Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Investor Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Corporate Governance

- Merger Information

- Stock & Dividends

- Shareholder Services

- Contact Investor Relations

- Email Subscription Center

- Media Center

Top 10 economic predictions for 2023

Executive Director and Asia-Pacific Chief Economist, S&P Global Market Intelligence

Director, Global Economics, S&P Global Market Intelligence

Principal Economist, S&P Global Market Intelligence

Senior Economist, IHS Markit

Below, we offer our top 10 economic predictions for 2023:

1. We expect COVID-19 to continue its transition to a global endemic and the status quo to prevail in Russia's war in Ukraine, with no material implications for the global economy.

Residual effects of the COVID-19 pandemic include episodic shortages that have complicated business planning and logistics and held prices higher than would otherwise have been the case. As the world moves into 2023 and continues the transition to an endemic, COVID-19-related shortages should become less frequent, helping prices in affected goods to ease further over the year.

Uncertainty around the course of the conflict in Ukraine remains and builds a premium into energy and other industrial commodity markets. We expect that the war in Ukraine will continue without major escalation through at least early summer, when a cease-fire may be achieved. That scenario will not end the conflict and economic sanctions and voluntary embargoes will remain. We do not expect renewed surges in commodity prices stemming from that conflict or the West's responses.

Looking ahead, softening global demand will be the dominant story and dampen inflation. While crude oil prices should ease over 2023, high energy costs will put a floor under the prices of processed materials and limit the decline in inflation.

2. Inflation will slow significantly in 2023, but achieving central bank targets will be a multiyear process.

After reaching multidecade highs in 2022, global inflation will moderate in response to tightening financial conditions, softening demand, and easing supply chain conditions.

Downward price pressures are already in the pipeline. S&P Global Market Intelligence's Materials Price Index, a comprehensive indicator of industrial commodity prices, has fallen nearly 30% from its record high in early March. Agricultural commodity prices are in the early stages of a correction and should decline through 2023, led by grain prices. Commodity price declines will filter downstream to intermediate and finished products, bringing some relief to businesses and consumers in 2023.

Yet, labor shortages and wage acceleration are contributing to the persistence of inflation, especially in services. In some sectors, such as machinery where price increases in 2022 did not keep up with input cost inflation, margin restoration will be a priority.

It could take several years to sustainably bring inflation rates down to central bank targets. Global consumer price inflation will likely ease to an average of 5% in 2023, finishing the year at a 3.5% year-on-year pace.

3. Global monetary policy tightening has further to go out heading to spring 2023 with much regional variation.

In the US, we expect the federal funds rate to peak near 5% next spring.

While the European Central Bank (ECB) moderated the size of its rate increases in December, its accompanying guidance was more hawkish than expected, suggesting the hiking cycle will continue well into 2023.

Many central banks in the region typically shadow ECB policy. The Bank of England (BoE) is an exception and faces US-style wage pressures. Still, with a recession already under way, recent fiscal tightening and concerns over a housing crash suggest the BoE will not go quite as far as the Fed. We expect a peak bank rate of 4% in spring 2023.

Monetary easing will likely begin earliest and be most pronounced in Latin America and emerging Europe. There, central banks tightened policy relatively early and substantially as inflation soared from 2021. We expect the Brazilian central bank to start lowering rates in mid-2023.

We do not expect the Fed to reverse course until it is confident that inflation will decline toward its 2% objective, implying rate cuts only from 2024 and disappointing futures market expectations of easing from late 2023. In broad terms, we see the same outlook for the ECB.

4. Mild recessions are forecast in the United States and Europe, but resilience in Asia Pacific will prevent a global recession.

In the US, persistently elevated inflation and extraordinarily tight labor markets have prompted a sharp monetary tightening that has resulted in higher Treasury term yields, wider spreads to yields on private bonds and mortgages, US dollar appreciation, a swoon in stock prices, a sudden reversal in house prices, and a notable increase in financial market volatility.

With a lag, and against the backdrop of waning pandemic-era fiscal relief, this broad and significant tightening of financial conditions will tip the US economy into a mild recession in the first half of 2023.

We forecast relatively short-lived and mild recessions in the EU/eurozone during the fourth quarter of 2022 and the first quarter of 2023, reflecting multiple headwinds and matching consistently with recent Purchasing Managers' Index™ (PMI™) data. The primary driver of expected real GDP contractions is private consumption given an acute squeeze on household real incomes due to exceptionally high inflation. A more severe, energy-driven recession will remain a potential risk beyond the current winter.

Asia Pacific is forecast to be the fastest-growing region of the global economy in 2023, acting as a counterweight to recessions in the US and the EU. This scenario reflects improving growth prospects in mainland China and continued economic expansion in other major Asia Pacific economies, including India and Southeast Asia. Australia, Indonesia, and Malaysia will continue to benefit from high commodity export revenues, particularly for oil, liquefied natural gas (LNG), and coal. Recessions in the US and the EU will dampen the region's economic performance since these economies purchase 27% of the region's exports.

Moderate expansions in Asia Pacific, the Middle East, and Africa will keep the global economy moving forward through 2023. Global real GDP growth is projected to slow from near 3% in 2022 to half that pace in 2023.

5. Housing markets will continue to weaken in the face of rising mortgage rates, but price declines may be tempered in some markets by still tight supplies relative to demographics.

In response to monetary tightening, mortgage rates will remain elevated through 2023. As a result, consumers who had previously locked in low rates will opt to remain in their current homes, and potential new homeowners will stay on the sidelines as purchasing a home is no longer affordable. Recession expectations and the cost-of-living crisis will further reduce demand and push prices lower in 2023, especially in overvalued markets.

We do not expect a market crash or full correction of price bubbles owing to the relative strength of labor markets. However, a need for even higher interest rates to counteract persistent above-target inflation or a significant increase in unemployment would increase the risk of a crash, leading to deeper and longer recessions. The highest risks are in Europe, the US, Canada, and Australia.

6. The US dollar has likely peaked and will retreat in 2023, but it will remain elevated compared with prior years.

Supported by favorable interest rate spreads and investors' flight to safety, the US dollar appreciated sharply over the first ten months of 2022, reaching unsustainable heights against the yen, the euro, and other major currencies before pulling back.

These forces will buoy the dollar through the first half of 2023. Subsequently, we expect the dollar to depreciate under the weight of large US current-account deficits and subdued economic growth.

The euro, which has weakened in response to the eurozone's vulnerability to the impacts of the Russia-Ukraine war and cautious monetary policies, will recover gradually. Meanwhile, some narrowing of US-Japan, long-term interest rate spreads and Japan's comparatively mild inflation rate will lead to some unwinding of the yen's sharp 2022 depreciation against the US dollar.

7. Emerging and developing economies (EMDEs) will remain resilient during 2023, but pockets of vulnerability will result in a two-tier growth path.

Higher interest rates in advanced economies, in combination with the expiration of most COVID-19 support measures in 2022, will have spillover effects for EMDEs.

The risks of higher default rates among domestic borrowers and sovereign debt restructuring have increased, but a wave of crises remains unlikely. Real GDP growth will be more vulnerable in EMDEs with slow policy responses, higher debt loads, and smaller external buffers, such as Zambia, Malawi, and Belarus.

The possibility of debt restructuring under the G-20 common framework, instead of disorderly defaults, is more likely for low-income, debt-distressed countries, especially in sub-Saharan Africa.

As a region, Asia Pacific has adopted more prudent policies since the Asian Crisis of the late 1990s and has more manageable debt levels and healthier external buffers. Asia Pacific will also benefit from lingering pent-up demand from the later lifting of COVID-19 lockdown measures, the resumption of pandemic-delayed infrastructure programs, relatively low inflation, and the modest recovery in mainland China's growth.

In contrast, emerging Europe will be severely affected by the slowdown in the eurozone and the continued impact of Russia's war in Ukraine.

8. Mainland China's easing of containment policies will propel a choppy economic recovery.

Given the likely outbreak waves in the wake of policy changes, the government will proceed to exit by balancing between alleviating public fatigue of containment measures and minimizing potential public health fallouts from the exit.

