Groww: How It Is Changing the Traditional Ways of Investing

Sarika Anand , Manisha Mishra

Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations.

Investing a decade ago entailed a lot of paperwork, many bank visits, long queues, and application processing that used to take days. When you add in a dearth of knowledge about financial products and widespread misselling by agents, the experience becomes nothing short of a nightmare.

These days, all you need is a bank account, some disposable income, and a smartphone to begin investing, increasing, and managing your wealth. Though some of the new investors are starting with mutual funds, equities, and other investment platforms, many of the investment-averse citizens were also noticed to step out from it altogether. However, with the emergence of Groww, the investment industry, it seems, has witnessed a laudable disruption with the easy ways of investing money with stockbroking and direct mutual funds that the platform has encouraged.

Here goes the Success Story of Groww, an organization that has made investing simple for millions of Indians. Know more about the Founder and History, Mission and Vision, Products, Business model, Revenue and Growth, Funding and Investors, Acquisitions, Awards, Competitors of the company, Challenges Faced , and other details ahead!

Groww - Company Highlights

About Groww and How it Works? Groww - Founders and Team Groww - Startup Story Groww - Mission and Vision Groww - Name, Logo and Tagline Groww - Products Groww - Business Model Groww - Revenue and Growth Groww - Funding and Investors Groww - Acquisitions Groww - Advisors and Mentors Groww - Awards Groww - Competitors Groww - Challenges Faced Groww - Future Plans

About Groww and How it Works?

Groww is a web-based investment platform that allows users to invest in mutual funds and equities directly. The company is a creator of a mutual fund direct access platform. Groww's technology is aimed to make investing simple, accessible, transparent, and fully paperless, allowing customers to invest in mutual funds without any difficulties.

Groww users can invest in mutual funds through SIPs and equity-linked savings. According to the company, it has over 20 million registered users, the majority of them are under the age of 40 and prefer to use their phones. It offers over 5,000 mutual funds that can be invested directly through its website and app, which is available on iOS, and Android.

It features a straightforward pricing structure that includes cheap trading fees. You can invest in a mutual fund for free with no hidden fees. Groww does not charge an account opening fee or a monthly maintenance cost. Moreover, with Groww's direct mutual fund plan, you can also earn an additional 1.5%.

Groww offers E-books, Resources, and Blogs that provide stock market essentials and updates to assist investors in making better decisions. One can open a paperless account immediately very easily. If you want to participate in the primary market, you can submit an online IPO application. A Brokerage Calculator is included in the software.

Groww - Founders and Team

Groww, which was founded in 2016 by 4 former Flipkart employees Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal , aim to make investment more accessible to young people by simplifying the process. The DIY (Do It Yourself) model, in which individual investors establish and manage their own investment portfolios, is preferred by most millennials.

Lalit Keshre

Lalit Keshre is the Co-founder and CEO of Groww. Keshre was a Btech, Electrical Engineering student in microelectronics from IIT Bombay. He looked after the Product and Engineering of the IITiam Systems. After completing his graduation Lalit founded Eduflix. He eventually joined Flipkart, where he was in the Product department and served for a little less than 3 years before founding Groww in May 2016.

Popularly known as the Co-founder and COO of Groww, Harsh Jain was an IIT Delhi student from where he completed his Master of Technology in Information and Communication Technology. Jain also has an MBA in Product Management and Marketing Technology from the UCLA Anderson School of Management.

Ishan Bansal

Ishan Bansal is another Co-founder of the company. Bansal was a student of BITS, Pilani, from where he completed his BTech in Mechanical Engineering. He has been a Charter Holder from the CFA Institute. Bansal also has an MBA degree in Finance from XLRI Jamshedpur. Ishan Bansal started his career in ICICI Securities. He eventually left the company and joined Naspers Limited as a Manager. Flipkart was the next company that he joined where he was in Corporate Development. After his brief stint with Flipkart, Ishan opted to co-found Groww.

Neeraj Singh

Neeraj Singh is known as the Co-founder and CTO of Groww. Neeraj has a Bachelor's in Information Technology from ITM University, Gwalior. He then opted for a Post Graduate Diploma in Advance Computing from C-Dac. Singh initially joined JDA Software as a Software Engineer and then opted for Ivy Computech as his company which he started as a Senior Software Engineer. He eventually joined Flipkart in the SDE department and eventually decided to co-found Groww with the other founders.

Groww - Startup Story

The founders of the company witnessed the change in the e-commerce market during their time at Flipkart and realized that investment is the next big opportunity. The e-commerce boom signaled an increase in average income and technology savvy, and it was at this point that the founders realized that individuals indeed have discretionary cash and will need assistance in putting it to good use.

When the founding team started investigating Indian financial options for interested consumers, they spent a lot of time learning about the market and identifying the users' basic pain concerns. They have to conduct numerous tests to determine the best user experience. Furthermore, the users' hard-earned money was on the line. This is why they needed to deliver a safe and secure solution, which required some time to develop.

Groww began as a direct mutual fund distribution platform in 2016 and has since grown to become one of the country's most popular mutual fund investing platforms. Groww added equities in the early part of 2020 in response to customer demand, and the following year, it launched digital gold, ETFs, intraday trading, and IPOs in rapid succession.

Groww is a Bangalore-based brokerage firm that offers online discount brokerage services for a single charge. Groww can help you invest in stocks, IPOs, and mutual funds directly. Nextbillion Technology Private Limited, a SEBI-registered brokerage, is known as Groww. NSE and BSE both have NTPL as a member.

In India, there are about 200 million people with disposable income, but only about 20 million actively invest. Groww's goal was to provide consumers with the information, resources, and customer engagement they needed to get started with investing as quickly as possible.

Groww - Mission and Vision

The company's mission is to give investors the greatest experience possible when it comes to managing their money.

Lalit Keshre, Co-founder and CEO, Groww, said – “Over the last few years, we have made investing in mutual funds and stocks simple and transparent for millions of investors in India. If we look at the opportunity that lies ahead, it still feels like Day 1. We started our journey with small steps writing blogs and making videos to educate people about investing. Our wealth as a nation will keep growing, and our mission is to provide the best experience for investors to manage their wealth. We are happy to partner with investors who believe in our long-term vision."

Groww - Name, Logo and Tagline

The Groww logo consists of a circle of two colours: Green and Blue. The logo depicts an increasing graph.

'There's just one right way,' says the company's tagline. The main goal of the company is to make the investing process as simple as possible for their clients. Investors can choose from a variety of mutual funds, and they can also invest in a variety of schemes with varying market capitalizations.

Groww - Products

The list of the products of Groww include :

- Mutual Funds

- Digital Gold

Groww - How to Select the Best Mutual Funds for Beginners

Groww - Business Model

Groww operates as a commission-free platform, charging flat-fee brokerage on equity and F&O trades, along with regulatory charges like STT, stamp duty, exchange transaction charges, and DP charges . For US stocks, there are no account opening or maintenance fees, but charges apply for forex conversion and exchange fees . Revenue sources include brokerage, interest on deposits, and potential future subscription fees for premium offerings and advisory services.

Groww charges a tiny fee, however, it is paid by the mutual fund firm, not by the client. They profit on the funds they sell, but it's a complicated process.

To begin, there are two types of mutual fund investments: regular and direct. In ordinary mode, a distributor appears, and you must pay the distributor a commission. The commission is calculated in such a way that it compensates you for your investment and profits.

Apps like Groww, on the other hand, give consumers a direct investing opportunity by combining different funds and companies into a single platform, thereby extending a wide range of possibilities.

For a fintech company like Groww, the first thing to keep in mind is to expand the customer base. Groww leverages technology to reach the proper target audience, which lowers its operating costs. People rarely switch between these types of applications. As a result, once the correct customer base has been established, they are likely to stick with you for the long haul.

Groww allows users to invest in mutual funds and equities from anywhere in the world, thanks to its high level of technology. With just a few mouse clicks, you can become an owner of a specific stock or mutual fund.

Groww - Revenue and Growth

Groww is one of many that has greatly interested investors. The company's earnings increased by 4.7 times to a little over INR 1 crore in FY20, up from INR 20.14 lakhs in FY19. Operating revenue increased by 3.25 times to INR 52.05 lakhs, with financial assets contributing an additional INR 48.24 lakhs.

The company has further seen an increase in its operational revenues in FY21, which were recorded at INR 30 crores in consolidated operating revenues. The fees and commission income that the company provides brought it around INR 13 crore in revenues, which was followed by income from its tech platform and support charges and other operational revenue, which helped the company gain Rs 15 crore and INR 2 crore in revenues. The expenditure of the company also grew parallelly, making the total expenditure of the company climb to INR 155.66 crore. Looking at the company's financials on a unit level reveals that Groww has managed to earn Re 1 of operating revenue by spending INR 2.95 during FY21.

The Y Combinator-backed business has witnessed a respectable increase in earnings, but it still trails companies like Zerodha and Upstox, which have earnings of INR 1,094 crore and INR 148 crore, respectively. Groww made INR 1 crore while ET Money made INR 2.24 crore in total in FY20.

Groww is expanding fast and has also achieved unicorn status in April 2021. The company closed $83 million worth of its Series D funding round led by Tiger Global Management, which helped it turn into a unicorn startup.

The company has enhanced its Broking app by introducing the 'Pay' feature , enabling users to engage in peer-to-peer transactions and make payments to merchants effortlessly by scanning QR codes.

