Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 ESG Framework Templates to Build an Eco-friendly Enterprise [Free PDF Attached]

![presentations on esg Top 10 ESG Framework Templates to Build an Eco-friendly Enterprise [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/02/Top-10-ESG-Framework-Templates_1-1013x441.png)

Lakshya Khurana

Swedish power company Vattenfall, a government-owned utility, is facing an unprecedented environmental crisis that threatens its existence. It wanted to sell electricity from three of its hydroelectric power stations on the bed of the Dalälven river. It is a World Heritage Site.

The Swedish government and the United Nations Education, Scientific and Cultural Organisation (UNESCO) were now committed to protecting the site, and power generation there would make these organizations lose face.

The Swedish government was also under pressure from local politicians and environmental campaigners to reduce its stake in Vattenfall. They claimed that the company, among Europe’s largest generators of electricity from renewable energy, was producing more hydroelectric power than the country’s grids could use.

With the government on the verge of issuing an order on reducing its stake, Vattenfall is in the process of implementing its new business model of ESG that will allay all environmental concerns, while allowing it to continue to be in business.

ESG, in fact, is a major go-to way for most businesses today. Why did Vattenfall choose ESG? Let’s understand…

What is ESG and why is important?

The acronym ESG stands for Environmental Social and Corporate Governance. It is the shared responsibility of the three parties involved in the business — government, stockholders/investors, and companies. Not working within ESG policies has damaged the reputation of a number of multinational companies.

ESG practices have been shown to improve both financial performance and business resilience in the long term. The risks that arise from its non-compliance are significant, but so are the benefits in terms of improved reputation and enhanced resilience.

Additionally, the ESG framework is becoming increasingly popular among financial professionals as they seek to provide investors with differentiated products that also consider social values in addition to traditional monetary values.

If you, too, want to benefit from the ESG framework, create a robust plan of action. To help you strategize effectively, we present our visually captivating templates.

Customizable Templates to Bring Your ESG Plan to Fruition

Creating a PowerPoint presentation from scratch is tasking and it might not turn out to be as eye-catching as you would like. This is where our professional PowerPoint services come in handy.

We have selected the most effective ESG framework PPT designs that will help you get started on educating your audience on the benefits of integrating an ESG plan. Let’s take a look at them.

Template 1: ESG Strategies Map Human Rights Product Responsibility

This PowerPoint layout uses an interactive map interface (strategy, KPIs, key constituents, etc) to identify key areas of risk and opportunity, as well as track your progress over time. With this PPT design, you can assess and manage your company's social and environmental responsibilities. So download it now.

Download this template

Template 2: Community Impact Annual Report PPT Slides

This PPT deck is perfect for organizations who wish to track their community impact and share the findings with funders and other stakeholders. You can use this design to cover snapshots of major CSR achievements, an overview of CSR initiative outcomes, the corporate profile of the company, etc. Download it now.

Grab this template

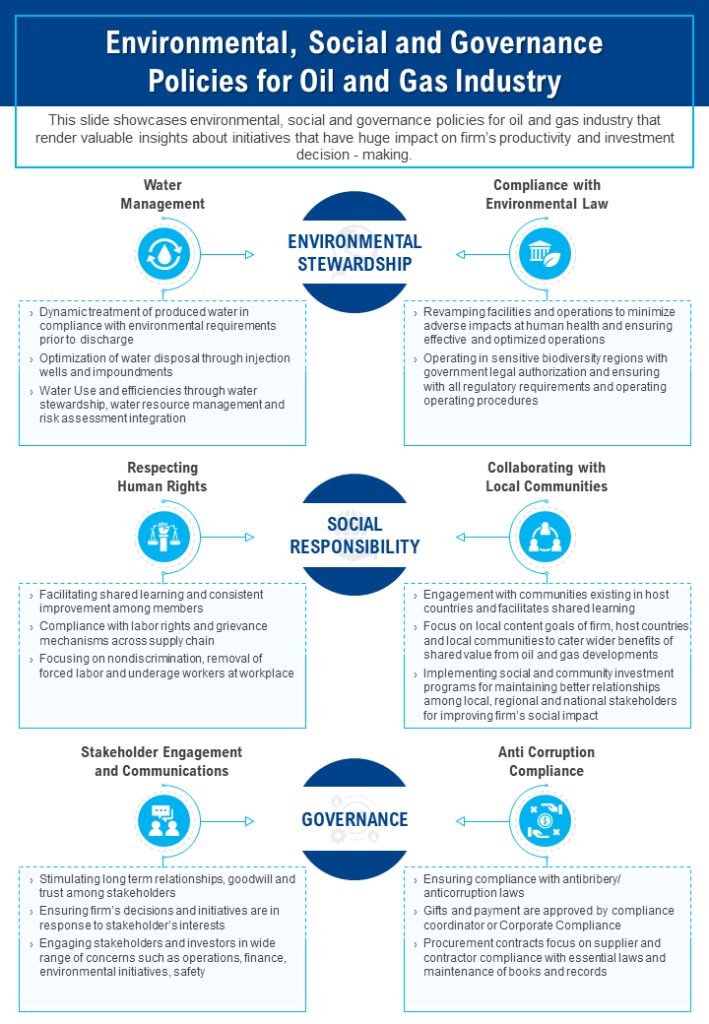

Template 3: Environmental Stewardship Social Responsibility And Governance Policies For Oil And Gas Industry PPT

This creative PowerPoint set will help you outline your policies and procedures for being a good steward of the environment and acting with social responsibility. Additionally, the design is completely editable and you can tailor it to your specific needs. This one-page document is perfect for sharing the policies of the oil and gas industry. So incorporate it now.

Download this template

Template 4: Environmental Social And Governance Policies For Oil And Gas Industry Document

This PPT theme is perfect for helping oil and gas companies adhere to the highest environmental and social standards. This design is concise, easy to use, and covers all the key points. This PowerPoint preset contains everything you need to get started, from an overview of ESG policies to a checklist of considerations. Therefore, employ it now.

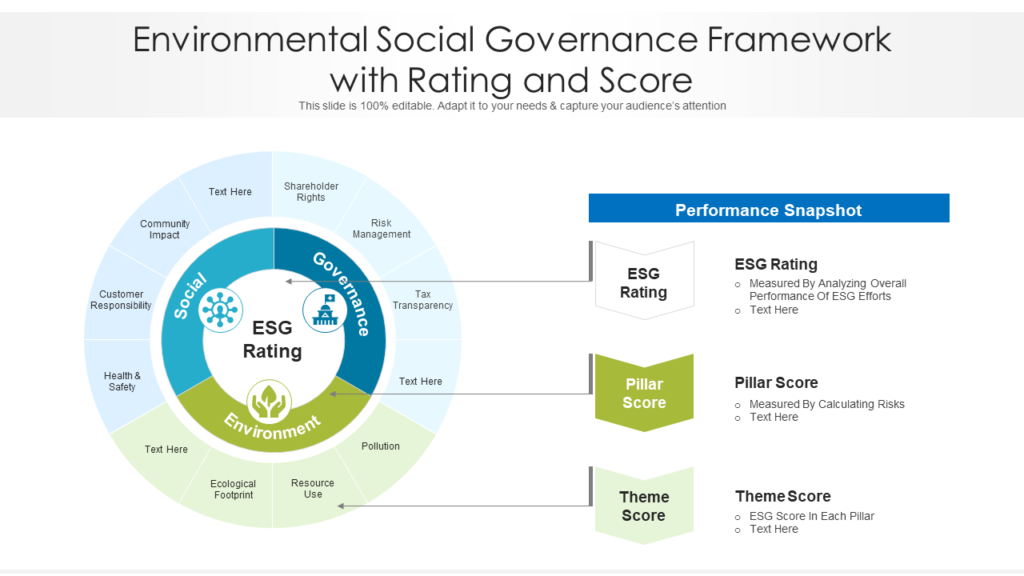

Template 5: ESG Framework With Rating And Score

This creative PowerPoint bundle provides an accurate and timely rating/score of your company's performance in relation to environmental and social responsibility. You can use this design to identify areas of strength and weakness. The PPT layout covers the ESG score, pillar score, and theme score. So get it now.

Template 6: ESG Strategy For Business Organisation

This PPT preset will help you develop a strategy that is tailored to your specific business needs, so you can make a real difference in your community and the world. You can use it to illustrate the elements for each of the ESG verticals, such as strict standards, people, transparency, regulation, etc. Download it now.

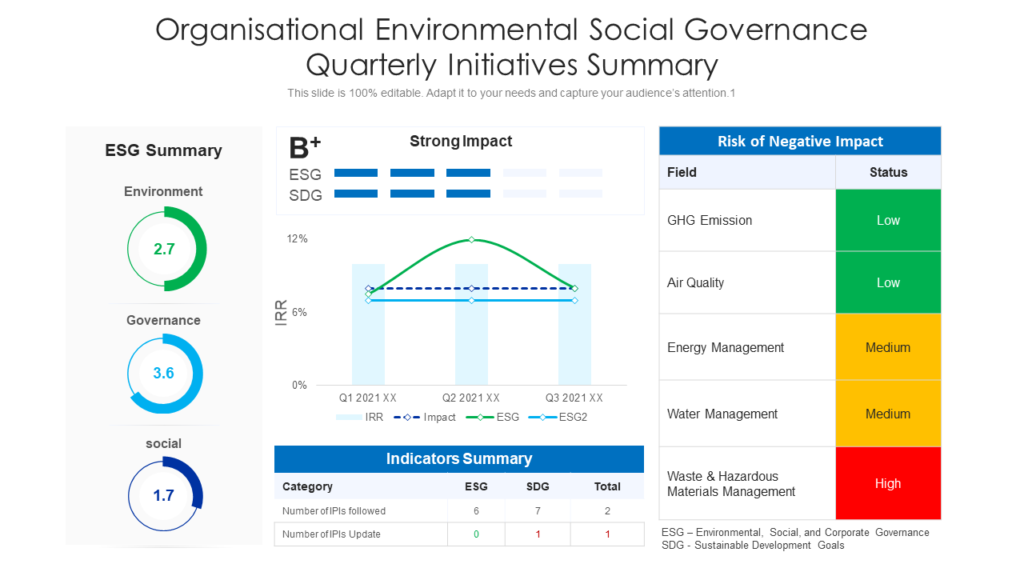

Template 7: Organisational ESG Quarterly Initiatives Summary

This PPT preset provides an up-to-date summary of the latest progress in the key areas, so you can stay informed about the latest developments in sustainability. You can use it to stay ahead of the curve including, an ESG summary, the negative impact risks, and an indicators summary. Download it now.