While financial markets may stage energetic rallies in response to the retreat of the policy, initial recovery of the real economy will be subdued, calling for accommodative economic policies to smooth the bumpy path.

9. Supply chain disruptions will ease markedly in 2023, but tensions from labor shortages will remain.

One of the lessons from the COVID-19 pandemic and its following recovery was that global supply was not geared to face the extreme demand shock that occurred upon the reopening of the world's major economies.

The recessions in Europe and North America that we anticipate in 2023 will help narrow the global supply-demand gap. That process has already started: S&P Global's PMI™ data show that global supplier delivery times in the manufacturing sector in November were down significantly from the peak in early 2022, with room to narrow further in some industries—equipment goods, mostly—as demand softens in 2023.

However, the easing of supply chain disruptions will likely be limited given labor shortages.

10. Labor shortages will remain a challenge in 2023 even as unemployment rates are predicted to rise modestly.

Economies that depended on migration for the provision of labor to keep their economies humming before the pandemic — the US, Canada, Western Europe, and Australia — will see migration flows improve, but probably not fast enough to head off capacity constraints.

In emerging markets, the wave of workers that moved from urban to rural areas during the worst of the pandemic will be slow to return, alongside a continued slow recovery of cross-country labor migration. Gulf Cooperation Council countries are an exception as migrants from East Africa and South Asia will remain crucial in supporting planned investments, given the insufficient local labor markets.

Another exception is emerging Europe — a significant share of Ukrainians and Russians who emigrated owing to the war in 2022 will remain abroad in 2023, boosting the population and potential labor force of other countries across Europe and Central Asia. Nevertheless, several countries face the risk of wage-price spirals amid skills mismatches and slow progress in containing inflation expectations.

Globally, hiring freezes will be more common than mass layoffs in 2023 as employers seek to retain talent. Job losses will be concentrated in sectors that are sensitive to credit conditions, such as real estate and finance.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Critical minerals supply chain outlook in Asia-Pacific

US extends metals protectionism

Outlook for US supply chain activity

Major economic developments of 2023 and how they’ll evolve in 2024

Subscribe to the economic studies bulletin, chloe east , chloe east nonresident fellow - economic studies , the hamilton project @chloeneast ben harris , ben harris vice president and director - economic studies , director - retirement security project @econ_harris sanjay patnaik , sanjay patnaik director - center on regulation and markets , bernard l. schwartz chair in economic policy development, senior fellow - economic studies @sanjay_patnaik louise sheiner , louise sheiner the robert s. kerr senior fellow - economic studies , policy director - the hutchins center on fiscal and monetary policy @lsheiner tara watson , and tara watson director - center for economic security and opportunity , senior fellow - economic studies @taraelizwatson marta wosińska marta wosińska senior fellow - economic studies , center on health policy @mwosinska.

December 21, 2023

- 17 min read

With 2023 winding down, we asked six Brookings experts to take a moment to look back on some of the biggest economic policy developments of 2023 and the ways they expect them to evolve in 2024. Explore their reflections on fiscal policy, the social safety net, climate economics, and more below.

On some dimensions, the U.S. labor market appears to have mostly recovered from the COVID-19 shock and to be stronger than before. By early 2022, the unemployment rate fell back to the very low levels seen right before the pandemic, and it has remained relatively stable throughout 2023 despite slowing job growth and rising interest rates. Median real weekly earnings among workers are now slightly higher than they were at the end of 2019. However, these encouraging points do not paint the full picture. The percent of the population out of the labor force is still much higher than before the pandemic. And half a million workers went on strike in 2023 demanding higher wages and improved working conditions. All of this comes against the backdrop of high, albeit falling, rates of inflation over 2023. The question remains of how workers have fared in the labor market overall.

In a Hamilton Project piece with Wendy Edelberg and Noadia Steinmetz-Silber, we reviewed evidence about how workers’ real pay has changed over the last few years in the U.S. We considered multiple measures of pay for different types of workers and used different measures of inflation, in comparison to various reference periods. Overall, we see some reasons for optimism. All pay measures that we examine have increased slightly relative to the end of 2022 and the end of 2019. Comparing to longer-run trends, most pay measures, adjusted for inflation using PCE, are recently showing gains that are somewhat above the levels predicted by historical trends. And the measures generally show that workers in lower-wage occupations and industries and those with lower earnings have seen larger gains since 2019.

However, not all of the news about real pay is as positive. First, even with recent gains, pay at the bottom of the distribution is still quite low and puts many households at or below the poverty line. Additionally, this trend of rising real pay at the bottom of the distribution appears to be weakening in recent quarters. Second, workers in the middle of the distribution saw more mixed changes in pay than those at the bottom or the top—some metrics show small gains and some show small losses for those in the middle. And finally, when pay is adjusted using CPI instead of PCE, which reflects the prices that are most salient to the average consumer, pay changes are weaker and, in some cases, were even negative.

Going forward I will be looking out for several key indicators of workers’ well-being. First, it is important to continue to pay attention to how real pay is changing, especially for different types of workers rather than just in the aggregate or for the average worker. Second, it will be crucial to focus on metrics of working conditions and worker compensation that are less traditionally studied, such as schedule reliability and access to benefits, particularly as alternative work arrangements like contractor and gig work become more common.

Related Content

Chloe East, Wendy Edelberg, Noadia Steinmetz-Silber

October 24, 2023

Retirement security remains an important economic issue. In 2023, the most notable “development” in this space, perhaps ironically, was no progress in terms of putting Social Security and Medicare on a sustainable fiscal path. While the Trustees of the Social Security Trust Fund estimated that the exhaustion date was moved up by one year to 2033, Congress made little to no progress on advancing a reform plan.

The continued recovery from the pandemic was also notable for retirement security, especially in terms of older worker participation in the labor market. The participation rate of older workers without a disability plummeted 3 percentage points in the immediate aftermath of the pandemic, but over the course of 2023 the labor market recovered about one-third of this loss. Further participation gains are significant as they signal an ability of older workers to gradually transition into retirement and improve their financial well-being in later years.

On the policy front, the most impactful development of 2023 was the implementation of the SECURE 2.0 Act—a set of incremental policy reforms designed to improve the retirement security outlook. Many of the provisions are phased in over time, such as the reform of a matching credit for contributions to retirement accounts by low- and middle-income households. But many of the provisions took effect in 2023, such as an initial increase in age at which savers must take required minimum distributions from retirement accounts.

A second important development was the onset of plans to curb increases in prescription drug pricing. For example, a few weeks ago the Department of Health and Human Services announced several dozen drugs with sufficiently rapid price increases to qualify for the Rebate Rule—which would effectively tax prescription drug companies for boosting prices too quickly.

A third important development was the release of a draft rule by the Department of Labor to expand protections for consumers receiving financial advice, including when purchasing fixed index annuities (annuities with a payout that typically depends on a stock market index). This “Retirement Rule” can potentially shake up the market for financial advice, with an aspiration that lifetime savings are directed to the best use for savers when they retire or rollover their savings.

With 2024 featuring a presidential election and a divided Congress, there appears to be limited opportunity for major reform—changes to Social Security and Medicare will almost certainly be omitted from the legislative docket. But important developments will occur under the radar, namely those related to already passed provisions on prescription drugs and the implementation of the Secure 2.0 Act. While these reforms are largely incremental in nature, they will cumulatively create additional stability for Americans’ retirements and serve as a foundation for enacting future retirement protections.

The Brookings Institution, Washington D.C.

2:00 pm - 4:00 pm EST

The Brookings Institution, Washington DC

2:00 pm - 3:00 pm EDT

Sanjay Patnaik

Related to climate change, one of the most important developments in the domestic policy space was the implementation of the Inflation Reduction Act , the U.S.’ first major legislation to address climate change. A major issue the Center on Regulation and Markets has focused on is permitting reform, a topic that is often neglected but without which the expected climate benefits of the IRA are unlikely to materialize . In addition to regularly engaging with a wide range of stakeholders on this topic, we published an article on how permitting could be reformed in the U.S. to make it more streamlined and allow necessary infrastructure to be built faster.