Groww Launched Intraday Trading and ETFs

Groww is hailed as a platform that is trusted by more than 30 million users. It is a customer-first company that brings ease and trust for the users while investing in Mutual funds, FDs, Stocks, Futures and Options, IPOs and more. Groww had equities, and then launched Intraday Trading and ETFs, expanding their product suite. With the launch of these products that cater to two diverse niches within the investing spectrum, Groww aims to provide a gamut of investment options to millennial investors with varied investment objectives. With intraday trading now enabled on 350+ stocks and select ETFs on Groww, investors can short-sell, place a stop-loss order, and track price movements through candlestick charts, within just a few clicks.

On the other hand, ETFs as an asset class can be explored by users who are inclined towards passive investment instruments. With Groww, investors can check all information related to ETFs such as expense ratio, fund manager details, and scheme objectives, as well as track the live price of the underlying securities on the go.

Groww launched Intraday Trading at a time when stock trading is gaining unprecedented popularity amongst Indians, especially young millennials. CDSL reported that the number of demat accounts with CDSL crossed 25 million only in the previous month, registering a 25% increase as against the pre-lockdown numbers. Moreover, since March 2020, mobile trades have more than tripled, as reported in September 2020, according to BSE’s trading data.

Speaking on the launch, Lalit Keshre, Co-founder and CEO, Groww said, “The launch of intraday trading and ETFs on our platform is in line with our promise to provide our customers with all kinds of investment options on a single platform. We already have all the direct mutual funds and gold available on the platform. In the days to come, we will keep adding more features to provide an all-encompassing investing experience”.

Groww also plans to follow this launch with a series of learning modules aimed at educating its investors about the intricacies of intra-day trading and ETFs. The company launched stocks investing on its platform in June 2020 and has recorded more than 4.5 Lakh Demat accounts within a short span, thereby becoming one of the fastest-growing discount brokers in the country. Currently in invite-only mode, customers would soon be able to invest in US equities on the Groww app as well.

Some other growth insights of the brand can be compiled as:

- Groww brags about having 30+ million registered users

- The platform has nearly $400 million in investment

- Groww is a one-of-a-kind startup that recorded over a 10X jump (from $250-300 million to $3 billion) in valuation in a little over a year in India.

- The nearest rival of Groww is Upstox, which recently raised a new round at around a $3.4 billion valuation

- It is a worthy competitor of Zerodha

- Groww had 6.63 million active clients, approximately 150,000 or 2.3% more than Zerodha at the end of September 2023, breaking the latter's lengthy reign at the top.

Groww will Foray into the Neobanking Segment

The company is currently looking to foray into the new banking space with a new neo-banking platform that it will likely launch soon. According to one of the sources close to Groww, the company believes that being a neo-banking company will further make it holistic for the users, which want to emerge as a one-stop solution for banking and investment.

Groww to Launch its Lending Arm

Groww is also looking to foray into lending and is in final talks for the launch of another vertical to its offerings, which would be lending, as per the reports dated January 14, 2021. The company will offer credit lines to some users after selecting them based on their transaction histories as per the mobile app usage, which Groww has already started to do. This step might prove to be playing a great role in multiplying the revenues of Groww, which aren't that noteworthy so far.

Groww Launched Ab Karega Invest

A growing number of investors from tier-II cities are now taking to investing through online platforms. The company will host conferences in selected Indian cities to make investing simple and accessible. Groww, a leading investment platform, stated that 60% of registered users registered with them hail from tier 2 and tier 3 cities. In light of this, Groww has launched a one-of-a-kind financial education initiative “ Ab India Karega Invest”, to bridge investors’ knowledge gap. As per the initiative, the Groww team will tour 52 select cities in 52 weeks and conduct conferences to explain the nuances of investing. The city meets are focused on creating a knowledge-sharing platform for industry players and aspiring investors as well as fostering local investor communities.

As a pilot campaign, Groww previously held meets in Lucknow, Jaipur, and Patna, and the overwhelming reception led to the extension of the campaign PAN India. On the occasion of the launch, Lalit Keshre, Co-founder and CEO, of Groww said “The penetration of financial services in India is really low beyond metros. Groww is making investing accessible to millions of people in India with a sharp focus on customer experience. For us, there are no boundaries. This program helps us in multiple ways, but the biggest one is to closely engage with aspiring investors spread across these cities in India”.

Groww Receives SEBI Approval

Groww has announced that the startup has received approval from SEBI for the Groww Nifty Total Market Index Fund. This development follows Groww's strategic move earlier this year when it acquired the mutual fund business of Indiabulls Housing Finance, paving the way for its foray into the mutual fund market. As the competition in India's mutual fund space intensifies, with formidable players like Groww's rival Zerodha and Jio Financial Services poised to enter the sector, the landscape is becoming increasingly dynamic.

Groww Gets RBI Licence to Operate as Online Payments Operator

Groww has successfully secured an online payment aggregator license from the RBI on April 29, 2024. This license permits the financial services firm to conduct e-commerce transactions via its UPI app, Groww Pay. Notably, Groww has been strategically expanding into the credit and payments space over the past two years to cater to both existing traders and new users. RBI's regulation of offline payment aggregators marks a regulatory shift, affecting face-to-face transactions via PoS machines and QR codes.

Groww Financials

Groww's revenue surged from Rs 30 crore in FY21 to Rs 351 crore in FY22, driven by a substantial increase in fees and commission income, which went from Rs 13 crore to Rs 326 crore during the same period. Additionally, tech platform and support charge revenue from Rs 15 crore to Rs 2 crore, while other operating system revenue grew from Rs 2 crore to Rs 23 crore between FY21 and FY22.

Operating revenue for the company increased by more than three times to Rs 1,277.8 crore in FY23 from Rs 351 crore in FY22. In FY23, subscription and commission fees accounted for 95.9% of total revenue. During the reviewed year, subscription fees and commission fees brought in Rs 1,226.1 crore for the startup.

Groww achieved profitability for the fiscal year that concluded on March 31, 2023. The company recorded a net profit of Rs 448.7 crore in FY23, compared to a staggering Rs 239 crore loss in FY22.

Company total expenses rose from Rs 663.6 crore in FY22 to Rs 932.9 crore in FY23.

Groww - Funding and Investors

Groww has raised around $393 million over 7 funding rounds that the company has seen to date. The company has recently raised around $251 mn in its Series E funding round on October 24, 2021. Here's a glimpse of the funding rounds of Groww:

Groww - Acquisitions

To date, Groww has acquired only one other mutual fund business, which is Indiabulls AMC. Groww acquired Indiabulls Mutual Fund for INR 175 crore, which includes cash equivalents of INR 100 crore. Groww will be one of the first fintech firms to join the 37 trillion dollar asset management market as a result of this purchase.

Groww acquired a minority stake in the SaaS startup Digio as part of its strategic investment on January 2, 2023.

Groww - Advisors and Mentors

Groww gets Satya Nadella, CEO of the second most valuable company, Google as its investor and advisor. Groww Co-founder and CEO Lalit Keshre is thrilled about this development and has not missed posting it on Linkedin.

Groww gets one of the world’s best CEOs as an investor and advisor. Thrilled to have @satyanadella join us in our mission to make financial services accessible in India. — Lalit Keshre (@lkeshre) January 8, 2022

Groww - Awards

Some of the awards that Groww received to date are:

- 2017-18: BSE Star MF award for Karnataka's 2nd best performer in the RFD category.

- 2017-2018: 3rd place in the BSE Star MF Fintech – Highest Transactions competition. 2017-2019

- 2018-19: BSE Star MF Fintech – Highest Transactions 2018-19: 1st position

Groww - Competitors

The top competitors of Groww are -

- Angel Broking

- Karvy Stock Broking.

Comparing Groww to its basic competitors :

- Upstox- They offer nearly identical services and a similar brokerage framework

- 5paisa- They offer the same services as 5paisa, but their cost is different because they offer zero brokerage trading. 5paisa offers superior service and charges a reduced brokerage fee (INR.10 per order flat)

- Flyers- In this situation, the services and pricing structure are the same as those of Zerodha. They do, however, give an API that is completely free.

- Angel Broking offers similar services, but with a much bigger profit margin.

Groww - Challenges Faced

The industry has risen at a pace of 12.5% per year over the last ten years, which is more than double the world growth rate. However, India's mutual fund asset base as a percentage of GDP is only 11%, compared to the world average of 62% this year. Individual investor demographic data suggests that 48% of somewhat older millennials (aged 29-37) participate in equities, whereas only 4% of the young generation (aged 22-28) do so.

Due to the perceived complexity and the need to have advisors on hand at all times to navigate the dangers, as well as the dread of the hazards, young or first-time investors are hesitant to enter the market. The challenge, according to the founder, was to not only alleviate these concerns but also to educate them. Here's where digital services like PhonePe , GPay , Paytm , and others have made a huge difference by combining a simple user interface with interactive instructional content.

Groww clearly displays a variety of goods to potential investors, together with the corresponding risk level and historic performance. It also provides consumers with a comprehensive summary of all mutual fund facts, which helps to educate them.

Groww - Future Plans

In the coming months, Groww will launch deposits, US equities, sovereign gold bonds, Futures and options, and other derivative products. Groww has prioritized financial education material since the company's beginning.

“Our philosophy has been to create an internet finance company, based on best user experience, transparency, and simplicity, with the goal of offering every investment product out there for an Indian retail investor. Further, while we cannot advise a customer on what to buy or sell, we can definitely provide them with the right information through our educational initiatives," Keshre, chief executive and co-founder, said in an interview.

The company intends to launch a flurry of financial education projects geared at millennials and develop the financial services sector over the following two years. It signed up roughly 7 million customers between September 2020 and April 2021, with 60% of those in Tier 2 cities and beyond, according to the business, and it aims to keep expanding in Tier 2 and Tier 3 cities in the upcoming years..

