How to Write a Successful Commercial Bank Business Plan (+ Template)

Creating a business plan is essential for any business, but it can be especially helpful for commercial bank businesses that want to improve their strategy or raise funding.

A well-crafted business plan not only outlines the vision for your company but also documents a step-by-step roadmap of how you will accomplish it. To create an effective business plan, you must first understand the components essential to its success.

This article provides an overview of the key elements that every commercial bank business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is a Commercial Bank Business Plan?

A commercial bank business plan is a formal written document describing your company’s business strategy and feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Commercial Bank Business Plan?

A commercial bank business plan is required for banks and investors. The document is a clear and concise guide to your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Commercial Bank Business Plan

The following are the critical components of a successful commercial bank business plan:

Executive Summary

The executive summary of a commercial bank business plan is a one- to two-page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your commercial bank company

- Provide a summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast, among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started and provide a timeline of milestones your company has achieved.

You may not have a long company history if you are just starting your commercial bank business. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company or been involved in an entrepreneurial venture before starting your commercial bank firm, mention this.

You will also include information about your chosen commercial bank business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is a crucial component of a commercial bank business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the commercial bank industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support your company’s success)?

You should also include sources for your information, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, commercial bank customers may include small businesses, startups, and entrepreneurs.

You can include information about how your customers decide to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or commercial bank services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will differ from competitors and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your commercial bank business may have:

- Proven industry experience

- Extensive knowledge of the market

- Robust and innovative products and services

- Strong financial position

- Excellent customer service

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, or launch a direct mail campaign. Or you may promote your commercial bank business via PR, by being quoted in the media, or by writing articles for industry publications.

Operations Plan

This part of your commercial bank business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, your Operations Plan will outline the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for a commercial bank business include reaching $X in sales. Other examples include adding new products, entering new markets, or expanding your distribution channels.

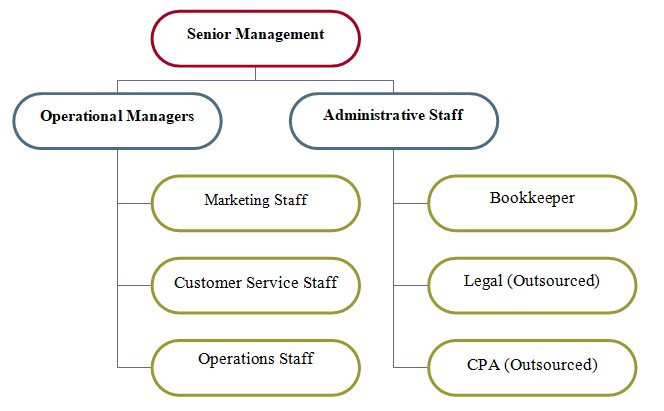

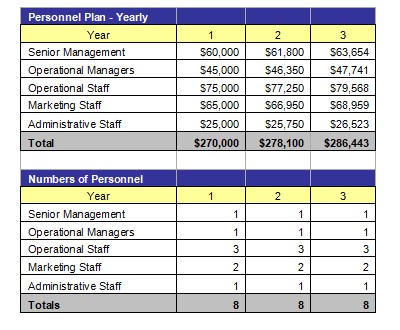

Management Team

List your team members here, including their names and titles, as well as their expertise and experience relevant to your specific commercial bank industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