Another essential aspect of the IRA we focused on was the potential impact of the IRA on U.S. greenhouse gas emissions, which was modeled and estimated by several research groups ahead of the passage of the IRA. However, the U.S. currently does not have an independent government office that could estimate the carbon impact of certain legislation in a non-partisan and independent manner. We therefore launched a Brookings task force on creating the blueprint for a federal Office of Carbon Scoring in the U.S., “to provide the institutional, analytical, and policy foundation for establishing a federal Office of Carbon Scoring (OCS) that would analyze the potential impact of proposed legislation on greenhouse gas emissions and other relevant climate metrics.” We also published a commentary on how carbon scoring could help Congress make real progress on climate change , further outlining our idea of carbon scoring in greater detail.

Another timely topic we focused on in the climate space was the behavior of firms in carbon markets, which are becoming increasingly important around the world, not only though mandatory carbon pricing regulations but also through voluntary carbon markets. On this topic, I published a working paper on how carbon permit markets can lead firms to capture surplus rents by drawing on empirical evidence from the European Union Emissions Trading Scheme (EU ETS). Similarly, we advanced our work on climate risk management, which is increasingly becoming important for governments, corporations, and consumers. In our most recent working paper on this topic , we propose a new framework for how firms can manage their climate risk exposure.

One important trend to watch out for in 2024 relates to a potential carbon border tariff in the U.S., as several bills related to a carbon tax in the U.S. were released recently , undoubtedly in response to the EU’s Carbon Border Adjustment Mechanism (CBAM). Three of the bills were bipartisan, which is a strong indication that there is potential room for the U.S. to institute some kind of carbon border fee, which would align it more closely with the EU.

Rayan Sud, Sanjay Patnaik, Robert L. Glicksman

February 14, 2023

March 16, 2023

Louise Sheiner

In 2023, investors began worrying about federal budget deficits again. Interest rates on U.S. Treasuries moved up sharply, despite the fact that budget analysts have been warning about the challenges of debt sustainability for decades. Why all the renewed attention to the deficit? A few possible reasons include:

- The budget deficit increased sharply in fiscal year 2023. After adjusting for the announcement and subsequent cancellation of Biden’s student loan forgiveness program, the deficit doubled from about $1 trillion in FY 2022 to $2 trillion in FY 2023.

- The standoff over the debt limit, the threat of a government shutdown, and the downgrading of U.S. debt by Fitch all increased concern about political dysfunction in Washington—perhaps suggesting to investors that it would take longer than they had anticipated for the government to start addressing the long-run budget challenges.

- The increase in interest rates—perhaps caused by renewed deficit worries, perhaps not—also led to increased concern over the deficit. The higher are interest rates, the faster the rise in the debt for any given set of tax and spending policies.

But in my view, nothing fundamental changed in 2023. A detailed breakdown shows that the jump in the deficit in 2023 reflected temporary and/or one-time factors that don’t imply that future deficits will be higher. And even before the recent political events, it didn’t seem likely that Congress was going to address our long-term fiscal challenges any time soon.

Since nothing fundamental changed in 2023, it is hard to understand the recent increase in rates: Were markets just not paying attention to fiscal issues until recently? Did they misinterpret the jump in the FY 2023 deficit as signaling larger deficits in the future? Or perhaps the recent increase isn’t about fiscal issues—perhaps it reflects changes in expectations about Federal Reserve policy or even increased productivity growth because of artificial intelligence. A surge in productivity growth, should it materialize, could greatly improve our fiscal outlook, offsetting the effects of higher interest rates.

Recent data suggest that at least part of the surge in rates was temporary: After hitting a post-2007 peak in October 2023, interest rates on Treasuries have been drifting down. Still, the rate on 10-year inflation-protected Treasuries on December 19, 2023 was about 1½ percentage points higher than its average in 2019. Will rates continue to decline, or will they settle at this higher level? Will the focus on the deficit continue—or will it fade away? These are issues I will be watching in 2024.

September 20, 2023

Louise Sheiner, Alexander Conner

November 22, 2023

Tara Watson

I’ve been watching the evolution of the U.S. safety net retreat back to a “new normal” after massive expansion in the COVID era. Food assistance—SNAP (the Supplemental Nutritional Assistance Program)—temporarily increased benefits and added an emergency allotment, changes that had phased out by early 2023. In 2021, the temporary expansion of the federal Child Tax Credit (CTC) made an enormous difference, especially for lower-income families. We saw child poverty fall by almost half for that one year.

Despite the end of SNAP emergency allotments and the expanded CTC, we are not quite returning to the pre-COVID safety net. In 2021, the federal government updated the Thrifty Food Plan, a change that was already in the works and boosted the amount of food assistance SNAP provides. Even with the end of the temporary measures, food assistance will remain above 2019 levels.

And states were also making changes to their safety net supports. The safety net is actually not one safety net, but at least 51 safety nets comprised of a patchwork of federal, state, and local programs. Over the last decade, many states were creating or expanding state Earned Income Tax Credits . Many states increased their TANF cash assistance programs before and during COVID, whereas others let the value of TANF benefits continue to erode. Even though the federal government helps equalize support across states, striking differences remain.

Looking ahead, there are a few safety net issues that will be important in the coming year or two:

First, there will be continued discussion about the CTC. There was momentum around getting the 2021 expansions made permanent, an effort which ultimately failed. But the more modest current version, which was part of the 2017 Trump tax law, will expire in 2025. There are debates about how much if any should go to non-earners, and how high up in the income distribution the credit should go. My colleagues proposed one compromise version .

Second, there is a bipartisan support for long-overdue reforms to the Supplemental Security Income program for low-income Americans with disabilities—raising the asset limits. Right now if single individuals have more than $2,000 in the bank they can’t qualify for benefits, which is a strong disincentive to save. There’s an opportunity to fix that in 2024.

Third, it will be interesting to see how states continue to use their income tax systems to help support children and families. When the expanded federal CTC ended at the end of 2021, some states opted to build on that success by developing their own CTCs. As states continue to experiment, it could widen the significant differences across states in safety net support.

Gabriela Goodman, Tara Watson

November 28, 2023

Lauren Bauer

August 19, 2021

Marta Wosińska

For over two decades, drug shortages have plagued various parts of the healthcare system, mostly in the hospital setting—only occasionally hitting the national headlines. 2023 was yet another year with over 100 unique drugs on FDA’s drug shortage list . The persistent nature of shortages may have gone unnoticed yet again were it not for some high-profile shortages, the most prominent and unnerving of which have been shortages of inexpensive, standard-of-care cancer treatments.

Drug shortages are primarily driven by economic forces. Most shortages occur with generic drugs where the fierce price competition that drives spending down for consumers and payers also turns up the dial on cost cutting. Companies making generic drugs have little incentive to invest in quality oversight and in buffering their supply chains, which raises the risk of manufacturing disruptions that then turn into shortages. This dynamic is particularly consequential for the hard-to-manufacture sterile injectable drugs. Companies also have a strong incentive to purchase cheaper inputs and off-shore production to lower cost environments, which can expose our drug supply chains to geopolitical risks.

With cancer shortages in the headlines, several Congressional committees held hearings on the issue including HSGAC , House Energy & Commerce and Senate Finance . Proposals for administrative and legislative actions abound , but there continues to be lack of appreciation for what actions will address root causes, what actions might help but might also be potentially wasteful, and what actions might frankly make things worse. The inability of policymakers to sort through the various ideas is particularly concerning because addressing shortages will require greater government spending, for which there is currently limited appetite.

To inform executive branch actions and legislation, colleagues and I have put forward a number of analyses coupled with policy recommendations, which I had the opportunity to highlight recently in my testimony with the Senate Finance committee. In a June report , Richard Frank and I proposed what the Medicare program and FDA can do to prevent and mitigate shortages of generic sterile injectable drugs caused by manufacturing quality lapses. To address the risk of future shortages due to geopolitical and climate change risks, colleagues and I developed a framework for how the federal government should assess which supply chains are most vulnerable to disruption—a key step in prioritizing government support. Other work includes recommendations on CMS’s proposal for building buffer hospital inventories and for implementing the IRA drug shortage provisions . Most recently, I had the opportunity to reiterate many of these recommendations in my testimony with the Senate Finance committee.