What does Groww do?

Groww is an online investment platform that allows users to invest in mutual funds and equities directly. The company is a creator of a mutual fund direct access platform.

What is Groww's business model?

Groww operates as a commission-free platform, charging flat-fee brokerage on equity and F&O trades.

Groww started in which year?

Groww was started in 2016 by four former Flipkart employees: Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh.

Which companies do Groww compete with?

The top competitors of Groww are Upstox, Zerodha, Upstox, IIFL, Finvasia, Angel Broking, SAS Online, Sharekhan, Edelweiss, and Karvy Stock Broking.

What are the Groww app charges?

Groww offers accounts for mutual fund investments with zero transaction charges, no redemption charges, or any other hidden charges. Furthermore, it also offers free account opening facilities that requires zero maintenance charges.

Must have tools for startups - Recommended by StartupTalky

- Manage your business smoothly- Google Workspace

Maximizing Efficiency: 8 Best Productivity Gadgets for Entrepreneurs

According to technology experts, productivity gadgets are devices or innovations that help individuals complete tasks more efficiently and effectively. These devices frequently use technology to automate operations, organize information, or simplify complex activities, eliminating distractions while increasing output. These devices come in various forms, from hardware to software programs, each

AI for Modern Tech Stack Solutions in Business Operations

This article has been contributed by Ms. Karunya Sampath, Co-founder & CEO of Payoda Technologies. When it comes to artificial intelligence, there is always a fear of missing out. However, AI is here to stay. The notion of AI has expanded so much over time that you may already be using

How to Generate Real Estate Leads Using AI

This article has been contributed by Satya S Mahapatra, Chief Brand Custodian and part of the Founder’s office at JUSTO Realfintech. India’s real estate sector is on a growth trajectory with nearly 4.11 lakh residential units sold in 2023, registering a growth of over 33% from 2022.

Magnum Ice Cream Marketing Strategy | Secrets Behind Magnum's Success

Brands like Magnum become instant favorites of people. The credit goes to the public relations team that works behind the scenes and creates mind-boggling marketing strategies and advertisements. These help the brand build its place in the market. And for Magnum, it's Unilever that is responsible for the media spend

- Español – América Latina

- Português – Brasil

Groww: Empowering investors with a user-friendly platform powered by Google Cloud

About Groww

Headquartered in Bangalore, Groww is India’s fast-growing online investment platform that offers a simple and easy way to invest in stocks, direct mutual funds, IPOs, ETFs, and digital gold. Its mission is to make investing as intuitive and accessible as ecommerce.

Tell us your challenge. We're here to help.

Groww makes investments simple and accessible, using google kubernetes engine to ensure a reliable platform for customers, and makes data-backed decisions to grow its business with bigquery., google cloud results.

- Reduces hardware costs with Preemptable Virtual Machines

- Enables a lean DevOps team with Google Cloud

- Analyzes data effectively and quickly for agile business growth

Provides users with a safe, reliable investment platform

Investing is one way to ensure financial security. However, the thought of it can be a daunting one, especially for people without any prior experience. With a mission to make investment simple for digital natives in India, Groww was launched in 2016.

"We noticed that many people were on social media, booking cabs, and ordering food online, but the same people were not investing, despite having the means to do so," says Singh. This observation led to a lightbulb moment for the team, and they realized that in order to appeal to the millennial, mobile-savvy generation, they had to create an investment platform that was as easy to use as an ecommerce platform.

"We've only got four or five people in DevOps, and that's only possible because Google Cloud products are already able to run on their own."

Managing unpredictable spikes with Google Kubernetes Engine

As with any platform, there are bound to be peak and non-peak hours when it comes to traffic. For Groww, regular spikes take place in the early mornings, or in the evenings when people are more relaxed having come home from work. But the nature of the fintech industry is a volatile one. Investors are only human, and their investment decisions can be swayed quickly by the news. As such, spikes in traffic can happen at the most unpredictable times. To cope with this unpredictability, Groww uses Google Kubernetes Engine to scale up and down automatically to meet the required capacity around the clock. This also helps the company save costs, as it pays only for what is needed.

"No matter how much of an expert you are, you can never predict when traffic on the platform will be heavy," says Singh. "Google Kubernetes Engine helps ensure that we never run out of capacity, without overspending on infrastructure cost."

More recently, the investment company started using Preemptible Virtual Machines , which run at one third of its hardware cost. It also leverages Anthos to monitor and manage its backend infrastructure and to have better workload visibility. Singh shares, "We are very open to adopting new technologies, and our team is always eager to learn if we can do things better. We believe that technology is always evolving and it's our responsibility to learn and make use of what's available out there."

Despite having so much running in the background, Singh explains that the company keeps a very lean DevOps team. "We've only got four or five people in DevOps, and that's only possible because Google Cloud products are already able to run on their own."

"From a startup perspective, BigQuery is really helpful because often setting up your data lake can be very costly and a distraction when the team is also busy focusing on setting up an infrastructure."

Making swift, data-backed business decisions

Infrastructure is only part of the equation for a successful business. Outside of operations, the ability to analyze data effectively is arguably the most important component for a startup to thrive. Groww leverages BigQuery to make decisions quickly and efficiently. "With BigQuery, we have a place where we can put all data, fire queries, and build dashboards almost instantly, allowing us to make business decisions quickly," explains Singh.

The team also uses Looker Studio to clearly visualize the information generated through charts and graphs. The best part? Groww doesn't need to spend additional time and resources setting up a large data team, since BigQuery does most of the work and in a shorter period of time. The resources saved also enables the team to focus on addressing functional requirements, rather than managing and sizing the data platform.

"From a startup perspective, BigQuery is really helpful because often setting up your own data lake can be very costly, and a distraction when the team is also busy focusing on setting up an infrastructure," adds Singh.

“As we gain more users with different wants and needs, it will be a natural progression that the company evolves. I believe that with Google Cloud, we are well equipped to pave the way for the future."

Ensuring security and compliance with Google Cloud

As a fintech company, security and compliance continue to be top priorities for Groww. It chose Google Cloud as its preferred cloud provider because there are three data center replication zones in Mumbai, which means it adheres to financial regulations for keeping its user data within borders.

Moving forward, Groww plans to evolve its platform alongside its users. Singh says, "As we gain more users with different wants and needs, it will be a natural progression that the company evolves. I believe that with Google Cloud, we are well equipped to pave the way to the future."

Start a conversation [email protected]

We are available here

- Our Clients

Groww -ing Users with Illustrations

Brand Overview

Founded in 2016, Groww is a new-age investment platform for millennials offering investments in direct mutual funds at 0% commission. Over 8 million users trust Groww for research and investing in mutual funds. Now, as India’s fastest growing investment platform, Groww has 35+ partners in just four years. It has raised nearly $30 million from 13 investors including Sequoia Capital, Ribbit Capital, Kairos, Propel Venture Partners, and others.

