How to Choose the Right Point of Sale (POS) System

Ellen Cunningham

6 min. read

Updated April 11, 2024

A point of sale (POS) system can be a great addition to your business. Capable of far more than simply taking credit cards, POS systems offer features like inventory management, reporting, and even time clock options.

In my work for CardFellow, a leading resource for small businesses looking for credit card processing and terminals, I regularly test, research, and write overviews of equipment. As a result, I field a lot of questions about POS systems.

But one question always comes up: “There are so many options. How do I choose?”

The good news is that picking the right POS system doesn’t have to be a chore. Follow these three steps to find the right POS system for your business.

See Also: How to Do Market Research

1. Know what’s most important to you

There are two approaches to deciding on a POS system: choosing based on features, or choosing based on costs.

Choosing by features

If particular features are the most important thing, you should choose a POS system first. But if low costs are a priority, you’ll actually want to find a credit card processor, then choose from the POS systems that processor can support.

Know which features you need

When I say that you should find your POS system first if specific features are most important, I’m talking about less common features. POS systems offer basic capabilities standard, including credit and debit card acceptance, reporting, and inventory management. For restaurants, the ability to split checks and add tips is also common.

So, what sort of features do you need to look for specifically? Here are the main ones:

- Online ordering for in-person pickup (restaurants)

- Delivery tracking for food or non-food businesses (pizza shops, florists)

- Age verification/ID prompt (liquor stores, tobacco sales)

- Integrated appointment or class calendars (healthcare, beauty salons, yoga studios)

If those features sound like must-haves for your business, it’s worth finding your preferred system first. Be sure to explicitly ask the POS company or processor if the feature you need is included, or check the POS company’s website.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

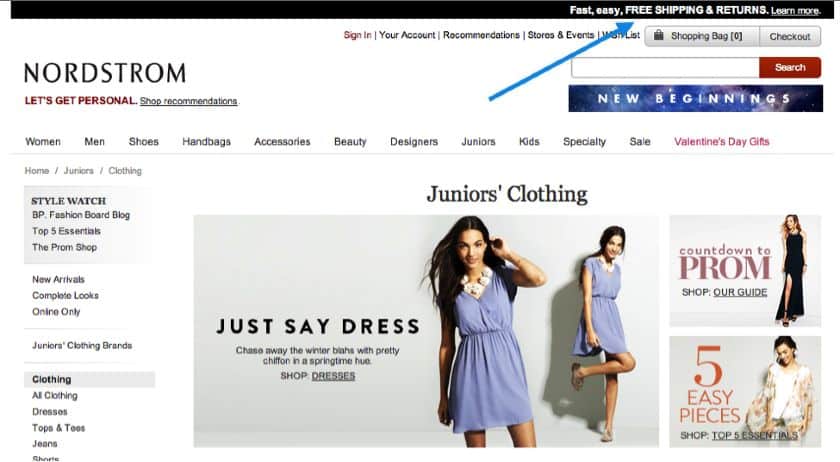

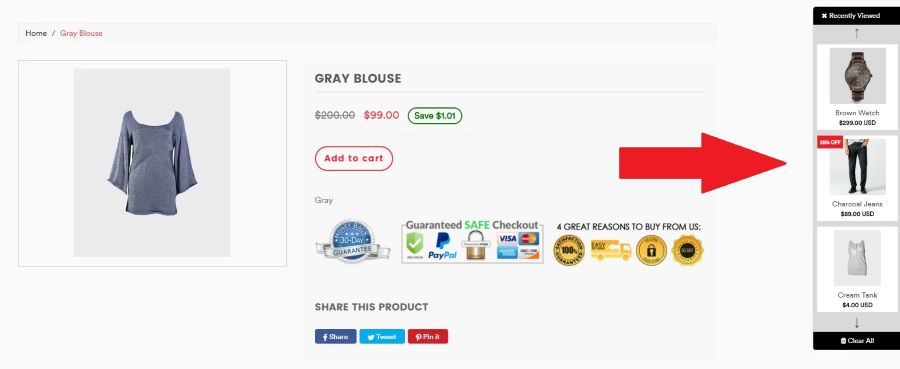

Use a product directory

The easiest way to research POS systems and find specific features is to use an online POS system product directory, like the one we have. These directories provide overviews of POS systems, so you can view important information quickly. You’ll be able to narrow down choices by the manufacturer, features, processor, and more.

Note that choosing your POS system first may limit your choice of processors, which can result in higher costs overall. We’ll get into that more in a minute.

Choosing by cost

If you scanned the list above and decided that standard POS system features will suit your needs, finding a processor first is likely to save you time and money. While POS systems (and costs to take credit cards) aren’t cheap, you may be able to reduce expenses by finding a competitive credit card processor and then choosing your system from the available options.

Picking a processor before a system gives you a much larger pool of options. Credit card processors usually offer multiple different brands and models of equipment, so you’ll still get to choose a system that fits both your needs and your budget.

When choosing a processor, start by getting quotes from multiple companies. A quick search online for credit card processing comparison sites can help you find services that will allow you to compare quotes privately, without sales calls. After you get quotes, you can ask about available POS systems. You’ll have a smaller range of choices, but the systems will be some of the most popular and user-friendly.

Many of the businesses I work with take this route when choosing a POS system, and find that it’s helpful to choose from tried-and-true popular systems even if it’s a smaller selection of the total systems on the market.

2. Decide if you’ll accept proprietary POS systems

Some POS systems are proprietary, meaning that you have to work with a specific processor in order to use that system. This isn’t inherently good or bad, but you should be aware of possible pros and cons.

A pro is that it may require you to do less research, as you won’t need to review pricing from multiple processors. You’ll get pricing from the processor that supports the equipment and that’s that.

A con is that you don’t have as much ability to negotiate your costs. Since the processor knows that you have to work with them to use the system, your competitive advantage disappears. You can’t simply go to another processor. Moreover, if you decide to switch processors in the future, you’ll have to purchase a different system, since your current one won’t be compatible with another company.

When making your decision, think about the worst case: If you switch processors for some reason, can you afford to buy new point of sale equipment even if your current system isn’t outdated? If not, a POS system that only works with specific processors might not be the best choice for your business.

You can identify systems that require specific processors by disclosures on the manufacturer’s website. It will often state the name of the credit card processing company that can support the system. By contrast, if it works with multiple processors, the site may mention that the system is “processor agnostic” or list multiple processing partners. If in doubt, you can also ask the POS manufacturer directly. They’ll advise on processors that support their system.

See Also: What You Absolutely Cannot Afford to Forget When Pricing Your Products

3. Decide if you’ll lease or buy

Another consideration when deciding on a POS system is how you’ll pay for it. Since POS systems are more expensive than basic countertop credit card machines, you’ll want to think about what makes sense for you.

Some companies will offer the option to lease equipment instead of purchasing it outright. The benefit is that there’s little or no upfront cost, but remember that leasing equipment can cost you a lot over time. The monthly fee you’ll pay could add up to many times the retail cost of the system. Be sure to check the math yourself, and scope out what it would cost to buy the machine outright.

It’s also worth noting that leasing often comes with a contract that can’t be cancelled for four years or more. The contract is often with a separate leasing company, not your processor, so even if you stop using your POS system, you’ll still be on the hook for the equipment lease.

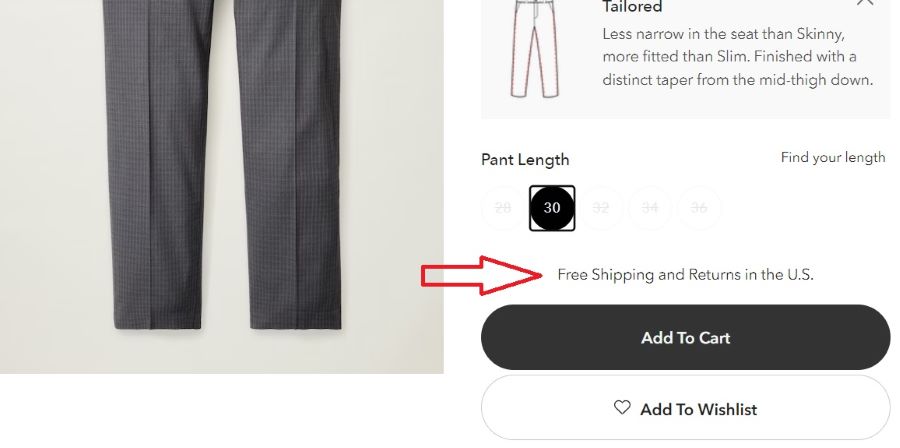

Purchasing a POS system outright is a bigger upfront commitment financially, but you’ll have the benefit of owning the equipment. Many POS companies offer free software updates, which will help keep your system current. If you choose to buy, you may want to consider purchasing a system with the newest technologies, like contactless (NFC) capabilities, so that you’ll be able to take a wider range of payment types.