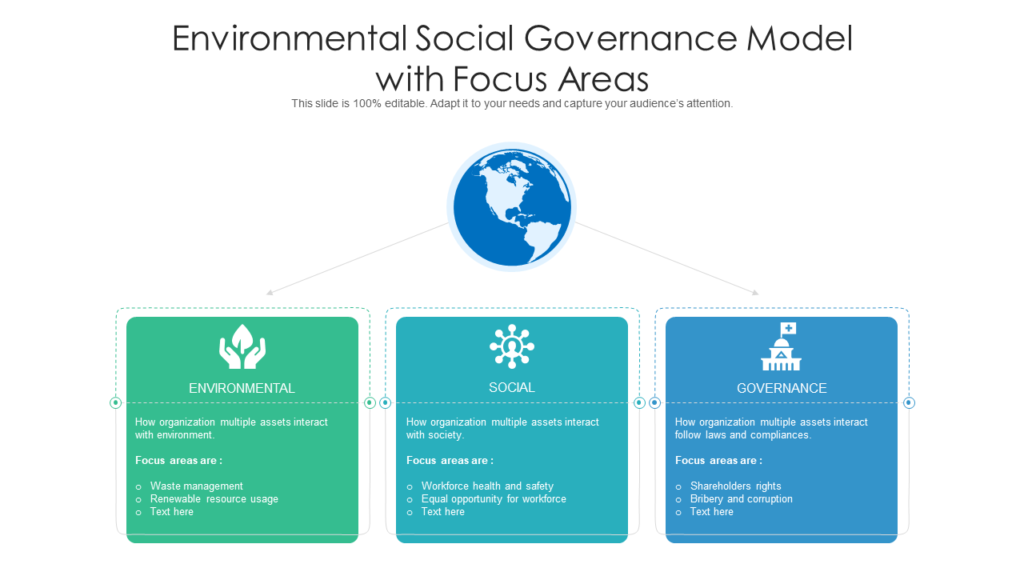

Template 8: ESG Model With Focus Areas

This PPT layout will help you identify and focus on key areas of the ESG metrics and implement best practices to create a socially aware work environment. Some of the focus areas covered in this presentation are waste management, renewable resources, workforce health, safety, etc. This PowerPoint layout also helps businesses identify and address critical sustainability issues. So get it now.

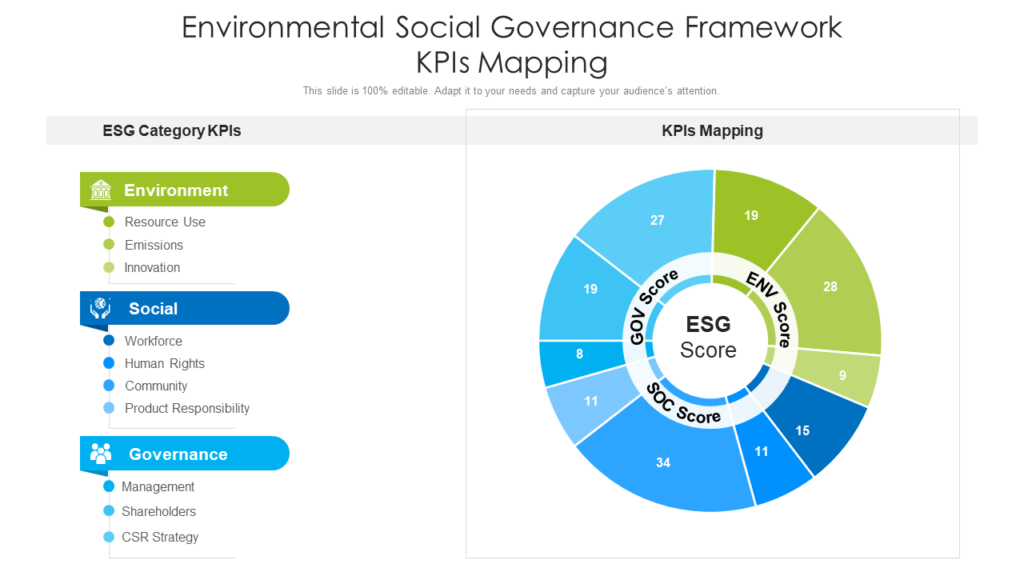

Template 9: ESG Framework KPIs Mapping

Pick this template to illustrate how ESG is a critical part of responsible investing. In this PPT layout, the KPI mapping will help you track your progress and identify areas of improvement. Besides, this design includes metrics, such as resource use, emissions, human rights, management, etc. Get it now.

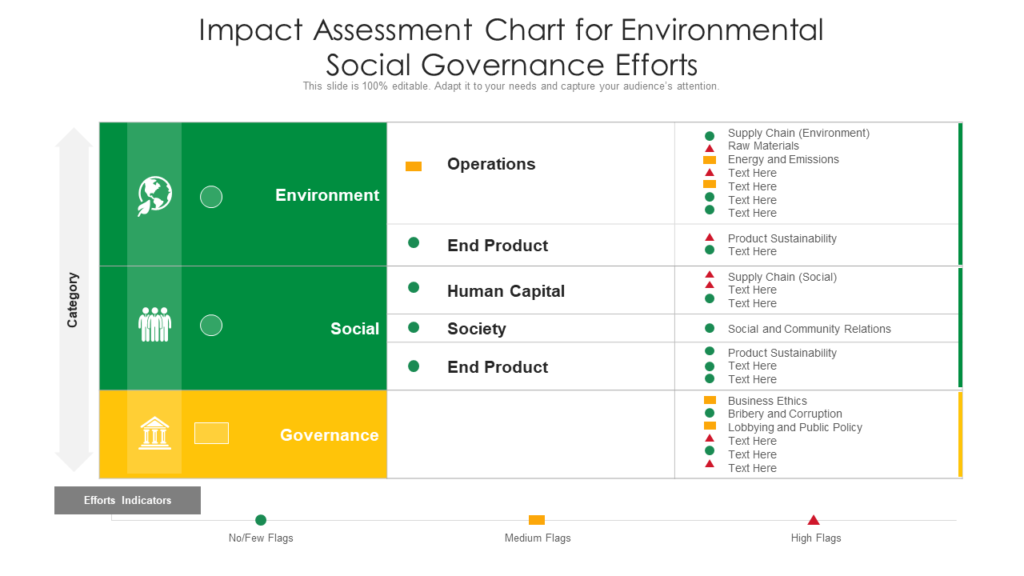

Template 10: Impact Assessment Chart For ESG Efforts

You can use this PPT design to keep track of your company's environmental and social governance efforts. With this PowerPoint preset, you can see at-a-glance how well your business is performing in terms of sustainability, operations, end product, human capital, etc. Download it now.

Modern businesses exist only to earn revenue but in this current global economy, that attitude is not enough. Especially if the consumer opinion is anything different, blind profits aren’t received well by the customer base that is more aware of worldwide issues. It is the duty of the companies and shareholders to make good on their investments.

However, many organizations have come under criticism recently because they are struggling to create profit for their shareholders along with minimizing the negative impact on the environment.

But you can use our stunning ESG framework templates to determine whether or not your operations are adequately protecting environmental and social interests. Download these stunning presentations right away and advocate an eco-friendly turn to your business.

P.S: To add sustainability and climate change to the social pivot plan of your company check out these amazing templates featured in this guide .

Download the free ESG Framework Templates .

Related posts:

- [Updated 2023] Top 25 Green Renewable Energy PowerPoint Templates for a Sustainable Coexistence

- Top 20 Sustainability, Social Responsibility and Climate Change Presentation Templates for Business and Environment Presentations!!

- 10 Elements of A Successful Corporate Sponsorship Proposal (With Presentation Templates)

- How To Create A Corporate Pitch Deck With Sample Templates and Examples

Liked this blog? Please recommend us

Top 10 Poka-Yoke PPT Templates for Fool-Proof Business Operations

![presentations on esg [Updated 2023] The 5 Leadership Styles Along (With PPT Templates Included)](https://www.slideteam.net/wp/wp-content/uploads/2021/10/with-logo-1-1013x441.jpg)

[Updated 2023] The 5 Leadership Styles Along (With PPT Templates Included)

Top 15 Business Card Templates to Represent Your Brand

Top 10 PPT Templates to Propagate the Benefits of Retirement Planning

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

Boardroom Secrets and Invitations Magazine!

7 Tips for Creating an Effective ESG Board of Directors presentation

An Effective ESG Board of Director’s presentation:

An Environmental, Social, and Governance (ESG) Board of Director's presentation is a critical communication tool for sustainability and good governance organizations. It can educate directors about the organization's ESG performance, assess progress relative to goals, and make decisions about future priorities.

What is ESG?

ESG is the acronym for environmental, social, and governance. It's a term that refers to the overall performance and its stakeholders. ESG includes things like environmental impact, social responsibility, and economic sustainability.

Boardroom Secrets and Invitations Magazine! is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

ESG can measure the effectiveness of your company's environmental, social, and governance (ESG) performance. ESG can inform decision-making for your company and its stakeholders.

How can you measure your business's ESG performance?

There are several ways you can measure your business's ESG performance. You can use financial performance metrics to monitor your progress, such as net income or cash flows. You can also use other metrics, such as social media likes and shares, environmental impact factors (EI), and public disclosure factors (PDFs). You can also use ESG indicators to measure the success of your business initiatives.

What types of data should you collect to assess your business's ESG performance?

To assess your business's ESG performance, you should collect data about customers, employees, the environment, and other stakeholders . This data can help you make informed decisions about improving your ESG performance.

How can you present your business's ESG performance?

There are a few different ways to present your business's ESG performance. One way is to have an ESG report prepared by an independent consultant. An independent consultant's report can provide a more comprehensive and accurate picture of your business's ESG performance than a report created by you or your team.

Additionally, an ESG board presentation can provide a more specific and concise snapshot of your business's ESG performance than could be found in a report from a consultant.

A slide show is another way to present your business's ESG performance. Slideshows can help you depict the various aspects of your business's ESG performance in an easy-to-read format. Slideshows can also visually represent how well your business meets its environmental, social, and governance obligations.