There is currently motivation in Congress to address drug shortages, but this may subside once the cancer drug shortages disappear from national news. Our Brookings team will continue to be actively engaged in educating policymakers and stakeholders on the issue, working to ensure that the suffering so many patients endured this year from drug shortages will cease to be the norm.

December 5, 2023

Marta Wosińska, Richard G. Frank

June 21, 2023

Marta Wosińska, T. Joseph Mattingly II, Rena M. Conti

September 13, 2023

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here . The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

Economic Studies

Vanessa Williamson

May 14, 2024

Brookings Institution, Washington DC

9:00 am - 1:15 pm EDT

10:00 am - 12:00 pm EDT

Watch CBS News

The most important economic questions of 2023

By Irina Ivanova

January 4, 2023 / 8:02 AM EST / MoneyWatch

American consumers, bruised by a grueling 2022, face another year of living dangerously.

Optimists and pessimists alike can point to their preferred indicators to predict how the year ahead is likely to go. In one corner, a recession looks probable this year. The Federal Reserve is also virtually certain to keep hiking interest rates, and wages continue to lag inflation. In the other are clear signs that last year's red-hot inflation is cooling, while the labor market keeps churning out jobs.

"Year-over-year inflation is continuing to fall and gasoline prices have returned to reasonable levels," David Kelly, chief global strategist at JPMorgan Funds, said in an email making the case for a brighter outlook. "The country is showing continued signs of moving on beyond the pandemic and, hopefully, both the bond market and stock market should do better in 2023 than in 2022."

With that in mind, here are biggest questions facing the U.S. economy in the year ahead.

- After a brutal 2022 for stocks, here's what Wall Street predicts for 2023

Will the U.S. enter a recession?

The economy will almost certainly slow, with one survey from the Conference Board calling a recession a near certainty . Yet most economists don't expect it to crash.

The signals flashing red are plentiful. The number of workers claiming jobless assistance has risen to their highest levels in a year. Interest rates on short-term Treasury bills have been higher than long-term interest rates since late last year — a condition known as an "inverted yield curve" that is a reliable predictor of recession. The Fed itself predicts anemic economic growth and a spike in the unemployment rate next year.

Any downturn is likely to be modest, according to many economists. Given how much trouble employers have had hiring during the pandemic recovery, most will be loath to lay off workers. And consumers are still in relatively good shape, having built up savings during the pandemic.

Will inflation subside?

The worst inflation in 40 years has eased since peaking in the summer, with prices in December increasing about 6.5% from a year ago, according to estimates from economists surveyed by FactSet.

"The evidence suggests we're already past peak inflation. So the year-on-year rate of inflation should start to move lower," Michael Gapen, chief economist at Bank of America, told " Face the Nation " this week.

However, he added, "It will probably take two to three years to get inflation back down to levels that we knew prior to the pandemic — in other words, low, stable and something we didn't necessarily talk about."

The good news is that many of the factors driving inflation higher have receded: Global supply chains are unsnarling, rents are falling and surveys show consumers are spending less than a year ago.

Still, at an annual rate of 6% inflation is triple the Fed's preferred target of 2% per year. Having been burned by declaring price hikes "temporary" last year, the central bank will be leery of declaring inflation dead too soon and could continue to hike interest rates until the U.S. is well into a recession.

Fiona Greig, global head of investor research and policy at Vanguard, sees the economy at a turning point.

"We've seen a cresting of the potential inflation measures, maybe a cresting of the hotness of the labor market," she said. "The question is, do we land softly, do we plummet quickly? Obviously, the Fed's policy actions play a role here."

Will gas prices spike again?

There's good news on this front, too. Gasoline prices are unlikely to return to last summer's record high, according to Patrick DeHaan, head of petroleum analysis at GasBuddy.

"I don't think Americans will have to dig as deep into their wallets this year to fill their tank. Most, if not all of the country will be able to avoid record-setting prices this year," DeHaan said. He predicts that national average gas prices this year across most of the U.S. will hover between $3 and $4 for a gallon of regular.

The chief factor restraining fuel prices is increased refining capacity in Texas, Nigeria, the Middle East and Asia. Closures of refineries, which turn crude oil into finished products including gas, diesel and jet fuel, were a major reason prices sure after COVID-19 exploded in 2020.

"COVID shut down refineries for months and months — some didn't come back online until this summer," DeHaan said.

The biggest question mark for gas prices is Russia's war in Ukraine , as well as the outcome of China's reopening as its COVID-19 cases increase. Changes in either area could dramatically reduce global oil supplies, which would likely drive up fuel prices.

"The EU continues to sanction Russia, and Russia has promised to respond to price caps. Ten months into this, there's still a level of stability even though that's not the ideal outcome," DeHaan said. "To lose [Russia's] output would be a big hit to the global economy at the time it's still recovering from COVID."

How safe is your job?

While the Fed has made weakening the job market a key pillar of its inflation-fighting strategy, the hit to employment this time around is likely to steer clear of the worst-case scenarios.

"Laying off people is a pretty dramatic move in light of the labor shortages we've been dealing with," said Vanguard's Greig. "There may be other cost measures that companies think about. Meaning, maybe they slow hiring rather than laying people off, maybe year-end compensation this year was more tepid than typical years."

Most economists expect the nation's unemployment rate to top out at between 5% and 6% — equivalent to another 3.5 million Americans losing their jobs. The pain will likely be concentrated in a few industries, including the interest-rate-sensitive housing sector and technology, which has seen large-scale layoffs.

Industries where hiring has exceeded the pre-pandemic trend, including retail, professional and business services, manufacturing, and transportation and warehousing, are also in danger of cutbacks, Deutsche Bank predicted. On the other hand, the still-understaffed areas of local government, health care and leisure and hospitality are collectively short 4 million workers, meaning they could continue to drive employment growth as hiring elsewhere slows.

Will you get a raise?

Worker wages have trailed the rate of inflation for more than a year, and employees are eager to catch up.

The signs on this front are mixed. Some government data shows that worker raises, which accelerated in the first half of 2022, have slowed. But people's expectations for higher pay haven't, with the amount of money Americans say they need to switch jobs recently hitting a record high.

And there's one method of getting a raise to stay ahead of inflation: switching jobs. Wages for job-switchers are growing by over 8% per year, exceeding the rise in consumer prices, according to the Federal Reserve Bank of Atlanta .

"There are many jobs if one wants to be employed. That's a good thing for the American worker," said Greig.

When will the stock market recover?

The S&P 500 lost nearly 20% of its value in 2022 and wiped out trillions in Americans' wealth. But a similar plunge is unlikely this year , Wall Street analysts said.

In the past 70 years, there have been only three instances in which the S&P 500 ended a year in the red and then went on to fall the following year: in 1973, 2000, and 2001, according to investment firm LPL Financial.

"Through many economic downturns, recessions and geopolitical crises over many decades, the stock market has always recovered. Those patient and courageous investors who were able to take advantage of those declines have usually been rewarded nicely," LPL analysts said in a research note.

The big question for investors is when. Most believe that when the Fed signals an end to interest-rate hikes, stock will rally. But that may not happen until the end of the year, or even until 2024. In the meantime, financial pros point out that low stock prices often present a good buying opportunity.

"Keep a long-term perspective — don't worry too much about asset prices being low," Greig said. "Markets are volatile and that's why a diversified approach, and simply staying the course, tends to perform pretty well."

- Unemployment

- Stock Market

More from CBS News

9 credit card debt settlement mistakes to avoid

4 big reasons to open a CD right now

What will happen to home prices if inflation stays high? Here's what some experts think

How long will it take to pay off $30,000 in credit card debt?