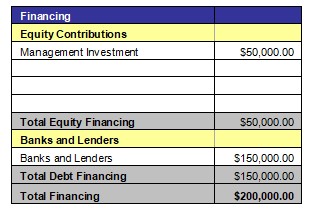

Financial Plan

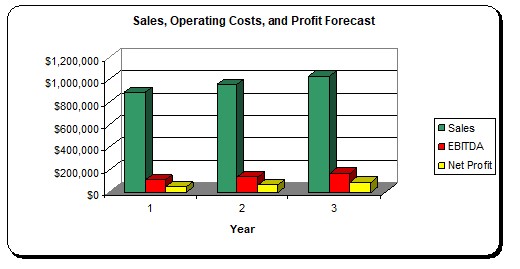

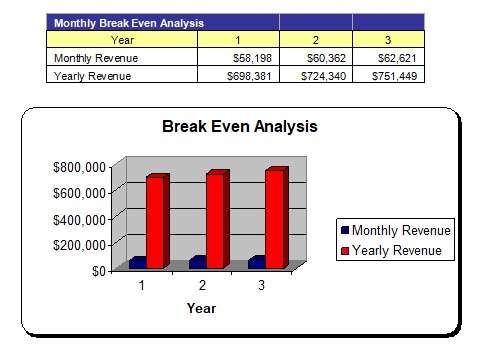

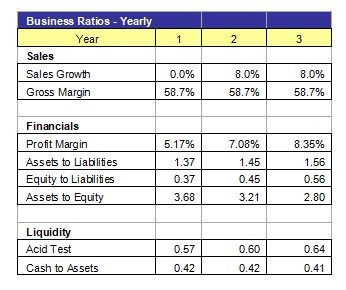

Here, you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

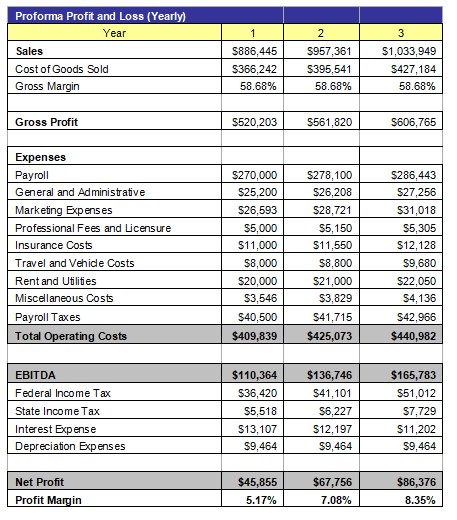

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Commercial Bank Firm

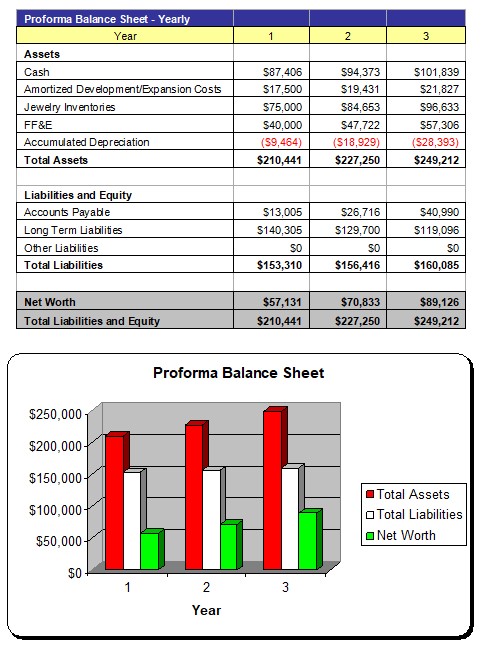

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : Everything you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Commercial Bank Firm

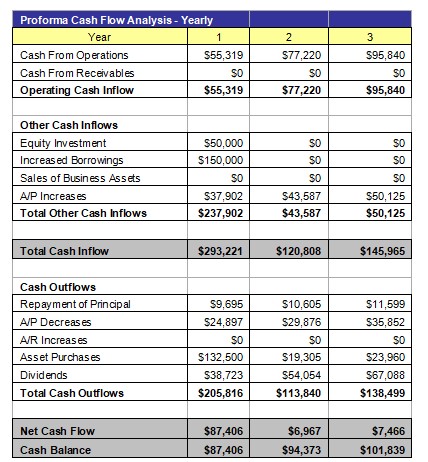

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include cash flow from:

- Investments

Below is a sample of a projected cash flow statement for a startup commercial bank business.

Sample Cash Flow Statement for a Startup Commercial Bank Firm

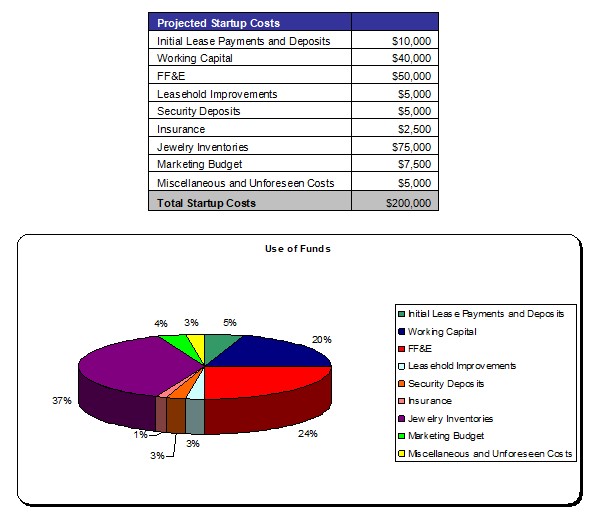

Finally, you will also want to include an appendix section including:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and grow your commercial bank company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

Now that you know how to write a business plan for your commercial bank, you can get started on putting together your own.