What are the benefits of having an effective ESG board?

Having practical ESG board presentational tools will help you make better decisions, but it can also help you assess the progress of your company's ESG performance.

By having an effective ESG board, you can:

Assess the progress of your business's environmental, social, and governance (ESG) performance.

Identify areas in which your company needs to improve.

Find ways to reduce environmental, social, and governance (ESG) risks.

Create a strategy for increasing the effectiveness of your company's environmental, social, and governance (ESG) initiatives.

Evaluate the effectiveness of your company's environmental, social, and governance (ESG) efforts regularly.

Recommend changes to your company's management that would improve the effectiveness of your ESG performance.

Use an effective ESG board presentation to understand your business and its stakeholders better.

Here are the best 7 tips for creating an effective ESG Board of Director's presentation:

#1 Cater to the Different skills of your board of directors

Cater your ESG presentation to the varied skill sets of your board members . Understand every board member will mix every board member's ESG skills, interest level on the topic, and understanding?

- For example, if your board is vital in finance, you can focus on the financial aspects of ESG. Include examples of how ESG Factors effects the Credit Worthiness of your organization? Ratings and Scores.

If your board is vital in marketing, you can focus on how ESG is communicated to the public.

#1 How ESG Data Points span cross-functionally can be highlighted in the presentation.

The board members should be educated on how ESG Data points and factors span Enterprise-wide functions; HR, Finance, Legal, Marketing, IT, Supply Chains, and varied Functions and the jurisdictions it operates.

#2 Every board should understand how the company will be evaluated in that industry.

How is the company operating, culture, ESG metrics, how the company is doing, and how are we doing to improve on ESG factors? Jane Bomba serves Clarivate and two different public companies in the USA. What ESG factors are we measuring, and how are we doing in those ESG factors?

My recommendation would be an analysis, a strategic road map with tangible action items planned by the CEO, CFO, and C-Suite , on how we will improve those baseline measurements?

ESG presentation with factors highlighted should be tailored to the specific company and industry. For example, a pharmaceutical company will have different ESG priorities than a food company. An environmental presentation for a power company will be other than one for a renewable energy company.

#4 ESG Systems being Implemented to Capture Baseline Measurements.

According to Jane Bomba, The board needs to know, like any new ERP implementation , what ESG systems are we implementing in the company and how are we doing with them are relevant to the board.

#5 Creating an ESG Department and Agenda for Chief Sustainability Officer

The Chief Sustainability Officer (CSO) is a new role in most organizations that create an ESG agenda.

- The CSO should be able to report how the company is doing against its NetZero 2030, 2050 commitment goals and what progress has been made with materiality assessments

- The CSO should also be able to report on the effectiveness of different ESG factors, initiatives and policies established

The board presentation is crucial for the CSO to report on progress and get buy-in from the board for future endeavours.

#6 Some Metrics / Measurements relevant to the industry - Analysts covering the stocks in their analysis

ESG Data points factors most pertinent to the Institutional Investors , Analysts covering the stocks in their analysis

- Example: CDP Water Disclosure Scorecard, Carbon Disclosure Project (CDP) Climate Change Report,

The organization's carbon footprint, water usage, and waste production

Community engagement metrics

Employee satisfaction and retention rates

#7 How ESG and Company Culture are being affected/measured against ESG factors

The company culture is a crucial driver of ESG. For example A company with a strong safety culture will have lower workers' compensation

- How are we doing?

- What can be done better?

- Are employees happy with the way things are going?

- What does the future look like?

Tags: sec esg comment letter, esg disclosure examples, sec esg task force, sec esg disclosure requirements

Ready for more?

How to make ESG real

The ‘how’ of a company’s environmental, social, and governance (ESG) proposition starts with recognizing what companies should be solving for: maintaining and reinforcing their social license to operate, in the face of rising externalities. Rising scrutiny of how companies address ESG means that a robust approach is more critical than ever, irrespective of whatever name one may choose to give to the attempt to address these externalities, whatever contours one may define for them at a given point, and whatever organizational or governance construct one may put in place for them. Indeed, we believe one may be agnostic to the term ESG but not to its underlying concerns. 1 These issues are addressed in detail in the accompanying article, “ Does ESG really matter—and why? ,” by Lucy Pérez, Vivian Hunt, Hamid Samandari, Robin Nuttall, and Krysta Biniek, McKinsey Quarterly , August 10, 2022.

Not all aspects of “E,” “S,” and “G,” however, are priorities for all companies, and it is unrealistic to expect that companies do not have to make hard trade-offs within and among ESG dimensions, or that they can lead on every topic. It is therefore instructive to observe companies that approach ESG in a rigorous, strategy-driven, socially attuned way. We call these organizations “forward-looking companies.” They make ESG intrinsic to their strategy by defining, implementing, and refining a carefully constructed portfolio of ESG initiatives that connect to the core of what they do. Forward-looking companies also contribute to a competitive landscape where good corporate citizenship is marshaled against existential challenges, not least—but not only—climate change.

When a company determines the dimensions of ESG where it wishes to be good and where it wishes to be excellent, it is making important decisions, with broader second- and third-order consequences. Forward-looking companies approach ESG decisions by seeking to gain a deep, evidence-based understanding of their own business and its broader potential effects. Since by now every major company has begun to embark on an ESG journey, and many have significant programs already under way, it is helpful to consider ESG progress in the context of a maturity curve. The ESG practices of today’s large companies generally cluster along three levels of ambition (Exhibit 1).

Explore COP28 with McKinsey

Join us for a series of dynamic virtual events during COP28. Discover new research, practical strategies, and collaborations across sectors that propel climate action and growth towards net-zero.

Being forward looking in ESG necessarily calls for considering the needs of a range of stakeholders and society more broadly . Stakeholder demands are shifting, and these shifts can over time dramatically affect competitive dynamics. Nor is the rate of change linear. As external shocks such as the COVID-19 pandemic and the war in Ukraine have shown, companies find it hard to move rapidly unless they have an ESG framework that is derived from, and deliberately advances, their strategy. Anticipating risks and opportunities and considering what value stakeholders have at stake requires continuous, judicious analysis; ESG is a process, not an outcome (Exhibit 2).

The approach of forward-looking companies is marked by four reinforcing parts of mapping, defining, embedding, and engaging.

The science of ESG mapping

The term “mapping” is used frequently in other competitive contexts. Mapping for ESG requires a thorough and inclusive exercise. The critical analysis is to figure out how the organization’s specific business model matches against each ESG dimension.

1. Considering what stakeholders have at stake

Comprehensive ESG mapping attempts to take account of who the important stakeholders are and what they value. Purpose is an enabler; it is much easier for a company to operationalize ESG when it has a clearly articulated corporate purpose, moored to the business model. It will not come as a surprise that forward-looking companies actively engage with their shareholders, whose capital is at risk. To unlock opportunities for all of their stakeholders, however, these companies tend to listen to a broad range of constituencies.

Employees rank highly on any list of essential stakeholders. The benefits of engaged employees include heightened loyalty and a greater willingness to recommend the company to others. 2 For example, see “ More than a mission statement: How the 5Ps embed purpose to deliver value ,” McKinsey Quarterly , November 5, 2020; “ Purpose: Shifting from why to how ,” McKinsey Quarterly , April 22, 2020; Aaron De Smet, Bonnie Dowling, Marino Mugayar-Baldocchi, and Bill Schaninger, “ ‘Great Attrition’ or ‘Great Attraction’? The choice is yours ,” McKinsey Quarterly , September 8, 2021; Arne Gast, Nina Probst, and Bruce Simpson, “ Purpose, not platitudes: A personal challenge for top executives ,” McKinsey Quarterly , December 3, 2020; and Naina Dhingra and Bill Schaninger, “ The search for purpose at work ,” McKinsey, June 3, 2021. Engaged customers are also essential. Consumers hold companies and their brands accountable for the impact of their conduct on employees, society, and the environment. Though customer preferences can vary, there are indications about what is likely to matter more for consumers in the years ahead. Our research on Generation Z (born 1995–2010) shows that young consumers are particularly mindful of ethical consumption, transparency, authenticity, and equality. 3 Tracy Francis and Fernanda Hoefel, “‘True Gen’: Generation Z and its implications for companies,” McKinsey, November 12, 2018. One study found that purpose-driven brands achieve more than twice the brand-value growth of brands that focus purely on profit generation. 4 Erica Sweeney, “Study: Brands with a purpose grow 2x faster than others,” Marketing Dive, April 19, 2018.

2. Identifying superpowers and vulnerabilities

The second element of mapping is to identify a company’s superpowers and vulnerabilities . Superpowers are a company’s unique capabilities to have differential impact. Vulnerabilities are the foundational expectations that critical stakeholders will require a company to address, in light of its specific business model. Identifying superpowers and vulnerabilities requires answering questions such as, What do we bring to society that no one else can? What are the areas of dissonance, where we need to change practices to align strategy with our societal impact? What do we do that is irreplaceable? What “home field” advantage do we have? For example, Natura &Co is a Brazilian-based manufacturer and distributor of cosmetics and other personal-care products, with significant operations in Latin America, Europe, and the Middle East. Its superpower is channeling its “home turf” of the Amazon rainforest; it can tap into its highly motivated base of stakeholders to protect biodiversity and advance global solutions to climate change.

Forward-looking companies test and strengthen their ESG proposition by conducting exercises such as an “ESG teardown.” Teardowns—dismantling a product or service to learn more and to compare it with the offerings of rivals—have long been used in manufacturing . ESG teardowns analyze what a company is doing now, and why. Frequently, the exercise will surface reasons for some initiatives that include “it seemed like a good idea at the time,” or “many companies seemed to be doing something similar.” Perhaps these explanations make sense in some cases, yet it is not possible to make a distinctive contribution by merely copying others—and at all events, companies have unique superpowers and vulnerabilities.

Forward-looking companies carefully consider the dimensions in which they have a particular ability to excel and can distinguish them from dimensions where their abilities are comparable to others. For example, a multinational pharmaceutical company may focus on social metrics (such as accessibility and affordability), a renewables company may prioritize environmental metrics (such as reductions in greenhouse-gas emissions, for scopes 1, 2, and 3), and a food company may elevate an equal mix of environmental (emissions reductions, water use, and waste) and social metrics (nutrition, product quality, and safety).