- Research Library

- My Knight Frank

- South Africa

- Chinese Mainland

- Hong Kong SAR

- New Zealand

- Philippines

- South Korea

- Czech Republic

- Germany - Berlin

- Germany - Frankfurt

- Germany - Munich

- Netherlands

- Switzerland

- Saudi Arabia

Global economics: five big themes for 2023

In January we released our Outlook 2023, where we examine our five big themes for our 2023, as part of The Wealth Report series. Below are some of the key findings we predict to have an affect on economies this year.

1. Rate of inflation

The rate of inflation will dictate when central banks can end the current cycle of rising interest rates. The results will reverberate through borrowing costs and global asset prices.

Two-thirds of our Attitudes Survey respondents cited inflation as the biggest risk for their clients’ ability to create and grow wealth in 2023 – interest rates were cited by just under 60%.

Peak inflation appears to have been in 2022 as the US’s headline rate cooled further to 6.4% in January from a high of 9.1% in June. In the UK the peak seemed to be later in October, with the effect of energy price caps, and has cooled from 11.1% to 10.1%. Energy prices have cooled globally. In part thanks to a mild winter natural gas prices are back at where they were at the outset of 2022, a fifth of the peak. Supply chain pressures have eased and with China abandoning the zero-Covid stance the potential for future disruption is lower.

According to the IMF global inflation is expected to fall from 8.8% in 2022 to 6.6% in 2023 and 4.3% in 2024.

2. Reset opportunities

There will be opportunities to reset as we enter a new investment environment, despite recessions across many major economies. Consensus being that we will see interest rates peak in the first half of 2023 and potential cuts at the end of the year. However, we will not see rates back to the ultra-low levels experienced since the Global Financial Crisis.

The Federal Reserve slowed their hiking pace in February, opting for 25bps (the slowest since March 2022) where the ECB and Bank of England implemented 50 bps hikes, a step down in pace from the latter half of 2022 but reflecting the stickier inflation on this side of the Atlantic. Currently market expectations are for a peak of 5%, 3% and 4.5%, respectively.

Economic downturns are already evident. However, the mood music has shifted in 2023 – The IMF began the year by revising their forecasts up , they expect global GDP to grow by 2.9% this year, 0.2 percentage points higher than in October. Alongside the IMF, the most recent Consensus Economics forecasts predicted that the euro zone too will avoid recession. There is a lag as the impact of higher rates works through economies and it’s not certain they will stop hiking but there is optimism for 2023.

3. Real estate

Real estate was the top cited opportunity among our Attitude Survey respondents, with 46% citing it, many are seeking diversification and a hedge against inflation. Residential and commercial property are both in the spotlight. Higher interest rates will temper demand for residential property in 2023. Some 15% of UHNWIs are looking to purchase a residential property this year, down from 21% in the previous year’s survey.

4. Geopolitical tensions

Tensions in 2022 were dominant and will continue to weigh on sentiment through 2023. Many will be familiar, but there will undoubtedly be surprises. The on-going war in Ukraine does not have a defined path and still offers a lot of unknowns. Energy markets – as mentioned earlier – have quietened and oil is around $80 a barrel from over $120 last year. If we see renewed offensives though, this could have significant effects.

5. The big three

The reopening of the Chinese mainland, dubbed the economic event of 2023 by The Economist , will offer a boost to global growth and was a primary reason for the IMF’s upgrade. After two years of strict zero-Covid policies, the government reopened the Chinese economy and international travel resumed on 8 th January 2023 after 1,016 days of closed borders. It was confirmed that the economy grew by 3% in 2022 the slowest since the 1970s. They have set the target at 5% for 2023.

This year India will overtake China as the world most populous country and will be among the fastest growing countries. This may have already happened as it was confirmed China’s population shrank in 2022 for the first time in 60 years. The Indian economy is the fifth largest in the world after displacing the UK in 2022 and is pipped to be one of the fastest growing this year with 7% growth forecast.

The agility of the US economy will be evident, some 11% of our survey respondents cited the US as an opportunity to grow wealth, and they may yet avoid recession. There is a lot of optimism for the US and US based assets, not least for currency benefits but due to the safe-haven status during volatile times. With the perception of peak inflation and potential reversal of rates at the end of 2024, equity markets are up 4-5% the past quarter.

Read more or get in contact: Flora Harley, residential research

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up below.

Subscribe here

Further reading

- Luxury Investment

- The House View

- Agriculture

- Development

- Residential Lettings

- Residential Sales

- UK Country Homes

- Senior Living

- Student Housing

- Data Centres

Publications

- The Wealth Report

- Active Capital

- London Report

- Rural Report

- Asia Pacific Horizon

- UK Residential Investment Report

- European Logistics

- European Office

- Africa Report

- M25 & South East Office Market Report

- Waterfront View

- ESG Property Investor Survey

- Asia-Pacific

- Australasia

- Middle East

- United States

- All Publications

Economic Letter Countdown: Hot Topics from 2023

As we launch into a new year of research, here’s a look back. Check out the list of our most popular FRBSF Economic Letter topics of 2023, featuring research insights from San Francisco Fed economists. Read more in the blog .

The Federal Reserve Bank of San Francisco (SF Fed) serves the public by promoting a healthy, sustainable economy, and supporting the nation’s financial and payment systems. With offices in Los Angeles, Seattle, Salt Lake City, Portland and Phoenix, the Bank serves the Twelfth Federal Reserve District, which includes one-fifth of the nation’s population and represents the world’s fourth-largest economy. As part of the nation’s central bank, the SF Fed informs monetary policy, regulates banks, administers certain consumer protection laws and acts as a financial partner to the U.S. government.

Goldman Sachs economists and strategists share insights on the key factors driving the global economy.

The global economy will perform better than many expect in 2024

In their 2024 Macro Outlook, Goldman Sachs Research explains why they expect the global economy to outperform expectations in 2024 — just as it did in 2023.

The US economy is on its final descent to a soft landing

In their 2024 US Economic Outlook, Goldman Sachs Research forecasts the US economy to easily beat consensus expectations again in 2024.

Will the UK economy keep up with the rest of Europe in 2024?

In their 2024 UK Outlook, Goldman Sachs Research predicts GDP growth in the UK to improve modestly in the year ahead.

2024 M&A Outlook: From Stability to Strength

Pressure on financial markets, shaky macroeconomic confidence, and rising interest rates all contributed to a subdued start to dealmaking in 2023 — although a welcome pickup in both announcements and new dialogue near the end of Q1 marked a notable shift toward recovery.

AI poised to begin shifting from 'excitement' to 'deployment' in 2024

In their 2024 Outlook, Goldman Sachs Asset Management expects the shift for AI from the excitement phase into the deployment phase to continue.

Read Goldman Sachs Research's full 2024 Outlook reports here.

Hedge funds investing in credit are in demand

Firms that allocate assets are, for a second year in a row, more interested in hedge funds that invest in credit than in any other hedge fund strategy, according to the Goldman Sachs Prime Services Hedge Funds Insights and Analytics team’s 2024 Hedge Fund Industry Outlook.

Capital markets are open and risk appetite is poised to grow in 2024

There are growing signs that capital markets activity will increase in 2024, according to leaders from Goldman Sachs Global Banking & Markets. Investors’ increasing conviction that the US economy will avoid recession, and that the Federal Reserve and other central banks will start cutting interest rates, could boost IPO activity and corporate debt issuance in the year ahead.

Why clients should stick with US stocks

US equities continued to outperform in 2023, with a 26% total return that exceeded non-US developed equities at 19%, emerging markets at 10%, and Chinese equities which lost 11%. Such strong performance has pushed US equity valuations into their top historical decile, meaning US stocks have been cheaper at least 90% of the time.

America Powers On: Why US equities are still poised to outperform in 2024

Goldman Sachs’ Sharmin Mossavar-Rahmani, head of the Investment Strategy Group (ISG) and chief investment officer of GS Wealth Management, shares ISG’s 2024 outlook, America Powers On, and her recommendations for clients in the year ahead.