Finish Your Business Plan in 1 Day!

Wish there was a faster, easier way to finish your business plan?

With our Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

How to Write a Business Plan to Start a Bank

Feb.29, 2024

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Table of Content

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have computers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; inventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Vegetable Farming Business Plan

Trading Business Plan

How To Write A Textile Manufacturing Business Plan

Start a Vending Machine Business in 2024: A Detailed Guide

Oil and Gas Business Plan

What Is Strategic Planning: Definition and Process

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Bank Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Bank Business

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Bank Business Plan Template FAQs

What is the easiest way to complete my bank business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your bank business plan.

How Do You Start a Bank Business?

Starting a bank business is easy with these 14 steps:

- Choose the Name for Your Bank Business

- Create Your Bank Business Plan

- Choose the Legal Structure for Your Bank Business

- Secure Startup Funding for Your Bank Business (If Needed)

- Secure a Location for Your Business

- Register Your Bank Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Bank Business

- Buy or Lease the Right Bank Business Equipment

- Develop Your Bank Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Bank Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

12 Steps to Starting a Successful Commercial Bank Business

By henry sheykin, resources on commercial bank.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

As the financial industry continues to expand, with a projected growth rate of 4.7% annually through 2028, there's never been a better time to enter the market with a new commercial bank. This guide outlines how to start a bank business , focusing on the strategic launch of "Luminous Bank", a modern commercial banking startup poised to redefine financial services with its headquarters in New York City. From securing crucial banking licenses to executing a targeted bank customer acquisition campaign , each step is detailed to provide potential bank founders with a clear pathway to success.

- Develop business plan.

- Ensure regulatory compliance.

- Secure funding.

- Establish tech infrastructure.

- Hire essential staff.

- Implement marketing strategy.

- Prepare business location.

- Form partnerships.

- Finalize launch strategy.

9-Steps To Start a Business

Before embarking on the journey to open a commercial bank like Luminous Bank, it's essential to thoroughly prepare and strategize. This involves understanding the regulatory landscape, securing adequate funding, and establishing a comprehensive business framework. Below is a detailed checklist that outlines the critical steps required to launch a successful commercial bank.

Business Plan Creation

Developing a comprehensive business plan for a Commercial Bank, specifically for the startup Luminous Bank, requires meticulous attention to detail and an expansive approach. This document is indispensable as it not only guides the operational setup and strategic direction of the bank but also plays a vital role in persuading potential investors and stakeholders of the bank's viability and potential for success.

Starting with an executive summary that encapsulates the bank's mission to revolutionize the banking experience through personalized services and advanced technology, the business plan must clearly define the bank’s short-term and long-term objectives. It should include a thorough market analysis , identifying target demographics, customer needs, and how Luminous Bank will meet these needs more effectively than its competitors.

An exploration of the competitive landscape is crucial. This will document key players in the banking sector, particularly in New York, and differentiate potential opportunities for Luminous Bank. The plan must detail the products and services intended for launch, supported by robust financial forecasts including projected revenues, profit margins, and a break-even analysis to underscore financial planning.

Essential Tips for Crafting a Robust Business Plan

- Focus on unique selling points (USPs) of Luminous Bank that would attract both individuals and businesses, emphasizing convenience, security, and innovation in banking products and services.

- Include clear, actionable strategies for risk management and regulatory compliance, particularly considering banking startup regulatory requirements and FDIC compliance for new banks .

- Prepare a detailed marketing strategy that outlines the commercial bank marketing strategies intended to propel the bank’s visibility and customer acquisition at launch.

The business plan should elaborate on the operational strategy, focusing on the development of bank technology infrastructure and the implementation of secure banking platforms to ensure reliability and security for customers’ financial transactions. Furthermore, the blueprint will highlight the organizational structure, from the executive level down to support staff, ensuring that roles and responsibilities are clearly delineated to facilitate a smooth operation.

This document will serve not only as a foundational blueprint guiding Luminous Bank toward its operational launch but also as a critical communication tool for engaging with entities essential to the bank’s growth, such as venture capitalists for bank funding and partners within the banking sector.