Thorough analysis of ESG quantifies both downside exposure to and upside opportunities. Forward-looking companies measure gaps between their aspirations and achievements. They also focus most intently on mapping how well ESG is reflected in core business practices. One test that all companies can apply after they have arrived at a new ESG strategy is to determine and parse the internal commitments that they have not yet met—and to ask why they have failed to meet them. Companies can also inquire about whether board meetings are now being conducted differently, with the company’s ESG strategy applied to decision making; whether operating-level meetings are conducted differently; the extent to which ESG considerations are a factor in budgeting, capital allocation, and product choice; and whether some stakeholder groups are expressing particular concerns.

Superpowers are a company’s unique capabilities to have differential impact. Vulnerabilities are the foundational expectations that critical stakeholders will expect a company to address, in light of its specific business model.

3. Benchmarking regularly and judiciously

Finally, forward-looking companies are exacting about their choices of metrics and peer sets. They are also creative about analyses and research (including the use of research from academia and thought leaders). One informative inquiry tracked the degree to which companies “walked the talk” in their disclosures about broader stakeholders. It found that, controlling for sector-specific effects, stronger stakeholder language about the importance of stakeholders paired with stronger operating performance across a number of metrics over a three-year period. 5 Ariel Babcock et al., Walking the talk: Valuing a multi-stakeholder strategy , FCLTGlobal, January 17, 2022.

Forward-looking companies’ selection of peer sets is not constrained by traditional categorizations. While corporations may define themselves by sector, a wide range of stakeholders adopt a much broader approach. Prospective employees, for example, look across industries for companies they would consider joining. There is, as well, a layer of nuance in choosing appropriate peer sets. Looking across geographies and industries is often instructive, but different geographies and industries require different analyses.

The choices in ESG decision making

Forward-looking companies recognize that they cannot be distinctive by pursuing every initiative that qualifies as ESG. To the contrary: because they have a clear understanding of their strategy, and their own strengths and gaps, they focus on identifying initiatives that matter most to their business models. ESG is an essential strategic concern, which means it affects how and where a company competes.

1. Considering high jumps and long jumps

There are two critical decisions that companies confront as they seek to enhance their readiness to address externalities along the ESG dimensions. The first is to decide on high jumps : the levels a company must reach to meet its ESG bar. This is higher than a regulatory bar, such as disclosure standards, environmental compliance, tax obligations, and wage scales—all of which must be met in every case. ESG is “next level” performance; it addresses, for instance, societal insistence on a living wage, environmental demands for net-zero emissions, and communal principles of diversity. These expectations will likely continue to move higher (even though a degree of volatility is to be expected in this regard as well).

The second step is to decide on a company’s long jumps : the one or two ESG areas where the company can take a leadership role and, ideally, affect other players in its ecosystem and beyond. Long jumps are reached by drawing from a company’s superpowers. Depending upon a company’s ecosystem, it may be uniquely positioned to facilitate notable social impact among multiple businesses worldwide. For example, Maersk founded the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping, which consists of 18 strategic partners from across the shipping value chain that accelerate carbon-neutral solutions for the shipping industry.

The concepts of high jumps and long jumps on the one hand, and superpowers and vulnerabilities on the other, are distinct. While both are rooted in a company’s unique business model and endowment, high jumps and long jumps are the specific courses of action a company takes in light of its superpowers and vulnerabilities. For example, Walmart has the prominent superpower of a large, robust network of suppliers. It uses this superpower to make a long jump in sustainability. The company instituted Project Gigaton, a collaborative program that enables suppliers to reduce their carbon footprints by a collective one billion metric tons (one gigaton) of greenhouse gases by 2030. Thousands of suppliers take part in Project Gigaton by setting targets, reporting on progress, and sharing knowledge. By 2020, the project had already reached more than 40 percent of its goal.

High jumps and long jumps are distinct from superpowers and vulnerabilities. High jumps and long jumps are the specific courses of action a company takes in light of its superpowers and vulnerabilities.

2. Thinking systematically about ESG trade-offs

Forward-looking companies do not ignore trade-offs when approaching ESG. Rather, as they consider their unique business models, they are clear about benefits and costs—including the costs of inaction.

One example is how a company may approach employee compensation. Paying above-market compensation could seem, at first, to be value destroying for shareholders, by potentially reducing investors’ returns, particularly in the short term, yet employee satisfaction can clearly drive better financial performance. 6 For example, see Alex Edmans, “Does the stock market fully value intangibles? Employee satisfaction and equity prices,” Journal of Financial Economics , September 2011, Volume 101, Number 3. Many companies find that by treating employees better, including by paying them well, they can not only increase productivity but also foster greater trust. Research suggests that this can become a source of competitive advantage. 7 Alex Edmans, “The link between job satisfaction and firm value, with implications for corporate social responsibility,” Academy of Management Perspectives , November 2012, Volume 26, Number 4.

Yet capital and time are finite. At some point, investing a marginal dollar in one constituency (say, employees, by means of higher salaries) could require increasing prices for another constituency (consumers). Elevating management time for one ESG initiative (for example, reducing waste) could detract from time that can be spent on other initiatives (for instance, community education). There is no one, clearly marked path that every business can follow. But there generally is a common marker that distinguishes how forward-looking companies execute ESG: they consider thoroughly, choose deliberately, and then act boldly. As part of that approach, forward-looking companies assess scenarios for not investing in a given area; they analyze the values at risk to determine the costs of standing still. They recognize that social expectations constantly evolve.

3. Measuring and assessing

A key part of making ESG real is not to measure for the sake of measuring but instead to measure what matters. Effective performance management in ESG, like effective performance management in other contexts, approaches shorter-term metrics with a view toward achieving longer-term, strategic goals. It uses clear milestones, pays careful attention to meaningful KPIs, and elevates objectives that tie directly to the business model (for example, water-use reduction, removal of antibiotics from fresh produce, or replacement of diesel machines with electric machines in warehouses).

Assessing progress is most effective when it is done regularly and, with robust data analytics, information can be updated very rapidly. Companies that have a considered process in place to measure their ESG performance are better positioned to respond even in times of rapid change. As the saying goes, “there are decades when weeks happen, and weeks when decades happen.” An informed perspective enables forward-thinking companies to move quickly as realities shift.

The approach to ESG implementation

Just as forward-looking companies make informed choices about ESG based upon their unique business model, they also act purposely to operationalize ESG throughout the organization.

1. Syncing ESG with operations

It can be tempting to approach corporate purpose and then ESG sequentially: that is, to consider that companies should first clarify their purpose, and then create ESG initiatives that accord with their purpose. But it is rare for large, established companies—which operate under a range of priorities, urgencies, and constraints—to be able to operate in this way. For example, after the big-box retailer Best Buy’s former chairman and CEO, Hubert Joly, had implemented a remarkable turnaround at the company , he observed :

“The question is often, ‘So where do you start and how do you sequence?’ The logical part of our mind would have us start with purpose, then derive the strategy: anchor it in purpose, and transform the organization on that basis.

“My personal experience is different. When we started the turnaround, I was very clear about my philosophy, which was that profit is not the purpose. Purpose is to contribute to the common good. But we did not spend time in the first three years of the turnaround on refining our purpose. We spent the time saving a ship that was sinking, by addressing key operational-performance drivers.” 8 “ Leading with purpose and humanity: A conversation with Hubert Joly ,” McKinsey Quarterly , June 18, 2020.

That does not mean that companies should move ESG to the back burner. There are opportunities for companies to think comprehensively about how they can advance major ESG initiatives as part of their core strategic plan, across 5Ps. We have identified key sources of opportunities:

- portfolio strategy and products : the products and services an organization provides, and the “where to play” and “how to play” choices it makes to best serve its customers

- people and culture : the talent—and the talent management approach—a firm deploys

- processes and systems : the operational processes it adapts to meet ESG-related targets

- performance metrics : the target metrics and incentives used to measure what the company wishes to achieve, how it is progressing, and the way it creates and distributes incentives to realize ESG initiatives

- positions and engagement : how the organization aligns its external positions and affiliations to be consistent with, and consistently deliver on, its ESG priorities

Depending upon the company and its business model, the range of key stakeholders can include key regulators and governmental actors, as well as other companies, and the range of initiatives can be far-reaching. Companies that have demonstrable success in ESG make deliberate choices in this regard.

It can be tempting to approach corporate purpose and then ESG sequentially. But large, established companies—which operate under a range of priorities, urgencies, and constraints—can rarely operate in this way.

2. Following through on initiatives to ensure impact

Forward-thinking companies then follow through on their initiatives. When ESG fits squarely within strategy, it is likely to have strong support from stakeholders within and beyond the organization. Consider the clothing and outdoor-gear company Patagonia, which has made protecting the natural environment part of its core mission. Initiatives such as facilitating connections to environmental groups; pledging 1 percent of sales to the preservation and restoration of the natural environment; and using only renewable electricity for its retail stores, distribution centers, and regional and global offices function in concert.

One powerful way companies can follow through is with incentives. This includes monetary incentives; indeed, a growing number of corporations are crafting compensation packages, particularly for senior leaders, that condition a portion of compensation on achieving specific ESG objectives (for example, emissions reductions). But monetary incentives are not the only way to encourage positive behavior, nor always the most effective.

An additional lever is “nudging,” which has been validated by behavioral science. Nudges can encourage energy savings and waste reduction, for example, by promoting inclusive behaviors, reminding employees to be mindful of their carbon footprint, or encouraging them to recycle. Forward-looking companies find that by consistently sharing with employees and other stakeholders how the organization is progressing along their prioritized objectives, such as diversity or sustainability—information that can be presented clearly in standardized reports—they can make ESG initiatives part of the business’s daily operations. Companies can celebrate teams that deliver on ESG expectations, or they can spotlight employees who contribute measurably to the organization’s ESG initiatives.

3. Discerning what the numbers do—and do not—say about ESG

Forward-looking companies find that their ESG metrics become more robust—and more refined—the longer and more consistently they use them. They also think carefully about which external ESG ratings agencies or score providers they should track most closely. The optimum is usually two or three and, in particular, the two or three that are most practicable for a business model and help companies meet their objectives. Forward-looking companies are careful not to conflate achieving high scores with realizing specific, strategic goals.