Brucira's Services

- Graphic Design

- Illustrations

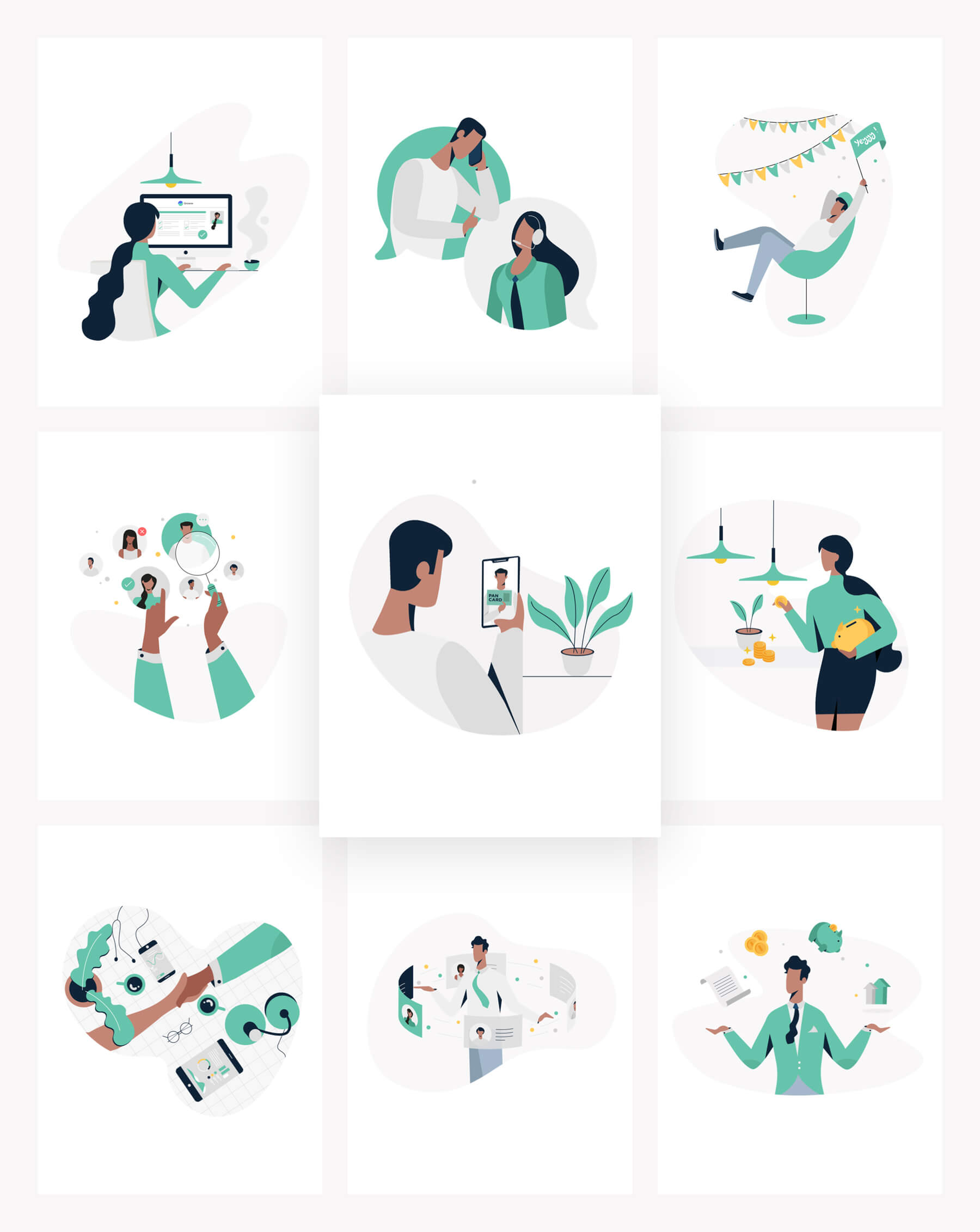

Since Groww’s target audience was Indian millennials, the illustrations they required for their website needed to reflect maturity and practicality without compromising on the visually enthralling elements that draw someone’s eye to an illustration. Groww’s team clearly communicated that the illustrations needed to be polished, refined, and sophisticated.

The Challenge

Brucira’s task was to design and develop illustrations that offered users a visually appealing look into the process of investments. As most of Groww’s target users were aged 35 and older, these illustrations had to stray away from Brucira’s usual ‘cute & beautiful’ style to fit a more mature audience.

The Approach

The first step of course was to accurately understand the service and the mindset of the target user. Groww offers a unique and intelligent way of investing in mutual funds which is often thought of as a complicated process. In contrast, the illustrations needed to communicate the simplicity of investing with Groww. Here are the next steps we followed:

- Draft sketch: We researched, collected references, and analyzed them in order to accurately capture the USP of Groww’s service.

- Setting the tone: We used positive imagery in the illustrations because it can make goals seem more achievable and actionable for users. This was done by creating characters with smooth body language and distinguishable rhythmic figures.

- Choosing the right colour palette: In the final step, we chose bright yet cool colours that added to the maturity of the illustrations while complementing the brand colours.

The Solution

Brucira created pretty yet sophisticated designs for Groww’s web pages. These illustrations served as visual guidelines and anchors for different aspects/elements of the website.

Take a closer look at our creations here:

Brucira designed sophisticated yet appealing illustrations that perfectly matched Groww’s needs. These illustrations offered a stunning visual overhaul to the brand and was exactly what everyone at Groww had envisioned. Brucira’s work was so well-received that these illustrations are still being used on Groww’s website & app as well!

Important Links

https://groww.in/

View Similar Case Studies

Designed subtle yet vibrant onboarding app illustrations.

Created an amazing promotional video for the 5th anniversary of Cashfree.

We have developed ruttl, which is a live website review tool.

- Apps Features

- How Investing App Groww Witnessed Over 200 Percent Growth in First Time Investors in COVID Hit 2020

How Investing App Groww Witnessed Over 200 Percent Growth in First-Time Investors in COVID-Hit 2020

Most of the first-time young investors are from pune, mumbai, new delhi, and bengaluru, groww says..

Neeraj Singh, co-founder and CTO, Groww

- Groww allows users to invest in FDs, stocks, gold, mutual funds

- It says most number of young women stock investors are from Mumbai

- Groww is headquartered in Bangalore

Groww, an Indian investing app, has witnessed 200 percent growth in first-time investors in 2020. This massive increase in user base is attributed to the opportunity created by lockdowns and the digital revolution spurred by the COVID-19 pandemic. Groww aims to simplify complex financial products in India especially for first-time and young investors. The Groww app allows users to invest in fixed deposits, stocks, gold, mutual funds, and develop a savings portfolio. The company says that the young audience is keen on investing and Groww has witnessed a 226.12 percent increase in the number of first-time investors from the age group 18-20 years, whereas in 2021 there has been an increase of 101.65 percent till now.

Pune, Mumbai, Bengaluru and New Delhi are the top cities that have witnessed consistent growth over the last two years in terms of the number of young investors who have started investing in financial products, Groww says. In addition, Pune tops the list across all the investment portfolios except IPO, for which Ahmedabad takes the lead. Groww is working on new products, features and updates that are focused on consumer's needs and will announce more in the future.

Expert opinion: TechArc chief Faisal Kawoosa says, “These platforms add a great value than only going with brokerage firms. These platforms know a lot about user behaviour as they rest on their smartphones and hence can leverage that understanding to decide the best investment portfolio. Also, they leverage data using AI and other such enablers to bring in a lot of value for them. Brokerage firms don't have that granular level of insights about the users.”

- How Razorpay Achieved 40-45 Percent Monthly Growth in COVID-Hit 2020

Gadgets 360 spoke to Neeraj Singh, co-founder and CTO, Groww to know a bit more about the company's journey so far and its future plans.

1. What were you doing before you began Groww?

I was with Flipkart where I joined as a level two software engineer and soon moved to a managerial level. I worked on supply chain products such as Warehouse Management, Order Management, etc. In my tenure with Flipkart I also built a few teams like Seller Platform in Market Platform, Returns & Refunds where we streamlined the product exchanges process. In 2014, we started with Motorola E, where people would buy a new phone in exchange for an old phone. By this time, I had the experience of setting up new teams from scratch and delivering whatever was needed. The last project I was associated with was called Flipkart Quick or F-Quick. We were a team of 30 engineers. It was a hyperlocal delivery model where one can ship groceries or any product within a locality. We built the product and tested it in the Koramangala, HSR, Electronic city area. The product is still being used by Flipkart.

- ToneTag on Its Plans to Bring Contactless Experiences at Malls, Banks, and Retail Shops

2. What motivated you to begin Groww? How did you and the other founders meet?

My journey in Flipkart was entrepreneurial in nature. I had set up the engineering teams from scratch and built scalable products. It was something I was comfortable with and hence I did not carry such hesitations and did not have any financial reservations either. It was at Flipkart that I connected with Lalit Keshre, Harsh Jain, and Ishan Bansal. We would use our personal time, whether during breaks or over the weekends, to brainstorm ideas for our startup. We knew what we did not want to do but were hunting for that eureka moment to finalise our startup idea.

3. Explain in brief what Groww is about and how it helps users?

- How Dream11 Fantasy Sports Weathered the Suspension of the IPL

Through my eyes, Groww is all about helping users manage, save, invest and transact money. Any financial institution runs on the back of users' trust. We are working to build a trusted platform, ensuring the safety of users' money. By nature, Indians are risk-averse so from day one, we have been working towards giving a safe and seamless platform to our users.

4. What was it like in the first year of being in business? What are your key learnings from the early days?

The first year was about understanding the users and building the product. One of the insights that we learnt was that 40 percent of the users use the internet, including from metro and tier 2/ 3 cities. According to a report, 220 million people will have access to the internet by 2025. Those people who have access to the internet can make investments but they still do not. Users wanted full control of investments so we wanted to enable a DIY investment economy for them. Our focus was to build a platform that was simple to use and gave easy access to investments. Additionally, goal-based investments are a myth and not followed by many. We observed that people did not link their investment choices or period with their life milestones.

- How DotPe Plans to Disrupt the Duopoly of Zomato and Swiggy

View this post on Instagram A post shared by Gadgets 360 (@gadgets.360)

5. How was it like sailing through the unprecedented COVID-19 crisis?

Every crisis is an opportunity. Like many others, it has done well for our business. A lot of people utilised their time to learn about investments. Some key insights are:

- How Fitness Startup Cult.fit Pivoted to a Digital Model to Stay Relevant During the Pandemic

- There has been a consistent spike in the number of new investors entering the space since 2020. We have seen 206.08 percent growth in first-time investors in 2020 and a 94.53 percent growth just within the two quarters of 2021, which is expected to increase manifold in this year, indicating that newer investors are entering the ecosystem

- There has been a visible increase in the percentage of first-time investors from the age group of 18-30 . The year 2020 witnessed a 226.12 percent increase in the number of first-time investors from the age group 18-20 years, whereas in 2021 there has been an increase of 101.65 percent already till date and growing. This has been the highest among all the other age groups, indicating that millennials and younger investors are taking interest in wealth creation at a younger age

- Women investors entering the space has witnessed an uptick since 2020 and has shown a similar trend in 2021 as well indicating rising interest among women investors across all financial portfolios

6. In which year did Groww make considerable progress? Could you offer more details on what happened through that year?

In my opinion, we have been making progress every day and every day is a celebration. As and when there was an increase in the number of customers using the Groww platform, it was a cause to celebrate for us. We are honoured to see this increase on a regular basis. This is a validation to our vision and efforts of becoming and remaining a customer-centric business. If we are able to make our customers happy throughout the year, I believe that year to be a fruitful one. 7. What was the thought process while building the Groww UI? Would a first-time investor understand the stock and MF jargon?

Eliminate clutter for the customers to let them think. This saves time for customers and does not drive them away from making investment decisions. With time, attention span has reduced. We want to make sure that the decision-making process is shortened for the customers. Clutter-free, simple to use and minimum steps to get to the final stage were the key themes around which we developed the Groww UI. We provide all the relevant information that will help them understand how a particular investment product works. We have placed the information in such a way that users don't lose their patience in finding their way to the information. Rather we have developed the look and feel to offer a clutter-free page. For a user who is proactively looking to understand investment products to make a decision, our clutter-free page will help them find their way.