Overall, a well-crafted business plan is a beacon that guides the setup and sustains the growth phases of a Commercial Bank, aligning all stakeholders to a unified vision and operational strategy.

Regulatory Compliance

Navigating the complex landscape of banking regulations is a foundational step in launching Luminous Bank . This involves meticulous adherence to both federal and state regulations. For a Commercial Bank starting in New York, obtaining the necessary banking licenses from the Federal Reserve and the FDIC is imperative. Additionally, coordination with New York State banking authorities ensures that all regulatory bases are covered.

Ensuring compliance goes beyond mere acquisition of licenses; it encompasses a thorough understanding of and adherence to the banking regulations set forth by these bodies. This ensures that the bank operates legally and upholds the highest standards of security and reliability. Notably, regulations cover a wide range of operations from customer privacy and data security to anti-money laundering protocols.

Comprehensive compliance sets the groundwork for secure and trustworthy banking operations, enabling Luminous Bank to build robust relationships with clients and stakeholders while navigating the banking industry's competitive landscape.

Key Tips for Efficient Regulatory Compliance

- Engage with experienced banking compliance consultants early in the planning process to ensure all regulatory requirements are clearly understood and integrated into the business model.

- Invest in scalable banking technology solutions that are designed to comply with current regulatory standards and are adaptable to future changes in the banking regulations.

- Regularly train staff on compliance matters to mitigate risks and ensure they are familiar with the complexities of banking laws and regulations.

Attaining and maintaining regulatory compliance is not merely about legal necessity; it is crucial in securing the trust of potential clients and partners. This strategic step supports the long-term viability and ethical standing of Luminous Bank in the financial market. Every component, from banking licenses to detailed compliance strategies, plays a significant role in crafting a secure and competitive commercial banking startup.

Capital Acquisition

To effectively launch Luminous Bank, securing the required $10 million in funding is essential. This financial foundation will support startup costs, initial operations, and robust marketing campaigns. Capital can be raised through a combination of venture capitalists, angel investors, or traditional bank loans, each offering distinct advantages and challenges.

Engaging venture capitalists might be a strategic option as they provide not only capital but also valuable business expertise and networking opportunities that can propel a new bank forward. However, they typically seek significant control or higher returns on their investment, which might influence the bank's strategic direction.

Angel investors are another avenue. These individuals provide capital for startups, usually in exchange for convertible debt or ownership equity. They can be more flexible than venture capitalists and may bring personal experience and contacts to the table, though they might offer less capital than venture capitalists.

Alternatively, securing a bank loan could be considered more traditional but requires demonstrating a sound business plan and potential for profitability to lenders. This method might involve less surrendering of equity but comes with the responsibility of regular repayments with interest.

Key Tips for Successful Capital Acquisition

- Prepare a detailed and compelling business plan that highlights market potential, competitive advantage, and financial projections to convince investors of the viability and profitability of the commercial bank.

- Build a strong management team with experienced banking professionals; this increases credibility and investor confidence during the capital acquisition phase.

- Consider a mix of funding sources to balance control and financial risk, optimizing the commercial bank's strategic flexibility and financial stability.

In conclusion, securing the necessary funding is a critical step in the journey to launching a successful commercial bank. By carefully considering the source of capital and approaching the right investors with a well-planned strategy, Luminous Bank can establish a strong financial base to support its ambitious goals.

Technology Infrastructure

Establishing a robust technology infrastructure is a critical foundation for any aspiring commercial bank. At Luminous Bank, we prioritize the integration of advanced banking technology solutions to ensure we offer secure, reliable, and user-friendly services to our customers. Key components involve developing comprehensive online and mobile banking platforms that not only meet but exceed current security standards and user expectations.

Partnering with leading online banking technology providers enables Luminous Bank to equip itself with scalable and secure banking platforms. These technological partnerships are essential in crafting an infrastructure that supports not only day-to-day banking operations but also innovative banking services tailored to the needs of modern consumers and businesses.

Effective Strategies for Building a Commercial Bank's Technology Infrastructure

- Choose Scalable Solutions: Opt for technology that can grow with your bank, accommodating increased customer numbers and more complex operations without degrading performance or security.

- Emphasize Security: Invest in top-tier security technologies to safeguard customer data against cyber threats, thus enhancing trust and compliance with global banking standards.