See Also: The Complete Guide to Choosing Your Business Structure

The tips outlined above will help you find the right system for your business in no time. Just remember:

Decide if you’ll shop by features or by processor

- Choosing by features: Use a product directory to research POS systems and choose the one you want, then set up a merchant account with a processor who can support that system.

- Choosing by processor: Choose a processor with competitive rates and fees. Then choose a POS system from the processor’s supported systems.

Ellen is the Marketing Manager for CardFellow, leading provider of free credit card processing comparison tools. She has a degree in English and spends her days researching and writing about everything related to credit card processing.

Table of Contents

- 1. Know what’s most important to you

- 2. Decide if you’ll accept proprietary POS systems

- 3. Decide if you’ll lease or buy

Related Articles

5 Min. Read

20 Marketing Tools Every Small Business Owner Should Try

12 Min. Read

A Complete Guide to Marketing ROI Tracking

4 Min. Read

How to Conduct a Sales Call

6 Min. Read

How to Use Coupons for Your Business

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Home > Software > Point Of Sale

The Ultimate Guide to POS Systems

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

The point of sale (POS) is a crucial moment in the success of your business. A good point-of-sale system makes for a smooth and easy sales process. But above and beyond that, a good system can add tons of value to the point of sale .

This guide will help you understand how to get more value out of the point of sale so you can boost productivity, improve business operations, and make more sales.

The ultimate guide to payroll table of contents

Point-of-sale basics.

- Payment processing

POS hardware

Pos software features, pos glossary.

Square readers are everywhere for a reason. It's easy to get started, reasonably priced, and scalable as your business grows.

What is the point of sale? It’s the moment when the customer makes a purchase.

In the past, the point of sale was pretty simple because most sales were made in cash. All business owners needed was a simple cash register to tally up the day’s sales.

Today, POS systems are designed to do so much more. A truly modern POS system can do a few key tasks :

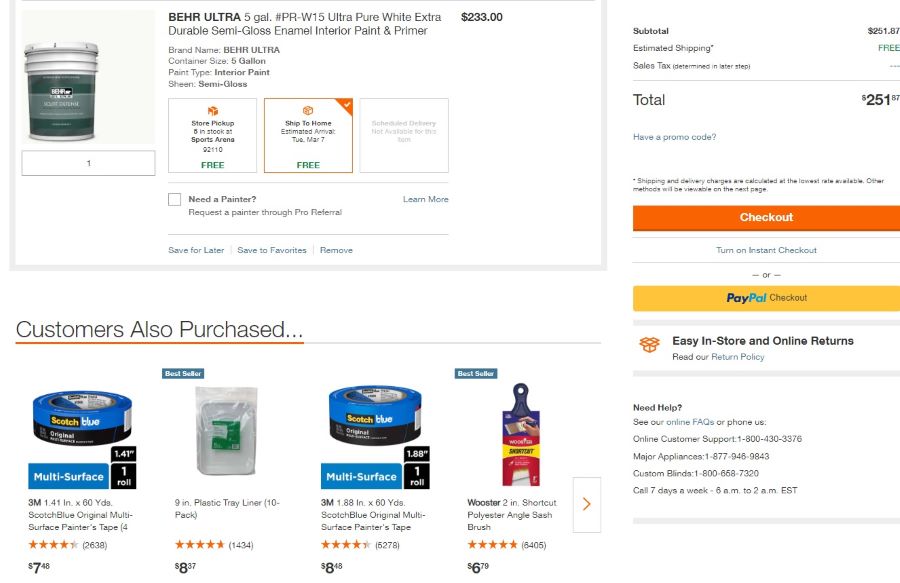

- Accept all modern payment methods from credit cards to digital wallets

- Manage and track the inflow and outflow of inventory

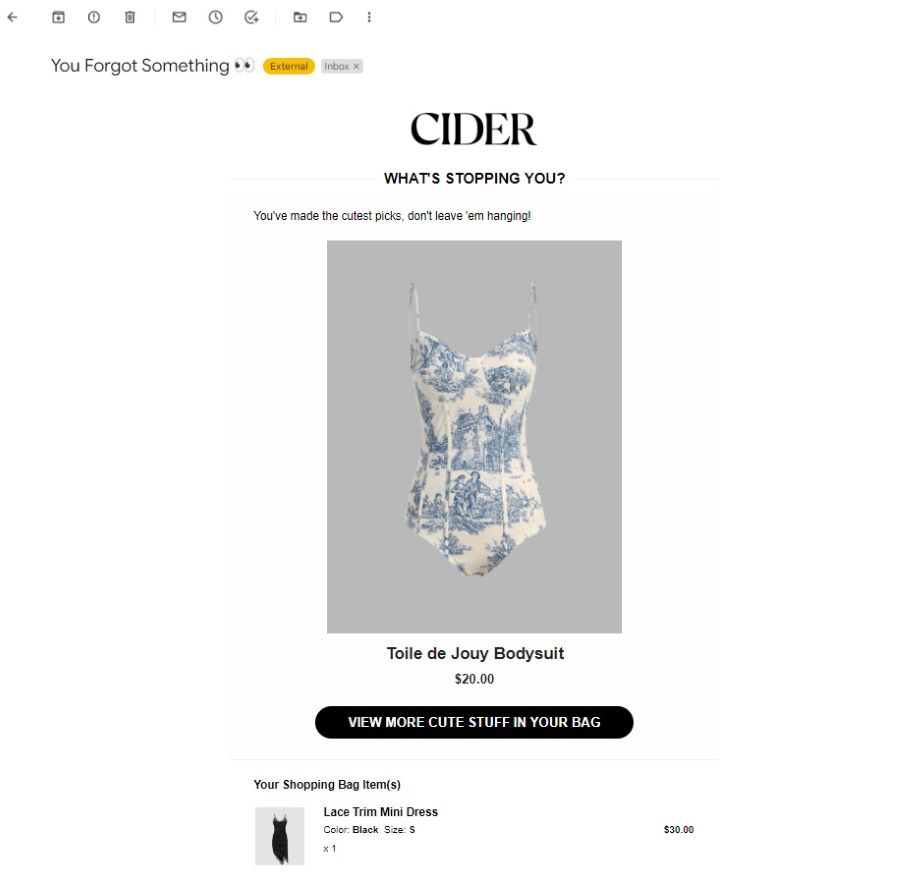

- Automate all processes that rely on the moment of sale, like accounting and customer loyalty

- Bring the sale to the customer through mobile payment options

These essential functions are what set apart the POS systems of today from the cash registers of days past. In the following sections of this guide, we’ll bring you up to speed with what exactly a modern POS system can do for your business.

By signing up I agree to the Terms of Use and Privacy Policy .

Important payment-processing factors to consider

Modern payment methods.

There are so many ways to pay these days. Here’s a list of all the methods we can think of:

- Credit card (including swipe, dip, and tap)

- Debit card (including swipe, dip, and tap)

- Digital wallets like Apple Pay, Android Pay, and Venmo

- Direct bank transfer (ACH payments)

- Cryptocurrency exchange

Each of these payment methods represents a way customers may want to pay for goods and services from you . Some methods are more common than others, but the kind of payments you usually take depend on specific business factors like location, industry, and services offered.

If you know what payment methods your customers want to use, you’ll want to find a POS system that makes accepting those kinds of payments easy.