8. Can an existing trader get onboard Groww? If yes, how?

For existing investors, only two things are important - how fast one can open an account, and whether they can move their existing investments to the platform. On Groww, the onboarding journey is less than a minute. This indicates seamlessness in the procedure. However, we continue working on making this experience even better and are aiming to introduce ways to make this process even simpler in the coming days.

9. Could you help give a sense of how far Groww has come in these few years? From when it began to where it is now.

As I am a tech and product guy, let me share my version of growth. Launching Groww in 2017, we initially started as a regular mutual fund distribution platform with only three mutual funds on the Groww website. It took us two months to build the first version. As a team, we were confident enough to build the initial product and we worked with the same capacity for more than 6 months. In these 6 months, we were also heavy on the experimentation front. We built MVP for various features — customer profiling, Robo advisory, risk analysis along MF transactions. We did rigorous testing with users and kept on learning. Our journey is based on continuous learning and improvement. Keeping user experience in mind, we kept adding or retaining the necessary features and removed the ones that were not helping our users. We made a major change after 6 months where we dropped lots of features like Robo advisory, customer profiling, and moved from just 3 mutual funds schemes to having all mutual funds and all AMCs. We moved to direct mutual funds on Groww in early 2018. We did this because our users loved what we built and they wanted more flexibility and more MF options to buy. All major upgrades we did so far were done based on what customers were looking for. Following user demand, we added stocks on our platform in the early half of 2020 and the same year launched digital gold, ETFs, Intraday trading, IPOs in quick succession. We are also working on launching a lot more products, features and offerings in the months to come.

10. What does the recent IPO of Zomato mean for tech startups in India?

In general, it is a good thing that tech startups are getting traded on the stock exchange for IPO. I don't think people should be deriving any inferences. At the end of the day, an IPO is an IPO. One should look beyond IPO and identify the problem the company is trying to solve, across sectors. Foreign investments are coming in for these startups and good products are getting built for consumers. That's what one should value in the companies. IPOs are unpredictable- If it doesn't fare well, it does not mean the company is not doing good. 11. Buying financial products in the Indian market is thought to be a complex affair. What is Groww doing to simplify that and make investing a simple affair? Every step we take is towards simplifying this affair. Groww is building a full-stack platform supporting the entire journey of an investor. We offer a place for an investor to not only gain knowledge and invest but also, reach out to someone if they get stuck anywhere. For example, when Franklin closed 6 schemes, investors did not know who to reach out to. We are working towards automating solutions for every possible challenge, situation and requirement, that can become time-consuming or a hindrance for a customer, and further delay the process of making investment decisions. 12. Could you offer data on the kind of users on your platform? What is the average age of users that invest in stocks and mutual funds in India? First Time Investors:

- There has been a visible increase in the percentage of first-time investors from the age group of 18-30. The year 2020 witnessed a 226.12 percent increase in the number of first-time investors from the age group 18-20 years, whereas in 2021 there has been an increase of 101.65 percent already till date and growing. This has been the highest among all the other age groups, indicating that millennials and younger investors are taking interest in wealth creation at a younger age

Young Investors:

- Top 5 cities from where the highest number of young investors have come on to the platform to invest

- Pune, Mumbai, Bengaluru and New Delhi are the top cities that have witnessed consistent growth over the last two years in terms of the number of young investors who have started investing

- Pune tops the list across all the investment portfolios except IPO, for which Ahmedabad takes the lead

- The majority of young investors are from Pune, New Delhi, Bengaluru and Mumbai across all the investment portfolios. Ahmedabad makes it to the top when it comes to IPO investments, Lucknow leads for Stocks, Kolkata spearheads investment in Mutual Funds, Hyderabad is the highest for investment in Gold till date for this financial year.

Highest numbers of young women investors are from Mumbai while the largest number of young male investors are from Pune till date for the current year.

Investment in Stocks - Mumbai has witnessed the highest number for young women investors while young male investors are leading the pack in Pune.

For Mutual funds - Lucknow saw the highest number of young women investors followed by Jaipur and Ahmedabad, whereas Bengaluru saw the highest number of young male investors followed by Jaipur and Lucknow.

Investment in Gold - Jaipur witnessed the highest number of young women investors followed by Kolkata and Hyderabad, additionally, Patna witnessed the highest number of young male investors followed by Jaipur and Bengaluru.

Investment in IPOs - Jaipur saw the highest number of young women investors followed by Kolkata and Lucknow. Ahmedabad saw the highest number of young male investors followed by Patna and Lucknow. 13. What are the other plans in the future? Are there any new features in the pipeline?

As a technology-enabled company, we are constantly innovating. Recently, we introduced IPO, bonds, FD, ETFs. We are constantly working on and will continue to roll out exciting products, features and updates in the coming days that are focused on consumer's needs. 14. What is the employee strength? Is Groww hiring currently? As the business grew, so did Groww's family. We have doubled our strength in the last one year and continue to hire aggressively.

For the latest tech news and reviews , follow Gadgets 360 on X , Facebook , WhatsApp , Threads and Google News . For the latest videos on gadgets and tech, subscribe to our YouTube channel . If you want to know everything about top influencers, follow our in-house Who'sThat360 on Instagram and YouTube .

Advertisement

- iPhone 16 Leaks

- Apple Vision Pro

- Apple iPhone 15

- OnePlus Nord CE 3 Lite 5G

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- Samsung Galaxy S24 Ultra

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Sony Xperia 10 VI

- Sony Xperia 1 VI

- Vivo X100 Ultra

- Vivo X100s Pro

- Realme GT 6T

- Realme Realme GT Neo 6

- Dell Alienware X16 R2

- Lenovo IdeaPad Pro 5i

- Apple iPad Pro 13-inch (2024) Wi-Fi

- Apple iPad Pro 13-inch (2024) Wi-Fi + Cellular

- boAt Storm Call 3

- Lava ProWatch Zn

- Samsung Samsung Neo QLED 8K Smart TV QN800D

- Samsung Neo QLED 4K Smart TV (QN90D)

- Sony PlayStation 5 Slim Digital Edition

- Sony PlayStation 5 Slim

- IFB 1.5 Ton 4 Star Inverter Split AC (CI2041G323G1)

- Carrier 1.5 Ton 5 Star Inverter Split AC (CAI18IN5R31W1)

- Apple to Launch iPhone 17 Slim That Costs More Than Pro Max Model: Report

- Motorola Razr, Razr 50 Ultra Design and Specifications Leak: See Images

- Tecno Camon 30 Series With 50-Megapixel Cameras Debuts in India: See Price

- Motorola Razr, Razr 50 Ultra Design Renders Surface Online; Razr 50 Specifications Leaked: See Images

- iPhone 17 Slim to Arrive as Most Expensive iPhone 17 Series Model With Refreshed Design: Report

- Microsoft Said to Plan Release of Next Call of Duty Game on Xbox Game Pass Subscription Service

- CoinDCX Report Claims Lower TDS on Crypto Could Improve Compliance, Tax Transparency

- Tecno Camon 30 5G, Camon 30 Premier 5G With 50-Megapixel Selfie Cameras Launched in India: Price, Specifications

- OpenAI Dissolves High-Profile Safety Team After Chief Scientist Sutskever’s Exit

- Redmi Note 13R With Snapdragon 4 Gen 2 SoC, 5,030mAh Battery Launched: Price, Specifications

- Moto G85 5G Surfaces on Geekbench Ahead of Debut, Could Be Equipped With Snapdragon 4 Gen 3 Chip

- ChatGPT Integrates Google Drive and Microsoft OneDrive For Paid Users With Connect Apps Feature

- Google Announces Android 14 for TVs With Picture-in-Picture Mode, New Energy Modes

- Privacy Policy

- Editorial Policy

- Terms & Conditions

- Complaint Redressal

Updated Dec 14 2023

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Contrary LLC (“Contrary”). Information provided reflects Contrary’s views as of a time, whereby such views are subject to change at any point and Contrary shall not be obligated to provide notice of any change. Companies mentioned in this article may be a representative sample of portfolio companies in which Contrary has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Contrary. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.

Weekly Newsletter

Research Roundup

Subscribe to Contrary Research's weekly newsletter.

Subscribe to our weekly newsletter.

Subscribe for a weekly digest on the best private technology companies.

About Research

Stay in touch

© 2024 Contrary Research · All rights reserved

Privacy Policy

- Blogs

- Groww App Review: Pros and Cons

My Experience With Groww: Pros, Cons & Personal Review After 3 Years

Published On 02 March, 2024 . By Dhiren Vaghadiya

When India went into lockdown in March 2020 due to the coronavirus, I had the opportunity to learn a lot about the stock market, mutual funds, and finance during those three months of lockdown. On April 19, 2020, I opened an account with Groww and purchased my first mutual fund. Since then, I have been associated with Groww and have not even considered switching to any other broker.

I have been using Groww for almost 3 years now, so I think, I am fully eligible to give a review of it. Let me share with you my experience with Groww and its pros & cons.

About Groww Company

The beginning of Groww was just like every successful business, born out of a problem. 4 Flipkart employees, Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh, faced two problems in India's financial and investing products - complexity and opaque . As a solution to these problems, they introduced Groww to the people in 2016.

They have made their product so simple and easy to use that even newbies can easily start their investing journey. Groww has focused entirely on simplicity and excellent UI/UX. However, I did feel a lack of transparency in the beginning.