India’s election-year economy will likely be a tale of two halves

A landmark general election in India, scheduled for the summer of 2024, will see the drivers of economic growth shift midway through the year, according to Goldman Sachs Research. Overall, despite food and oil supply shocks keeping inflation elevated, growth is forecast to remain stable and resilient.

Asset allocation outlook: The case for greater portfolio diversification in 2024

As fears over inflation and interest rates start to moderate, the case for taking on more risk may be rising. Christian Mueller-Glissmann, who heads asset allocation research in Goldman Sachs Research, and Alexandra Wilson-Elizondo, co-chief investment officer of the multi-asset solutions business in Goldman Sachs Asset Management, explain their outlooks for asset classes and portfolio strategies.

M&A in 2024: Navigating opportunities and challenges

After a slow start to 2023, deal-makers are starting to return to the negotiating table. Goldman Sachs’ Stephan Feldgoise and Mark Sorrell, the co-heads of Global Mergers & Acquisitions in Global Banking & Markets, explain the M&A outlook for the year ahead.

Deal-making and IPOs are poised for a revival in 2024

Despite a challenging global economy and geopolitical landscape, the outlook for deal-making, IPOs, and corporate and investor activity is expected to improve in 2024, according to Jim Esposito, Dan Dees, and Ashok Varadhan, the co-heads of Goldman Sachs' Global Banking & Markets business.

The 60/40 portfolio should offer a better risk-reward in 2024

The 60/40 formula for buy-and-hold investment portfolios may return between 4% and 5% and become less risky next year, as major central banks gradually pivot from ratcheting up interest rates to lowering them, according to Goldman Sachs Research. This follows two years of relatively poor performance.

Oil prices are forecast to trade between $70 and $100 a barrel in 2024

The price of a barrel of oil is likely to trade between $70 and $100 for most of 2024, according to Asset & Wealth Management Investment Strategy Group (ISG) at Goldman Sachs.

Japan’s stock market is forecast to have a transformational year in 2024

The Japanese equity market is forecast by Goldman Sachs Research to rally again in 2024, boosted by solid global economic growth and stock market reform.

How private equity strategies are changing amid higher-for-longer rates

As changes in everything from technology and interest rates to sustainability concerns ripple through the corporate world, private equity will have advantages compared to public market investing when it comes to large-scale company transformation for the modern economy. However private equity’s playbook will likely be quite different than the past, according to Goldman Sachs Asset Management.

What’s the outlook for deal-making, corporate and investor sentiment, and markets?

In this episode of Goldman Sachs Exchanges, Dan Dees, Jim Esposito, and Ashok Varadhan, the co-heads of Goldman Sachs' Global Banking & Markets business, discuss their views on the markets, corporate and investor sentiment, and the outlook for deal-making. They also share their thoughts about the direction of the industry as well as their leadership and career advice.

Jan Hatzius, Goldman Sachs’ Chief Economist, on 2024 US Outlook

The US economy could grow faster than people think in 2024. Goldman Sachs’ Chief Economist Jan Hatzius shares his three main reasons for optimism.

The S&P 500 Index is forecast to return 6% in 2024

In their 2024 US Equity Outlook, Goldman Sachs Research expects US stocks to have a modest return next year, as above-consensus economic growth is partly offset by high equity valuations.

Asset Management Outlook 2024: Embracing New Realities

As the new year approaches, new realities are taking shape. To help investors navigate these changes, we aim to identify the most meaningful market trends and investment opportunities of 2024.

Why the global economy and markets can continue to outperform in 2024

Goldman Sachs’ Jan Hatzius, the firm's chief economist and head of Goldman Sachs Research, and Dominic Wilson, senior advisor in the Global Markets Research Group, discuss their outlook and the findings from their recently published 2024 macro outlook entitled, The Hard Part is Over.

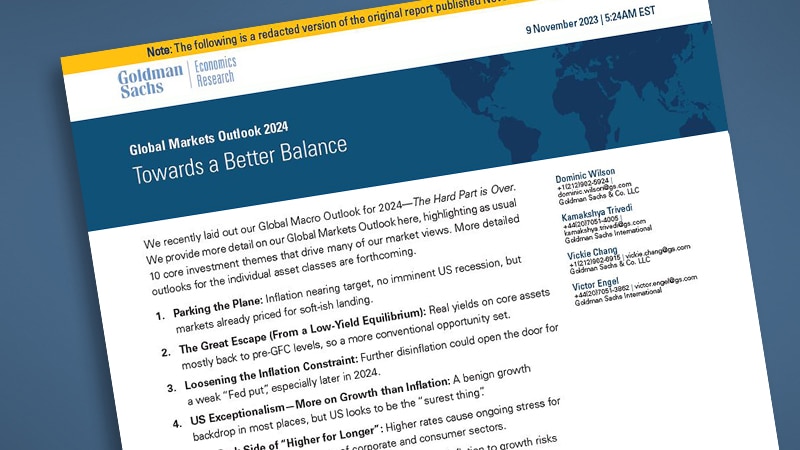

Global Markets Outlook 2024: Towards a Better Balance

Goldman Sachs Research highlights 10 core investment themes that drive many of its market views.

US mortgage rates are forecast to stay above 7% in 2024

US mortgage rates are forecast to be higher than expected in the coming year, according to Goldman Sachs Research. Home prices are also projected to increase, even as borrowing costs remain elevated.

AI may start to boost US GDP in 2027

Generative artificial intelligence has the potential to automate many work tasks and eventually boost global economic growth: Goldman Sachs Research forecasts AI will start having a measurable impact on US GDP in 2027 and begin affecting growth in other economies around the world in the years that follow.

Millennial and Gen Z values could change the economy

The attitudes of young consumers stand to shift consumer spending, according to Jen Sullivan of Goldman Sachs Asset Management.

Is China’s economy facing Japanification?

As China’s economy sputters, investors are asking whether the country could repeat Japan’s experience in the 1990s. Goldman Sachs Research finds that even though there are some key similarities between the two situations, China’s “Japanification” is far from certain.

The Fed is likely finished hiking rates as the US avoids recession

Worries that rising inflation will force the Federal Reserve to raise interest rates later this year appear to be fading amid encouraging signs in the jobs market. Goldman Sachs Research’s Chief U.S. Economist David Mericle shares his views on the U.S. economy, inflation, and the Fed’s path from here.

AI investment forecast to approach $200 billion globally by 2025

Innovations in electricity and personal computers unleashed investment booms of as much as 2% of U.S. GDP as the technologies were adopted into the broader economy. Now, investment in artificial intelligence is ramping up quickly and could eventually have an even bigger impact on GDP, according to Goldman Sachs Economics Research.

Will the UK economy go into recession in 2023?

U.K. economic growth is projected to be flat for the rest of the year as tighter monetary policy slows expansion, according to the Asset & Wealth Management Investment Strategy Group (ISG) at Goldman Sachs.

How fragile is the US consumer?

Is the consumer in better shape than sentiment readings would suggest? Kate McShane, retail analyst with Goldman Sachs Research, separates the signal from the noise.

What’s next for China’s economy?

China's emergence from Covid lockdowns was expected to boost the global economy. But a string of disappointing data is giving investors, policymakers and market watchers a new reason to worry. Goldman Sachs Research’s Hui Shan, chief China economist, explains the drivers behind the outlook for the world’s second-largest economy.

The probability of US recession in the next year has fallen to 20%

The probability of a U.S. recession in the coming year has declined, as recent economic data signal that bringing inflation down to an acceptable level will not require a downturn, according to Goldman Sachs Research.

How India could rise to the world’s second-biggest economy

As India’s population of 1.4 billion people becomes the world’s largest, its GDP is forecast to expand dramatically. Goldman Sachs Research projects India will have the world’s second-largest economy by 2075.

What’s ahead for the U.S. economy?

The U.S. economy has shown signs of surprising resilience this year, despite concerns over inflation, recession and the Fed’s path from here. In the latest episode of Goldman Sachs Exchanges , David Mericle, chief U.S. economist in Goldman Sachs Research, explains why he’s generally optimistic that the U.S. economy can avoid a recession and achieve a soft landing.