Developments on ESG metrics are shifting in real time. The US regulatory environment is fluid. Outside of the United States, the International Financial Reporting Standards (IFRS) completed its consolidation with the Value Reporting Foundation in August 2022, formalizing the new International Sustainability Standards Board (ISSB). 9 “IFRS Foundation completes consolidation with Value Reporting Foundation,” August 1, 2022. ISSB houses the Sustainability Accounting Standards Board standards and the Integrated Reporting Framework. Implementation is usually done via the International Organization of Securities Commissions, whose members set standards as listing requirements on their exchanges.

Each of these organizations has a mandate to protect investors and markets. As well, the European Union has asked the European Financial Reporting Advisory Group to propose reporting standards for its Non-Financial Reporting Directive, with a view of materiality on both the investor and civil-society level. Because the European Union supports the IFRS/ISSB initiative, there is grounds to hope that any overlap between IFRS and the European Union will be limited. Though it is not certain that the trajectory will continue, ratings have been converging. The next, great challenge will likely be impact-weighted accounting that reflects a company’s financial, social, and environmental performance.

The engagement and dialogue of social license

While it is relatively easy to map and measure how ESG initiatives align with a business model, it is much harder to track—and to analyze—the maintaining of social license. 10 A call for impact-weighted financial accounts to reflect a company’s environmental, social, and financial performance is already building. See, for example, “Impact-weighted accounts,” Harvard Business School. Companies that are focused on making ESG real have learned, first, to encourage open dialogues with stakeholders rather than to shy away from them; second, to speak directly to stakeholder concerns by showing how their ESG efforts connect to and advance the company’s strategy; and, third, to maintain a regular cadence in ESG reporting.

1. Using ESG engagement to sharpen strategy

Forward-looking companies think carefully about communications—not just in terms of what resonates with investors, but with a range of stakeholders; and not just communications for the sake of announcing to others but in order to learn, become smarter, and improve as an organization. Employees are a key constituency and are invariably an important source of insight. Companies can also continuously improve by engaging through trade groups and alliances (the choice of which is itself a rigorous and iterative process), both to better inform their own views and to accelerate impact at scale.

Having an informed sense of opinion helps inure companies to becoming overly defensive. Committed performers embrace the reality that engagement can be a little bumpy. Dick’s Sporting Goods, for example—the largest sporting-goods retail company in the United States—endured tremendous pushback when it announced in 2018 that it was discontinuing the sale of assault-style firearms and high-capacity ammunition magazines. The company absorbed both immediate top-line losses and a drop in its share price. Yet the company continued to engage openly with consumers, employees, and investors, stuck to its purpose, and soon saw its earnings and market capitalization surpass previous levels.

Having an informed sense of opinion helps inure companies to becoming overly defensive. Committed performers embrace the reality that engagement can be a little bumpy.

2. Showing investors the business proposition

Investors increasingly seek more information about and insist upon more accountability for ESG. They also need to know how a company’s ESG initiatives complement and strengthen its strategic plan. Forward-looking companies demonstrate clearly how specific ESG initiatives flow into the business model and have hard metrics to demonstrate progress. They can also take committed actions such as establishing a task force to identify and collect ESG data points for reporting, dedicating full-time outreach and communications employees to the investor relations team, thoroughly integrating sustainability into company reports (including the annual report), and describing specific ESG initiatives and performance against those initiatives in investor presentations.

Companies have also incorporated ESG directly into capital raising, particularly by issuing green- or sustainability-linked bonds (SLBs). These securities feature structural or financial provisions on predefined KPIs, measured against sustainability targets. For example, England-based fashion house Burberry announced a medium-term sustainability bond in 2020 to finance sustainability-linked projects. That same year, Novartis priced €1.85 billion of SLBs, linked to specific ESG targets. The key, of course, in choosing whether to use such instruments is to consider how they could complement and advance a company’s ESG priorities.

Regardless of capital mix, there are clear advantages to greater transparency. Stakeholders, particularly (but not only) investors and regulators, expect and increasingly demand detailed disclosures. While regulations vary across countries and jurisdictions, the global trend is toward more robust information. Companies that succeed in implementing business-driven ESG initiatives, meeting hard targets along the way, demonstrate to stakeholders that they can build and sustain value in the context of regulatory change. ESG is already core to their operating model.

3. Making cadence core to the dialogue

Finally, forward-looking companies find that not just the quality of interactions with stakeholders and the detail of information shared with them but also the pace of communications is essential. Delaying ESG reporting could be interpreted as a signal of lesser commitment.

Meeting a steady ESG cadence is a developable skill, and it is improved the more it is practiced. Mohandas Gandhi once observed that “your actions become your habits; your habits become your values; your values become your destiny.” That is very much the case with ESG reporting. When ESG is core to the business model, reporting on ESG becomes part of the ordinary course of doing business. External shocks are less likely to present an undue burden on ESG reporting. Just as well-managed companies have accounting information quickly available because it helps them discern their business performance, forward-looking companies have ESG data at the ready before and during challenging periods.

Most companies are engaged in an ESG journey. But a culture of continuous improvement in ESG is unlikely to take hold at a company unless ESG is not just taken seriously but systematized and tightly linked to the company’s purpose. Forward-looking companies approach ESG in a rigorous, evidence-based, and well-considered way. They increasingly and deliberately incorporate and advance ESG considerations as core to their business model—to enable a more sustainable business and to make ESG real.

Lucy Pérez is a senior partner in McKinsey’s Boston office; Vivian Hunt is a senior partner in the London office; Hamid Samandari is a senior partner in the New York office; Robin Nuttall is a partner in the London office; and Donatela Bellone is an associate partner in the Phoenix office.

The authors wish to thank Krysta Biniek, Pablo Illanes, Conor Kehoe, and Mekala Krishnan for their contributions to this article.

This article was edited by David Schwartz, an executive editor in the Tel Aviv office.

Explore a career with us

Related articles.

The net-zero transition in the wake of the war in Ukraine: A detour, a derailment, or a different path?

Solving the net-zero equation: Nine requirements for a more orderly transition

Emphasizing the S in ESG

Blog – Creative Presentations Ideas

infoDiagram visual slide examples, PowerPoint diagrams & icons , PPT tricks & guides

How to Stand Out With Impactful ESG Sustainability Report PowerPoint Presentation

Last Updated on March 8, 2024 by Rosemary

If sustainability report statements are an essential tool in your company’s development, you may want to reflect this approach in how your documents look to highlight message validity. Creating engaging, influential, and meaningful PowerPoint presentations covering this critical topic of our time is easy when supported by suitable graphics. You may think about them as brand visuals for three pillars of the ESG sustainability report – Environmental, Social, and Governance. Follow through this text to discover some slide examples which might enhance your next ESG summary.

Elevate your business performance presentations with our curated resources – visit our financial performance PPT reports webpage.

We’ve prepared a diagram overview to inspire creative thinking in illustrating sustainability issues. You will find a few slides with design analysis below. Feel free to grab the ideas for topics such as:

- explaining ESG reporting components with pillars infographic

- manifesting the company’s sustainability statements

- illustrating the company’s ESG strategy with a flowchart

- comparing the company’s performance in environmental, social, and governance initiatives

- planning ESG sustainability projects for four quarters of a year

Get all the graphics presented here – click on the slide pictures to see and download the source illustration. Check the complete Corporate ESG Sustainability Report Presentation here.

Why Use Diagram Visuals in ESG Sustainability Report?

Reporting data related to three different areas of sustainability may be challenging for a presenter. In the case of ESG development, we are talking about environmental, social, and governance responsibilities and it’s crucial for the whole presentation to state this difference clearly. That is where visuals come in handy as they support information architecture and convey the message in a digestible way. Using diagrams, color-coding, adding meaningful icons, enriching data with appealing charts, or placing it in a composition of containers helps organize the information logically and absorb it into your audience.

If you plan to cover all areas of ESG in your report mixing several message areas in one presentation may help you succeed.

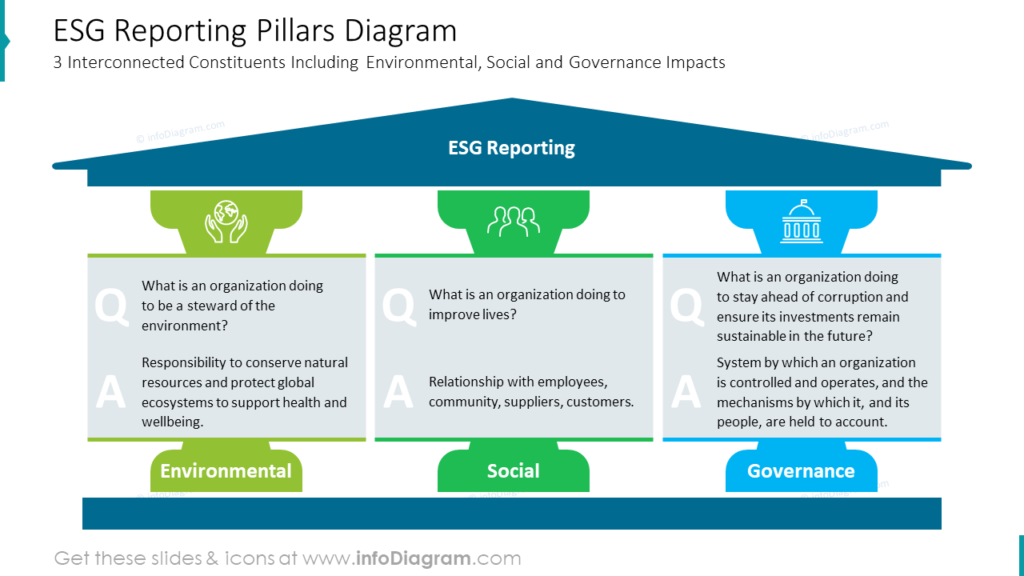

Explain 3 Interconnected Constituents of ESG Reporting With a Pillars Diagram

Explaining the ESG sustainability approach is often the first step in opening the presentation. It helps grab the audience’s attention and is fundamental for understanding the following slides with detailed analysis and descriptions. Presenting the company’s statements in the form of questions and answers adds a human factor that may be helpful to your audience in relating to the message.

What catches attention on this slide is a symbolic, graphical representation of three sustainability components in the form of pillars supporting ESG reporting. Each principle is assigned a different color, continuing throughout the presentation. This layout creates well-defined Q&A space, and the initial letters added to each section highlight the convention. The exact role of strengthening clarity was given to icons on top of pillars.