Today, Groww has become a significant company with over 1000 employees and more than 40 million users . Several large investors from around the world have invested in it, such as Tiger Global, Ribbit Capital, and Combinator. In 2022, even Microsoft CEO Satya Nadella invested in Groww.

However, this company is still running at a loss. Its financial performance for the last six years is given below.

What I Liked The Most:

1. fast & user-friendly interface:.

One of the standout features of the Groww app is its user-friendly interface. Navigating the app is seamless, with intuitive menus and clear categorization of investment options.

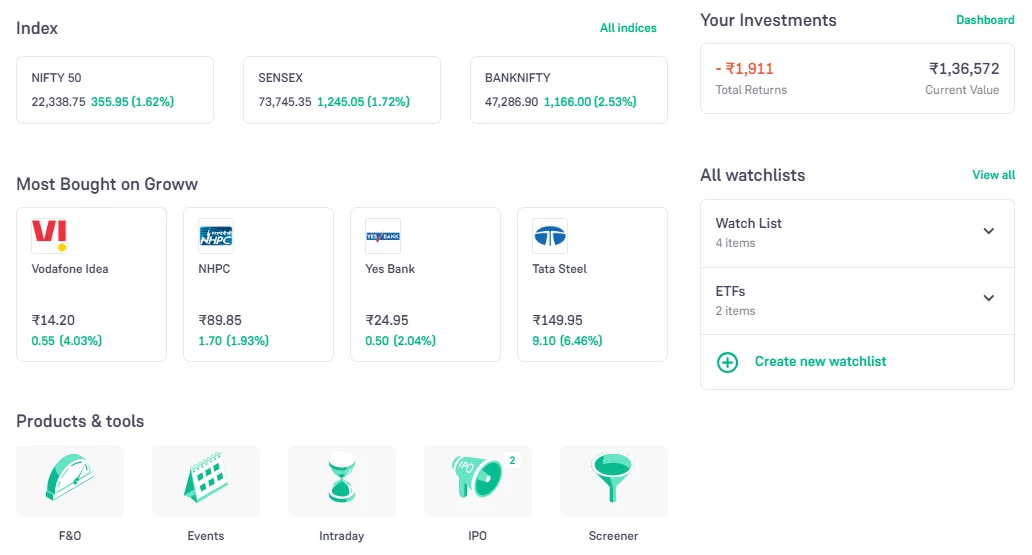

The UI of Groww is like an e-commerce store where stocks' logos, names, and pricing are displayed quite clearly. Additionally, on the main page, you can find indices, current portfolio status, IPOs, and watchlists. Whether you're a novice investor or a seasoned pro, the app's simplicity makes it easy to explore .

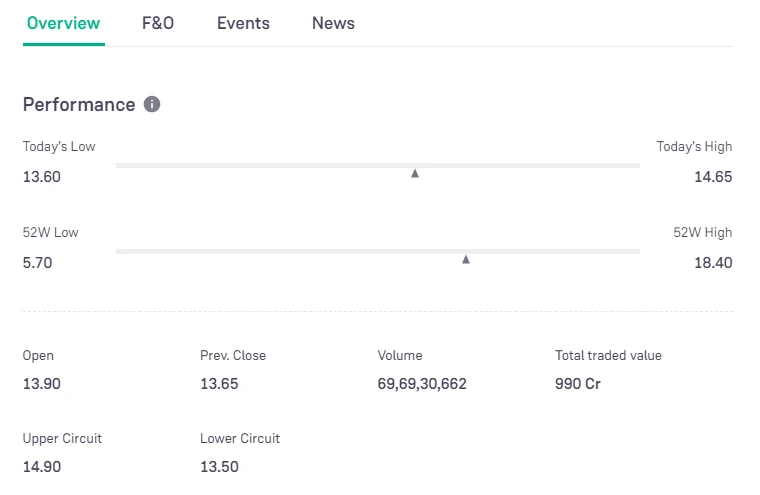

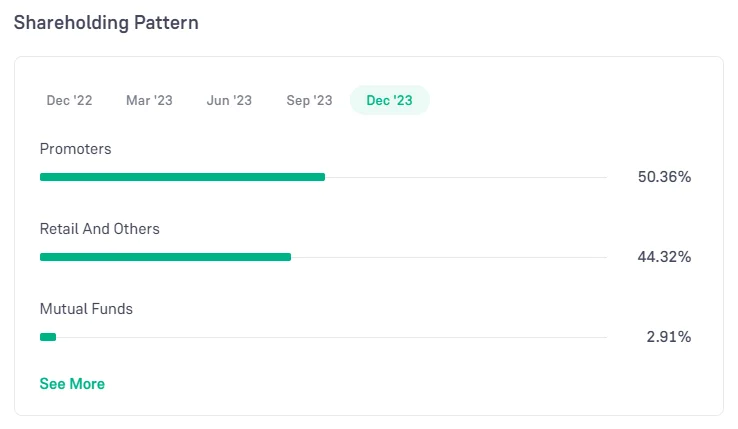

2. Simple & Detailed Stock Overview:

If you want to analyze a stock, you don't need to go anywhere else. In the Groww app, you can find important company events such as upcoming AUM meetings, bonuses, and dividend announcements all in one place .

In addition, important fundamental ratios of the stock such as PE ratio, Debt to Equity, EPS, ROE, Book value, Face value, and dividend yield can all be found on the stock overview page. Also, the financials and holding status of the stock are displayed in a very effective way using bar charts. This is very easy to understand for any new investor.

3. Diverse Investment Options:

Groww offers a wide range of investment options, catering to different investment goals and risk profiles. From Mutual Funds, SGB Gold Bonds, Exchange-Traded Funds (ETFs), stocks, and Initial Public Offerings (IPOs) to US stocks, they provide a diverse set of choices to suit individual preferences.

4. Simple Login & No AMC:

While brokers like Zerodha and Paytm Money charge an Annual Maintenance Charge (AMC) of 300 rupees, Groww has no AMC charge . In addition, most brokers provide IDs and passwords for login, but Groww offers a one-time Google login option with the added security of a 4-digit PIN. This makes the login process easier and eliminates the need for repeated logins.

5. Other Handy Features You Might Have Overlooked:

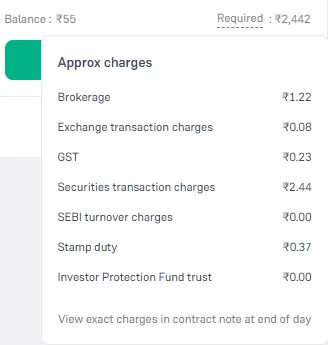

Approx Charges: Here, you can see all the charges you'll incur when you buy or sell a stock, like GST, brokerage, STT, exchange transaction charges, and more. This will help you understand how much funds will be required to buy any stock.

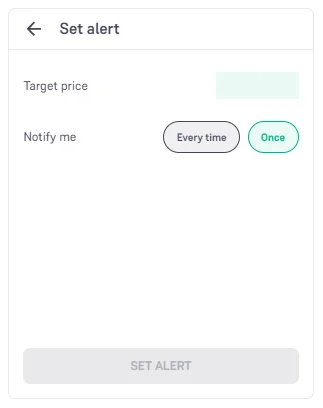

Price Alert: By using this feature, you can track the price of a stock. You just need to set a price, and when that price is reached, you will receive a notification.

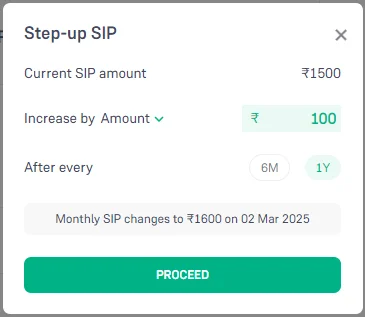

Step-up SIP: With this feature, you can automatically increase your SIP amount either based on a fixed value or a percentage during a 6-month or 1-year time period.

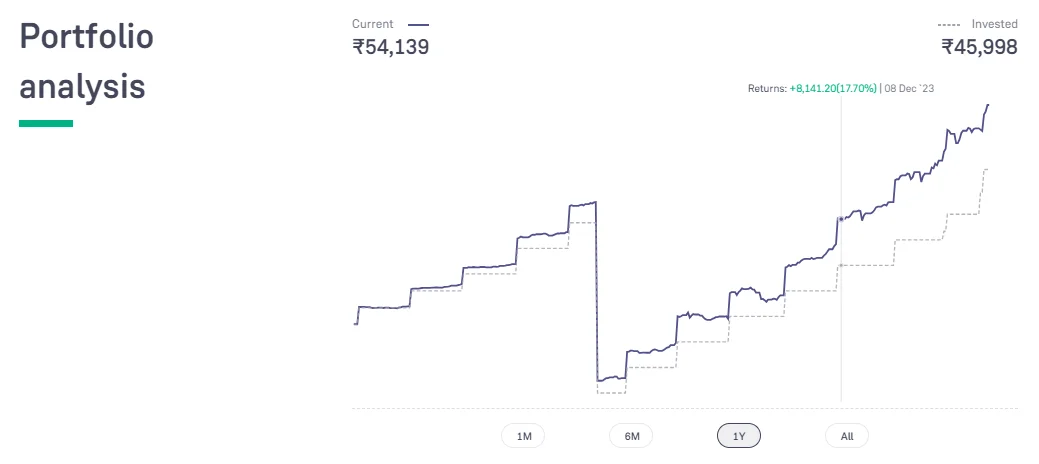

Mutual Fund Portfolio Analysis: Here, you can analyze your current mutual fund investment through easy-to-understand visualizations and reports. You can view a graph of current value vs invested amount and see asset allocation based on sector, market cap, and companies. In addition, you can also access capital gains tax reports.