The outlook for Indian equities

Is the best still ahead for Indian equities? Sunil Koul of Goldman Sachs Research separates the signal from the noise.

Emerging stock markets projected to overtake the US by 2030

The stock market capitalization of emerging markets is forecast to eclipse that of the U.S. and other developed markets in the coming years, according to Goldman Sachs Research.

Why a US recession has become less likely

The probability of a U.S. recession in the coming year has declined, as the risk of a disruptive debt-ceiling fight has disappeared and stress in the banking sector appears to be only a modest drag on the economy, according to Goldman Sachs Research.

How countries and companies are reshaping their supply chains

How are countries and companies reshaping their supply chains for a new era of global trade? In this episode, Andrew Tilton, chief Asia Pacific economist in Goldman Sachs Research, Luke Barrs from the Fundamental Equity business in Asset Management, and Richard Hill, chairman of the board at Marvell Technology, discuss the macro pressures and geopolitics that are affecting global supply chains, as well as the impact on the investment landscape.

Is it Time to Invest in Emerging Markets?

As the global economic backdrop continues to improve, is it time to invest in emerging markets? In the latest episode of Exchanges at Goldman Sachs , Kay Haigh, co-CIO of Fixed Income, and Hiren Dasani, co-head of emerging markets equity, within Goldman Sachs Asset & Wealth Management, discuss the recent rally in emerging markets and the outlook for 2023.

Goldman Sachs CEO David Solomon on the Economy, Markets and the Firm’s Performance

In a special episode of the Exchanges at Goldman Sachs podcast, Goldman Sachs Chairman and CEO David Solomon shares his views on the macroeconomic environment — including his concern that inflation is likely to be “stickier” and harder to manage — as well as what’s on the minds of clients and the CEOs he meets with.

Investors Expect Equity Capital Markets Activity to Double This Year

A wide range of investors think activity in equity capital markets will double in 2023 from the year before, when markets were beset by volatility, according to Goldman Sachs’ Annual Equity Capital Markets Investor Survey.

China’s Reopening is Poised to Boost Global Growth

China’s reopening from Covid-19 restrictions will not only accelerate the country’s economic recovery, but it will also boost global economic growth, according to Goldman Sachs Research.

A Deal on the Debt Limit is Likely—but Not Without a Lot of Uncertainty

The political standoff over raising the U.S. federal debt limit will likely be resolved—but it’s still likely to create uncertainty for financial markets if history is repeated.

Commodities: An Underinvested Supercycle

Jeff Currie, global head of commodities research, explains why commodity markets will be shaped by underinvestment in 2023.

Why the US Dollar May be Past its Peak

The U.S. dollar may have soared against other major currencies in 2022, but there are growing signs that the greenback is past its peak, according to Kamakshya Trivedi, the head of currencies, interest rates and emerging markets strategy in Goldman Sachs Research.

France’s 2023 Outlook Hinges on Energy, Inflation, and Government Reforms

The French economy was able to keep growing for a large part of 2022 despite a number of challenges. A report from Goldman Sachs Research predicts the country will experience a period of weakness but narrowly avert a recession.

The Global Economy in 2075: Growth Slows as Asia Rises

What are the long-term trends shaping the global economy? What countries are likely to power global growth in the decades to come? In the latest episode of Exchanges at Goldman Sachs , Kevin Daly, co-head of the economics team covering Central & Eastern Europe, the Middle East and Africa, discusses the team's long-term projections and the continued convergence between emerging and developed market economies.

Outlook 2023 - Caution: Heavy Fog

2022 was a tumultuous year. Equity markets dropped precipitously, interest rates rose at the fastest pace in decades and commodity prices gyrated in response to high inflation and geopolitical tensions. The Investment Strategy Group within Goldman Sachs Wealth Management expects 2023 to be less turbulent for markets, with inflation moderating and major central banks approaching the end of their tightening cycles. Yet there is still a fog of uncertainty facing investors.

What’s Ahead for Economies and Markets in 2023?

What’s in store for economies and markets in 2023? In this episode of Exchanges at Goldman Sachs , Jan Hatzius, head of Goldman Sachs Research and the firm’s chief economist, and Dominic Wilson, Senior Advisor in the Global Markets Research Group, explain why they believe the U.S. can avoid a recession and how the economic landscape is improving in Europe and China in 2023.

M&A in 2023: A Complex but Optimistic Outlook for Deal-Making

After soaring to record levels in 2021, the global M&A market slowed in 2022 against a challenging economic environment. So what can we expect in 2023? In the latest episode of Exchanges at Goldman Sachs , Stephan Feldgoise and Mark Sorrell, the co-heads of the Global Mergers and Acquisitions business in Goldman Sachs Investment Banking, discuss the drivers behind 2022’s activity and what to expect in the year ahead.

2023 Commodity Outlook: An Underinvested Supercycle

Just as commodity markets have been dominated by the dollar in 2022, Goldman Sachs Commodities analysts expect them to be shaped by underinvestment in 2023.

The Outlook for Financial Services

Banks are often seen as a leading indicator for the economy—so what are they telling us now about the picture in the US? GS Research’s Richard Ramsden and Alex Blostein discuss the broader sector in the latest episode of Exchanges at Goldman Sachs , also sharing the themes and sentiment they took away from the recent GS US Financial Services Conference.

Jan Hatzius, Goldman Sachs' Chief Economist, on 2023 US Outlook

What makes the US likely to avoid recession in 2023? Our Chief Economist Jan Hatzius says there are two opposing forces at play, one positive and one negative – and the positive one should prove stronger.

Asset Allocation Outlook for 2023: Greater Diversification and Divergence

Market volatility, inflation and positive correlations across assets have put a question mark on the diversification benefits of multi-asset portfolios. In the latest episode of Exchanges at Goldman Sachs , Goldman Sachs Research’s Christian Mueller-Glissmann, who heads asset allocation research, breaks down what investors should keep in mind when building portfolios in 2023.

Is It Time to Switch from Stocks to Bonds?

As central banks ratchet up interest rates to contain inflation, high-grade bonds are starting to give stocks a run for their money, according to Goldman Sachs Research’s 2023 Outlook for Asset Allocation.

The Bear Market in Global Stocks is Forecast to Get Deeper in 2023

The bear market in stock markets is forecast to intensify before giving way to more hopeful signals later in 2023, according to Goldman Sachs Research.

US Stocks are Forecast to Have Less Pain but No Gain in 2023

“Put simply, zero earnings growth will drive zero appreciation in the stock market,” David Kostin, chief U.S. equity strategist, wrote in the team’s 2023 Outlook.

2023 US Economic Outlook: Approaching a Soft Landing

The key macroeconomic question of the year has been whether inflationary overheating can be reversed without a recession. Analysis from Goldman Sachs Research economists suggests that the answer is yes—an extended period of below-potential growth can gradually reverse labor market overheating and bring down wage growth and ultimately inflation, providing a feasible if challenging path to a soft landing.

Japan Economics 2023 Outlook: Focus on Wage Growth and BOJ Leadership Change

While our Goldman Sachs Research economists expect Japan’s real GDP growth to slow to 1.3% in 2023, from 1.5% in 2022, they look for growth to continue to outpace its potential. Consumption is likely to directly benefit from economic reopening, and they also expect capex to remain firm on the back of pent-up demand, labor shortages due both to demographics and reopening, and supply chain rebuilding.

Asia Views: 2023 Outlook: Inflation Peaks and Growth Troughs

Economic growth is likely to start 2023 on the weak side across most of the Asia-Pacific, according to Goldman Sachs Research economists, as a fading reopening boost, slowing global manufacturing cycle, and past monetary tightening weigh on activity. As these headwinds fade and China’s reopening gets underway, they expect growth to reaccelerate. While most of our economists’ GDP forecasts are a little below consensus for 2023 as a whole, they are more positive on second-half growth, particularly in China.