Transaction fees

The next thing to consider is how expensive the fees for payment acceptance are. Keep in mind that different payment methods (like the following) have different fees assessed:

- Cash payments don’t have any fees assessed by the processor.

- Debit and credit card payments have fees assessed by the processor with debit card fees usually being a bit lower.

- Digital wallets, direct bank transfers, and cryptocurrency exchange usually have fees assessed as well.

It’s important to note that these fees are not pointless —processing a credit card is too complicated for small businesses to handle on their own. That’s why almost all businesses use the services of a processing company.

Transaction fee types

Transaction fees usually come in two types:

- Flat rate fees are when you get charged the same amount for every transaction.

- Interchange-plus fees have a variable amount that changes based on what the credit card company charges.

Generally speaking, interchange-plus fees are cheaper than flat-rate fees because interchange-plus fees are more responsive to the actual cost of processing. That said, some processors that use interchange-plus pricing will charge a high monthly fee. So, the key to saving money with interchange-plus is processing enough transactions to make up for the monthly fee.

If you don’t process a lot of transactions or have trouble with consistent processing, a flat-rate fee may be more cost-effective. See the tables below for an example where flat-rate processing is more cost-effective and an example where interchange-plus processing is more cost-effective.

100 transactions per month at $10 per transaction

1,000 transactions per month at $20 per transaction.

Some processing companies don’t list their processing fees and instead work out a fee with you over the phone. It’s important to use your negotiation skills to get a decent price when working with processing companies like this.

POS hardware can range from a simple card reader to a kitted-out iPad stand. The kind of hardware you’ll need depends on how you plan to use it. Here’s a list of the hardware you may want to consider :

- Mobile card reader . These card readers often attach to your smartphone or tablet. Some are battery powered. But all of them have one simple function: the ability to process credit cards anywhere.

- Standard terminal . The classic credit card terminal has no bells and whistles. It’s usually just a card reader with a number pad that needs stationary power and an internet connection.

- Smart terminal . There’s a lot of variety in smart terminals. Most POS providers have their own versions of these types of terminals. The function of a smart terminal is to handle more complicated business tasks, like inventory management and item lookup.

- Cash drawer . A standalone cash drawer allows you to connect to your smart terminal to make change for cash payments.

- Receipt printer . Many businesses are going paperless with receipts using smart terminal receipt options like email. But, if your customers need or expect paper receipts, you may want to pick up a receipt printer.

- Barcode scanner . This one is pretty self-explanatory—it scans product barcodes. It also helps with inventory management on smart terminals.

- iPad stand . Some POS providers have built their software for iPad and will only sell you an iPad stand. One nice thing about using an iPad for POS is that you can remove the tablet from the stand and assist customers around the shop with a mobile POS device.

- Classic cash register . We wouldn’t really recommend using the old-school cash register systems. They tend to be clunky, more expensive, and have fewer smart features.

Using the above-listed features as a guide, you can decide what your business needs. Many modern brick-and-mortar businesses opt for something simple like a smart terminal and a cash drawer.

Software features are the heart and soul of modern POS systems. It’s in the software that all the magic happens—magic that allows you to automate your business operations from one central place.

Inventory management

Tracking and managing inventory can be a pain if your POS system isn’t helping you do it. Luckily, today’s POS systems offer comprehensive inventory tracking and management tools. The best POS inventory management integrations will help automate many tasks:

- Keeping track of in-store stock

- Keeping track of stock in multiple locations

- Notifying when inventory of a certain item is low

- Making it easy to order new inventory

- Analyzing the flow of inventory to generate reports on top-selling items

Each of these functions can be a game changer. For example, POS systems that have inventory-management programs that can track inventory at multiple locations can make it possible to automate your shipping process.

If for example, a person wants an item that’s in a different store, you can either send them to that store, or you can offer to ship them the product from that location. Thus, this functionality not only consolidates your inventory more efficiently, but it also gives you more opportunities to make a sale.

There’s no underestimating the power of good inventory management software . It’s a feature you’ll definitely want to consider when choosing a POS system.

Square is the best free point-of-sale system on the market. From invoicing to inventory tracking, Square gives you all the features you need to boost your POS experience.

Employee management

Employee management makes it easy to track employees and manage their permissions to your POS software.

A good employee management program will allow employees to clock in using a login you’ve created and permissions you’ve designed. The program will also track employee sales and will generate performance reports to help you determine if an employee needs further training.

Many POS systems integrate with third-party accounting software like QuickBooks . Automating your accounting process will help simplify your already-complicated business taxes. And the point of sale is a great place to have your accounting software working for you by tracking your sales and returns.

Customer loyalty

Many modern POS systems offer customer loyalty integrations. You can set up rewards programs, offer gift cards, and keep better track of your return customers. Not only do rewards programs keep people coming to your place of business, they also help you gain insight as to what keeps your customers coming back.

Industry tools

Some POS systems have specific tools for a given industry. Upserve, for example, offers a ton of restaurant-focused tools that automate the ordering process. There are many POS systems that are built around a specific industry, but the most common industry tools you’ll find in a POS system include restaurant and retail programs.

No matter your industry, it may be worth doing a quick search to see if there is a POS system designed for your kind of business.

This is a list of terms commonly used in talking about point-of-sale systems.

POS. Abbreviation for point of sale.

Terminal or credit card terminal. A piece of hardware used to process transactions.

Interchange-plus pricing. A common pricing model used by credit card processors. The word “interchange” refers to a fee that major credit card companies charge. This fee changes from transaction to transaction, so interchange-plus pricing is whatever the major credit card company charges plus the fees of the credit card processing company.

Digital wallet. A kind of payment method made via smartphone. Customers will have apps like Apple Pay or Android Pay on their phones that they’ll want to use to purchase items at your store. There are also online-only digital wallets and checkouts, like PayPal and ChasePay. These payment methods make for faster online checkouts.

Swipe . Swipe payments use the magstripe on the back of the card.

Dip . Dip payments use the EMV chip on the front of the card.

Tap . Tap payments use an embedded chip that emits radio waves and connects to the card reader.

ACH . This acronym stands for automatic clearing house. It’s an online network for processing transactions between financial institutions.

Cryptocurrency . A type of digital currency made popular by the rise of Bitcoin. These currencies are decentralized in that no official governing body distributes them. Coins or tokens held in these types of currencies are not physical entities; they are digital only.

The takeaway

POS systems can be a total game changer for your business. The level of automation and data reporting they can bring to your workflow is a catalyst for greater efficiency and faster growth. Now that you know what to look for in a modern POS system, the next step is to find the right one for your business.

We recommend checking out our detailed reviews of the top POS systems on the market today .

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

- Search Search Please fill out this field.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

- Products and Services

Best POS Systems for Small Businesses

Manage your sales and inventory with one system

:max_bytes(150000):strip_icc():format(webp)/MichaelRosenston-dc9ea36078684eb9a17e5bbbed31dbad.jpg)

From contactless payments to online sales, point of sale (POS) systems improve the customer experience and make it easier for business owners to track inventory, sales, and employee performance. Moreover, your POS solution supports omnichannel experiences, which are seamless transitions between in-store, phone, and online sales.

In fact, 44% of retailers plan to upgrade or replace their POS, while 32% prioritize omnichannel experiences using their existing POS solution.

Selecting the best POS system for your small business is challenging. We researched more than two dozen POS solutions and compared them side-by-side. We judged systems on their ease of use, hardware and software options, customer service, features, and pricing packages.

The 6 Best POS Systems for Small Businesses in 2024

- Best Overall: Square

- Best Value: eHopper

- Best for Restaurants: TouchBistro

- Best for Retail: Vend

- Best for E-Commerce: Shopify

- Best for Inventory Management: ShopKeep by Lightspeed

- Our Top Picks

- TouchBistro

- ShopKeep by Lightspeed

- See More (3)

- Methodology

Best Overall : Square

Square provides flexibility for small businesses and plenty of room to grow.