- Focus on User Experience: Ensure that the interfaces of your online and mobile platforms are intuitive and customer-centric, facilitating a seamless banking experience that can attract and retain users.

The establishment of a strong technology infrastructure serves not only to streamline operations but also positions a commercial bank as a forward-thinking institution ready to tackle the challenges of a dynamic financial landscape. Luminous Bank's commitment to top-grade banking technology solutions underscores our dedication to operational excellence and customer satisfaction.

Hiring Key Staff

The foundation of any successful Commercial Bank hinges on the strength and expertise of its team. For Luminous Bank, assembling a cadre of seasoned professionals is not just a step but a strategic imperative. Key positions such as the Chief Executive Officer (CEO) and Chief Financial Officer (CFO) need leaders who not only understand the banking industry competitive landscape but are also visionaries in financial market trends. Compliance officers are equally crucial, ensuring that all operations adhere to banking startup regulatory requirements such as those set by the FDIC.

Essential Tips for Recruiting Top Banking Talent

- Utilize industry-specific recruiting firms renowned for their network and deep understanding of the financial sector.

- Emphasize the innovative culture and growth potential of starting with a new Commercial Bank, appealing to top-tier candidates seeking impactful careers.

- Offer competitive packages that include not just salaries but also incentives and benefits aligned with roles in high-stakes banking environments.

Customer service representatives form the front line of any bank and are pivotal for bank customer acquisition campaigns and retention. Their hiring process should focus on individuals with strong interpersonal skills and a grasp of secure banking platforms , essential for day-to-day operations and enhancing customer satisfaction.

In summary, the recruitment strategy for Luminous Bank should emphasize not only the experience and qualifications necessary for high-level decision-making and compliance adherence but also the soft skills crucial in fostering strong customer relations and operational excellence. This balanced approach in hiring will equip Luminous Bank with a resilient and responsive team ready to meet the challenges of the modern financial landscape.

Marketing And Branding

In the competitive landscape of commercial banking, establishing a robust marketing and branding strategy is paramount for Luminous Bank. The primary goal is to carve out a unique market position that highlights the personalized service, technological innovation, and security we offer. To achieve this, a multi-faceted marketing plan will be developed, focusing not only on traditional media but also on digital platforms to optimize customer reach and engagement.

Key components of the strategy include the development of a strong brand identity. This involves creating a memorable logo, an impactful tagline, and a cohesive visual style that resonates with both individual and business clients. Consistency across all marketing materials underpins the brand's credibility and helps in establishing a trustworthy presence.

Promotional strategies will be tailored to highlight the benefits of choosing Luminous Bank. Initial launch promotions may include offering zero fees on new accounts for the first six months or competitive interest rates on savings accounts. These offers not only attract attention but also provide a direct incentive for potential customers to engage with the bank.

Effective customer acquisition campaigns will be crucial. Utilizing online marketing tools such as targeted ads, SEO, and social media platforms can drive significant traffic and conversions. Moreover, partnerships with fintech firms could provide innovative solutions that entice tech-savvy customers and disrupt normal banking experiences.

Essential Tips for Successful Bank Marketing

- Segment your market : Understand the different needs of your target demographics. Tailored messaging can dramatically increase the effectiveness of marketing campaigns.

- Leverage data analytics : Use data-driven insights to refine marketing strategies and improve customer engagement metrics. This will help in optimizing the allocation of marketing resources for better ROI.

- Focus on customer experience : Ensure that all marketing communications clearly convey the bank's commitment to convenience, security, and personalized service. A satisfied customer is often a repeat customer and a source of valuable referrals.

For Luminous Bank, distinguishing itself in a burgeoning field of established players and new entrants will require a targeted approach that intertwines innovative banking solutions with strategic marketing tactics. The comprehensive marketing and branding initiative will not only pave the way for immediate customer engagement but will also set the foundation for long-term sustainability and growth in the commercial banking sector.

Location Setup

Establishing the headquarters for Luminous Bank in New York City is a strategic decision aimed at leveraging the dense financial ecosystem of this global finance hub. The headquarters will not only serve as the nerve center for all operations but will also symbolically situate Luminous Bank within the competitive landscape of major commercial banks.

To ensure optimal accessibility and convenience for both employees and clients, selecting a location with robust transport links is crucial. Proximity to major transportation hubs, such as subway stations and bus routes, enhances client interactions and staff commutes. Equally important is the security feature of the location — a vital component in the banking industry that instills trust and safeguards the interests of stakeholders.