China 2023 Outlook: After Winter Comes Spring

After a very challenging 2022, Goldman Sachs Research economists expect China GDP growth to accelerate from 3.0% this year to 4.5% next year on the back of China’s potential exit from its zero-Covid policy, which they assume will start shortly after the “Two Sessions” in March. China’s reopening would imply a strong consumption rebound, firming core inflation, and gradually normalizing cyclical policies in 2023.

2023 Europe Outlook: Milder Recession, Higher Terminal Rate

Goldmans Sachs Research economists maintain their long-held view that the energy crisis will push the European economy into recession this winter, as surveys and production data point to a sizeable slowing in energy-intensive industries, and high inflation will reduce real household incomes. But they now see a shallower recession as the hard data have remained surprisingly resilient, the rebalancing of the gas market has reduced the risk of energy rationing and governments have provided significant fiscal support.

Why the US is Expected to Escape Recession in 2023

The U.S. will probably stick a soft landing next year: the world’s largest economy is forecast to narrowly avoid a recession as inflation fades and unemployment nudges up slightly, according to Goldman Sachs Research.

Macro Outlook 2023: This Cycle Is Different

Global growth slowed through 2022 on a diminishing reopening boost, fiscal and monetary tightening, China’s Covid restrictions and property slump, and the Russia-Ukraine war. Goldman Sachs Research analysts expect global growth of just 1.8% in 2023, as US resilience contrasts with a European recession and a bumpy reopening in China.

Europe’s Energy Crisis: End in sight or far from over?

Plentiful natural gas supplies and mild weather across Europe are creating optimism that the continent may be able to avoid shortages and blackouts this winter. But is that optimism premature? In this episode of Exchanges at Goldman Sachs , Goldman Sachs Research’s Samantha Dart, a senior energy strategist who focuses on the natural gas markets, and Jari Stehn, our chief European economist, discuss the state of Europe’s energy crisis and its impact on the broader European economy.

The US Economy Is Poised to Slow as the Fed Taps the Brakes

The Federal Reserve is tapping the brakes on U.S. economic growth, which could help bring down inflation and temper the most overheated job market in postwar American history, according to Goldman Sachs Research.

Will the US go into recession?

Can the Federal Reserve slow the U.S. economy enough to bring down inflation without causing a recession? It’s a delicate balance, but there are several reasons that it could be more achievable than in the past, according to economists at Goldman Sachs.

Stagflation Risk

As 2022 continues to unfold, two major growth risks loom large against a backdrop of alarmingly high inflation—the prospect of a Fed policy mistake, and of a sizable disruption in the Euro area's energy flows. How policymakers navigate these risks, and their growth and market consequences, are Top of Mind.

The Case for Commodities: ‘Super-Backwardation,’ Structural Demand and Inventory Shortages

In this episode of Exchanges at Goldman Sachs , Jeffrey Currie, global head of Commodities Research in Goldman Sachs Research, discusses why he believes commodities are entering a supercycle and how the current geopolitical landscape is shaping commodity markets.

Moving to Seven Rate Hikes in 2022

Following the strong CPI print on February 10th, Goldman Sachs Research is raising their Fed forecast to include seven consecutive 25bp rate hikes at each of the remaining FOMC meetings in 2022 (vs. five hikes in 2022 previously). They continue to expect the FOMC to hike three more times at a gradual once-per-quarter pace in 2023Q1-Q3 and to reach the same terminal rate of 2.5-2.75%, but earlier.

What’s Ahead for the Housing Market

In this episode of Exchanges at Goldman Sachs , Douglas Yearley, Chairman and CEO of Toll Brothers, and Terry Hagerty, Goldman Sachs’ co-head of Homebuilding and Building Products, discuss the outlook for the housing and home building market in 2022.

Piloting Through: Why Investors Should Stay the Course

In this episode of Exchanges at Goldman Sachs , Sharmin Mossavar-Rahmani, head of the Investment Strategy Group and chief investment officer for the Consumer and Wealth Management Division discusses the investment themes outlined in ISG’s 14th annual investment outlook, Outlook 2022: Piloting Through , and explains why investors should continue to stay invested.

Is 2022 the Endemic Year?

In the latest episode of Exchanges at Goldman Sachs , Jeffrey Shaman, Director of the Climate and Health Program at Columbia University’s Mailman School of Public Health, and Dr. Eric Topol, Founder and Director of the Scripps Translational Science Institute, discuss the rapid spread of the Omicron variant of SARS-CoV-2 and the potential shift to an endemic phase of the pandemic in 2022.

2022: The Endemic Year?

While the lightning spread of the Omicron virus variant has led to a record surge in cases globally, its more transmissible but milder nature has also raised the question of whether it’s ushering in a more manageable, endemic phase of the virus in 2022.

Asset Management: Investment Ideas 2022

Explore Goldman Sachs Asset Management's key themes of 2022 and the potential sources of attractive returns they could create.

US Economics Analyst: 10 Questions on the Political and Policy Outlook for 2022

Will Congress pass any reconciliation package this year? Will Democrats maintain control of Congress after the November midterm elections? Goldman Sachs Research’s economists offer insight into these questions and more.

European Economics Analyst: 10 Questions for 2022

Although the renewed surge in Covid infections is likely to weigh on services activity over the winter, Goldman Sachs Research expects a more manageable hit to European economic activity than last year.

Asia Economics Analyst: Ten questions for 2022

Regional growth will decelerate this year, but should remain above trend in many economies.

David Solomon on the Firm’s Performance, the Global Economy and What to Expect in 2022

In the latest episode of Exchanges at Goldman Sachs , Goldman Sachs Chairman and CEO David Solomon shares his thoughts on the year ahead and what he expects for the global economy, markets and corporate activity.

Investment Strategy Group's Outlook 2022: Piloting Through

In 2021, the US economy showed its resilience and US equities outperformed once again, supporting the Investment Strategy Group’s long-held tenets of US Preeminence and Staying Invested . While risks have risen, we expect a favorable economic backdrop to continue to support equities this year.

Global Views: Earlier Runoff, Four Hikes

Chief Economist Jan Hatzius discusses the Omicron variant's effect on the economic outlook for 2022, and how persistent inflationary pressures could modify the Fed’s schedule for hikes and balance sheet normalization.

What’s Next for M&A?

The record wave of M&A activity that we witnessed in 2021 is showing no signs of slowing as we turn the page on a new year. Goldman Sachs’ Stephan Feldgoise and Mark Sorrell, co-heads of the global mergers and acquisition business in the Investment Banking Division, explain the drivers behind the deal-making activity and the outlook for 2022.

What’s Ahead for Global Economies and Markets in 2022?

Global economies and markets are facing a more complicated landscape amid rising rates, slowing growth and shifting monetary and fiscal policies. Goldman Sachs’ Jan Hatzius and Dominic Wilson examine what’s in store for 2022.

Inflation: Here Today, Gone Tomorrow?

As U.S. inflation hits 30+ year highs, experts debate whether the “temporary” pandemic-related inflationary pressures could prove persistent. In the latest Exchanges at Goldman Sachs episode, Goldman Sachs’ Allison Nathan speaks with Mohamed El-Erian, President of Queens’ College, Cambridge University, and Chief Economic Advisor at Allianz, and Jan Hatzius, Goldman Sachs’ Chief Economist and head of Goldman Sachs Research, for their views on where inflation goes from here—and what that means for the economy, monetary policy, interest rates and assets.

Outlook 2022: The Long Road to Higher Rates

Goldman Sachs Research says the fastest pace of the recovery now lies behind us, but there are reasons for optimism on global growth heading into 2022.

Sign up for BRIEFINGS, a newsletter from Goldman Sachs about trends shaping markets, industries and the global economy.

Thank you for subscribing to BRIEFINGS: a newsletter from Goldman Sachs about trends shaping markets, industries and the global economy.

Some error occurred. Please refresh the page and try again.

Invalid input parameters. Please refresh the page and try again.

Connect With Us

Engaging Economic Research Topics in 2023: Unraveling Economic Complexities

Are you searching for economic research topics? If yes, then have a close look at some of the best economic research topics to try in 2023.