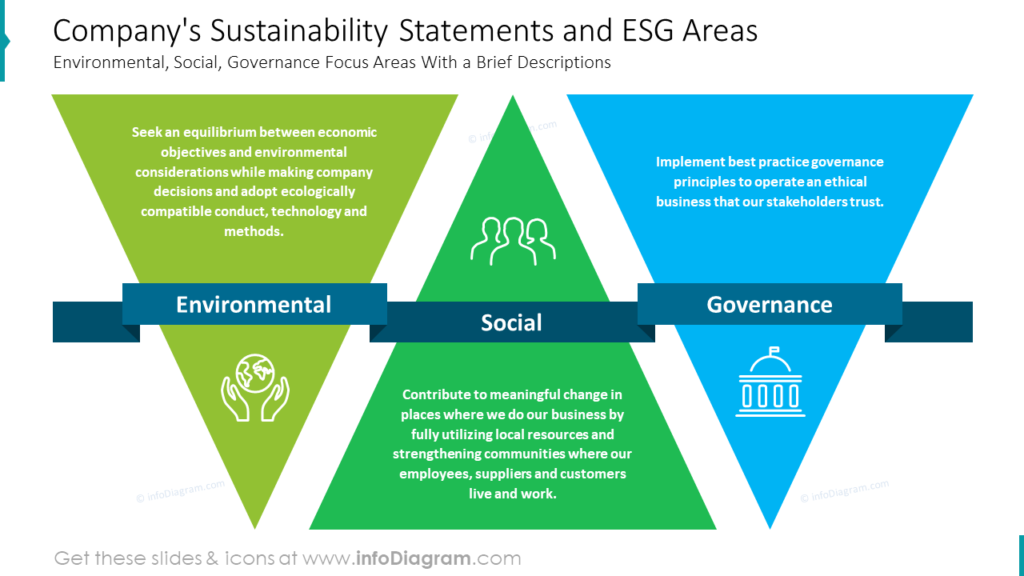

Manifest Company’s Sustainability Statements and ESG Areas With Bold Infographic

While reporting performance data, one may struggle with the company’s overall goal in its sustainability development. It’s a matter of values shared among all employees that make the change possible, and strong visuals seem to be very effective in delivering inspirational messages. Environmental, Social, and Governance ideas dressed in bold infographics can be read and memorized.

Notice on the slide below how color-coding from the previous example was continued and helps to learn to distinguish sustainability areas in a glance. The proposed color palette refers to nature, liveliness, solidity, and peace, and complementary triangular shapes connected with one ribbon with titles symbolizes their connection and wholeness. Some statements are given by us but can be easily transformed into unique ideas.

Illustrate Company’s Sustainability Ambition With ESG Strategy Flowchart

Presenting strategic milestones is crucial to many development studies. Reaching sustainability goals is no different; therefore, a PowerPoint flowchart may be an important addition to the ESG presentation.

What is worth noticing is that we deal with the triple process chart in this situation. A simple table doesn’t seem enough in this case due to a lack of flow indicators. Take a look at the example below where we combined in one diagram ESG stages such as:

- Impact

As set in previous slides color-coded environmental, social, and governance information are set apart. The overall flow of the process is marked with three easy-to-notice arrow-shaped ribbons binding description containers. To empower ease of reading stage titles, outline icons were added.

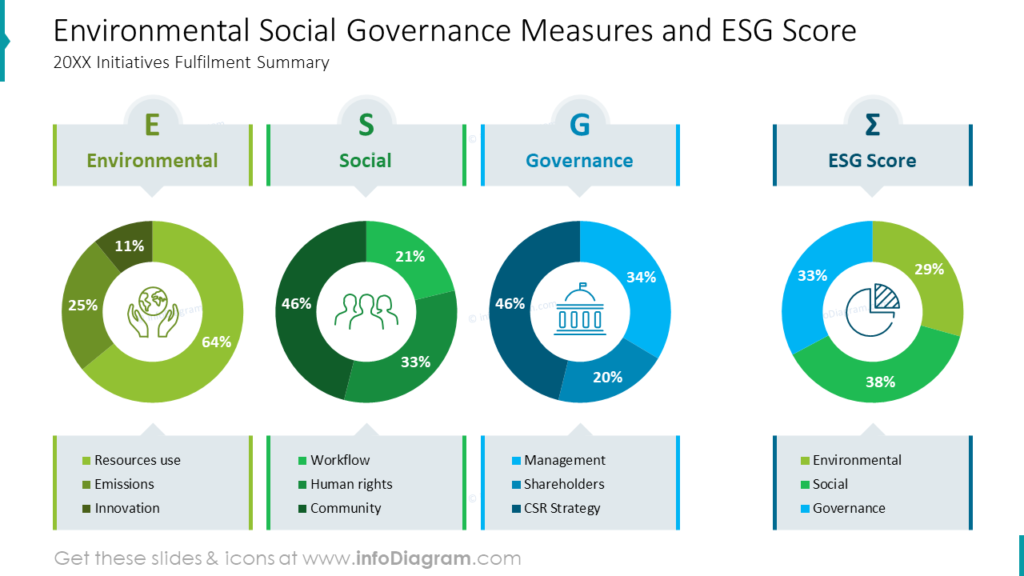

Compare Environmental Social Governance Measures and ESG Scores on Data Charts

After going into details in sustainability analysis, a brief summary of results may be a helpful addition to the ESG report. Such a slide helps to determine whether the objectives have been achieved and is a base ground for further planning. Environmental, social, and governance performance can be compared against each other, or each factor can be broken down into its parts.

Comparing the share of the result is especially clear when using pie charts, as the example below shows. They are useful in all scenarios, and their round shape allows for strengthening identification with icons. Thanks to the consistent use of colors, it is easy to distinguish charts despite the amount of data shown. Shades of green and blue are persistently used in charts and title and legend containers which results in a logical and easy-to-read infographic.

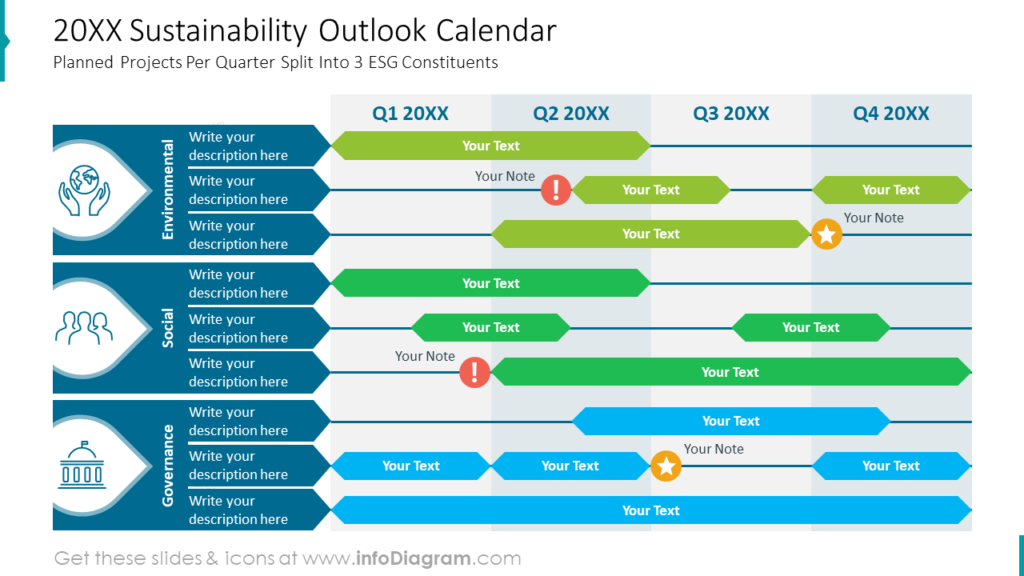

Plan ESG Sustainability Business Projects for the Next 4 Quarters With an Outlook Calendar Table

Calendar PowerPoint slides apply to past achievements and to set goals for the future. In this paragraph, we’re presenting the possible use of multiple timelines in the planning process. You can see on the slide below how versatile this template is in showcasing long-term and short-term plans in one layout.

This specific diagram simultaneously presents goals and planned actions in every area of ESG scope. What helps organize information in this data-rich calendar is the consistent use of colors for environmental, social, and governance issues, along with a bold title column containing titles, icons, and a list part. Also, in the bottom layer of this matrix, colored columns representing four quarters of the year increase the readability of this diagram. What stands out against this background are vivid yellow and red markers with icons that highlight critical points on the timeline.

Summary of Design Tips for Corporate ESG Sustainability Report Presentation

Covering ESG sustainability topics in presentation slides requires a plan and a dose of the consequence of its implementation. Avoiding ambiguity may be challenging when we simultaneously convey three different threads – environmental, social, and governance). We wrote this article to share our visual approach to complex slide messages because it worked for us and our clients in many situations. Feel free to inspire yourself and remember some useful tips we have revealed to you in this article:

- assign different colors to each of the ESG threads

- be consequent in colors used throughout the whole presentation

- if you need more colors within a thread, use shades of the primary thread color

- use bold, colorful text containers for descriptions you wish to stand out

- apply meaningful symbolic graphics like pillars to tell a story in your report

- consider using less common shapes like triangles to arouse curiosity in your audience

- emphasize flow relation using arrow-shaped ribbons connecting stages of the process

- illustrate data metrics with color-compatible charts

- strengthen your message with meaningful icons and colorful markers

- use the whole space of the slide to compose your diagrams within it

For more inspiration, subscribe to our YouTube channel:

Resource: PowerPoint Templates for Corporate ESG Sustainability Report Presentations

The ESG sustainability report diagrams presented on this blog are available for download in our infoDiagram collection of ready-to-use templates. You will find many slides appropriate for institutional, business, and civil audiences in this presentation, including development goals, sustainability roadmap, annual highlights and KPIs, RASIC table, and meritorious lists of examples for environmental, social, and governance actions. Check more slide examples contained in the ESG Sustainability ReportPresentation below:

Corporate ESG Sustainability Report PPT Presentation

If you are looking for more visuals to illustrate sustainability topics try our template for the circular economy and sustainability .