Unfortunately, the portfolio analysis feature is not currently available for stock portfolios, which is very disappointing. This is a basic and important feature that is crucial for users.

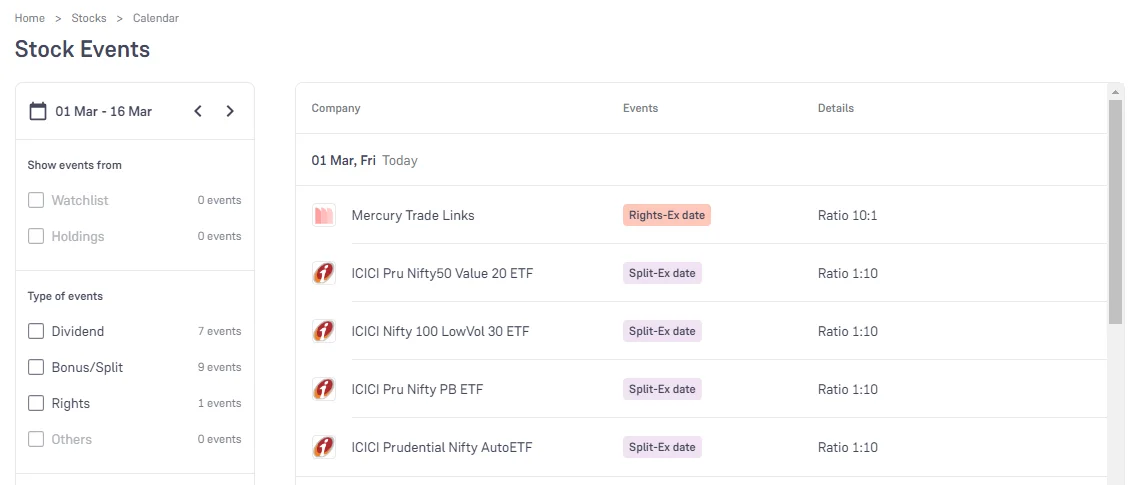

Stock Event Calander: The Groww has now added a new and very useful feature of a Stock Events calendar. Here, you can find out upcoming events related to stocks added to your particular watchlist and those in your holdings.

Additionally, various events such as dividends, stock splits, etc., can be filtered. Try it yourself to discover more features.

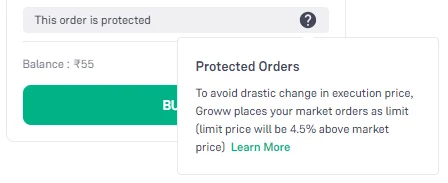

Protected Orders Feature: Sometimes, unexpected fluctuations in the market price can lead to significant losses when we place orders at market price.

To address this problem, Groww has introduced a simple yet very important security feature. It automatically converts your placed market orders into limit orders, and if the market price suddenly rises by more than 4.5% from the current price, the order will not be placed. This protects you from unforeseen market fluctuations.

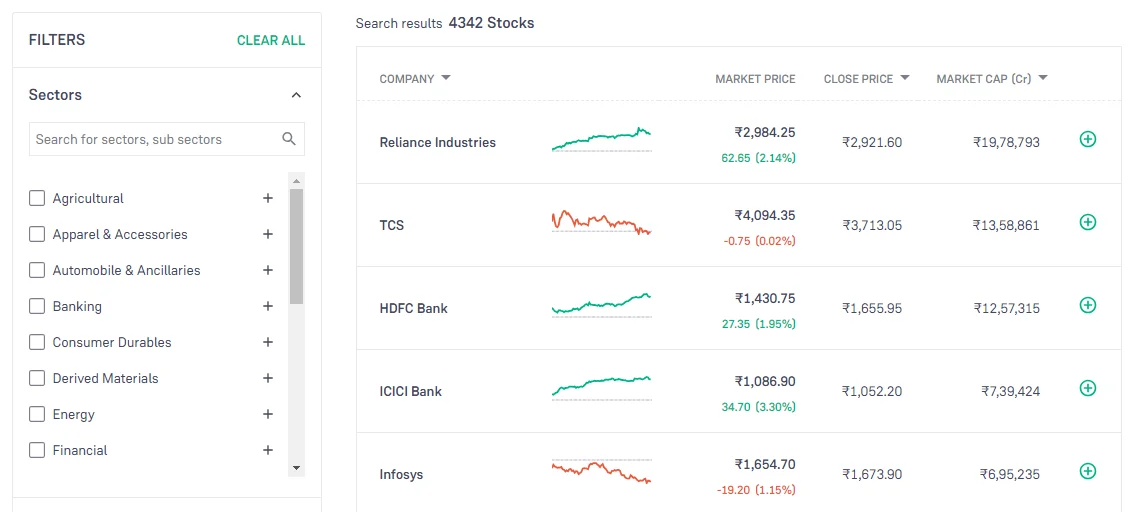

Stock Screener: I consider this stock filter to be the pocket version of a stock screener. Here, you won't find options to filter by ratio as in an advanced screener. However, you can filter stocks by sector, market capitalization, price, and index.

Daily Mutual Fund And Stock Portfolio Update Notification: You can enable this feature with the below-mentioned instruction. This way, you will continue to receive notifications for the ups and downs that occur in your portfolios on a daily basis. Just follow this: Tap on Notification Icon > Click on View All > Go to Manage Notification > Change setting in Notification Manager.

UPI: Groww recently added the UPI payment option to their mobile app. This will give us an even more seamless experience.

6. Educational Resources:

Investing can be complex, especially for beginners. Groww understands this and offers a range of educational resources to enhance financial literacy. The app provides articles, videos, and tutorials on various investment topics, helping users understand the fundamentals of investing, develop investment strategies, and stay informed about market trends.

Things That Need Improvement:

1. customer support:.

Due to being a discount broker, their customer support is quite poor and slow. After complaining, they respond quite late. However, they are continuously trying to improve their support, but don't expect too much . As an investor, you may not need customer support as much, but if you are a trader, you may face more problems.

2. No Advanced Features:

It has been almost 2 years since Groww introduced stocks, but many features are still missing such as bracket orders, cover orders, after-market orders (AMO), stock portfolio analysis and more. These are all small features that Groww should provide quickly.

3. Some Technical Glitches:

Some users have reported experiencing technical glitches on the app. As an investor, technical glitches may not make a big difference to you. But if you are a heavy trader, you need to keep this weakness of Groww in mind. Even small glitches can cause significant losses for you.

4. No Commodities & Currency Trading Option:

Although Groww offers investment options from the Indian stock market to the US stock market and equity derivatives trading such as futures and options. But the option for commodity and currency trading is still missing.

5. Loss-Making Company:

Groww has been in operation for almost 8 years now, but it is still operating at a loss. This is a significant threat because any problem with the company’s investors could cause significant losses. However, according to SEBI regulations, the stocks in our portfolios are held by government depositories like CDSL, not by our stock brokers, so we are not at risk .

But still, you should never keep too many funds in your account. Add funds only when you need to buy stocks.

Conclusion:

In my opinion, you should definitely try Groww once because there are no account opening charges and zero AMC charges, its completely free. I have been using Groww for 2 years and I have not felt the need to switch to another broker or open another account. Therefore, try it once and see if it suits you or not.

I have shared all my personal experiences with Groww through this blog, including what I liked and disliked, and put it in front of you. So I think, if you want to go with any discount broker, then definitely consider Groww .

References:

About author

Dhiren Vaghadiya

Hello! I'm Dhiren, an avid investor who continuously find valuable stocks to invest in. I enjoy delving into stock finances and conducting fundamental research. I'm a self-learner, primarily using YouTube and Google to learn new things. Additionally, I love music, movies, dogs and nature's serenity. Blogging, SEO, investing and spirituality are my favorite subjects.

Advertisement

Recent blogs.

What Is Debt Snowball Method And How Does It Work?

Become a Smarter Investor: Identify Biases Holding You Back

Learn How To Improve Or Maximize Your SIP Return?

My Experience With Groww: Pros, Cons & Personal Review After 3 Years

How To Analyze Stocks Portfolio Before Investing? (100% Free)

- Stock Analysis (3)

- Stock Market Tools (2)

- Company Analysis (2)

- Investing (7)

- Stock Market Facts (3)

- Stock Market History (1)

- Pros & Cons (1)

- Finance (2)

- Comparison (1)

- Investing Tips (2)

- Back To Basics (2)

Popular Tools

- Intrinsic Value Calculator

- SIP Calculator

CAGR Return Calculator

Other Blogs

Stop guessing and start calculating.

- Stock Explorer

- Dividend Yield Calculator

- Future Value Calculator

- Cookie Policy

- Terms & Conditions

© 2024 FinEstimator.

Disclaimer: The financial blogs and tools provided on this website are for informational purposes only. We do not constitute financial advice, and the accuracy or completeness of the information cannot be guaranteed. Users are encouraged to conduct their own research and seek professional financial advice before making any investment decisions.

We use cookies to ensure best experience for you

We use cookies and other tracking technologies to improve your browsing experience on our site, show personalize content and targeted ads, analyze site traffic, and understand where our audience is coming from. You can also read our privacy policy , We use cookies to ensure the best experience for you on our website.

By choosing I accept, or by continuing being on the website, you consent to our use of Cookies and Terms & Conditions .

- SOUTHEAST ASIA

- Leaders Speak

- Brand Solutions

- Cloud Computing

- How investment platform Groww keeps rising cloud costs at bay

- Bhragu Haritas ,

- Updated On May 25, 2022 at 08:49 AM IST

- By Bhragu Haritas ,

- Published On May 25, 2022 at 08:49 AM IST

All Comments

By commenting, you agree to the Prohibited Content Policy

Find this Comment Offensive?