Robust free option for online sales

Easily track inventory

Integrated payment system

Expensive processing fees for businesses with high volumes

Free option lacks advanced features

Extra fee for a loyalty program

Founded in 2009, Square POS systems and devices are used in small businesses, from retail shops to diners. The platform’s versatility, combined with various pricing options, makes Square the best overall POS system for small businesses.

Square offers three plans, all of which provide integrated payments. You’ll pay credit card processing fees of 2.9% plus $0.30 for online transactions on the Free Plan and the Professional Plan charges the same rates, but costs $12 a month for extra features. The Performance plan also costs $26 for even more features, but charges the same fee for processing. Premium costs $72 and offers lowering processing fees of 2.6% + $0.30.

For most small businesses, you’ll want a Square register for $799. But the company also offers mobile square readers and iPad stands so you can customize your setup. All three plans come with standard features like:

- Barcode scanning

- Invoice and electronic gift card options

- Instagram selling capabilities

- View low and out of stock inventory

- Sales reports

- Time tracking

- Timecard reporting

Select from popular Square plans such as:

- Free: It’s free to sell online or in-person while tracking inventory, reviewing sales reports, and overseeing your employees.

- Professional: $12 a month and create custom websites without Square branding.

- Performance: For $26 a month you get advanced reporting, reviews, marketing features, and more.

- Premium: Costs $72 a month. It has a lower processing fee and performance features.

Square also offers integrations with your small business software. Just head to your dashboard to connect your POS system with:

- WooCommerce

- QuickBooks Online

Get more from your services by adding extra services like loyalty, email marketing, and payroll programs. If you need help with your Square POS system, you can contact Square support via phone or email or get answers from the seller community or support articles.

Get 20% off your first Square POS hardware device with code DDSquare . Valid 4/3/23-6/30/23.

Best Value : eHopper

Inexpensive software with everything a small business owner needs to run a company.

Extremely affordable POS system

Built-in inventory management

Works with most tablets

No gift card management

Credit card processing fees charged to customers

For nearly 15 years, eHopper has provided an affordable alternative to pricey POS software. Its low-cost plans give entrepreneurs access to customer and inventory management tools, making it a clear winner in our best value category.

The eHopper POS system offers four plans, all of which include integrated credit card processing features. Currently, the merchant fees are passed to customers via a surcharge. With all versions, you’ll get features like:

- Inventory management

- Print or email receipts

- Tip management

- Reporting options

- Customer management

The company offers two plans to chose from, a free version, and a paid service:

- Essential: The free plan helps you easily adjust inventory, manage customer accounts, or create barcode labels for your products.

- Freedom: For $29.99 a month, you get employee time tracking options, low stock alerts, and QuickBooks integrations.

- Restaurant: It’s $39.99 a month for menu building, table management, and floor planning tools, along with standard POS features.

- OmniChannel: The regular cost is $39.99. This plan adds loyalty, e-commerce, and enables Meta sales.

With eHopper, you can use existing hardware or Android tablets, iPads, Windows PCs, and Poynt terminals. But, eHopper offers a variety of hardware options for sale, including:

- Hardware bundles

- Thermal printers

- Cash drawers

- Credit card terminals

- Stands and accessories

You won’t get many integrations with eHopper, but you can add an additional loyalty package to your plan. You can call, initiate a support ticket, or chat with customer service for help with your POS system. The company also offers an online knowledge base.

Best for Restaurants : TouchBistro

TouchBistro

TouchBistro supplies restaurateurs with cloud-based analytics to boost their food and beverage sales.

iPad POS system

Integrated credit card processing

Easy-to-use interface

Must use mostly Apple products

Customer support isn’t always responsive.

In business since 2010, TouchBistro offers software designed specifically for the restaurant industry. TouchBistro is our top pick for the best restaurant POS system with restaurant inventory management tools and restaurant-specific hardware.

TouchBistro POS software licenses start at $69 per month. With a TouchBistro system, you’ll get various tools and features to support your operations, such as:

- Intuitive touch controls for table management

- Remote menu management

- Add recipes to manage inventory costs

- Access data and reports via the cloud portal

You can add services to get more from your restaurant POS, which are available through TouchBistro, including:

- Reservations system for $229 per month

- Online ordering for $50 a month

- A gift card program for $25 per month

Choose your own hardware or buy from TouchBistro’s hardware partners for equipment such as:

- Apple Mac Mini computer

- AmpliFi MeshPoint HD

- Kitchen and thermal printers

- Networking hardware

- iPad stands

- Payment devices

TouchBistro integrates with many popular programs, including QuickBooks, Sage, and 7Shifts.

If you run into problems, TouchBistro provides plenty of self-service options. You can also contact them via email, chat, and 24/7 phone support.

Best for Retail : Vend

Trusted retail software that your employees will learn how to use in minutes.

No limits on products

Works offline (Limited functions)

Simple interface

Must buy the upper plan tp have comprehensive software

Gets costly when adding registers

Founded in 2010, Vend is a reliable provider of POS systems that are easy to use and compatible with many equipment types. With advanced inventory management and analytics, Vend wins our best POS system for retail.

Vend offers three plans that cover one register and one location, but you can pay to add extra registers and locations. All versions give you features that are easy to use and support your retail operations, such as:

- Real-time inventory management

- Unlimited products and employees

- Customizable receipts for email or print

- Total cash management

- Inventory control levels

- Easy-to-personalize reports

- A mobile dashboard

All three plans give you API access, integrated payments, POS, and 24/7 support. An overview of the plans and prices:

- Lean: For $69 per month when paid annually or $89 for monthly payments, this version contains all standard features.

- Standard: It’s $119 per month when paid yearly, or $149 with monthly payments. This package adds accounting and ecommerce features.

- Advanced: It costs $199 per month when paid annually or $269 per month when making monthly payments. This packaged adds loyalty, advanced reporting, and more.

You can choose from tons of hardware options or use your existing equipment. Vend offers bundles, and you can use Mac or Windows systems. This POS software integrates with nearly all credit card processing companies, along with top retail programs like:

- BigCommerce

Get the customer service your retail store needs with Vend’s responsive support systems, including 24/7 online or in-app live chat support, email, phone center, plus a full knowledge base.

Best for E-Commerce : Shopify

Oversee in-store and online sales easily from your mobile dashboard.

No extra transaction fees above interchange rates

Abandoned cart recovery comes with every plan

Plug-and-play hardware

Only two staff members can access the POS with the Basic plan

Inventory location are limited

Since 2006, Shopify has provided e-commerce entrepreneurs with capable online shopping services that are easy for store owners to use and offer a pleasant digital customer experience. Its robust virtual features make it the best POS for e-commerce.

To use the Shopify POS system, you need to select a Shopify plan first. These programs cover your e-commerce website and blog, plus many features, ranging from $29 to $299 per month. Your Shopify plan determines your credit card processing fees:

- Basic: In-person rate is 2.7% and online rate is 2.9% + $0.30

- Shopify: In-person rate is 2.5% and online rate is 2.6% + $0.30

- Advanced: In-person rate is 2.4%, and online rate is 2.4% = $0.30

All plans include the Shopify POS Lite plan with features such as:

- Order and product management

- Customer profiles

- Integrated credit card processing

- Quick response (QR) codes

- Custom discounts and discount codes

If you opt for the POS Pro version for $89 per month per location, you can take advantage of added features like:

- Smart inventory management

- Unlimited registers

- Omnichannel selling features

- In-store analytics

Shopify offers tons of plug-and-play hardware, so it’s easy to customize your setup. Choose from complete retail kits, tap and chip card readers, and iPad stands. To get assistance, go through Shopify’s 24/7 support center or check out its vast knowledge base.

Best for Inventory Management : ShopKeep by Lightspeed

With advanced inventory tracking and a simple interface, ShopKeep by Lightspeed is a favorite among small business owners.

Low stock phone alerts

- Unlimited inventory items

Inventory reporting features

Basic package doesn’t include online payments.

Can only accept gift cards with upper plans or by purchasing an add-on

Founded in 2008 and acquired by Lightspeed in 2021, ShopKeep by Lightspeed is a cloud-based POS system used widely by small retail stores, like specialty shops and cafes. However, its impressive inventory capabilities make ShopKeep the best POS for inventory management .