Planning the layout of the physical branch offices involves thorough considerations not only about aesthetics but also about functionality. Each branch should reflect the bank’s commitment to modernity and customer service. It includes everything from the ergonomic setup of the workspaces to the technological equipment that facilitates efficient banking transactions.

In addition to the static features, dynamic elements like customer flow management must be well-designed to create a favorable first impression and an enduring user experience. The design should intuitively guide the customer to various sections of the branch, minimizing wait times and enhancing service efficiency.

Key Tips for Efficient Branch Office Setup

- Engage with an experienced commercial real estate agent who specializes in corporate properties to find locations that align with strategic business goals and customer accessibility.

- Invest in state-of-the-art security systems , including surveillance cameras, biometric scanners, and secure vaults, to ensure the safety of both clients and assets.

- Implement eco-friendly designs and materials to resonate with modern consumers’ preferences for sustainability, thereby enhancing corporate responsibility and brand image.

Every aspect from the conceptualization to the realization of Luminous Bank’s physical locations must mirror the ethos of innovation, security, and customer-centricity that Luminous Bank stands for. Moreover, ensure these spaces are compliant with all regulatory requirements including FDIC compliance and Americans with Disabilities Act (ADA) standards to provide an inclusive environment.

Partnerships And Alliances

Securing robust partnerships and alliances is critical to the successful establishment and growth of a Commercial Bank. By forging strategic relationships with financial institutions, fintech companies, and other relevant stakeholders, Luminous Bank can leverage these partnerships to gain significant technological advantages, expand customer reach, and enhance service offerings.

Collaboration with financial institutions not only broadens the horizon for diverse financial products and greater financial stability but also enhances the bank's credibility. Engaging with seasoned players in the banking sector provides access to mentorship, crucial banking insights, and improved risk management practices.

Integrating fintech partnerships into our operations stands as a cornerstone for innovation. These collaborations will enable Luminous Bank to implement state-of-the-art banking technology solutions. From secure banking platforms that guarantee customer data safety to advanced algorithms that improve credit assessment, the technological uplift from these partnerships is indispensable.

Moreover, working alongside non-financial companies can broaden the scope of services Luminous Bank offers, making the bank a versatile entity in the financial market. These relationships might pave the way for unique products tailored to the changing needs of consumers, thereby distinguishing Luminous Bank in a competitive commercial banking startup landscape.

Key Tips for Effective Banking Partnerships

- Conduct thorough financial market analysis to identify potential partners whose vision aligns with that of Luminous Bank.

- Engage legal experts to ensure all collaborations comply with banking startup regulatory requirements and other legal obligations.

- Consider partnerships with online banking technology providers to enhance the digital experience for users, focusing on ease of access and transaction security.

The strategic alliances formed by a commercial bank should be dynamic and adaptable to technological advancements and evolving consumer needs. These partnerships are not simply beneficial; they are essential for a successful launch and the long-term sustainability of the bank in a rapidly evolving financial sector.

Launch Plan

Executing a successful launch for a Commercial Bank like Luminous Bank is a complex, yet exhilarating challenge that involves multi-faceted promotional activities and careful strategic planning. The initial phase focuses on organizing a memorable launch event that not only introduces Luminous Bank to the market but also solidifies its brand presence among potential clients and stakeholders.

Key elements of the launch include an invitation-only event that targets industry influencers, potential large-scale customers, and media personnel. This event should serve as both an introduction to Luminous Bank's innovative banking solutions and a showcase of its commitment to technological advancement and customer service. Strong emphasis will be placed on how Luminous Bank stands out from traditional banking institutions, particularly through its digital platforms and personalized service offerings.

Following the high-profile launch, a series of targeted promotional activities should be rolled out. These are designed to attract early adopters and build a robust initial customer base. Strategies such as introductory offers, partnerships with local businesses, and community-focused financial literacy workshops will be essential. Additionally, a digital marketing campaign leveraging social media, email newsletters, and online banking forums will help in maintaining momentum post-launch.

- Expand advertising efforts to encompass both traditional and digital media.

- Use customer feedback from early adopters to refine service offerings.

- Initiate a referral program to increase word-of-mouth marketing.

The phased roll-out to other major cities will depend heavily on the analysis of operational performance and customer feedback from the initial launch in New York City. Metrics such as customer acquisition rates, service uptake, and satisfaction scores will guide the expansion strategy. Adjustments will be made to ensure that as the bank scales, it continues to meet the expectations of a diverse client base while maintaining regulatory compliance and operational excellence.

