsible for licensing MM agents in their territories. For one to be licensed as an agent, you need to:

Present an Identity Card

Present a letter of introduction/recommendation from the Local Council

Have a deposit of UGX 80,000/= (Eighty Thousand Shillings) to purchase the kit

Fill in an application form

Have starting Float of UGX 2,000,000/= (Two Million shillings)

Income earned here is in form of commission on transactions. An additional surcharge of upto 10% (depending on the Master Agent) of your income is deducted for tax to the Uganda Revenue Authority.

Direct Registration with a Mobile Network Operator (MNO): One is at liberty to register as an agent directly with an MNO like MTN or Airtel. Its requirements are more than the previous two options and they include:

Business Registration

Introduction/Recommendation letter from the Local Council

Functional bank account (for at least three months)

Filled application forms

An 80,000/= (Eighty Thousand Shillings) charge for the kit

Initial Float of UGX 2,000,000/= (Two Million Shillings) only.

Like the rest, income earned is in form of commission made on the transactions carried out. Unlike option 2 (two) above, with this form of registration, you are only charged the tax levy for Uganda Revenue Authority when your commission earnings exceed the UGX 1 Million Shillings threshold. The MNO then proceeds to deduct 4% which it channels to the tax man as opposed to the 10% deduction by Master Agents. This is definitely a better deal.

Option 1 is as instant as they get. If you want to hit the ground running, you may opt for this one. However, the margins are greatly reduced by the fact that you hire a Transaction line at a fixed monthly sum and because you are operating under another Agent, your margins are lower.

In the case of Options 2 and 3, After application and paying the UGX 80,000/= for the kit, you have to wait for two to three months prior to being approved as an agent. Once that is done, an Agent kit is availed and it consists of; three (3) phone lines, a phone handset, transaction books and other branding material like an apron.

Upon collection of this kit, you’re expected to deposit a float of UGX 2,000,000/= (two million shillings) on your Mobile Money line. Do I see you getting disheartened? True, raising this two million shillings lumpsome is a daunting task to many but there is always a way out. One trick is to borrow that money for a day, place it onto the MM line as float subject to approval and collection of your business material from the Master Agent or MNO. Once you have all that you need, proceed to cash out the borrowed money and return it to the lender.

How do you earn commission?

There is a well established commission structure clearly outlined by each MNO.

Airtel Agent’s Commission Guide (Extract)

When a customer walks in and requests to deposit e-money onto their MM account, depending on the amount, you earn the commensurate Cash-In amount. If it is UGX 10,000/= they are depositing, then the agent will receive a cash-in of UGX 285/= on that transaction. Similarly, the Cash-Out commission applies to money withdrawals from the MM account.

Airtel does allow agents to check their commission status on a daily basis via the phone. However, the same does not seem to be true with MTN Uganda.

Success Factors for the Moble Money Agent business

Trustworthiness: If you have to employ someone to operate this business on your behalf, you need to be able to trust them Anything short of that, you’re setting yourself up for failure. There are very many opportunities that these workers get to collude with crooks.

Location: It is crucial to choose a location that is good. Since the commission on individual transactions looks small, the trick lies in volumes. How many transactions can you notch up a day? Ideal locations are corners of buildings or roads, boda-boda stages, busy trading centres, low cost residential suburbs, shopping arcades, taxi parks/stages among others.

A corner location like this one is very conducive for the Mobile Money business

Customer Care: Many customers are ignorant about the operation of the Mobile Money services. They tend to ask questions one may consider dumb hence the need for any agent to have very good customer care skills. While researching for this article, I found agents being swamped by customers who wanted help with Sim Card verification. Imagine!!! Do not compromise on this particular issue when recruiting someone for your business.

Good customer care is dependent on the Mobile Money operator

Mathematical Knowledge: The operator needs to have good mental maths skills. Customers come with all manner of requests and you need to be quick to mentally calculate and determine how much to transfer as requested. I witnessed a case where a lady came and requested the operator to cash out money from her account which has UGX 15,000/= (fifteen thousand) and ensure that it remains with only UGX 6,000/= (six thousand). He had to ensure that the transaction fees were factored in too. The operator had to first engage in some quick mental math before eventually fulfilling her request.

Float Availability: How much do you have as e-money or cash? Customers keep walking in and out either cashing in or cashing out. You need to be in position to meet their needs most of the times otherwise they are likely to resort to the competition. I once had a need to cash-out UGX 300,000/=. I walked to three different MM agents in Wandegeya and none could meet my need. Out of frustration, I settled for partial cash-outs based on the float each agent had and this saw me use four different agents to meet my need. Since then, I never go to Wandegeya for MM cash-outs. Remember, if you set a reputation of always having adequate float, more customers patronise your services thereby enriching you commission-wise.

What are some of the notable challenges of this lucrative business?