Published by

Chief Diagram Designer, infoDiagram co-founder View all posts by Peter Z

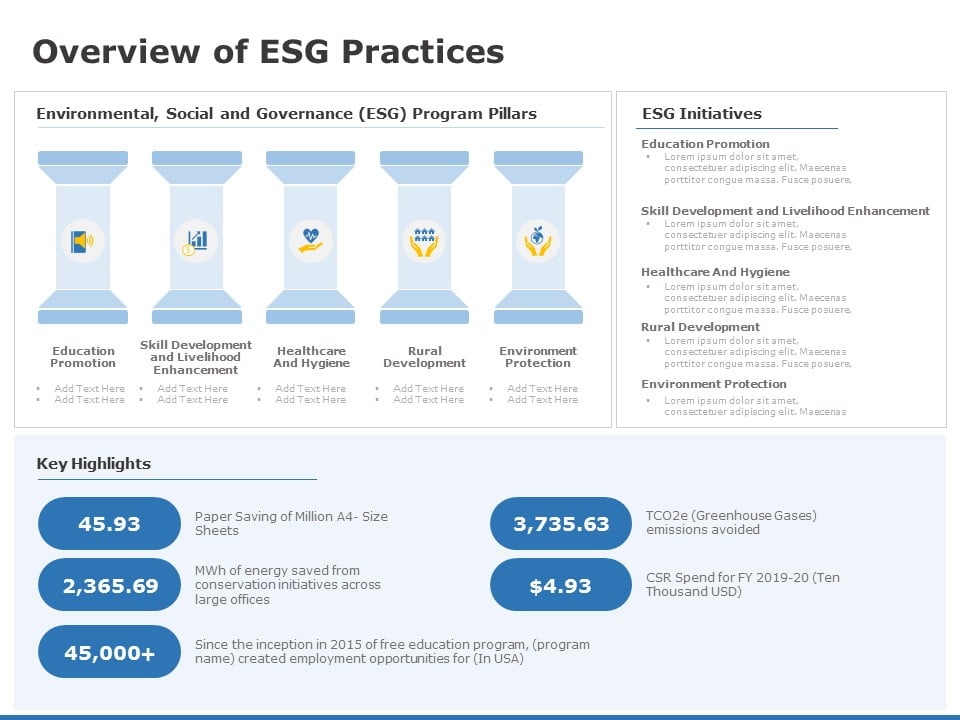

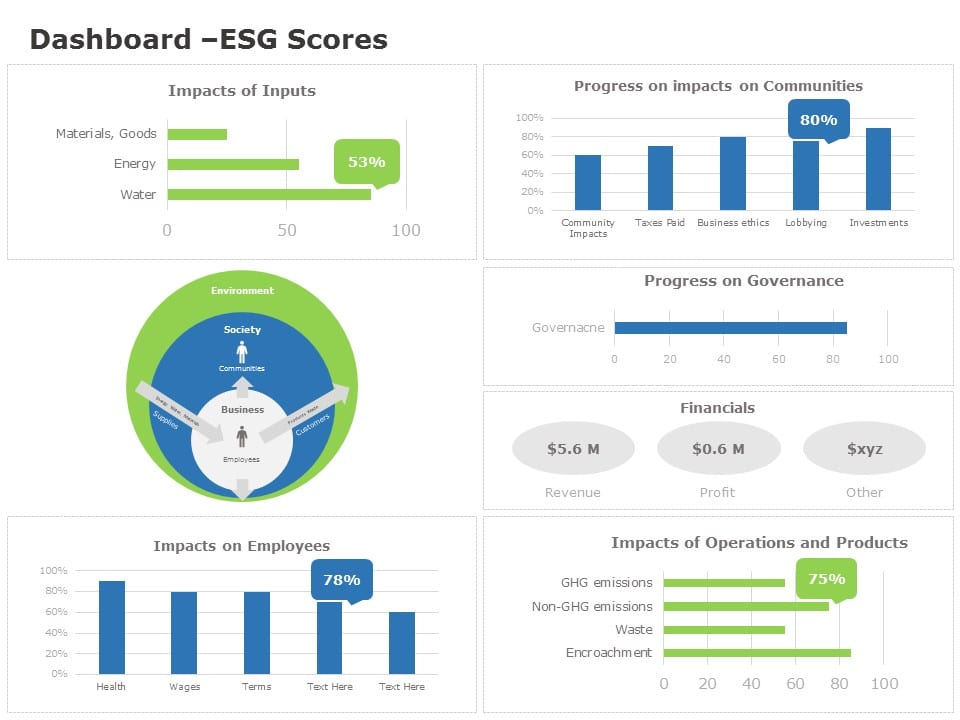

Home PowerPoint Templates PowerPoint Templates Environmental Social Governance PowerPoint Template

Environmental Social Governance PowerPoint Template

The Environmental Social Governance PowerPoint Template features slide designs for presenting ESG analysis, risks, and opportunities. ESG is the acronym for Environmental, Social, and Governance. Using these three aspects, investors and analysts deduce the functioning quality of the company. The environmental aspect deals with how the procedures or production at the company is impacting the immediate environment, e.g., waste management and emissions. The S in ESG corresponds to the social interaction of the company with the customers & employees. It also involves other parameters like data privacy and policies. The governance in ESG points to the management team and leadership. This aspect primarily attracts investors, as they will put more trust in organizations with a consolidated team of directors and leaders.

Our ESG Slide Template features nine editable slides in two background color variations (white and dark). The color palette chosen for this presentation template has green shades representing the ESG concept. The template begins with a cover slide showing the green earth illustration with a human hand and leaves around it. Professionals can opt for how to start a presentation by introducing the presentation title and company name on this slide. Following this slide is a semi-circle three-segment diagram with icons to note descriptions. Similarly, this semi-circle diagram is enriched with more relevant icons on the next slide. These icons can help in the visual communication of the concept before the audience.

This Environmental Social Governance PowerPoint Template also includes individual slides for E, S, and G with editable text boxes having a green color scheme. These slides carry icons and an engaging design. Presenters can also use the three-column and table slides to discuss the ESG analysis. The last slide is a summary presentation slide with donut charts, bar graphs, and color-coded bars. So, this ESG Presentation template can help consultants and analysts showcase the ESG status of the company in both descriptive and numerical data forms. Using the text boxes, they can demonstrate environmental impacts or governance setup risks.

Similarly, they can discuss the opportunities for investing. The company executives can also use this PPT Template to discuss the ESG status and development of management strategies accordingly. Hence, download this best PPT template and customize it with all PowerPoint versions and Google Slides. Alternatively, you can download other sustainability PowerPoint templates and presentation slides.

You must be logged in to download this file.

Favorite Add to Collection

Details (18 slides)

Supported Versions:

Subscribe today and get immediate access to download our PowerPoint templates.

Related PowerPoint Templates

Organizational Climate Diagram PowerPoint Template

Stairs Infographic PowerPoint Template

6-Component Governance Operating Model

5S Plan Diagram Template for PowerPoint

- Contributors

Introduction to ESG

Mark S. Bergman , Ariel J. Deckelbaum , and Brad S. Karp are partners at Paul, Weiss, Rifkind, Wharton & Garrison LLP. This post is based on a recent Paul Weiss memorandum by Mr. Bergman, Mr. Deckelbaum, Mr. Karp, David Curran , Jeh Charles Johnson , and Loretta E. Lynch . Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here ) and Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here ).

Interest on the part of investors and other corporate stakeholders in environmental, social and governance (“ESG”) matters has surged in recent years, and the current economic, public health and social justice crises have only intensified this focus. ESG, at its core, is a means by which companies can be evaluated with respect to a broad range of socially desirable ends. ESG describes a set of factors used to measure the non-financial impacts of particular investments and companies. At the same time, ESG also provides a range of business and investment opportunities.

Net flows into ESG funds available to U.S. investors have skyrocketed, totalling $20.6 billion in 2019, nearly four times the previous annual record set in 2018, [1] while ESG funds in Europe also attracted record inflows of $132 billion in 2019. [2] More than 70% of funds focused on ESG investments outperformed their counterparts in the first four months of 2020, [3] and nearly 60% of ESG funds outperformed the wider market over the past decade. [4] Consumers and investors are placing a growing value on ESG, and industry leaders have responded in a number of ways, including issuing comprehensive sustainability reports and expanding ESG disclosures in their annual reports, providing information to ESG rating agencies and publicly communicating ESG commitments.

This post, the first in a series focused on ESG disclosure and regulatory developments, provides an introduction to ESG and identifies several critical issues for companies and their in-house counsel to keep in mind in evaluating and monitoring ESG actions and statements.

The Fundamentals of ESG

ESG grew out of investment philosophies clustered around sustainability and, thereafter, socially responsible investing. Early efforts focused on “screening out” (that is, excluding) companies from portfolios largely due to environmental, social or governance concerns, while more recently ESG has favorably distinguished companies that are making positive contributions to the elements of ESG, premised on treating environmental and social issues as core elements of strategic positioning. While climate figures prominently in ESG discussions, there is no single list of ESG goals or examples, and ESG concepts often overlap. That being said, the three categories of ESG are increasingly integrated into investment analysis, processes and decision-making.

- The “E” captures energy efficiencies, carbon footprints, greenhouse gas emissions, deforestation, biodiversity, climate change and pollution mitigation, waste management and water usage.

- The “S” covers labor standards, wages and benefits, workplace and board diversity, racial justice, pay equity, human rights, talent management, community relations, privacy and data protection, health and safety, supply-chain management and other human capital and social justice issues.

- The “G” covers the governing of the “E” and the “S” categories—corporate board composition and structure, strategic sustainability oversight and compliance, executive compensation, political contributions and lobbying, and bribery and corruption.

ESG metrics have evolved in recent years to measure risk as well as opportunity. In his “Dear CEO” letter in 2018, BlackRock Chairman and CEO Larry Fink wrote that:

[s]ociety is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society. Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate.