Insights for a Successful Bank Launch

- Engage local communities through sponsoring events and charitable activities to build brand affinity.

- Align with tech partners to ensure your banking technology solutions are robust and appealing to tech-savvy customers.

- Monitor real-time feedback during the initial launch phase to swiftly address any operational hiccups.

Overall, the launch plan for Luminous Bank should be as dynamic and forward-thinking as the banking services it aims to provide. By blending innovative marketing strategies with meticulous operational planning, Luminous Bank will not just launch, but will soar, setting a new standard in commercial banking.

Launching Luminous Bank encompasses careful planning and strategic execution across multiple domains—from securing funding and ensuring regulatory compliance to implementing cutting-edge technology and hiring top-notch staff. With a robust foundation and a clear roadmap, Luminous Bank is poised to offer unparalleled banking services, aiming to become a benchmark of customer satisfaction and financial success in the competitive banking landscape of the United States.

$169.00 $99.00 Get Template

Related Blogs

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- Writing Business Plan

- Buy a Business

- How Much Makes

- Sell a Business

- Business Idea

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

- ATM locations

- ATM locator

Estás ingresando al nuevo sitio web de U.S. Bank en español.

How to get started creating your business plan, a successful business plan can help you focus your goals and take actionable steps toward achieving them. here’s what to consider as you develop your plan..

Regardless of whether or not you’re pitching to investors and lenders, starting a business requires a plan. A business plan gives you direction, helps you qualify your ideas and clarifies the path you intend to take toward your goal.

Four important reasons to write a business plan:

- Decision-making: Business plans help you eliminate any gray area by writing specific information down in black and white. Making tough decisions is often one of the hardest and most useful parts of writing a business plan.

- A reality check: The first real challenge after deciding to launch a new venture may be writing the business plan. Through the process, you may realize your business idea is a bit flawed or not yet fully developed. This may feel like extra work, but the effort you put into improving your idea during this step can bolster your chance of future success.

- New ideas: Discovering new ideas, different approaches and fresh perspectives are invaluable parts of the business planning process. Working closely with your concept can lead to unexpected insights, shifting your business in the right direction.

- Developing an action plan: Your business plan is a tool that will help you outline action items, next steps and future activities. This living, breathing document shows where you are and where you want to be, with the framework you need to get there.

Business plan guide: How to get started

Use this exercise to gather some of the most important information. When you're ready to put an outline together, follow our standard business plan template (PDF) and use this business plan example to use as a guide as you fill in your outline. Once your outline is finalized, you can share it with business partners, investors or banks as a tool to promote your concept.

- Vision: Your vision statement sets the stage for everything you hope your business will accomplish going forward. Let yourself dream, pinpointing the ideas that will keep you inspired and motivated when you hit a bump in the road.

- Mission: A mission statement clarifies the purpose of your business and guides your plan, ultimately answering the question, "Why do you exist?"

- Objectives: Use your business objectives to define your goals and priorities. What are you going to accomplish with your business, and in what timeframe? These touchstones will drive your actions and help you stay focused.

- Strategies: Your objectives describe what you’re going to do, while your strategies describe how you’re going to do it. Consider your goals here, and identify the different ways you’ll work to reach them.

- Startup capital: Determine what your startup expenses will be. Having a clear idea will allow you to figure out where the money is coming from and help you spend what you have in the right areas.

- Monthly expenses: What do you estimate your business’ ongoing monthly expenses will be? This may change significantly over time — consider what your expenditure could be immediately after launch, in three months, in six months and in one year.

- Monthly income: In order to cover your expenses (and hopefully make a profit), you will need to estimate your income. What are your revenue streams? It's always wise to diversify your income. That way, you won’t be tied to one stream that might not be lucrative as quickly as you need it to be.

- Goal-setting and creating an action plan: Once you have all the specifics outlined, it's time to set up the step-by-step action items explained in the companion guide, a standard business plan outline. This process will utilize the hard work you've already done, breaking each step down in a way that you can follow.

A business plan isn’t necessarily a static document that you create once and then forget about. You can use it as a powerful tool by referencing it to adjust your priorities, stay on track and keep your goals in sight.

Business plan: An outline

Use this exercise to gather important information about your business.