ShopKeep offers three plans, which all come with one free credit card reader for eligible merchants. Credit processing is included, and you’ll pay one flat rate of 2.6% plus $0.10 per transaction. All plans offer many great features, including:

- Unlimited transactions

- Customer payments via text message

- Real-time sales data

- Matrix inventory

- Employee management and rewards

- Inventory reports like sales trends and inventory value

Ecommerce features are only offered in the Standard or Advanced plants. Each plan only covers one location. If you have multiple locations, you can contact the company for a custom plan.

To get the best prices, you’ll want to make one annual payment. You can pay monthly, but the cost is higher. Here are the plans:

- Lean: $69 per month paid annually or $89 per month paid monthly for all base features including integrated payments.

- Standard: $119 per month paid annually or $149 per month paid month. This plan adds accounting and ecommerce features.

- Advanced: $199 per month paid annually or $269 per month paid monthly. This plan adds omnichannel loyalty and advanced reporting.

ShopKeep sells equipment individually or as part of a kit. There is both hardware for desktop and iPad. For example, the retail kit comes with:

- Cash drawer

- Receipt printer

- Bluetooth scanner

- Receipt paper

Customers can call, email, or look through the self-support resources.

Frequently Asked Questions

What is a point of sale system.

Your point of sale (POS) system puts all your transaction data in one spot. Many programs provide tools to track inventory, manage employees, and see revenue data in real-time. POS solutions go beyond traditional registers to offer you various ways to accept payments from anywhere in your store.

Small business owners use a POS system to better understand their sales trends, available inventory, and customers. Moreover, mobile solutions enhance the customer experience with quick checkout options and integrated customer programs.

What Does a POS System Include?

Today you can build a POS system that works for your store, so you’re not limited to just a cash register. Typical hardware for small businesses includes:

- A standalone POS cash register or an iPad system

- Cash drawer

- Receipt printer

- Credit card reader

However, you can add self-service kiosks, mobile units, and customer displays to enhance the shopping and buying experiences.

What Are the Types of POS Systems?

Although retailers still rely on standalone systems, many prefer iPad solutions, which allow you to place the iPad on a secure stand or carry it throughout the store. Mobile units or self-service kiosks are especially crucial for curbside sales or contactless payments, so many business owners incorporate these types of units into their existing setup.

Most POS systems place some or all features in the cloud . This gives you access to tools using different devices in your store or from home.

What Are the Expected Costs of a POS System for a Small Business?

POS systems come with a hefty monthly cost, and if you’re starting new, you’ll also spend quite a bit on hardware. Many larger POS providers offer financing or payment plans for bundled hardware kits along with month-to-month payment options for your POS software subscriptions. Prices ranges consist of:

- Monthly POS software: Free to $299 per month

- Basic hardware bundles: $299 to $899

- Payment processing: Interchange fee (small percentage of the transaction) plus $0.10 to $0.30 per transaction

How We Chose the Best POS Systems for Small Businesses

To find the best POS systems for small businesses, we reviewed several factors, including subscription prices and fees, hardware types and costs, payment processing options, and features. After searching through more than two dozen POS providers, we narrowed it down to winners in specific categories by the best POS systems for things like e-commerce, inventory management, and retail use.

MoMo Productions / Getty Images

Aptos. " 2022 POS / Customer Engagement Survey ."

Square. " About Square ."

eHopper. " About eHopper ."

Touch Bistro. " About Us ."

Vend. " About Us ."

Zippia. " Shopify History ."

Lightspeed. " Lightspeed to Acquire ShopKeep ."

Businesswire. " ShopKeep Acquires Ambur POS ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-652722160-2a1cbe4f84e54fcfba43d78e02a7fd1a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

When you use links on our website, we may earn a fee.

Best POS Systems for Small Businesses of 2024

The POS providers listed below are our top picks for the Best Point-of-Sale Systems for Small Business of 2024. Each POS provider offers a unique POS system with features, pricing, and hardware that meets the needs of small businesses and startups.

Popular POS Systems

Block (formerly Square) »

Toast »

TouchBistro »

Clover »

Why Trust U.S. News

Our ratings are unbiased. We follow strict editorial guidelines, maintain a separate business team, and have a transparent methodology.

Sources Reviewed

POS Systems Considered

Companies Selected

Table of Contents

Compare the Best POS Systems for Small Businesses

Compare quotes for pos systems.

- Rating Details

According to Capterra’s research , retailers across the U.S. are saying goodbye to traditional POS systems with bulky counter registers and opting for cloud-based POS software that runs on tablets , with iPads being the most favored hardware option. In fact, small to midsized businesses doing less than $10 million in sales make up 79% of cloud-based POS system users.

The mass adoption by small businesses of cloud-based POS systems, also known as mobile points-of-sale or mPOS, makes sense. Small businesses have different needs than larger enterprises, and cloud-based business software meets a lot of those needs. Mobile POS systems are ideal for small businesses because they tend to be more affordable and provide busy business owners with the flexibility needed to grow their companies. Cloud-based POS systems can cut costs with month-to-month subscriptions and minimal upfront expenses, since they are often designed to run on mobile devices, such as tablets and smartphones. Cloud-based POS systems also allow owners to keep track of business on the go, through mobile apps on their cellphones.

The modern approach of mPOS systems is a great fit for any small business, whether it’s an e-commerce site, local coffee shop, or boutique clothing store. To help you identify the right POS provider for your small business or startup, we compiled a list of the Best POS Systems for Small Business, based on our overall rating of the Best Point-of-Sale Systems of 2024 .

Our Best Rated POS Systems for Small Businesses

- Block (formerly Square)

Vend by Lightspeed

Fill out this questionnaire to get customized pricing from providers that meet your needs.

Best POS Systems for Small Businesses in Detail

SEE FULL REVIEW »

Vend by Lightspeed »

Shopify »

Lightspeed »

How Much Does a Small Business POS Cost?

Cloud-based POS systems tend to be cheaper than traditional on-premise options. In fact, Capterra’s research suggests that most mobile POS providers actually design and price POS software for small businesses. Abandoning long-term contracts and hefty upfront costs, many cloud-based POS systems use month-to-month subscriptions or don’t charge a monthly fee at all. However, mobile POS systems don’t just cut costs on software; upfront hardware expenses also are less for cloud-based POS systems. Instead of outfitting your entire restaurant or retail store with expensive equipment, cloud-based POS providers typically design POS software for tablets. Downloading a mobile app onto your smartphone or tablet gives you access to a fully functional POS system that can be used in your store or on the go at farmers markets and trade shows. This makes cloud-based POS systems a great option for startups that can’t afford an upfront POS hardware investment or may not even have a space for a standard register.

While mobile POS systems are less expensive, small businesses still pay credit card processing fees, monthly software fees, and hardware expenses, depending on the POS provider. For instance, Block’s POS system is free to use without signing any contracts. It also provides users with one free magstripe reader to begin taking payments. However, you must use Block Payments , its integrated in-house payment processor, as your credit card processing solution. This means that while you don’t pay a monthly fee for its POS software, you will pay it a per-transaction fee for its payment processing.

Other POS providers, like Vend by Lightspeed , don’t have in-house payment processors. Vend charges a monthly fee for its POS software that starts at $99 per month if paid annually, and allows you to shop around for the best payment processing rates from more than 20 compatible third-party credit card processing companies . Lightspeed offers different monthly fees depending on your industry and Shopify has a tiered-plan structure designed to provide you with different price options based on the features your business needs.

Consider both how much you’re paying and what you’re paying for to find the right POS system for your small business. Not all POS systems provide free equipment, but free card readers may not meet your needs. A POS provider’s monthly fees may be higher than another, but it may include features that other providers only offer as add-ons for additional costs. It is best to call a company representative and get a quote for your exact business needs.

POS Systems Price Comparison Chart

What Should I Look for in a Small Business POS System?

The best small business POS systems are cloud-based. Therefore, you should begin your search by identifying mobile POS providers. From there, you should narrow down your POS options with the following factors in mind.