- Foul Language

- Inciting hatred against a certain community

- Out of Context / Spam

Join the community of 2M+ industry professionals

Subscribe to our newsletter to get latest insights & analysis., download etcio app.

- Get Realtime updates

- Save your favourite articles

- neeraj singh

- cloud computing

- public cloud

- Google Gloud

- financial services

- datacenter exclusive

Alert: Beware of fake offers promising earnings. Confirm details with us at [email protected] #StaySafe

#D2C #Fintech #Finance

Groww is a leading fintech company in India that provides easy access to a variety of investment products such as mutual funds, stocks, ETFs, and gold through its user-friendly platform.

A Proud Moment

Confluencr won the ‘The best B2C Campaign’ #NoSHEaveNovember for Plush

For stocks product, investors and potential investor crowd was targeted with influencers selection in finance and investment niche which targeting for F&O, traders were targeted with market analysis and trading influencer. For Mutual Funds and SIP a combination of all categories like entertainment, vlogging, lifestyle and finance was made content with to target all potential audience.

mid-tier local city based crowds were targeted with local Instagram influencers that were known for using vernacular language.

The content was spread across all platforms like YouTube, Instagram, Twitter and Telegram and LinkedIn.

Frequency varied for each campaign, however influencers in one campaign went live in close proximity to ensure the buzz about Groww was maintained.

The campaign was planned all around the platform starting with specific products and expanding it to weekly and annual events with ultimately creating user created educational content. Content was also put out with respect to annual and bi-annual events with shoutouts and self interest content generated with influencers.

Hear ’em Speak!

Let’s Influence Together!

Our efficient and effective influencer marketing campaigns help as a catalyst in your digital marketing.

We are able to considerably reduce user acquisition costs and improve user retention through our content.

Get in Touch with Our Experts

More impact stories from confluencr.

Total Views

Influencers.

Illustrator

Case study on Groww app & its Redesign

Creative Fields

Information Architecture

- experience design

- interface design

- user experience

- user interface

No use is allowed without explicit permission from owner

Groww Associate Product Manager

@ shortlisted for placement on pitch deck.

Problem Statement: Solve Discovery

Users coming on groww app often don’t know where to invest. propose a solution (doc/presentation) for this problem via changes/additions in our app to make every user cohort find easily what they need. the objective is to ensure all users coming on groww are effortlessly able to find the mutual fund they want to invest in. currently users can find where to invest in on explore page, search, dashboard, assistant on the groww app., presentation submission.

Experience new growth possibilities with Microsoft Advertising today >

Microsoft Advertising case studies

How Rainbow Tours achieved high-value outcomes with Microsoft Advertising

How ENRG Pro achieved a 95% ad completion rate with Microsoft’s Connected TV ads

The first Pharmaceutical brand to launch Video ads with Microsoft Advertising saw almost 2X increase in brand searches

How Blue Corona helped Len The Plumber Heating & Air increase ROAS with Microsoft Advertising

How Blue Corona helped Len The Plumber Heating & Air increase return on ad spend (ROAS) by 318% with Microsoft Advertising

How ixigo generated a remarkable 44% total conversions with Microsoft’s Dynamic Search Ads

Green KPIs for the win: How Microsoft Invest helps brands lowering carbon emissions

IMAGES

VIDEO

COMMENTS

Photo by google search: Groww App. To begin with this case study so while designing i explored UX fundamentals, Heuristics, UI Design and prototyping. This study was done in 3 Days where i applied ...

Groww - Mission and Vision. The company's mission is to give investors the greatest experience possible when it comes to managing their money. Lalit Keshre, Co-founder and CEO, Groww, said - "Over the last few years, we have made investing in mutual funds and stocks simple and transparent for millions of investors in India.If we look at the opportunity that lies ahead, it still feels like ...

7 Followers. · Writer for. Bootcamp. Passionate Product Designer with 4+ years of experience creating intuitive and engaging digital products. Skilled in Wireframing, Prototyping, Figma etc. See all from Sujit Sinha. See all from Bootcamp. See more recommendations. Groww is an app that helps you invest in Mutual Funds, Stocks, Gold and helps ...

Ensuring security and compliance with Google Cloud. As a fintech company, security and compliance continue to be top priorities for Groww. It chose Google Cloud as its preferred cloud provider because there are three data center replication zones in Mumbai, which means it adheres to financial regulations for keeping its user data within borders.

Groww has its own story of success. In the following years, it intends to keep growing in Tier 2 and Tier 3 cities. Digital presence is used for the majority of promotions. The marketing strategy of Groww is improved according to the changes in the present world. The importance of online marketing has increased dramatically in the Internet era.

Brucira's work was so well-received that these illustrations are still being used on Groww's website & app as well! Important Links. https://groww.in/ View Similar Case Studies. Fin Tech Bitpay. Designed subtle yet vibrant onboarding app illustrations. Fin Tech Cashfree. Created an amazing promotional video for the 5th anniversary of Cashfree.

While Groww App has a user-friendly interface, with minimalistic design, there is always room for improvement. This case study shows my attempt to identify flaws within the SIP flow of the Groww ...

The Groww app allows users to invest in fixed deposits, stocks, gold, mutual funds, and develop a savings portfolio. The company says that the young audience is keen on investing and Groww has witnessed a 226.12 percent increase in the number of first-time investors from the age group 18-20 years, whereas in 2021 there has been an increase of ...

22 January 2024. 4 min read. In 2016, four Flipkart employees - Lalit Keshre, Harsh Jain, Ishan Bansal and Neeraj Singh, quit their jobs to start a venture that could make investing easy. They called this venture Groww and started operations In 2017. Here is all you need to know about the founders, the history of Groww and investors backing ...

An UX Research Project Case Study. 10 min read · Sep 6, 2023. 1. Read stories about Groww App on Medium. Discover smart, unique perspectives on Groww App and the topics that matter most to you ...

Groww - the fintech app, launched its book Discovering India: Through the eyes of Groww. It showcases the transition from traditional savings methods to modern financial instruments, highlighting the increasing financial literacy among various demographics, including the youth and women. The book presents real stories from across the country ...

In October 2021, Groww announced a $251 million Series E round at a $3 billion valuation, and it has raised a total of $393.3 million in funding as of December 2023. The company's Series E round was led by ICONIQ and included other investors like Alkeon, Lone Pine Capital, and Steadfast.

Groww is an Indian investment platform that allows users to invest in a range of financial products, including mutual funds, stocks, and gold. While I don't have access to specific case studies or up-to-date market information, I can provide you with a general overview of Groww's marketing strategy and its key elements. User-Friendly Mobile App: […]

Whether you're a novice investor or a seasoned pro, the app's simplicity makes it easy to explore. 2. Simple & Detailed Stock Overview: If you want to analyze a stock, you don't need to go anywhere else. In the Groww app, you can find important company events such as upcoming AUM meetings, bonuses, and dividend announcements all in one place.

About Groww (The 4 Founders of Groww, Source: TechCrunch) One of the best mutual funds investment platforms in India - Groww is a Bangalore, India based startup that was established in the year 2016 by the four former employees of Flipkart i.e. Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh with a primary goal to launch the mutual fund investment facility on digital platforms.

In 2018, Groww moved completely to GCP. Singh believes, for Groww, the kind of workloads the company has, public cloud was the best choice. "It was very easy to set up. We could quickly use and ...

Read writing about Case Study in Groww Engineering. Investing made Simple. ... Open in app. Sign in Get started. ABOUT GROWW; CAREER; Tagged in. Case Study. Groww Engineering. Investing made Simple. More information. Followers. 1.1K . Elsewhere. More, on Medium. Case Study; John Francis in Groww Engineering. Dec 2, 2018. Building a Finance App ...

@Groww success story | Groww case study | @Planify In 2016, four Flipkart employees - Lalit Keshre, Harsh Jain, Ishan Bansal and Neeraj Singh, quit their jo...

Now the development environment has been set up and we can build different apps for different variants using react-native-config and Android's build variants using simple commands added in package.json. You have to add appropriate product flavors in your app level build.gradle for the above commands to work. stage {.

The content was spread across all platforms like YouTube, Instagram, Twitter and Telegram and LinkedIn. Frequency varied for each campaign, however influencers in one campaign went live in close proximity to ensure the buzz about Groww was maintained. The campaign was planned all around the platform starting with specific products and expanding ...

1 23. Comprehensive platform design- Web design. Shaurya Somvanshi. 4 20. Experiential Mirror-Vision in product design. Multiple Owners. 2 26. UI exploration- Web design. Shaurya Somvanshi.

Be the kind of investor you want to be. when you need it. Apply for a loan, get it within minutes. one place. Pay anyone, anywhere, anytime with Groww Pay. Start Online Investing in Stocks and Direct Mutual Funds with India's Leading Investment and Trading Platform - Groww. Equity Trading, US Stocks, Direct Mutual Funds with Zero-commission.

Problem Statement: Solve Discovery. Users coming on Groww App often don't know where to invest. Propose a solution (doc/presentation) for this problem via changes/additions in our App to make every user cohort find easily what they need. The objective is to ensure all users coming on Groww are effortlessly able to find the mutual fund they ...

City — Roorkee. Branch — Geological Technology. Institute — IIT Roorkee. Email — [email protected]. Contact — 7037203714. Problem statement. Teenagers (ages 13-18) face challenges ...

View marketing case studies of how business use Microsoft Advertising products to achieve their business goals.