Answer these questions to start your planning process. Your responses will provide important information about your business, which you can use as an overview to develop your plan further.

- What is your dream?

- What do you feel inspired to do or create?

- What keeps you motivated, even in the face of uncertainty?

- Why does this business exist?

- What purpose(s) or need(s) does it fulfill for customers?

Objectives

- List the goals of your company, then number them in order of importance.

- What will the business accomplish when it’s fully established and successful?

- How much time will it take to reach this point?

- For each goal or objective listed above, write one or more actions required to complete it.

Startup capital

- List any and all startup expenses that come to mind.

- Next to each:

- Estimate the cost of any expenses you can.

- List the most likely source of the funding.

- Circle the high-priority expenses.

- Assess whether your available capital is going toward the high-priority items. If not, reconsider the way you will allocate funds.

Monthly expenses

- If you can, estimate your business’ ongoing monthly expenses immediately after launch, in three months, in six months and in one year.

- If you can’t, what information will you need in order to estimate your expenses?

Monthly income

- What are your revenue streams? Estimate your monthly income accordingly.

- Which revenue sources deliver fast or slow returns? Are there other sources you could consider to diversify assets?

- After completing your outline, reference your responses as you work through a traditional business plan guide. This next step will allow you to expand and add more detailed information to your plan.

- When you’re ready to make your formal plan, reference this companion guide, a standard business plan outline (PDF). We've also included a business plan example to help as you fill in your outline.

Learn how U.S. Bank can support you and your business needs at usbank.com/small-business.

Learn about U.S. Bank

Related content

Refinancing your practice loans: What to know

Staying organized when taking payments

How to fund your business without using 401(k) savings

7 tips to help grow your business after launch

Mapping out success for a small-business owner

Unexpected expenses: 5 small business costs to know and how to finance them

How to identify what technology is needed for your small business

Key considerations for online ordering systems

Tools that can streamline staffing and employee management

How increased supply chain visibility can combat disruptors

How one organization is funding equity in the Chicago area

Making the leap from employee to owner

Starting a business with a friend: How to talk about it

How to choose the right business savings account

5 tips to help you land a small business loan

7 uncommon recruiting strategies that you may not have tried yet

Checklist: What you’ll need for your first retail pop-up shop

4 restaurant models that aren’t dine-in

Streamline operations with all-in-one small business financial support

Planning for restaurant startup costs and when to expect them

The moment I knew I’d made it: The Cheesecakery

Business tips and advice for Black entrepreneurs

Make your business legit

How a bright idea became a successful business (in Charlotte, North Carolina)

Starting a business? Follow these steps

How to establish your business credit score

Talent acquisition 101: Building a small business dream team

What is needed to apply for an SBA loan

How does an electronic point of sale help your business keep track of every dime.

Opening a business on a budget during COVID-19

How I did it: Grew my business by branching out

6 common financial mistakes made by dentists (and how to avoid them)

How I did it: Turned my side hustle into a full-time job

Quit your job to start a business: How to save enough

How a 13-year-old created a clothing line that reflects her passions

How to test new business ideas

How running a business that aligns with core values is paying off

Meet the Milwaukee businessman behind Funky Fresh Spring Rolls

From LLC to S-corp: Choosing a small business entity

Costs to consider when starting a business

The different types of startup financing

Making a ‘workout’ work out as a business

How mobile point of sale (mPOS) can benefit your side gig

Disclosures.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice. Mortgage, home equity and credit products are offered by U.S. Bank National Association. Deposit products are offered by U.S. Bank National Association. Member FDIC.

Sample Commercial Bank Business Plan

Here is how to write a commercial bank business plan .

The financial services sector of any economy can never be complete without the services offered by commercial banks.

Commercial and private banks are profit-based. They grant loans, accept deposits, and also offer other types of financial services like electronic banking (including the transfer of funds among others).

Commercial Banking Business Plan Sample

In writing your commercial bank business plan, the following sections should not be left out.

These are basic to having a successful and implementable plan. They include the executive summary section, the company description, market analysis, and competitive analysis sections.

Additional sections include a description of management and organization, breakdown of products and services, marketing plan, sales strategy, request for funding, and financial projections.

Each of these is key to writing a comprehensive commercial bank business plan.

Executive Summary Section

As the name suggests, your commercial bank business plan should have the executive summary section. This should be the first section of your plan. Though this is the usual pattern, it is written last.

This is understandable because it summarizes your entire plan.