- Industry: Point-of-sale systems tend to come in two varieties: retail and restaurant. Choose a POS system that is designed for your industry. This can be more challenging for cafes and other businesses that straddle the line between retail and restaurant. Think about where the majority of your sales come from and choose a POS system that will have features that best support these transactions.

- Price: Mobile POS systems are generally less expensive than traditional on-premise systems. Therefore, cloud-based POS systems are a better fit for small businesses and startups with tight budgets. The main expenses of a mobile POS are monthly fees, the number of locations and registers, hardware, add-on features, and credit card processing fees. Be sure to take advantage of free trials to ensure that the POS system you’re interested in will work for your small business.

- Hardware: Cloud-based systems are designed to run on tablets, most commonly iPads. However, some businesses need additional equipment, such as card readers, cash registers, cash drawers, receipt printers, barcode scanners, kitchen display systems (KDS), and customer-facing displays. Be sure to pick a POS system with the hardware your small business needs.

- Features: Retail and restaurant POS systems provide different features to help you run your particular business efficiently. Retail stores will find inventory management tools that can sync across multiple locations to be helpful, while restaurants may focus on loyalty programs, online reservations, and mobile or web order-ahead technology. According to Capterra’s research , restaurant patrons find these features to be the most important to their overall experience. Capterra also found that 52% of restauranters cite high operating and food costs as their top challenge. Restaurant POS systems offer menu management features that track the price of ingredients and other food costs that can help restaurant owners optimize their menu.

- Customer support: When it comes to POS providers, choose one that offers 24/7 customer support. The ability to call a live representative instead of using email or online chat with a bot makes a big difference when your business is experiencing a POS system error that's keeping you from making sales.

- Payment processor: Payment processing is one of the most important factors in choosing a POS system. Some POS providers offer an integrated in-house payment processor, while others allow you to shop around for a third-party credit card processor. Both have advantages and disadvantages. In-house payment processing means that everything is handled under one provider and can be easier to manage for a small business owner. However, shopping around for a payment processor may reduce your processing fees. Read our rating of the Best Credit Card Processing Companies of 2024 to make sure your credit card processor is right for you.

Security: A POS system should have security features, beyond Payment Card Industry compliance, that protect your business and its customers. The National Retail Security Survey reports that 72.5% of businesses use POS data mining as a part of their loss prevention system.

Point-of-Sale Features

What Is a Small Business POS System?

A POS system is a combination of software and hardware that in its most basic form allows you to ring up sales. At its most advanced, a POS system runs numerous aspects of your business like sales analytics, payroll , and customer relationship management (CRM) platforms. A small business POS system is one that provides quality budget-friendly POS options for growing businesses and startups.

A POS system and payment processing are different. Payment processing, also known as credit card processing , is done by a processor that acts as an intermediary by transferring funds between a merchant account and a business’s bank account. The credit card processor does this by integrating with a POS system. The POS system is the software and hardware used to accept the payment. It collects the payment information through a swipe, dip, or tap of the customer’s credit card, and encrypts and passes along the data to the payment processor.

You can learn more about this process in our What Is Payment Processing? Guide.

To use a POS system, you will need a phone, a tablet, or a laptop . You will also need a merchant account, payment processor , internet connection, and subscription to a POS account. The hardware is needed to set up your various accounts, build an online store, and sell goods. A merchant account allows you to accept payment from debit and credit cards, while a payment processor is used to process a payment-card-based transaction. An internet connection connects your business to the payment processor, and a subscription to a POS provider brings the whole thing together.

If your business has a physical location, you may need additional hardware, such as a cash register and cash drawer, a receipt printer, and a computer or tablet to connect everything and use as an interface.

For more information, visit our guide How to Use a Point-of-Sale (POS) System .

Read our ratings and reviews for more information on point-of-sale systems.

POS System Guides

- Best POS Systems

- Best POS Systems for Small Business

- Best POS Systems for Restaurants

- Best POS Systems for Retail

- How to Use a POS System

POS System Reviews

- Revel Systems

Other 360 Reviews

- Business Phone Services

- Credit Card Processing Companies

- Customer Relationship Management

- Payroll Software

Why You Can Trust Us: 17 Point-of-Sale Systems Researched

At U.S. News & World Report, we rank the Best Hospitals, Best Colleges, and Best Cars to guide readers through some of life’s most complicated decisions. Our 360 Reviews team draws on this same unbiased approach to rate the products that you use every day. To build our ratings, we researched more than 17 and analyzed 11 reviews. Our 360 Reviews team does not take samples, gifts, or loans of products or services we review. All sample products provided for review are donated after review. In addition, we maintain a separate business team that has no influence over our methodology or recommendations.

U.S. News 360 Reviews takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

- Best POS Systems For Small Business In Canada

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Best POS Systems For Small Business In Canada For May 2024

Updated: May 1, 2024, 10:42am

Fact Checked

The best point-of-sale (POS) systems do more than just process transactions. These systems can also streamline your daily workflow by combining tools such as employee scheduling, customer loyalty programs and inventory tracking into one sleek platform. Granted, choosing the right system can be a challenge. That’s why we analyzed leading providers across various metrics to bring you this list of the best POS systems for small business in May 2024.

Featured Partner

Best POS Systems of 2024

- Why You Can Trust Forbes Advisor Small Business

Shopify POS

Lightspeed POS

Ehopper pos, aloha cloud, revel systems, forbes advisor ratings, what is a point-of-sale system, how to choose the best pos system, how much does a pos system cost, point-of-sale vs. cash register: which is right for you, how to use a pos system, methodology, 2024 pos system trends, frequently asked questions (faqs).

- Best Payment Gateways

- Best Credit Card Processing Companies

- Best Credit Card Machines In Canada

- Best Mobile Credit Card Readers

- Best Retail POS Systems

On Shopify’s Website

Pricing starts at

$7 per month for casual sellers $51 per month ($38 per year) for retail sellers

Mobile payments

Key features

Syncs with Shopify online store, smart inventory management

- Clover: Best for Integrations

- Square POS: Best for Businesses on a Budget

- Shopify POS: Best for Retail Businesses

- Lightspeed POS: Best for Customer Loyalty

- eHopper POS: Best for Omnichannel Businesses

- Aloha Cloud: Best for Next-Day Payments

- Erply: Best for Inventory Management

- Revel Systems: Best for Hospitality Businesses

- KORONA POS: Best for High-Risk Merchants

- PayPal POS: Best for No Monthly Fee

The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content to guide you in making the best decisions for your business journey.

To find the best POS systems for small businesses, we considered over 20 of the top POS providers in the space and narrowed it down to 13, which we then evaluated across three key categories and 12 different metrics. Our ratings consider factors such as transparent pricing, employee self-sufficiency, compatibility with third-party integrations, access to customer support and ratings. All ratings are determined solely by our editorial team.

BEST FOR INTEGRATIONS

Price starts at

Contact sales for pricing

Versatile POS, invoicing, employee management

Clover offers a wide range of plans and pricing options to fit any budget, although its hardware costs are high. When you apply for a Clover Account without purchasing hardware, you can enjoy a 90-day trial period where the monthly software fee is waived, which serves as its free trial. It is easy to use and has a host of features that can help businesses of all sizes manage their transactions more effectively.

One of the biggest benefits of Clover is its integrations. There are hundreds of software apps available in the Clover App Market that can manage various aspects of a business. These apps integrate seamlessly with Clover devices, making it easy for businesses to get started.

Who should use it: Clover is a good point-of-sale system for businesses of all sizes. Its wide range of features and integrations make it a versatile solution that can be tailored to fit the needs of any business.

Learn more: Read our Clover POS Review

- Monthly fee waived the first 90 days if not getting hardware

- Extend the functionality of your POS with integrations from the Clover App Market

- Wide range of hardware available

- Attractive pricing on its monthly plans

- Pricing isn’t disclosed online and can vary when choosing a Clover partner to order through

- Hardware is expensive

BEST FOR BUSINESSES ON A BUDGET

$69 is the hardware starting price (plus processing fees)

Easy to use, free reader, create customer loyalty programs

Square POS is a great option for businesses that are on a budget because it has no monthly fee—just pay the reasonable processing fee of 2.65% for all major credit card transactions and 0.75% plus $0.7 per every Interac chip and PIN or tap transaction. The hardware starts at $69 It’s simple to operate and doesn’t require any training to get started.