He goes on to say that:

Companies must ask themselves: What role do we play in the community? How are we managing our impact on the environment? Are we working to create a diverse workforce? Are we adapting to technological change? Are we providing the retraining and opportunities that our employees and our business will need to adjust to an increasingly automated world? Are we using behavioral finance and other tools to prepare workers for retirement, so that they invest in a way that will help them achieve their goals? [5]

Other leading business leaders have also supported more expansive views regarding the purpose of a corporation. In August 2019, the Business Roundtable, a non-profit organization comprised of corporate CEOs, released a new Statement on the Purpose of a Corporation (the “BRT Statement”). [6] The BRT Statement was signed by the CEOs of nearly 200 leading U.S. companies and identified shareholders as one of five key stakeholders—along with customers, workers, suppliers and communities. The BRT Statement supersedes prior statements that endorsed shareholder primacy (the idea that corporations exist principally to serve shareholders), and “outlines a modern standard for corporate responsibility.” [7]

ESG in Practice

Under the current disclosure regime applicable to public companies listed in the United States, there is no affirmative duty to provide disclosures on ESG matters. As a practical matter, however, it can be anticipated that important stakeholders, such as investors, insurance companies, lenders, regulators and others, will increasingly look to companies’ disclosures to allow them to evaluate whether those companies have embraced ESG agendas. And, even in the absence of an affirmative duty to disclose, the substance of the information that companies do elect to report regarding their actions to identify and manage ESG risks and opportunities will be subject to the securities laws.

As we will discuss in future posts in this series, the ESG regulatory landscape regarding disclosure is rapidly evolving. While there is a general recognition of the value of, and the imperative for, consistent and decision-critical information to more easily evaluate how companies are overseeing and managing ESG-related risks and opportunities, most companies have yet to achieve that level of consistency. Moreover, ESG factors cover a broad range of activities that may or may not be relevant to particular businesses and their performance, or their potential positive effect on communities, or more broadly, societies. These metrics need to be refined. Accordingly, a prudent public company will find it desirable to establish its own criteria for determining the scope and content of its ESG disclosures, both to mitigate legal risk and identify future opportunities that ESG presents in terms of growth and differentiation.

In the absence of international consensus regarding ESG disclosures, a number of frameworks and indices have emerged to guide company disclosures and inform investors. Some of the leading international frameworks include the Global Reporting Initiative standards, the Sustainability Accounting Standards Board (SASB) standards, the United Nations Principles for Responsible Investment and the United Nations Sustainable Development Goals. Ratings have also proliferated over the last decade. Morgan Stanley Capital International (MSCI) and specialist firms such as Sustainalytics have recently been joined by traditional credit rating agencies such as Moody’s and S&P Global. A recent estimate suggests that the “global market for ESG ratings is currently worth about $200m and could grow to $500m within five years.” [8] The influence of these frameworks and rating agencies is such that they may shape regulation to come.

ESG is also influenced by public opinion. ESG issues are inherently reputational, especially given recent societal events. As more companies provide ESG disclosures and commitments, and given the speed of social media responses and the news cycle, observations about a company’s ESG actions or inactions are often published and sometimes go viral. Companies that are out of step with public opinion and market demands may face punishing reputational consequences.

Matching Aspiration and Action

We will describe in subsequent alerts the challenges faced by companies in developing a disclosure posture that satisfies the needs of a growing number of stakeholders, as well as the challenges faced by many of those stakeholders in obtaining information that is consistent and decision-critical. While ESG disclosures today are, from an SEC perspective, purely voluntary, over time that could change, and in the meantime there may be increasing pressure from a range of stakeholders to incorporate ESG statements. If a company’s ESG disclosures (for example, those in relation to compliance with legal, regulatory or voluntary standards or a particular commitment to achieve an ESG-positive outcome) later appear to be false or misleading, the company could face reputational backlash, shareholder lawsuits or possibly regulatory enforcement. Putting aside which disclosure standards they adopt, companies should ensure that they take a systematic approach to ESG reporting.

We highlight below considerations that should facilitate tying aspirations to actions and mitigating legal and reputational risks for commitments that cannot realistically be achieved:

- Monitor internal ESG disclosures and commitments . Management should appoint a team tasked with monitoring the company’s ESG disclosures and commitments, recognizing that these statements can appear in a variety of formal communications ( g. , SEC filings, or in documents incorporated by reference in SEC filings, sustainability reports and corporate responsibility reports) as well as informal communications ( e.g. , communications to employees, social media posts, media interviews and website postings). The team should identify existing ESG commitments to establish a baseline. Thereafter, the team should have a procedure in place to monitor ESG disclosures of the company as well as of peer firms.

- ESG statements made publicly should be vetted for factual accuracy and context in the same way as any other statement of fact.

- Forward-looking commitments should be qualified as such, much as other forward-looking statements are (with aspirational qualifiers and appropriate disclaimers).

- Management should consider extending the internal disclosure controls and procedures process to ESG statements, since some statements may well find their way into SEC filings.

- Even though ESG disclosure standards are not mandatory, the SEC has noted that it will be comparing information that is voluntarily provided with disclosures made in SEC reports and registration statements, which is consistent with its general approach of monitoring analyst and investor calls as well as other statements made outside of SEC filings (for example, to police the use of non-GAAP financial measures and selective disclosure rules).

- As with all material statements that are included in public disclosure, coordination among the relevant internal constituencies is critical and collaboration should be encouraged.

- Educate employees on the risks associated with ESG disclosures . Employees responsible for preparing and updating ESG disclosures should be sensitized to the risks associated with public disclosures and to the importance of ensuring that ESG statements are consistent with the company’s description of its business, its MD&A and its risk factors in annual and quarterly reports, even if those latter disclosures have no apparent ESG themes.

- Measure ESG performance . The ESG team should establish procedures to determine whether the company’s actions match its public ESG goals, the standards set by industry leaders and the frameworks established by third parties that the company has committed to—or is required to—follow. Doing so can help a company identify any vulnerabilities in order to mitigate potential legal and reputational risks.

1 See Greg Iacurci, “Money moving into environmental funds shatters previous record,” CNBC (January 14, 2020) , available here . (go back)

2 Lucca De Paoli, “European ESG Funds Pulled in Record $132 Billion in 2019,” Bloomberg (January 31, 2020), available here . (go back)

3 See Madison Darbyshire, “ESG funds continue to outperform wider market,” Financial Times (April 3, 2020), available here . (go back)

4 See Siobhan Riding, “Majority of ESG funds outperform wider market over 10 years,” Financial Times (June 13, 2020), available here . (go back)

5 Larry Fink, Blackrock, “‘Dear CEO Letter” (2018), available here . (go back)

6 Business Roundtable, “Business Roundtable Redefines the Purpose of a Corporation to Promote ‘An Economy That Serves All Americans’” (August 19, 2019), available here . (go back)

7 Id . (go back)

8 Billy Nauman, “Credit rating agencies join battle for ESG supremacy,” Financial Times (September 17, 2019), available here . (go back)

One Comment

Common ESG metrics by Deloitte, EY, KPMG, PwC: Please show business case.

The Big Four accounting firms EY, PwC, KPMG, and Deloitte have unveiled on 22 September 2020 a paper proposing to harmonize ESG reporting standards. However, they have not presented any business case. Real data with real companies is what is needed.

Author: Sharafat A. Paracha, 25 September 2020.

Many years ago, before ESG was even coined, I was a young graduate with a Masters’ in Sustainability and I proposed Bordier & Cie, one of the oldest private banks in Geneva (and the only one to have maintained its unlimited liability status), to develop a Corporate Social Responsibility Index for one of its clients. That was 1999 and again in 2000. Claude Morgenegg, the person who hired me, had a Ph.D. in mathematics and in charge of the analysis team. He looked at the general framework I submitted to and then said: you have a model. Great! Now prove it works by collecting the data. That is when reality kicked me in the face and showed me that it was easier said than done.

So, I had to design a system for collecting the data I needed that was not publicly available. Remember, this was before sustainability reports were a common staple. Only a few Scandinavian companies were informing the public on CSR issues. I had to design a questionnaire to give to companies and follow-up with them to obtain answers. Answers from companies were not enough. No, no, no. I had to validate their answers by conducting investigations into their activities around the world, comparing their reports from what NGOs and other sources said. Then I had to convert it all into understandable, measurable and comparable metrics before arriving at a final selection. Then, there was the process of analyzing all the information I had, filtering it and assessing it before it could be ready to be transcribed into a system of notation. This CSR index needed also to be reproducible in the future. Only then one could use it for decision making in portfolio selection. I still have the work I did for them in a diskette. Remember those? I cannot read it as the technology is now obsolete. It was hard work which I did alone but with good guidance and serious oversight. It was necessary as what was at stake was tens of millions of Swiss francs and Bordier & Cie reputation to deliver to the client and to the rest of the private banks. Bordier & Cie became among the first private banks in Switzerland to offer CSR analysis to its clients.

The situation in ESG now in 2020 is completely different from 20 years ago. Sustainability reports have become a staple for corporations. There are a plethora of sustainability standards. There are now teams of ESG analysts who work in banks and for specialized funds producing streams of reports regularly. There is an overload of sustainability perspectives, systems and data. Complexity in ESG has become the norm.

The big four accounting firms EY, PwC, KPMG, and Deloitte are not facing the challenges I faced. They are not alone and are not operating with limited resources. They have access to every ESG source and data. They have substantial resources. They have knowledge, experience and clout. Together with the World Economic Forum they have unveiled on 22 September 2020 a paper proposing to harmonize ESG reporting standards. However, they fail to provide any data, any case study, any business model to back their proposal. Putting a table of metrics together is the easy part. The harder part is getting companies to agree, getting the data, independently validating the data (be in no doubt that if you don’t do this you expose yourself to serious risks – after all, there are also short sellers), getting banks to find them useful, getting clients to put their money.

This is a welcome first step, don’t get me wrong. ESG needs this to take-off and anything that starts the ball rolling is to be encouraged. But I believe a solid business case is necessary. When I developed the Bordier & Cie CSR system, I looked into more than 20 companies. It is reasonable to ask the Big Four accounting firms and the World Economic Forum to commit to providing 20 ESG evaluations of diverse types of corporations based on their harmonized metrics for IBC’s Winter Meeting in January 2021.

Supported By:

Subscribe or Follow

Program on corporate governance advisory board.

- William Ackman

- Peter Atkins

- Kerry E. Berchem

- Richard Brand

- Daniel Burch

- Arthur B. Crozier

- Renata J. Ferrari

- John Finley

- Carolyn Frantz

- Andrew Freedman

- Byron Georgiou

- Joseph Hall

- Jason M. Halper

- David Millstone

- Theodore Mirvis

- Maria Moats

- Erika Moore

- Morton Pierce

- Philip Richter

- Marc Trevino

- Steven J. Williams

- Daniel Wolf

HLS Faculty & Senior Fellows