Take payments in person, over the internet, by phone or at the farmer’s market. Collecting leads, marketing via email or text, and creating customer loyalty are also possible with this point-of-sale system.This software is perfect for businesses that want to expand their selling beyond a physical location because it easily integrates with Instagram and Facebook, all while managing your entire business from one place.

Who should use it: Businesses on a budget that need an easy-to-use POS system with no monthly fees.

- Free forever plan available

- Includes a free card reader

- Receive better processing fee rates with a high volume of transactions

- Very customizable with numerous add-ons available

- Potential payment delays

- Processing fees could cut into profits

- Its buy now, pay later rates are very high

BEST FOR RETAIL BUSINESSES

$7 per month for casual sellers, $119 per month for retail sellers

Yes, 3 days

In-person and mobile POS, order management, customer profiles

Shopify POS is a point-of-sale software used by businesses of all sizes. It turns any mobile device into a point-of-sale terminal, and is fully integrated with Shopify’s other tools and services. It’s especially well suited for businesses that sell both online and in physical stores, as it allows for unified reporting of sales data from both channels.

Additionally, it offers a wide range of features for inventory management, staff management and customer relationship building. Its hardware is sleek and easy to use, and comes with built-in payment processing.

Learn more: Read our full Shopify POS Review.

Who should use it: Shopify POS is a solid choice for businesses looking for a comprehensive point-of-sale solution.

- No credit card required for its free trial

- Works for omnichannel businesses

- Syncs inventory between online and off-line orders

- No transaction fees when using Shopify Payments

- No free option

- Not the most affordable option

- Must pay for hardware

BEST FOR CUSTOMER LOYALTY

$119 per month, ($89 per month when paid annually)

2.6% plus $0.10 processing fee, dedicated account manager, integrated payments

Lightspeed POS offers a point-of-sale system that is both easy to use and scalable, making it a great choice for businesses of all sizes. The system is EMV compatible and PCI compliant, ensuring that your customers’ data is protected. Lightspeed also offers inventory management and reporting features, allowing you to keep track of your sales and profits in real time.

With its built-in membership and subscription tools, Lightspeed Subscriptions makes it easy to keep your customers engaged and coming back for more. You can offer exclusive deals and discounts to members, as well as monthly boxes filled with their favorite products. The system has secure automated recurring payments that make it a breeze to manage all your memberships and subscriptions.

Who should use it: Businesses that want a customer loyalty program should use Lightspeed POS.

- Each plan includes a register

- Industry-leading customer loyalty options

- Inventory management

- Account manager for every company

- It’s expensive compared to its competitors

- Must request a quote for hardware pricing

BEST FOR OMNICHANNEL BUSINESSES

Free; $29.99 per month (billed annually)

Unlimited transactions, pre-authorization, cash discount, tip management

The eHopper POS system is perfect for small businesses with multiple sales channels. Its free plan is ideal for companies that don’t process many transactions, as there’s a 300 transaction limit per month. However, its paid plans include both unlimited products and transactions.

With a one year contract, paid plans start at $29.99 per month, billed annually. Month-to-month contract pricing starts at $39.99 per month. For a true omnichannel experience, choose the OmniChannel plan starting at $39.99 per month (month to month). This plan gives e-commerce and loyalty features not commonly found in other plans.

Who should use it: Businesses that sell in store, online and through marketplaces such as Facebook and Instagram will find the best value in eHopper’s OmniChannel plan.

- Paid plans include a free business website

- Free processing in the U.S.

- Unlimited products and transactions on paid plans

- Menu builder unavailable under free plan

- Its free Essentials plan doesn’t come with the cash discount or surcharge option that eHopper is best known for

BEST FOR NEXT-DAY PAYMENTS

Free; $65 per month

No, demo only

Next-business-day payments, email marketing, loyalty

Formerly known as NCR Silver, Aloha Cloud is a cloud-based POS system for restaurants. It helps manage the front and back of house, retain and grow your customer base and gives you actionable insights into your business. It offers a free Starter plan, but you’ll pay higher processing rates of 2.99% plus $0.15 per transaction. Its Premium plan starts at $175 per month and comes with a lower payment processing rate of 2.25% plus $0.15 cents per transaction.

Who should use it: Restaurants that want next-business-day access to their funds.

- Free forever plan

- Email marketing and loyalty included with both plans

- Access to funds the next business day

- 24/7/365 customer support

- Personalized onboarding

- Payment processing rates are high for its free plan

- Inventory costs extra

- Pricey paid plan

BEST FOR INVENTORY MANAGEMENT

Free; $39 per month

CRM, mobile app, API access

Erply stands out for its robust functionality and broad applicability. With its tiered pricing, the platform is structured to cater to different business needs—from basic POS requirements for small shops to complex inventory systems for larger retailers. The ease of integration with a variety of payment providers and the adaptability of its mobile app are key strengths, allowing businesses to operate seamlessly.

Erply’s premium packages come with advanced CRM and API access, supporting improved customer interaction and enabling better business automation. Additionally, the platform offers an impressive range of customization features and scalability, particularly advantageous for growing businesses. The capability to provide industry-specific solutions, demonstrated through its detailed POS and inventory management system, makes Erply a preferred choice for diverse business types.

Who should use it: Erply is ideal for businesses of varying sizes, from small stand-alone stores to large-scale franchises and enterprises. However, you’ll need its paid plan for inventory management features.

- Paid plans come with an inventory database and backend management

- Offers a variety of payment processors

- Paid plans have API access

- Inventory management not available for its free plan

- Limited customer support on free plans

BEST FOR HOSPITALITY BUSINESSES

$99 per month

(per terminal, two-terminal minimum)

In-house payment processing, kiosk and mobile orders, delivery orders, multi-location management

Revel Systems shines particularly for its versatility and robust feature set in the hospitality sector. Its POS software is comprehensive, encompassing everything from intuitive point-of-sale functionality to employee management and customer relationship management. Revel is also highly adaptable to different order methods—traditional, kiosk, mobile and online—ensuring a seamless ordering experience for customers.

Its capability to manage multiple locations from a single dashboard is a significant advantage for businesses with multiple outlets. In-house payment processing, coupled with support for diverse payment types, enhances the ease of transactions. Revel’s flat processing fee structure helps businesses manage their expenses more effectively. And when you pair it with its POS hardware rather than sourcing your own outside Revel, you know the software is compatible, which is crucial for high-traffic hospitality businesses.

Who should use it: Revel Systems is best suited for hospitality businesses, particularly those operating across multiple locations.

- Accept delivery, kiosk, online and mobile orders

- Manage multiple locations from one dashboard

- Dedicated account manager

- Steep onboarding fee (starts at $674)

- Two-terminal minimum

BEST FOR HIGH-RISK MERCHANTS

$59 per month ($79 per month CAD)

No transaction fees, API access, e-commerce store

KORONA POS stands out for its comprehensive offering that caters well to high-risk merchants. It provides an impressive feature set that includes e-commerce integration, employee time tracking, loyalty program integration, EMV and mobile payment options, retail inventory management tools and CRM capabilities. The system does not bind businesses with contracts or hidden fees and offers unlimited users and sales.

Another distinct advantage is its compatibility with high-risk merchant industries such as CBD, liquor, wine, dispensary and vape, which many other POS systems do not support due to the inherent risk. KORONA POS further supports scalability, making it an excellent choice for businesses looking to grow or manage multiple stores. Its 24/7 professional support ensures businesses receive help when needed.

Who should use it: KORONA POS is best suited for high-risk merchants who prefer a fixed monthly fee instead of transaction-based fees.

- No transaction fees

- Includes an e-commerce store

- Unlimited users

- Unlimited sales

- Works with high-risk merchants

- Need an Enterprise plan for ticketing and event management

- No pre-built integrations on its first three plans

BEST FOR NO MONTHLY FEE

(commercial transactions start at 2.90% plus a fixed fee)

No monthly fee, inventory management, daily performance reports

PayPal POS , now integrated with the restaurant POS called TouchBistro, charges no monthly fee. Instead, you’ll pay a per-transaction fee. These rates depend on how the transaction occurs, such as if it’s a commercial or QR code transaction. Transaction fees start at 2.90% plus a fixed fee based on the currency received. For example, each Canadian dollar received carries a $0.30 fee.

QR code transactions that are $10 or below cost 2.40% plus a fixed fee and any QR code transaction that’s $10.01 and above cost 1.90% plus a fixed fee. With PayPal POS in Canada, you don’t need any new hardware beyond your existing tablet or smartphone.

Who should use it: Businesses that want to pay a per-transaction fee rather than a monthly fee

- No monthly fee, just pay transaction fees

- Accept commercial and PayPal QR code payments

- No additional hardware necessary

- Transaction fees can get expensive

A POS system, also known as a point-of-sale system, is a hardware and software solution used to conduct transactions. This could be anything from selling a product to managing inventory or tracking customer data. A POS system can be as straightforward as a card reader or as complex as an all-in-one solution that includes features such as loyalty, scheduling, front of house, inventory management, customer relationship management (CRM) and e-commerce.

POS systems are used by businesses of all sizes in a variety of industries, including retail, restaurants, hospitality and services. If you’re running a business that relies on transactions of any kind, then a POS system is likely a good fit for you.

To choose the best POS system, first consider whether or not the system offers the tools and features your business needs—now and in the future. Ideally, a POS system should make it easy and affordable to accept payments no matter where you are selling or how customers are paying. Additionally, look at the bigger picture in terms of pricing. Depending on your sales volume, it may or may not be worth opting for a POS system with a higher monthly rate if it comes with the benefit of lower transaction costs.

Here are a few key factors to consider when choosing a POS system:

- Plans and Pricing: There are a few elements to consider in regard to POS pricing. Not only is there generally a monthly fee to use the service, but there are also varying payment processing fees. Oftentimes, the higher the monthly fee, the lower the transaction fees. For this reason, it’s worth considering your sales volume and determining which plan is the most cost-effective. On top of that, there are also fees associated with purchasing hardware to factor in.

- Software and Hardware: In addition to the POS software, it’s worth considering whether or not you will also require POS hardware, such as terminals and card readers. Even if it’s not something you currently need, it’s worth considering if you might need it in the future as your business grows.

- Features: Though POS systems should offer the same features more or less, most also offer unique features. For example, some may offer features designed to meet the needs of certain industries or use cases, such as a POS system with the option to split the bill for restaurant patrons.

- Ease of Use: The best POS systems are easy to set up and intuitive to use.

- Customer Support: One of the other key factors in the decision-making process–and one of the most overlooked, is the inclusion of high-quality support that is not only available 24/7 but available via a variety of channels from live chat to phone support.

POS Software Features

When choosing a POS system, the first step is to consider what features you need. Do you need basic transaction processing or do you need more advanced features such as loyalty, appointment scheduling, inventory management or email marketing?

Here are some common POS software features to look for:

- Credit card processing: All POS systems will process credit and debit cards, but some systems will require you to use a specific payment processor. Others will let you choose your own processor.

- Loyalty: If you want to offer loyalty programs or gift cards, look for a system that offers this feature.

- Appointment scheduling: If you’re in the business of appointments, such as a salon or spa, look for a system that offers online booking and appointment reminders.

- Inventory management: If you need to track inventory levels, look for a POS system that includes this feature. Some systems will even let you automatically reorder when inventory gets low.

- Customer relationship management (CRM): If you want to track customer data, look for a system that includes a CRM feature. This will let you keep track of customer purchase history, contact information and more.

- Reporting: All POS systems will offer some kind of reporting, but some will be more robust than others. If you need detailed reports on your business performance, look for a system that offers this.

- E-commerce: If you want to sell online as well as in store, look for a system that offers an e-commerce solution. This will let you manage inventory and orders from one central platform.

POS Hardware Features

In addition to software, you’ll also need to consider hardware when choosing a POS system. The type of hardware you need will depend on the type of business you have and the features you’re looking for.

Here are some common POS hardware features to look for:

- Touch-screen display: A touch-screen display is a common feature on POS systems. This lets you easily navigate the software and enter information.

- Receipt printer: A receipt printer is a must-have for any POS system. This lets you print receipts for customers.

- Barcode scanner: If you need to scan barcodes, look for a POS system that includes a barcode scanner.

- Cash drawer: A cash drawer is another must-have for any POS system. This lets you store cash and keep it organized.

- Payment terminal: If you want to accept credit and debit cards, you’ll need a payment terminal. Some POS systems come with a built-in terminal, while others require you to use a separate one.

Types of POS Systems

There are many types of POS systems on the market, from simple card readers to all-in-one solutions. The best POS system for your business will depend on your specific needs.

Here’s a rundown of the different types you might encounter.

Restaurant POS A restaurant POS system is a specialized type of POS system that’s designed for restaurants. These systems typically include features such as table management, kitchen display systems and online ordering. Most will also have inventory management, so you can auto-reorder ingredients as they get low.

Retail POS A retail POS system is designed for retail businesses. These systems typically include features such as inventory management, customer loyalty programs and gift cards. Some retail POS systems also offer appointment scheduling and reporting.

iPad POS An iPad POS system is a type of mobile POS system that uses an iPad as the main point-of-sale terminal. These systems are becoming increasingly popular due to their portability and ease of use. Many iPad POS systems come with built-in features such as credit card processing, scheduling and receipt printing.

Mobile POS A mobile POS system is a type of POS system that can be used on a mobile device, such as a smartphone or tablet. People are relying more on these systems because of their portability and easy setup. Many mobile POS systems come with built-in features such as credit card processing, inventory management and receipt printing.

Android POS An Android POS system is a type of mobile POS system that uses an Android device as the main point-of-sale terminal. Due to their mobility and simple-to-use interface, these systems are increasing in popularity, too. Most Android POS systems come with features such as credit card processing, barcode scanning and receipt printing.

Cloud POS A cloud POS system is a type of POS system that’s hosted in the cloud. This means that all of your data is stored online, making it easy to access from anywhere. Cloud POS systems are becoming more popular because they’re easier to set up and use than traditional POS systems. They also typically come with features such as inventory management, customer loyalty programs and gift cards.

POS Terminal A POS terminal is a type of POS system that’s designed for businesses that need to process credit and debit cards. These terminals typically come with features such as EMV compliance, PCI compliance and fraud prevention.

The cost of a POS system will vary depending on the type and features you need. Generally, the more features you want, the more you can expect to pay. Some companies lend you a POS system in exchange for a monthly fee, while others require that you purchase the system outright.

More expensive POS features include:

- Credit card processing: To process credit and debit cards, you’ll need to pay a monthly fee for most POS systems.

- Inventory management: Some POS systems come with inventory management, while others require you to purchase a separate system.

- Customer loyalty programs: To offer customer loyalty programs, you’ll need to pay a monthly fee for most POS systems. Most have this as an optional add-on, rather than a built-in feature.

- Reporting: Most POS systems come with reporting, while others require you to use a third-party integration. For more advanced reports, you may need to pay for a higher-tiered plan.

- Online ordering: Restaurants that want to offer online ordering will need to pay a monthly fee for most POS systems, in addition to any third-party costs such as fees for DoorDash or Uber Eats.

To reduce costs, you can look for a POS system that comes with a free trial period. This will allow you to test out the system before committing to a long-term contract. You can also look for discounts, such as seasonal promotions or referral programs. However, the easiest way to pare down costs is to only pay for the services you need.

When considering the cost of a POS system, you’ll also need to factor in the costs of hardware, such as receipt printers and barcode scanners. These can range in price from a few hundred dollars to a few thousand, depending on the quality and features you need.

After paying for hardware and software, you usually have to pay processing or transaction fees. These are typically a percentage of the total sale, plus a small per-transaction fee. For example, if you’re paying 2.5% plus $0.10 per transaction, and you make a sale for $100, your total fee would be $2.60.

Sample Processing Fees for In-Person Transactions